China RE Group Chairman removed; MP's operating loss $0.88 for every US$1 of revenue; Neo's Q3 loss; Ionics recycling PEA; Hastings' default mitigated; Another Brazil hopeful; BRE's Chevkinite

Rare Earth 25 November 2024 #160

Another opus magna, as one rare earthling recently termed it. In spite of that one subscriber recently complained about too little content….

Singapore

Rare Earth Supremacy: China’s Ace in the Clean Technology Competition

In October 2024, China’s first comprehensive regulation to tighten state control over the critical sector of rare earth resources took effect.

This superficial paper already begins with a gross misinterpretation. The facts about the rare earth law are in the free section of the 1. July 2024 issue of The Rare Earth Observer.

The paper makes statements that are factually wrong - relying on media publications on rare earth which are at best hit-and-miss, at worst journalistic Titanics that sank after hitting The Rare Earth Observer’s iceberg of fact.

The paper additionally feeds on a decades-old western stereotypes which hold no water today.

We have sent a 13 points comment to the author for her consideration, here an excerpt:

1. "In October 2024, China’s first comprehensive regulation to tighten state control over the critical sector of rare earth resources took effect.”

This is an objectively false statement. The rare earth law merely bundles ages-old, pre-existing regulation. There were exactly 2 new elements in this, as you can read up here.

2. "Consequently, Western powers, such as the United States and the European Union, are under increasing pressure to secure essential REE for clean technologies needed to transition to a low-carbon economy.”

A bit of research into the matter shows, that US and EU have no use for the low-carbon economy rare earth elements. They both depend on imports of the components and finished products made from/with rare earth.

3. "China’s low costs, fuelled by state subsidies and lax environmental standards…”

This is a sad and outdated, typical western stereotype. China in the 1980s and 1990s was a desperately poor country. It accepted foreign direct investments of dirt industries who were no longer wanted in the “West”.

Today China has the most stringent rules and numerical emission targets for rare earth mining and production.

7. "Earlier, in June 2024, Beijing declared rare earth resources to be state-owned and placed the industry under government oversight, ensuring product traceability."

This is false. China’s constitution, the current version dating 1982, expressly says that means of production are state owned, among them land and the resources underneath. This is not unusual. If you do some research, you will find that state-ownership of subterranean resources is quite common, also in industrialised nations. A non-issue.

8. "Additionally, in January 2022, Beijing banned foreign direct investment in rare earth mining projects"

This is a false statement. All foreign investment in China’s domestic mining of anything has been banned since 2000.

And so on and so on. Pretty disappointing for such a highly acclaimed institution like the Institute of Defence and Strategic Studies of the S. Rajaratnam School of International Studies, NTU.

Curious

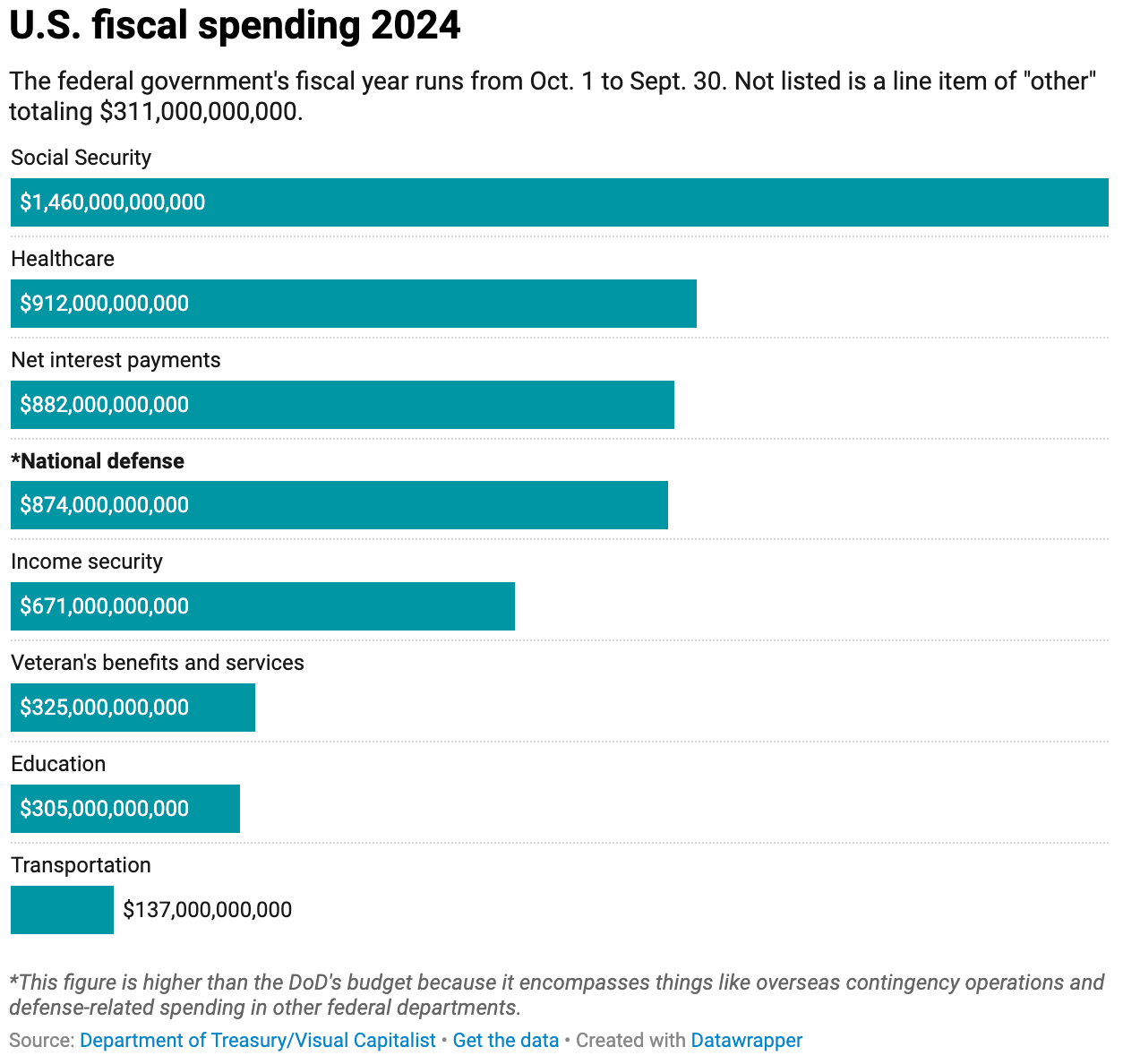

Pentagon fails 7th audit in a row, but CFO says progress is being made

In what would be a CFO’s worst nightmare, the Department of Defense (DoD) has failed its seventh audit in a row since its first in 2018. While the consequences of audit failures have caused major issues for private businesses, the country’s largest government agency, which has a 2024 budget of $824 billion — a $26.8 billion increase from 2023 — has been given until 2028 to account for its spending.

Impressive. But it also shows that the Pentagon’s investment pledges for rare earths and magnets are actually petty cash money.

Turkish sideswipe at the EU

Turkey and China sign rare earth cooperation agreement

The “Memorandum of Understanding on Cooperation in Natural Resources and Mining” was signed by Turkey’s Minister of Energy and Natural Resources, Alparslan Bayraktar, and China’s Minister of Natural Resources, Wang Guanghua, during the International Mining Conference in Tianjin, China.

Minister Bayraktar noted that Turkey, which discovered the world’s second largest rare earth element reserve in Eskişehir in 2022, aims to establish an industrial facility capable of purifying 570,000 tons of rare elements annually. He expressed Turkey’s readiness to collaborate with countries in Africa, West, and Central Asia on rare earth mining.

The Turkish Myth

We had debunked the Eskişehir-myth already on 29 July 2022:

The paper “Geology, mineralogy and fluid inclusion data of the Kızılcaören fluorite-barite-REE deposit, Eskisehir, Turkey” of February 2002 estimates the rare earth mineral resource as 4 million tons with a TREO of 0.3%, basically all light rare earths, and 400,000 tons mineral resource of Thorium at 0.2%.

If that should be somewhat accurate, then it is ~12,000 t TREO, before recovery losses. That is even less than the hopeless 20,000 t TREO in Storkwitz, Germany.

We are quite certain that the Turkish side knows the details well.

This is just another Turkish political stunt, a sideswipe at the EU, who did not take this lousy rare-earth-bait 2 years ago.

Energy Policy Priorities for the 119th Congress and Trump Administration

We expect that the second Trump administration will seek to repeal most, if not all, of the Biden administration’s actions on climate change and the environment. One target of these efforts will likely be the Inflation Reduction Act of 2022 (IRA). The new administration may seek to repeal the IRA in whole or in part. We also anticipate a repeal and replace of the power plant rule, new source performance standards for oil and gas, and emissions standards for greenhouse gas and criteria pollutants from mobile sources, greatly impeding the Biden administration’s electrification efforts.

The IRA expanded and extended federal tax credits for the deployment of clean energy technologies and manufacturing. The federal tax credits are available for solar, wind and other renewable generation projects. The IRA expanded available tax credits to include energy storage, carbon capture, the production of hydrogen, clean fuels and manufacturing of qualifying solar, wind and battery components, inverters and critical minerals.

It would probably mean the end to the U.S. rare earth related initiatives, except for the DoD’s comparatively small demand for magnets and for certain other campaign-produced non-ferrous defense materials.

China to tighten export curbs on critical metals ahead of Trump's return

China's Commerce Ministry unveiled detailed specifications of dual-use technologies and items -- used for both civilian and military purposes -- that will fall under the country's export controls. The rules take effect on Dec. 1

China’s Ministry of Commerce explains:

Formulating a unified "List" is a basic requirement for implementing the "Export Control Law of the People's Republic of China" and the "Regulations of the People's Republic of China on Export Control of Dual-Use Items" (hereinafter referred to as the "Regulations"), which will soon be implemented, and is also an important reform measure to improve the export control system.

The "List" will take over the items on the dual-use export control lists attached to multiple legal documents of different levels such as nuclear, biological, chemical, and missile that are about to be abolished, and will fully draw on international mature experience and practices.

It will be systematically integrated according to the division method of 10 major industry fields and 5 types of items, and uniformly assign export control codes to form a complete list system, which will be implemented simultaneously with the "Regulations". The unified "List" will help guide all parties to fully and accurately implement China's laws and policies on export control of dual-use items, improve the governance efficiency of dual-use export control, better safeguard national security and interests, fulfill international obligations such as non-proliferation, and better maintain the security, stability and smooth flow of the global industrial chain and supply chain.

Here the link to the original document.

To make 2 points absolutely clear:

These rules/lists are designed for China’s compliance with international commitments on non-proliferation and related export controls. Or more concretely, they serve to restrain often loose-cannon Chinese exporters who sell anything to anyone, which then foreign media are usually are quick to blame on the Chinese government.

In this context, however, do remember that most Chinese regulation is designed to serve multiple purposes, reasonable and more controversial ones.

These Chinese rules compare to U.S. export controls.

There may be licensable equipment under this regulation that could perhaps serve to produce, convert or refine rare earths.

But what immediately jumped into our eyes was:

Cerium metal powder (nano)

Tributyl phosphate (TBP), flotation agent (defoaming) in mining, a solvent for rare earth, uranium and plutonium solvent extraction (~30% solution of tributyl phosphate in kerosene)

For TBP there are several other large suppliers outside China. For example BASF.

Ukraine can make America rich - Trump ally

The country has rare earth minerals worth trillions and is ready to make a deal with the US, Senator Lindsey Graham has said

Ukraine could be extremely useful to the US because it is brimming with valuable natural resources and is willing to negotiate an agreement with Washington on extraction, Senator Lindsey Graham has said.

The Republican senator from South Carolina told Fox News that the Ukraine conflict is ultimately "about money."

An extract of the interview was published on the senator's YouTube channel on Wednesday. "You know that the richest country in all of Europe for rare earth minerals is Ukraine?" he said, estimating the worth at 2 to 7 trillion dollars.

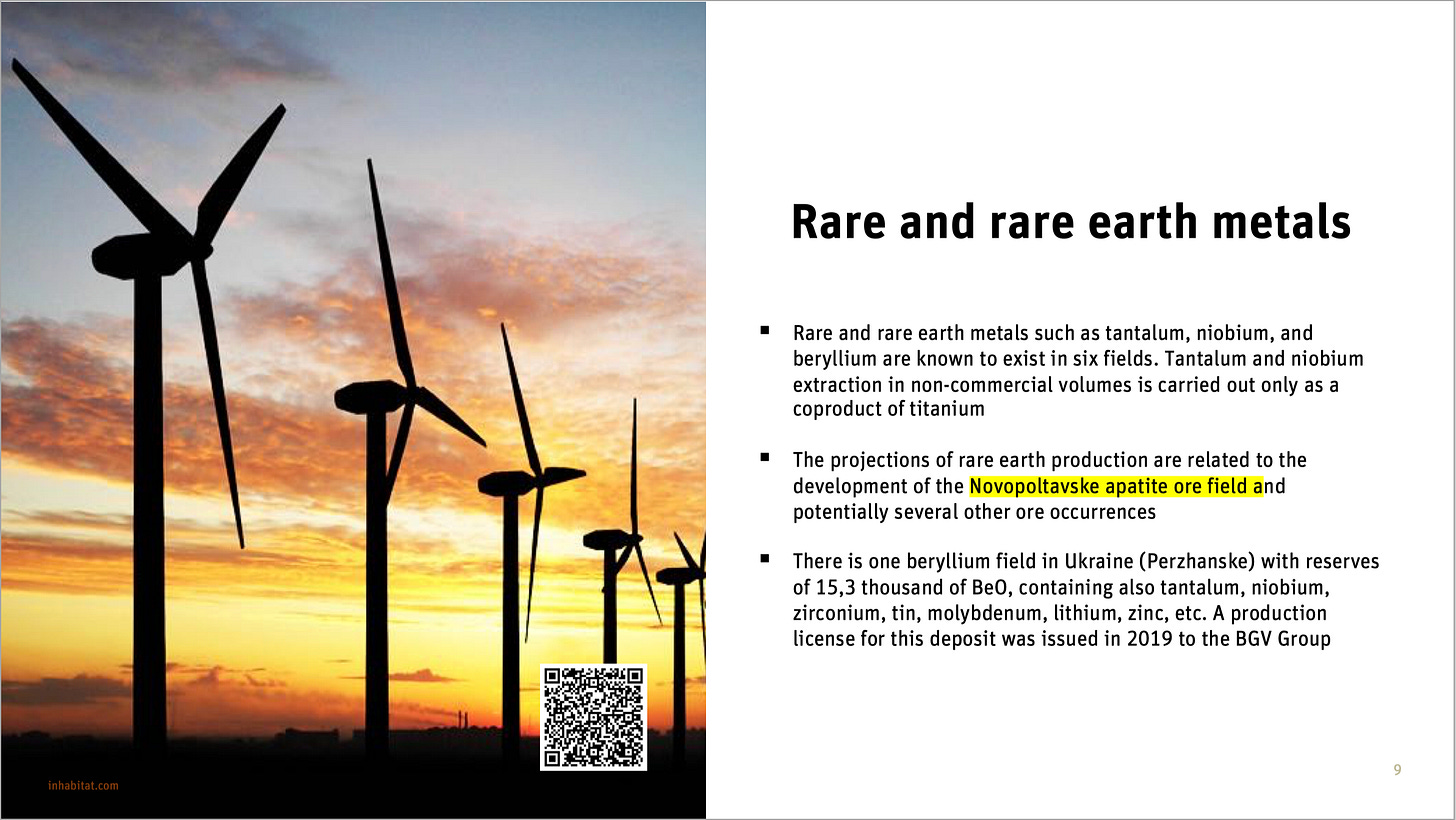

To add some meat to the bone, here the portfolio from Ukraine’s Geological Survey.

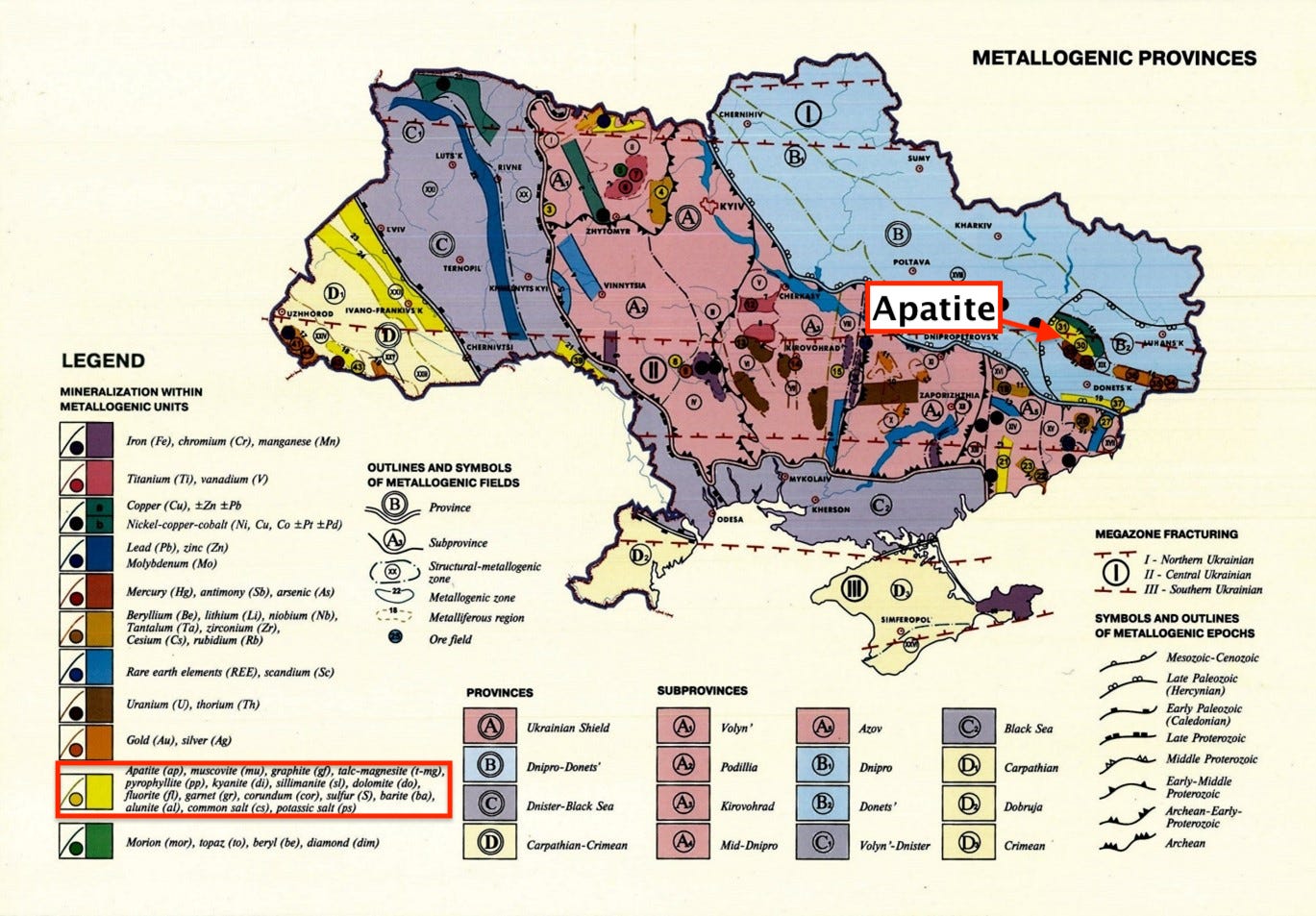

After a in-depth search we are pretty sure the “Novopoltavske apatite ore field” is here:

And now a look at the frontline:

It is quite possible that Ukraine may be forced into a cease-fire and ultimately to an unfavourable peace settlement by the incoming Trump administration in the U.S., generally deemed amenable to “cutting deals” also with unsavoury regimes. This would entail territorial losses for Ukraine, most definitely including areas of high Russian share in the population, i.e. Donetsk and Luhansk.

This being so, the related resources would drop-out of of the Ukraine Geological Survey’s Critical Minerals Portfolio.

If Ukraine were luring the U.S. with resources beyond the current frontline, it would tell a long story of what the real intent is.

Russia reacts

And, as certain as the Amen is in church, here the comment from Moscow:

US needs Ukraine's rare earth metals, including lithium — Lavrov

"It is no coincidence that US Senator Lindsey Graham said outright (he is not a diplomat and does not hide his thoughts), that the US needs to ensure that Russia suffer a defeat in Ukraine, because there are many rare-earth metals, including lithium," Lavrov said. "He said so to Vladimir Zelensky when he visited him recently. He said that the US needs these riches. And he added that they would help Ukraine and in return they would take all this from it as payback."

Maximising Nigeria’s rare earth elements potential

Maximising Nigeria’s Rare Earth Elements (REE) potential presents a promising alternative to the country’s heavy reliance on oil. Nigeria can unlock it’s REE potential, contributing to economic diversification and sustainable development. This can transform the country’s mineral resources into a vital asset, fostering long-term economic stability.

Nigeria has several REEs and a wide range of solid minerals, although extensive exploration and mining of these resources are yet to commence at commercial scale.

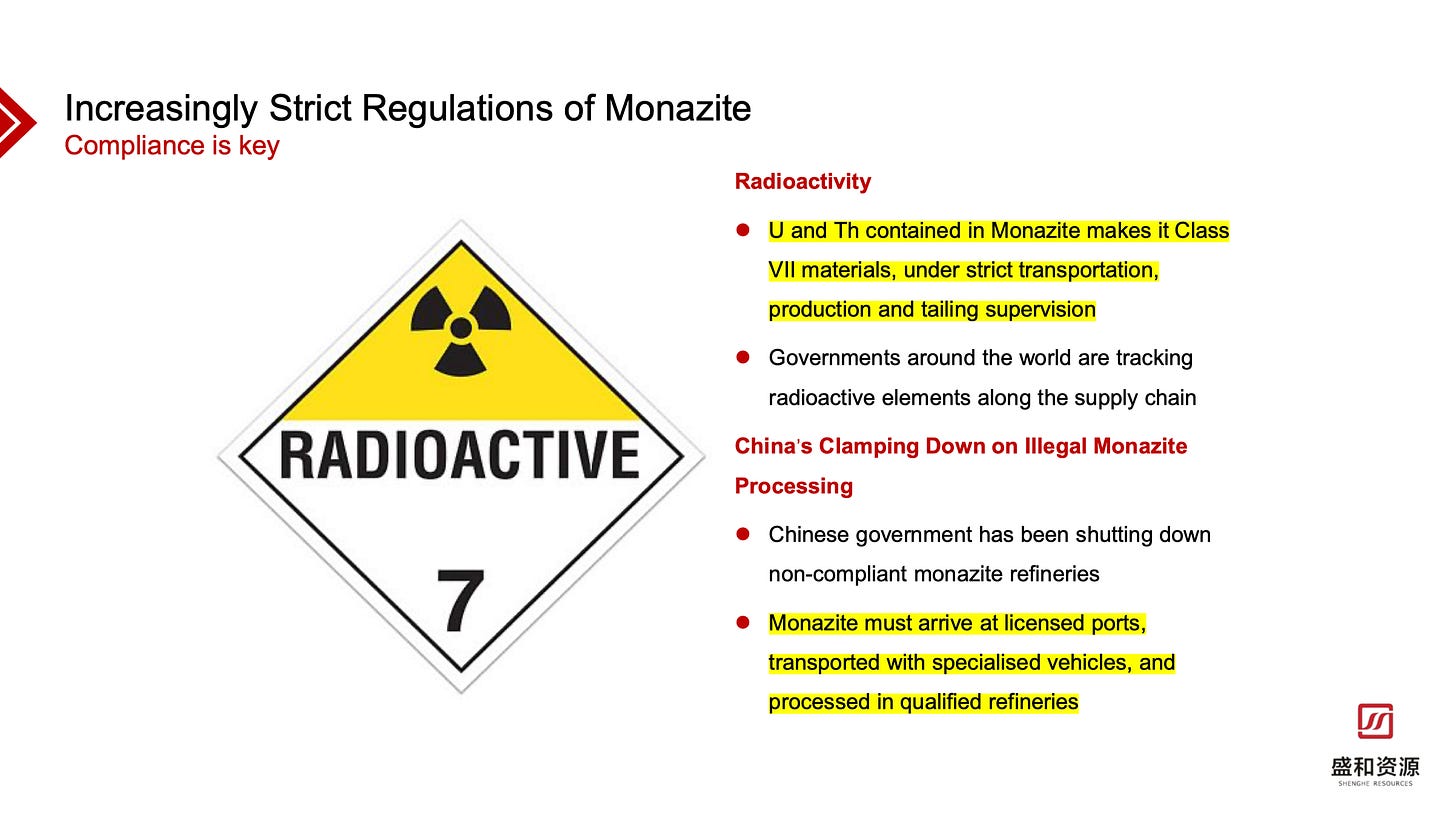

So far, in terms of rare earths, we are talking about artisanal mining of heavy mineral sands based monazite. Nigerian monazite by and large has a radioactive thorium content of 5-6%. It is produced under the most primitive and unsafe conditions imaginable, with serious implications for the health of workers.

January to July 2024 monazite imports from Nigeria more than doubled year on year to 13,000 t. It is now China’s largest monazite supplier.

For its high thorium contents this Nigerian monazite should be shipped as International Maritime Dangerous Goods Code (IMDG) Class 7. A very expensive hobby and few shipping lines will accept it. Therefore monazite cargoes are declared falsely some general cargo of harmless nature, as zircon sand or as cerium phosphite, an alternative name for monazite that nobody outside the industry knows.

As Shenghe Resources’ presentation at the recent TZMI indicates, there will be a sudden and certain end to this:

Actually, all China monazite imports are cleared through one and the same logistics company in different locations.

TNLA Bans Mechanized Mining in Myanmar’s Ruby Hub

The Ta’ang National Liberation Army (TNLA) says large-scale ruby mining in Mogoke, Mandalay Region, will be suspended until it benefits the community.

The TNLA and allies seized the ruby hub 189km north of Mandalay city in July.

“We are designing a policy to benefit residents and serve their interests. We will suspend large-scale gem mining with heavy machinery until then,” said TNLA spokeswoman Lwei Yay Oo.

A role model for rare earth mining? Of course China’s rare earth mining in Myanmar is not about jewellery, but it has ruined communities nonetheless.

China rare earth exports jump as fears of Myanmar supply disruption spark more buying

The world's largest producer of rare earths last month shipped 4,753 metric tons of the 17 minerals used to make products ranging from magnets in electric vehicles to consumer electronics, data from the General Administration of Customs showed.

That compared with 4,181 tons in September and 4,291 tons in October 2023.

Exports in the first 10 months of 2024 rose 6.8% from the same period a year before to 47,689 tons, the customs data showed.

China's rare earths imports last month fell 12.5% from the year before to 9,471 tons, bringing the total from January to October to 111,960 tons, a year-on-year drop of 22.9%.

Careful with the numbers, the media are manned with generalists and therefore lack all and any expertise in the trade of rare earth raw materials

The correct numbers are in our post of 6 November 2024 (only for paying subscribers):

China imports 23% down

China’s imports of rare earth raw materials from Myanmar were 40,000 t during the first 9 months of 2024, down 12,000 t or 23% from the same period in 2023. These 12,000 t are exclusively ‘other rare earth compounds’, whereas China’s imports of mixed oxides from Myanmar remained stable.

During Q1 2025 we’ll analyse the full 2024 rare earth numbers for everything and anything in an extra posting - for paying subscribers only.

China, Myanmar to Establish Joint Security Company, Reports Say

China’s government has reportedly proposed the establishment of a “joint security company” with Myanmar’s military junta in order to ensure the safety of Chinese projects and personnel in the country.

According to a November 15 report in The Irrawaddy, the junta formed a working committee on October 22 to prepare a memorandum of understanding (MoU) for the establishment of the security company.

Unfortunately for Beijing, many of China’s large infrastructure projects, and the CMEC corridor itself, are located in areas that have become active conflict zones. This means that whether or not they are being targeted specifically, increasing numbers of Chinese enterprises and joint ventures are falling into the hands of resistance groups. In July alone, anti-regime People’s Defense Forces took control of the China-backed Alpha Cement factory in Mandalay Region, and a major Chinese-backed nickel processing plant in Sagaing Region.

Plus the rare earth mining operations in Kachin State.

While Chinese leaders are fond of stating that their country practices a policy of “non-interference” in its partners’ internal affairs, this principle has always been subject to a good deal of flexibility. Once Chinese security personnel are deployed inside Myanmar, even with the consent of the military junta, it will be harder for Chinese leaders to square the rhetoric of Chinese engagement with the practice.

A “joint security company” is without precedence, but after several of its Myanmar investments were attacked by independence forces, China has had enough.

China plans something similar with Pakistan in the restive province of Balochistan.

A US$1 billion business is of course irresistible

Myanmar’s KIA Says Rare Earth Mining Set to Resume in Pangwa-Chipwi Area

The Kachin Independence Army (KIA), the armed wing of the Kachin Independence Organization (KIO), is preparing to resume rare earth mining operations in the Pangwa-Chipwi area of Kachin State, known as one of Myanmar’s rare earth hubs, according to the ethnic armed group.

The KIA/KIO has rules and policies in place for rare earth mining, said Colonel Naw Bu, the spokesperson of the group. He added that relevant leaders and departments are still negotiating the details of the planned mining operations, so no official permissions have been granted yet.

“In preparation, we are also negotiating with businessmen on how to proceed with the operations,” he said.

There are more parties to agree with than just the miners and the KIA.

China Hands Back 300 Myanmar Junta Troops Who Fled Border Town Seized by KIA

People’s Liberation Army officers handed the 302 soldiers back to the Myanmar military at the Man Wein border gate, which borders Jiegao in China’s Yunnan Province.

Defying pressure from China, the KIA captured the Kanpiketi on November 20. The ethnic army has now seized most of Kachin State, except for the capital Myitkyina and surrounding area. Among its conquests are rare earth mines near the Chinese border.

India

638 FDI Proposals Cleared in Sensitive Sectors Since 2019

The home ministry has cleared 3,638 foreign direct investment proposals in sensitive sectors since 2019, officials told a parliamentary panel on Tuesday. The ministry is the nodal authority for granting security clearance in sensitive sectors before issuance of licences, permits, permissions and contracts to companies, bidders and individuals by the administrative ministry.

The clearances include FDI proposals from the US, Mauritius, Singapore, the Netherlands and the UAE. The sectors which require the home ministry’s nod include broadcasting, telecommunication, satellites (establishment as well as operation), private security agencies, defence, civil aviation, mining and mineral separation of titanium bearing minerals and ores, its value addition and integrated activities.

That means heavy mineral sands incl. monazite are subject to India’s Home Ministry clearance.

India needs to focus on building processing capabilities for critical minerals: IREL CMD

Critical minerals are quite important for the economy. Its incorporation in functional materials leads to superior material of construction, improved performance and technology which is vital for modern technology. Since critical minerals are subjected to long drawn ecosystems, economic application of such minerals requires exploration, exploitation, processing and refining. Intermediate industrial application is required to convert them into suitable materials for user industry.

Straight and simple: if India can’t produce rare earth permanent magnets, it will not be an alternative industrial investment destination.

This back-and-through, one-step-forward-and-two-steps-back has been going on for much too long.

India’s government should lose patience with its state-owned development impediments.

Wyoming

Leaders convene at Governor’s Business Forum

The panel of industry experts highlighted emerging and unique projects and trends which will have a significant impact on Wyoming and its businesses and community.

“There are so many exciting energy and mineral production projects happening in Wyoming,” Kruka stated. “I could not list them all, but the top projects include Exxon’s expansion project and the Chokecherry and Sierra Madre Wind Energy Project. Also, we are seeing an increased demand for carbon dioxide enhanced oil recovery projects.”

She continued, “We have rare element resources as well, with new projects located near Upton [Rare Element Resources pilot plant] and Wheatland, but my personal favorite is the memorandum of understanding between Rocky Mountain Power and Eight Rivers who are looking at constructing a new coal-fired power plant in Wyoming.”

Coal-fired power plants are not only fashionable in China.

Twelve years ago

Rare Earth | Technical Revolution

This documentary was filmed in 2012, when John L. Burba was still Chief Technology Officer and Executive Vice President of Molycorp, Inc.

Has anything changed?

//Science

National Rare Earth Functional Materials Innovation Center achieves new breakthrough in the preparation technology of high rare earth content aluminum-scandium alloy

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.