Pseudo Rare Earth Projects: Victoria's Government serves China; New China Mineral & VAT Laws; Myanmar...still; IAC Leaching Advances; Tianhe Magnetics IPO falls flat. And more.

Rare Earth 27 December 2024 #162

A quick note

Today there is a story for you, how Australia’s Victoria victimises its farmers in order to serve China’s state-controlled mining interest.

In our subscriber-only Companies section we also have an analysis of magnet maker Tianhe’s IPO prospectus.

In the Price section we discuss the supplies from Myanmar, as some in the community may not have fully grasped the outsized importance of these supplies for China - and thereby for the rest of the world.

There are outright paranoid write-ups in Chinese publications on potential U.S. independence from China’s critical minerals. There is no space for this here today. But we’ll keep a couple of the hilariously funny ones for later.

This is our last issue in 2024. We hope you enjoy our little publication in this remote corner of the internet and that you find it useful.

Have a happy, joyful and rare-earthy new year!

//Politics

Australia slashes $63bn from expected mining export revenues as China slows

Australia has downgraded its expected mining export revenue by more than 100 billion Australian dollars ($63 billion) over the next four years due to China's slowing economy, Treasurer Jim Chalmers said on Monday.

On the back of the write-down, which will be reflected in the midyear budget released on Wednesday, Australia expects to receive AU$8.5 billion less in company tax receipts over the period.

It seems that Australia wants to support its First World standard of living, basing on a Third World economic concept.

And the beneficiary of Australia’s troubles is China.

In fact Australia has become so expensive, that even the most basic downstream rare earth investment amounts are totally blown out of proportion. Australia can only hope that China’s appetite for unprocessed Australian resources does not wane.

Australia’s Victoria giving up farming in favour of shipping sand to China

Devastated farmers told Avonbank mineral sands mine will go ahead on their land

After more than 100 years, the Johns family have found their beloved farm in the footprint of a potential new mine.

If it is approved, they won't be able to live in their house for 36 years while mining at WIM Resource's new Avonbank mineral sands site is underway because of the noise, lights, vibration and "toxic dust".

Victoria's Mining Act allows mining companies to compulsorily acquire land once granted a mining licence.

Planning Minister Sonya Kilkenny's office said the project's Environmental Effects Statement was still under review — as it has been for more than a year — meaning it was not yet determined whether the mine at Dooen would go ahead.

But multiple farmers have told the ABC they've received phone calls from WIM Resource saying it has been approved and an announcement would follow.

It means WIM Resource could have the power to compulsorily acquire the Johns family's property for the duration of the mine's life.

A bad case of NIMBY?

Are we looking at yet another case of not-in-my-backyard, or is there more?

Scale

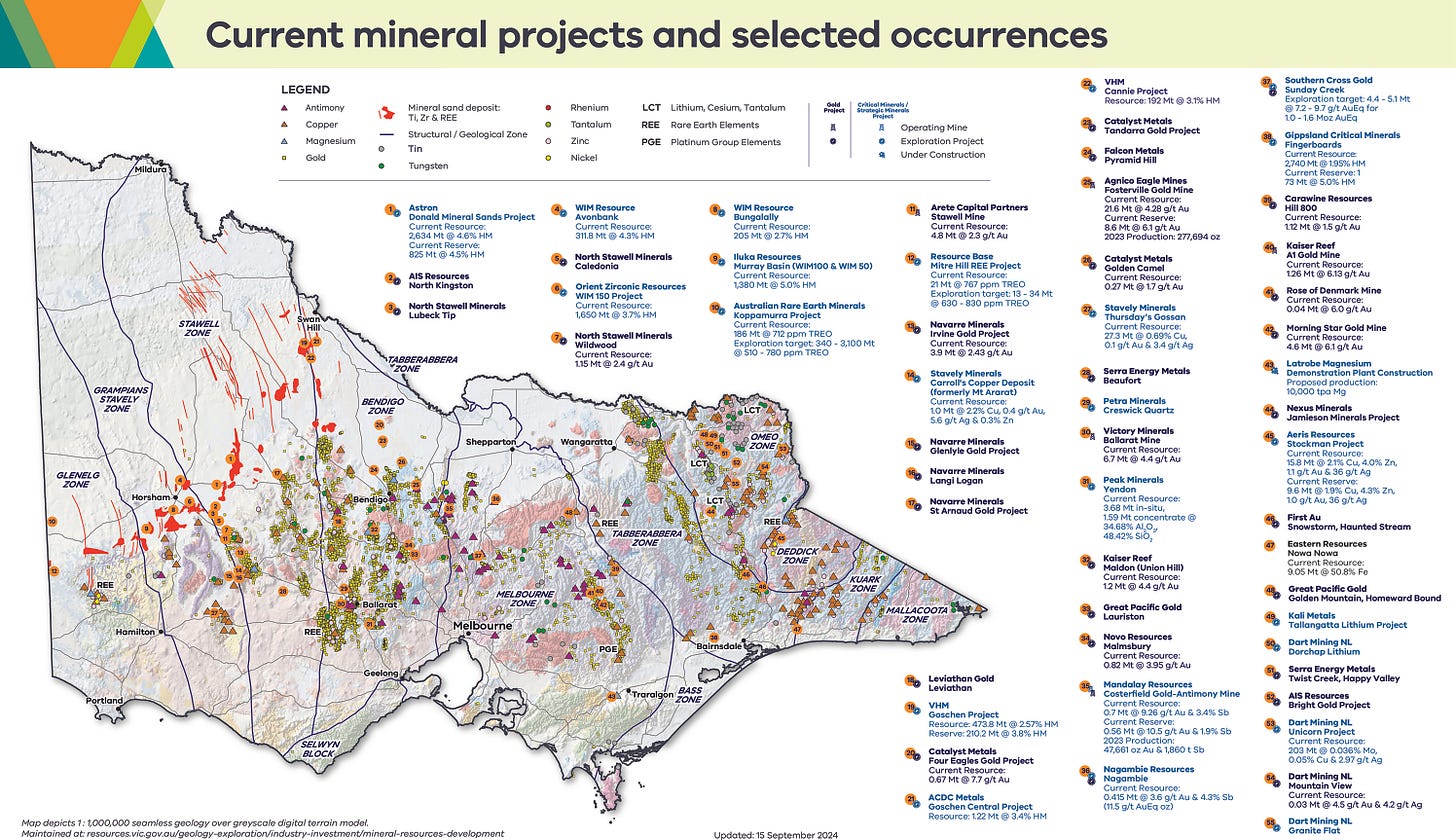

About half of Victoria is subject to mineral exploration.

WIM Resource

Superficially the main shareholders of WIM Resource Pty Ltd are:

Ying Enterprises Pty Ltd, Australia: 27.97%

Guangtong Developments Ltd, Hong Kong: 27.59% (address listed at a residential address in Shenzhen, China)

Bradley’s Polaris Pty Ltd, Australia: 13.37%

Zongshan Holdings Pty Ltd, Australia: 11.82%

Shenghe Resources Pte Ltd, Singapore: 9.9% (whose mother company is a Chinese state-controlled Shenghe Resources Holdings)

The total paid-up capital of the company is A$37,908,273.19.

WIM and Shenghe Resources

During an investor call more than 2 years ago China state-controlled Shenghe Resources said that it acquired shares in WIM Resources in Q2 2022 for RMB83 mio (ca. A$18.2 mio):

In Shenghe Resources annual report 2022 the acquisition amount for 9.9% of WIM Resources shares is put as RMB86,143,100, ca. A$18.5 million at the exchange rate of the period in question. The acquisition of the stake had been executed on 2 March 2022.

Oddity

The odd thing is that - as per WIM Resource Pty Ltd record of 28 February 2022 -the WIM shareholder Ying Enterprise Pty Ltd sold 9.9% of WIM’s shares to Shenghe Resources at A$4,403,482.70, which appears to be slightly less than the A$18.5 mio in Shenghe’s 2022 annual report.

On second look these A$18.5 mio seem to match Shenghe Resources share acquisition amount plus WIM Resource’s subsequent capital increase - a year later.

Shenghe Resources, Singapore, also participated in the capital raise to maintain its official 9.9% shareholding.

The capital increase also brought 20 new shareholders on board - out of the blue, some even from New Zealand.

9 of WIM’s 29 shareholders - including Shenghe Resources Singapore - registered that the WIM Resource shares are beneficially held. These 9 represent more than 40% of shares of WIM Resource Pty Ltd.

Five of the six officers of WIM Resource were born in China. Three of the five China-born officers also reside in China.

Sole born-in-Australia director John Bradley is 81 years young.

There are more details, which we leave aside for brevity.

However, we are satisfied that WIM Resource are ultimately controlled by China state-owned Shenghe Resources Holdings, China.

Q.E.D.

Now we could stop here after having demonstrated that Victoria is sacrificing its citizens’ interest in favour of a foreign power in at least one case.

But lets carry on, there is more.

Added-value occurs exclusively in China

It is not only Shenghe Resources-controlled WIM, it is also Shenghe Resources backed VHM (we reported on both) plus Gippsland Critical Minerals (we reported) with their pseudo rare earth projects.

Why pseudo: actually they plan digging up heavy mineral sand of single digit percent value-carrying content with a little bit of monazite sand either inside the HMS, or separated. They plan to send all of it to China, with benefit and added-value actually exclusively occurring in China.

The puny few thousand tons of monazite sand contained in the HMS actually won’t change a thing. Core motivation is China’s import dependence on heavy mineral sands, 60% in ilmenite/rutile and 90% in zirconia.

“Send for processing to China”

The miners in Victoria repeat the evil spin, which originally had been created for MP Materials, of “sending rare earths for processing to China”, insinuating that the finished products would come back to the miners for resale.

Truth is, that export processing of rare earths has been illegal in China for decades and that is why this “send for processing to China” strictly speaking is an audacious lie.

Desertification i/o rehabilitation

The good-day-sunshine story spread by miners is that displaced farmers, after well-deserved rest of 5-6 years, can return to their land and continue happy farming as before, also because the miners would rehabilitate the land after being done with strip mining.

A source close to the government tells The Rare Earth Observer:

The land, though generally low rainfall, retains moisture for long periods of time due to unique underlying clay areas. Naturally the farmers are devastated - not only because they will lose their homes and multi-generational farms, but also because once the clay layer is destroyed through mining the land can never be returned to production.

Apart from that, government audits of so-called “rehabilitation” have shown rehabilitation by miners having been deficient or even none.

This can’t possibly have escaped the attention of the government of Victoria and the farming lobby may have a valid point here.

Radioactive pollution potential

The farming lobby is firing all guns, and radioactive pollution potential can be a silver bullet against “vampire miners”.

An expert witness statement regarding Shenghe Resources’ prospective supplier, VHM Ltd, and its "Goschen Mineral Sands and Rare Earth Project" (which is a misnomer) exposes a surprisingly careless and incomplete evaluation by the junior mining company:

In general one can say that the radioactive contents are excavated thoroughly diluted, but return in much higher concentration in the tailings.

China knows well

China itself has been adversely affected by large amounts of thorium being illegally discarded and long ago banned the domestic mining of monazite.

China instead imports from those countries that are willing to mine and process monazite. Western-style resource colonialism.

Regarding food, China even prohibited the import of fish from Japan due to the very remote possibility that it might be contaminated with radioactive wastewater from Fukushima.

Farmers’ legal options

And how about going legal?

If farmers aren't happy with what's been offered the miner can take them to the Civil and Administrative Tribunal where they will invariably lose.

It is a matter for each Australian state to regulate. By and large underground resources are owned by The Crown, i.e. actually the Australian government.

That means while you can own or lease the land above the resource, you don’t own the rights to the resource underneath. Pretty much the same as in China.

This can create conflicts, as it does in Victoria.

It is on the above background one should understand this overall review of the legal framework:

Embarrassed China

Central-government-controlled Shenghe Resources’ activities may become a liability for the Chinese government, if Shenghe don’t stay away from projects that cause outrage abroad, whether it is mining on sacred land in Africa or socially contentious projects in Australia.

Whether deserved or not, internationally China already has a poor mining reputation. Shenghe Resources should not add oil to fire.

Embarrassed U.S.

The U.S., under the administration of the newly re-elected President Trump, may question whether Australia’s government is inadvertently supporting China’s dominance in rare earths and other metals. This concern arises as his trade advocates examine the global landscape of critical minerals, particularly given China's significant influence over companies like Rio Tinto and certain other mining enterprises.

Embarrassed miners

China-controlled WIM Resource Pty Ltd removed all their community information from their website. Shenghe Resources guilty as charged?

Embarrassed bureaucrats

Victoria’s bureaucrats are apparently somewhat aware of this 3-6 of their employer.

They are hiding from concerned citizens.

Our take

Mining is never beautiful and there always is environmental and social impact.

More than 200 picturesque villages and farming communities have been vacated and destroyed in Germany since the 1950s, in order to make way for strip-mining of coal. It rendered 27,000 hectares of arable land unusable, a comparatively small portion of 0.75% of total arable land in Germany.

10 million hectares of arable land were expropriated in China between 1991 and 2013 according to Zhang Yulin, professor of sociology at Nanjing University. This to make way for infrastructure, industry and housing.

Perhaps Victoria’s government should think more about sustainability and adding value. A mine is a self-depleting asset, by its very nature unsustainable. A grown agricultural economic base is provenly sustainable and the added-value occurs at home, not at some distant shores.

Anyway, while WIM is private, China-owned, the market obviously seems unconvinced that VHM Ltd should be a good investment idea.

New China Mineral Resource Law

The most important feature of this law is, that in its entirety it does not apply to strategic minerals, among which rare earth resources are.

Rare earths have got their very own law, bundling ages-old regulation.

That’s it.

China via Sinocism

Standardizing public statements by economists, analysts and fund managers

According to a report from Cailian, securities regulatory bureaus in multiple regions have recently issued supervision requirements to brokerages and other entities, aiming to strengthen the management of public statements—especially those made by chief economists, brokerage analysts, fund managers, and other industry practitioners.

According to multiple sources, at least one brokerage research institute has issued internal directives tightening management over its analysts. Analysts are required to fully regulate their speech and conduct, strictly adhere to professional standards, and be reminded that research reports should be the sole standard for expressing viewpoints. They are cautioned not to make sensational comments merely to grab attention, not to relax their standards to attract clients or follow hot topics, and not to test regulatory boundaries with a fluke mentality.

Censorship of analysts will not really improve confidence in the Chinese economy.

Two Projects in Asia and Africa Highlight the New Realities of Chinese Development Finance

The days of easy access to Chinese loans are over. The Cambodian PM may have mistakenly thought that he could move forward with the construction of the canal because, up until recently, the Chinese always seemed to come through with the money. Not anymore.

It’s Chinese creditors, not African borrowers, that are caught in a “debt trap.” In the mid-2010s, Chinese creditors lent a lot of money to countries that did not have the financial strength to repay, particularly Zimbabwe. But China isn’t going to seize the Hwange power station, as ill-informed critics in the West and India will no doubt suggest. Instead, Sinohydro and other Chinese creditors are stuck with a bunch of bad debt that’s now weighing down their financial statements. That is the real debt trap.

Food for thought. Also in rare earths China’s investment appetite may have been reduced.

Myanmar

Nothing New from KIO/China Meeting

This was unlike previous meetings that the KIO had with the Chinese, when they had instead met with officials from Yunnan Province, the Chinese province that borders Myanmar.

During this meeting the Chinese side focused on peace in the border area, according to Colonel Naw Bu, spokesperson for the KIO and its armed wing, the Kachin Independence Army (KIA).

Whilst the meetings between the KIO and the Chinese were underway, the Chinese reopened the border trading posts on the border with Kachin State. But, the border posts were not fully opened and there are still restrictions on what can be brought through them.

Since 7 March 2024, the KIA has intensified its offensives against the junta and its allies in Kachin State and captured several towns including, on 29 March 2024, the capture of Lweje Town where there is a border crossing to China.

The KIA-led coalition subsequently captured all of Kachin Special Region 1 between 29 September and 21 October 2021. This is an area with large reserves of rare earth metals that covered areas of Kachin State in Waingmaw, Chipwi, and Tsawlaw, townships and the Chinese border.

Previously it was controlled by the junta-aligned Kachin Border Guard Force (BGF) led by U Zahkung Ting Ying. After the KIA captured the area, on 28 October, it abolished the designation of Kachin Special Region 1 to refer to the area.

Clearly China is looking for a way to get rare earths supplies up and running again, without destroying its alliance with the Myanmar military junta.

For the KIO rare earths is a billion dollar per year business, useful to fill the KIO’s war chest.

China’s proposed joint security force with the Myanmar military junta to may actually be little more than a Chinese People’s Liberation Army expedition corps using Myanmar scouts. This may create a united front of the Myanmar ethnic armies against a foreign invader, too risky for China.

Read about the Myanmar-China rare earth trade details and why we have not seen an impact yet in the Price section below.

Korea

Ministry of Strategy and Finance and the Ministry of Trade, Industry and Energy supply chain stabilisation

The government will invest 55 trillion won for three years in stabilizing supply chains in preparation for the possibility of intensifying trade disputes between the U.S. and China after the inauguration of the Donald Trump administration. Through this, the goal is to reduce the dependence of key materials on foreign countries to less than 50% by 2030.

While the U.S. is strengthening export controls on key materials such as semiconductors to China, China is setting a "counterattack" by controlling exports of rare earth and other key minerals to the U.S. In particular, it is feared that resource weaponization will intensify due to the intensification of the U.S.-China dispute following Trump's return to power.

The problem is that Korea's dependence on imports from China for major metal minerals is increasing. According to the Korea Customs Service, China's natural graphite imports accounted for 97.2% in the first 11 months of this year. Nickel oxide and nickel hydroxide accounted for 53.6% of imports from China last year, but soared to 82.7% this year.

There were better options, but China’s government chose to make really bad moves. China has become too risky to rely on - by its very own actions.

Laos to Suspend Alluvial Gold Mining, PM Says

He stated that the government is reducing or eliminating concessions in rich forest zones and banning new projects in protected forests. It will enforce stricter environmental assessments for projects near water, farmland, or residential areas. Developers must also follow detailed plans to manage and close operations responsibly.

Non-compliance will lead to warnings, project suspension, or loss of concessions. The government is also working to better manage transport of minerals and repair damaged roads. Efforts will focus on processing minerals locally to add value while protecting natural resources.

This refers to all mining in Laos, also rare earths.

New China VAT Law from 1 January 2025

Two articles caught our attention:

Article 7 Value-added tax is an extra-price tax, and the sales amount of taxable transactions does not include the amount of value-added tax. The amount of value-added tax shall be separately stated on the transaction voucher in accordance with the provisions of the State Council.

Theoretically this would give way to quoting prices separately from VAT, like in normal countries, not as per current practise including VAT, e.g. rare earth prices.

(iv) When a taxpayer exports goods, the tax rate is zero, unless otherwise provided by the State Council.

In other words, the whole VAT refund upon export matter is in the hands of the prime minister and his colleagues, who decide these rates at will.

Ca. 39% of China’s total tax revenue is VAT. It would be interesting to learn how much of it is non-refunded VAT upon export, including rare earth products.

China’s National Development & Reform Commission

Announcement on Soliciting Opinions on the Catalogue of Industries Encouraged for Foreign Investment

(Draft for Public Comment)

In order to implement the spirit of the Third Plenary Session of the 20th CPC Central Committee and implement the deployment of the State Council, we have revised the Catalogue of Industries Encouraged for Foreign Investment (2022 Edition) and formed the Catalogue of Industries Encouraged for Foreign Investment (Draft for Public Comments). We are now soliciting public opinions.

Among the encouraged items, apart from motherloads of fossil fuel projects, we find:

15. Use tungsten, nickel, cobalt, tantalum, niobium and other rare metal resources for smelting, deep processing, application product production and recycling , magnetic component production

20. Deep processing of rare metal materials such as tantalum and niobium

22. Rare earth magnetic materials

61. Processing of high-end rare earth application products that meet the requirements of rare earth new materials

86. Production of organic polymer materials: aircraft skin coatings, rare earth cerium sulfide red dyes...

260. R&D and production of holmium laser and carbon dioxide laser treatment products

Given China having shot itself in both feet by limiting and licensing trade of these products, foreign technology holders of the relevant items will not be excited about a prospect of investing in China.

We don't know what we want, but we want it with all our might!

We also find that activities on the list which are actually on China’s negative list for foreign investment, such as “exploration, mining and beneficiation of scarce minerals in China (such as potash, chromite, etc.)”

//The light side

Things spellcheckers can do to your corporate penetration

It may be kind of difficult to extract rare earths from parasites. We are somewhat inclined to believe that they meant Parisite.

India Intensifies Search for Critical Minerals

Successful Auctions and Reserve Details

Out of 48 critical mineral blocks auctioned in four tranches, 24 have been successfully allocated. According to Union Mines Minister G. Kishan Reddy, India holds approximately 40 million tonnes (MT) of graphite, with significant reserves in states like Andhra Pradesh, Chhattisgarh, and Tamil Nadu. Phosphorus reserves are estimated at 31 MT, primarily in Madhya Pradesh and Rajasthan, while titanium reserves total nearly 16 MT across Kerala, Maharashtra, and Odisha.

Expanding Resource Base

Since the MMDR Amendment Act, 2015, GSI has augmented resources for 15 critical minerals. This includes 230 MT of rare earth elements (REE) concentrated in Gujarat and Assam, 282 MT of niobium in Gujarat, and 830 MT of glauconite/potash primarily in Rajasthan and Bihar. Lithium reserves are pegged at 5.9 MT in Jammu & Kashmir and 6.4 MT in Rajasthan.

Why does Trump want Greenland?

The United States has previously attempted to acquire Greenland. President Harry S. Truman's administration offered $100 million for the island after World War II, while President Andrew Johnson's administration explored the possibility in the 1860s after a commissioned report highlighted the island's resources.

Denmark maintains control over Greenland's defense and foreign policy, though the island gained increased autonomy through the 2009 Self-Government Act. "The Greenlandic people have their own rights," Martin Lidegaard, former Danish foreign minister and then-chairman of the Danish Parliament's foreign policy committee, told The Washington Post in 2019.

While the purchase of territories isn't unprecedented in American history – including the Louisiana Purchase from France in 1803 and Alaska from Russia in 1867 – The Washington Post calculated in 2019 that acquiring Greenland could hypothetically cost up to $1.7 trillion, though the point remains moot as both Danish and Greenlandic officials maintain it isn't for sale.

Ion-adsorption clay recovery rates

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.