China New RE Regulations: 2 Changes; EU-OZ MOU: EU's Achilles Heel; Peak's Offtake; UUUU produce NdPr; Lindian's PEA; Hastings-Neo; Shenghe EIA approved after 4 years; Rainbow's Pilot

Rare Earth 1 July 2024 #151

Here I stand and can do no other

Martin Luther (1483–1546)

We have been criticised for being political towards China. We take exception. It is not The Rare Earth Observer, who

made rare earth a national security matter.

gets people arrested for exchange of petty information.

is reminding people of keeping anything rare-earthy a secret on a bi-monthly base.

The best comment on China in recent memory is this one:

Even though fairness is not and has never been a socialist virtue, our attitude towards China is and remains fair is fair, right is right and wrong is wrong.

//Politics

Reuters get it wrong, again

China issues rare earth regulations to further protect domestic supply

The regulations, issued by the State Council or cabinet on Saturday, say rare earth resources belong to the state, and that the government will oversee the development of the industry around rare earths - a group of 17 minerals of which China has in recent years become the world's dominant producer, accounting for nearly 90% of global refined output.

Their global industrial significance is such that under a law that entered into force in May the EU set ambitious 2030 targets for domestic production of minerals crucial in the green transition - particularly rare earths due to their use in permanent magnets that power motors in EVs and wind energy.

EU demand is forecast to soar sixfold in the decade to 2030 and sevenfold by 2050.

The new Chinese regulations, which will take effect on Oct. 1, say the State Council will establish a rare earth product traceability information system.

Those rules fanned fears that restrictions in rare earth supplies might help increase tensions with the West, particularly the United States, which accuses China of using economic coercion to influence other countries. Beijing denies the claim.

Cold coffee served

Except for 2 new points, this is all “cold coffee.” Long pre-existing regulations, partly more than 10 years old, formulated under one umbrella of a single law.

But why should Reuters know or even check that? It is is much easier recite stereotypes and put a clickbait headline to it. Journalistic failure, in our view.

EU rare earth demand

The EU’s demand will neither soar sixfold, nor has anybody forecast anything like that. Why? The EU does not consume the value-carrying rare earths because it does not have the downstream industries who consume them. So how should EU rare earth demand increase?

Any demand increase for rare earth happens foremost in China.

Rare earth for fossil fuel production and consumption

What the EU consumes are overwhelmingly the “cheap as cabbage” (standard grades cost ~US$1/kg to US$2/kg) overproduced elements lanthanum and cerium:

The total rare earth compounds export of China to the EU in 2023 was 6,640t for US$61 mio

Out of this lanthanum and cerium compounds were 4,892 t or whopping 74%! Value US$5.3 mio (US$1.08/kg)

And for good measure, since the EU still has trouble distinguishing between metals and compounds: China exported 815 t of RE metals to the EU in 2023, valued at US$4.8 mio. Peanuts.

What these lanthanum and cerium imports are used for in the EU:

Much of the rest goes into really critical applications like glass-colouring.

Recommendations, not targets

Then, when challenged on the impossibility to achieve CRMA targets in a number of products, EU officials point out that the CRMA should not be understood as a target, but as a recommendation. Also, in terms of ‘target achievement,’ the EU will refer to the averages across all Critical Raw Materials.

In our view, if we go by the average across all CRM, then we would argue the CRMA ‘targets’ have already broadly been achieved.

But lets get back to the subject.

Two new elements of the China law

Since they chose not to do their homework, of course Reuters fully miss the 2 new points:

Applicable penalties are edged in stone now

A state rare earth material reserve is being postulated

The reserve

During the past 10 years we have observed several failed attempts of the National Food and Strategic Reserves Administration to build a rare earth reserve that made sense. There was always uncertainty of how much of what rare earth to buy and how to determine the price. Now the relevant state organs are compelled to get it done.

Read on, why they would want to do so.

Import reliance

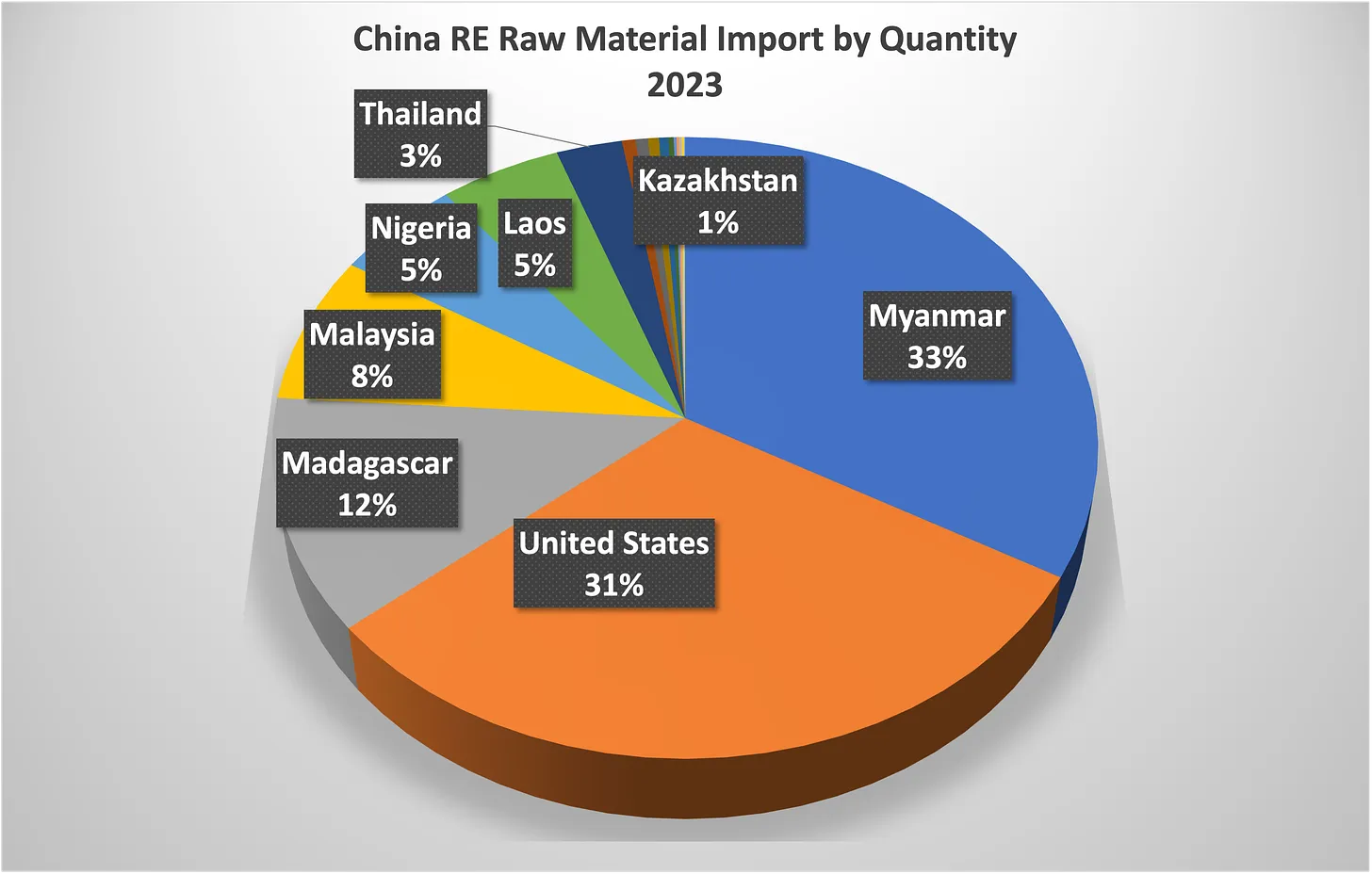

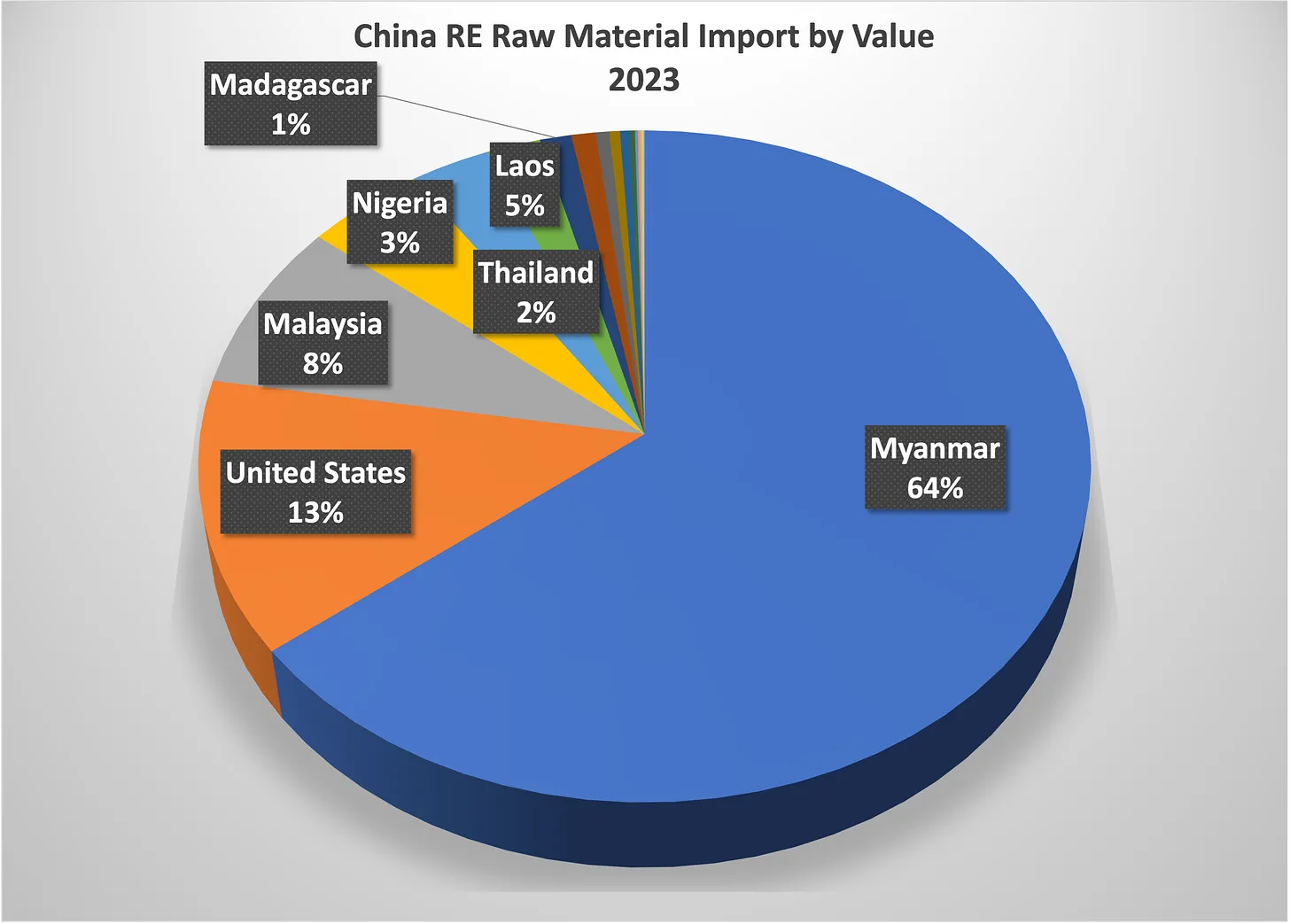

China heavily relies on imports of rare earth raw materials. Chinese imports of rare earth raw materials have increased 14 to 20 times of 2015 levels, depending on the kind of raw material. Our estimate is close to 50% TREO overall import reliance on rare earth raw materials.

Not counted imports of 5.5 mio tons of heavy mineral sands, not all of which contain monazite. But according to China estimates should be good for ~50,000 t TREO.

A grey rhino event (expressly NOT a black swan) could cause significant market upheaval. A failure of one of the major exporters to supply China would be a grey rhino event.

Import reliance, not import dependence!

China’s policies encourage import of rare earth raw material, while putting domestic rare earth raw material mining into a straightjacket.

Why:

Monazite “single element mining” has been banned since 2012. The only reason we can imagine for that is the lack of control over radioactive waste disposal. For imported monazite we can see a supply chain taking shape in China, which features extraction of radionuclides before the material is passed on to the processing company. We expect that to become mandatory once the capacities suffice (combined with the advantage of stock-piling fuel for Chinas global roll-out of safe, modular, cheap and highly efficient Thorium Molten Salt Reactors (TMSR) in about 10 years time - remember, carbon neutral is all about energy supplies).

After the closure of all (known) domestic ion adsorption clay (IAC) mining sites in 2014, China is now limited to a handful of IAC sites because of the unsustainable in-situ leaching with ammonium sulphate, which irreparably poisons water resources, whether underground or on the surface.

While China could feed the whole world based on it’s own domestic rare earth resources for at least the coming 100 years at current demand levels, doing so is viewed as being unsustainable in Beijing. Mind you, the ages-old objective to reduce rare earth exports to 30,000 t TREO is still in the room, but there is no such implied limit on the export of rare earth permanent magnets.

Poor editing at Reuters

All this is what Reuters completely miss and they rather choose to spread fear, uncertainty and doubt, a.k.a. FUD, than providing solid journalism along their very own “Trust Principles.”

Bloomberg report

Analysts highlighted one aspect of the new regulations that could put pressure on Chinese output: refineries may no longer be able to use imported ores in order to produce above their government-set production quotas, they said. Imports — mostly from neighboring Myanmar — now provide about a quarter of China’s rare earths raw materials.

We disagree with Bloomberg’s entire paragraph. The import reliance is twice as high. The above-quota production based on imported materials is a core element of production planning as well as of resource preservation policy. And it is sourly needed downstream, where the value creation happens.

The original text of the law

For your convenience, this is the direct link to the publication of the State Council. And here underneath is a free translation of the entire text. There may be inaccuracies, no warranties for correctness, also no implied ones:

And yet another miscarriage

Turning critical minerals into free range eggs

The challenge: the geographical concentration of critical mineral mining and refining continues to increase, and is expected to increase further by 2030.

One of the solutions suggested is bifurcation, a premium on critical minerals produced in the West with expensive environmental regulation. But, will consumers pay an environmental premium?

The good, old, time-honoured myth that China is a rare earth environmental hog and western junior rare earth miners are all environmental angels. Fantastic!

Just recently the “angels” at Rio Tinto have been sued in a UK court for radioactive poising of water resources in Madagascar at a mine that supplies monazite to China.

As GITI laid out in an online presentation to the German Chamber of Commerce in China (AHK) on 25 June 2024, China today relentlessly applies the probably world’s strictest operational and environmental rules on rare earth companies. The country’s supreme leader has made unmistakably clear, if Chinese miners abroad should end up in hot water for violating the Law of the Land, they could expect no help from the Chinese government at all.

Environmentalists inside China also can sue behemoth state-owned enterprises for environmental non-compliance, as Shuang Tan report:

Shuang Tan are also among the authors of the awesome and legendary China Water Risk Rare Earth Shades of Grey Report of 2016. We had the privilege to meet one of the authors personally. Mind you, Rare Earth Shades of Grey’s status is 8 years ago.

Ecological Civilisation

As we learn from Xi Jin Ping Thought on Ecological Civilisation, China’s supreme leader is an environmentalist. And one must acknowledge that China is pulling all the right levers, earnestly trying to face up to its responsibility as the world’s largest polluter.

In terms of Myanmar (being ⅓ of China’s rare earth raw material import quantity and almost ⅔ of China’s rare earth raw material import value) and in case certain non-rare earth mining projects, Xi yet has got to walk the big “ecological civilisation” talk.

If one wanted to believe the toxic emissions of Washington Times, Xi Jin Ping has been a fellow rare-earthling all along.

The author’s strange ideas do not end here.

To take rare earths as an example: no planned rare earth projects outside of China can achieve a 15% return on investment at current prices, according to Benchmark Source.

Prices for neodymium-praseodymium oxide are, as of April 2024, around US$54/kg in China. Almost 40% of rare earth mines outside China require prices of between US$75/kg to US$85/kg, 15% of mines require prices above $85/kg.

Lynas NdPr cost of production ~US$30/kg?

According to Lynas COO Poul de Roux, Lynas’ cost for producing NdPr are around US$30/kg, net of China VAT.

But lets get serious.

The author obviously has zero knowledge about running a business in China and wrongly assumes that the business environment, laws, regulations, cost, etc in China should be the same as in the West. It isn’t. Further he is oblivious to the fact that domestic AND foreign invested enterprises in China both do receive subsidies. Our in-depth research into selected China rare earth and magnet companies could only identify WTO-compatible subsidies.

Garbage in, garbage out

As far as Benchmark are concerned, if you analyse deadbeat rare earth projects, you end up with deadbeat cost of production.

We don’t need to discuss that leading rare earth enterprises in China currently book provisions for inventory impairment as they are writing red ink.

But comparing lean and mean actually producing enterprises to projects that only exist on paper is - very, very mildly speaking - rather unwise.

REIA Conference in Tokyo

The Deep-Sea Mining of Rare Earths: Pros and Cons

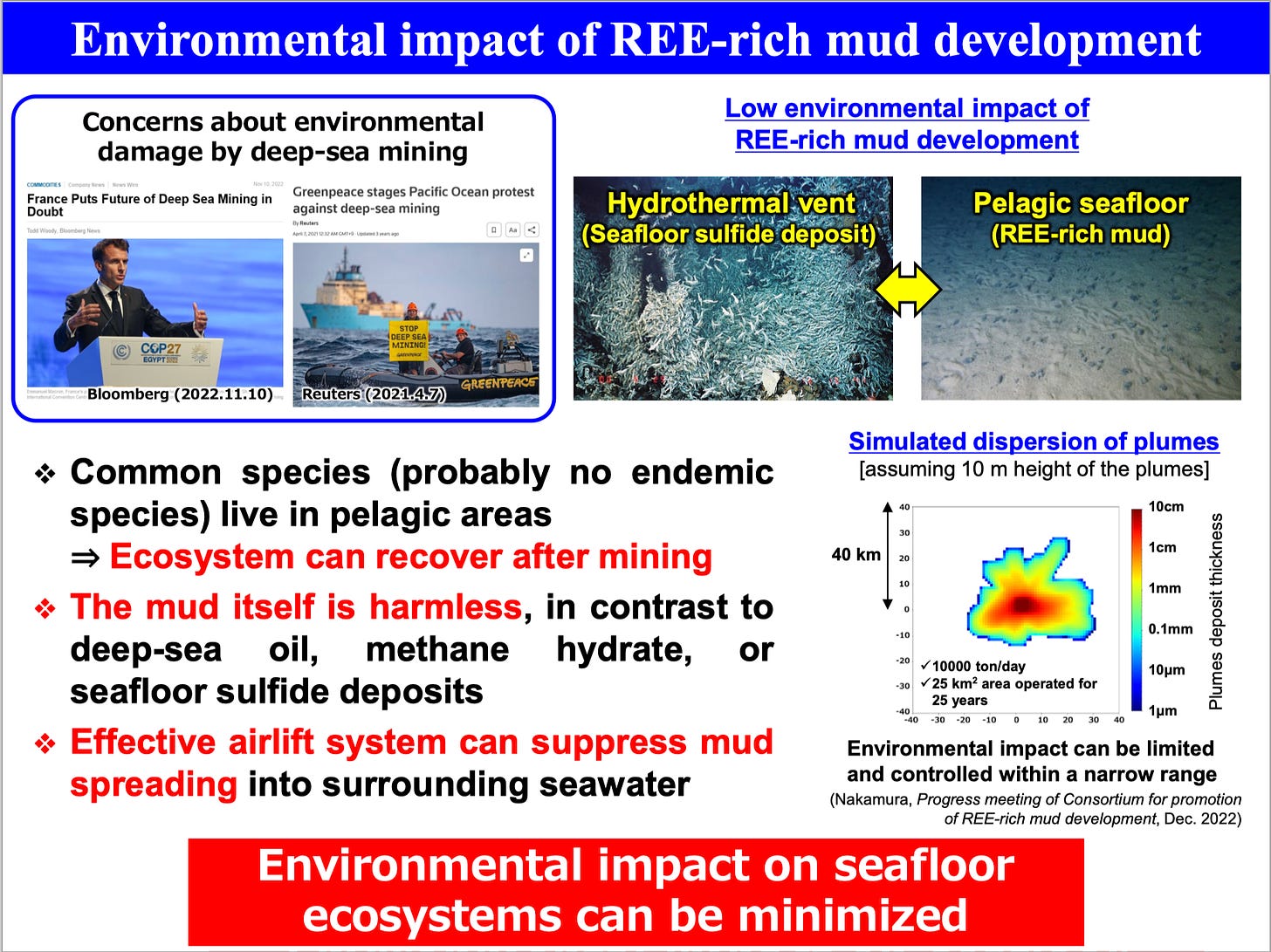

Professor Kato of Tokyo University presented the concept of deep sea mining of rare earths just off Minami-Torishima island in Japan.

The story of this deposit is ages old and it is essentially the perpetual messaging to China that Japan could do without China’s rare earths.

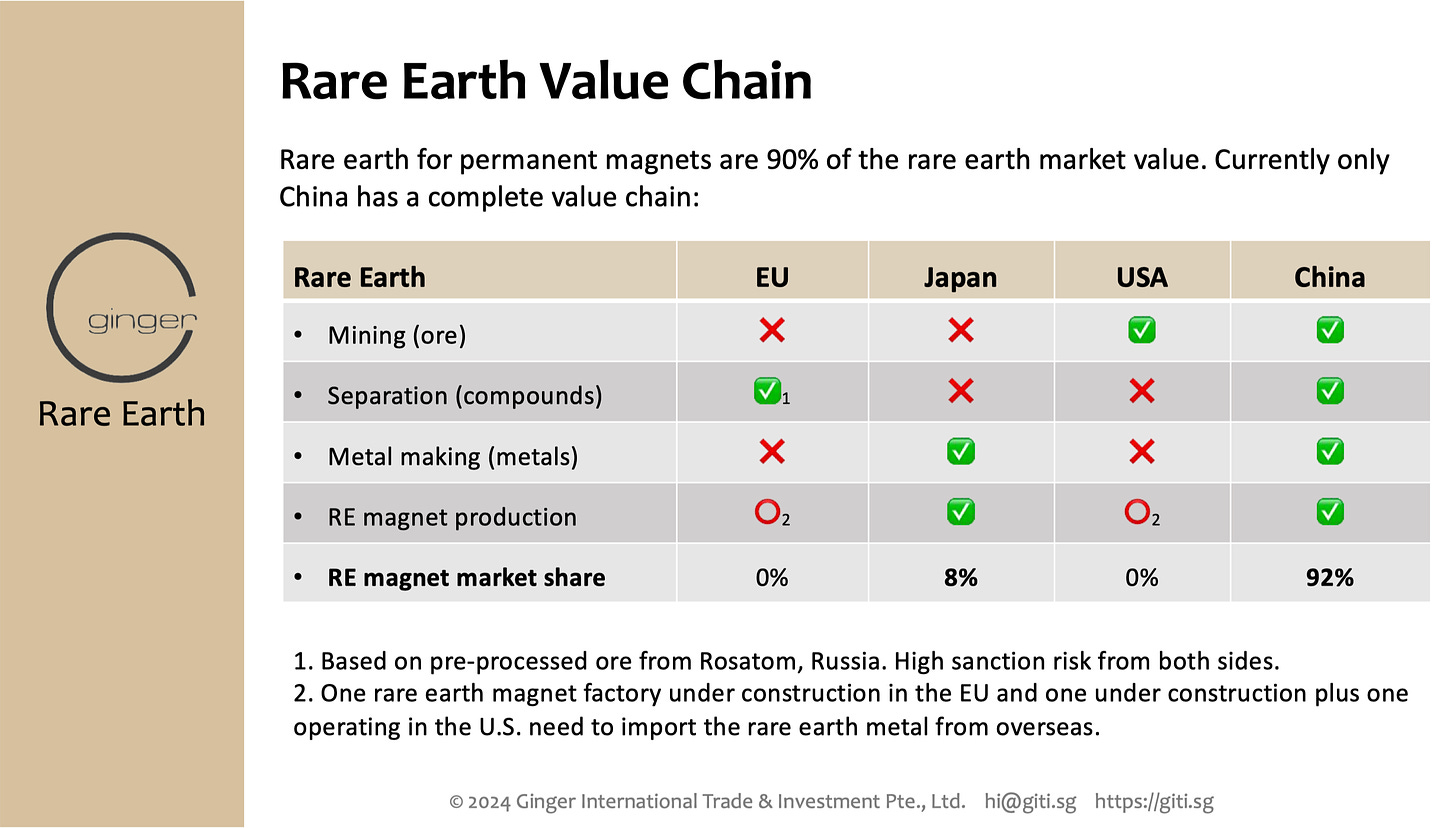

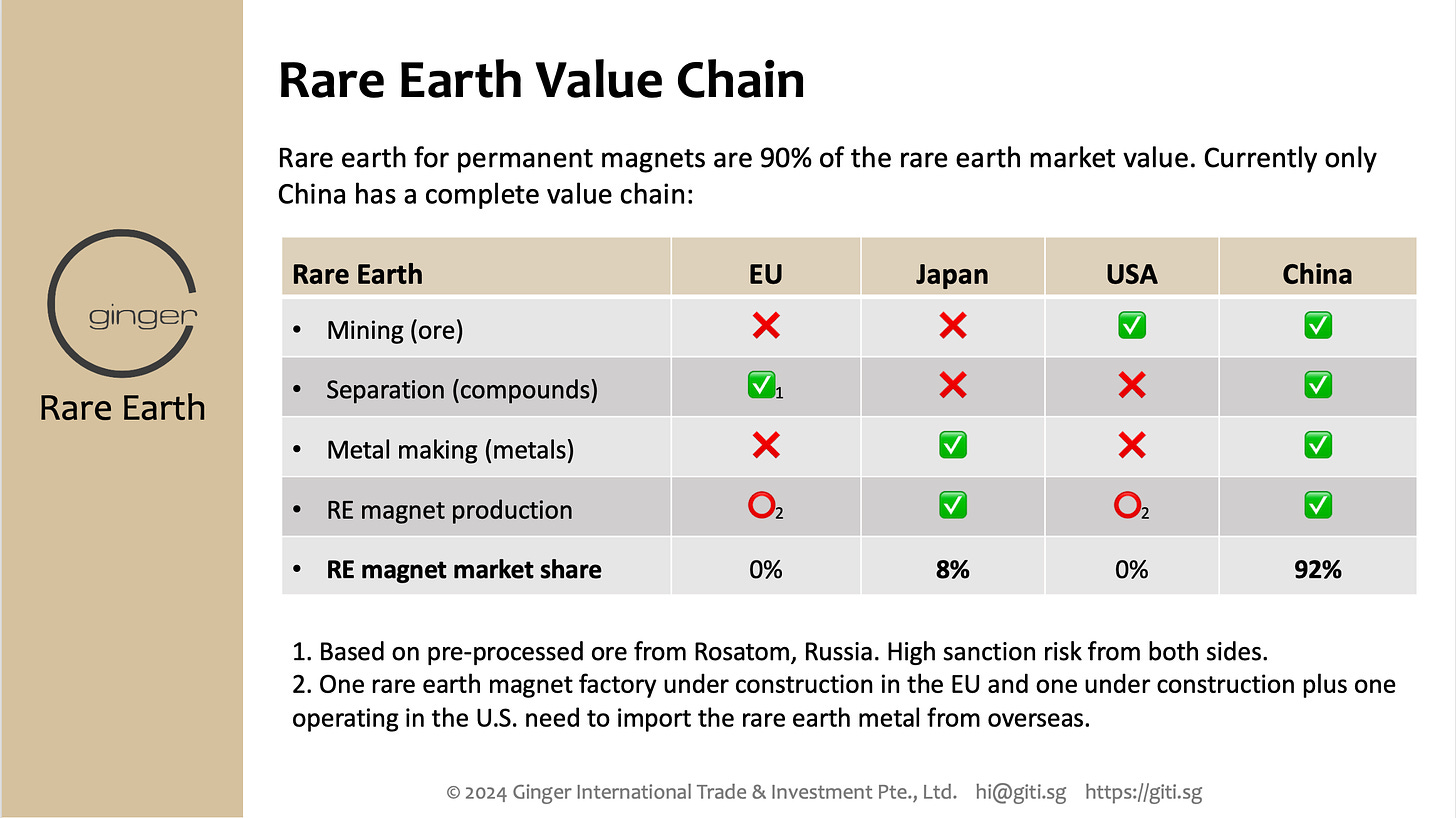

Japan is the only country outside China with a rare earth value chain. All others are merely bystanders. Also the core conflict in rare earths is and has always been between China and Japan, in our humble opinion.

No contras

In his pointedly political presentation Professor Kato almost exclusively focussed on the pros of the concept. We disagree with several old, misleading or even plainly wrong numbers presented.

In terms of environmental impact Professor Kato claims that it would be negligible at this particular location of the Pacific Ocean. Kato therefore is of the opinion that Minami Torishima should be mined.

Kato blissfully excluded the fact that we know next to nothing about the deep sea flora and fauna, other than a having a hunch that messing with it may trigger a chain of reactions that may hugely affect world food supplies.

Deep-sea mining license

The UN agency International Seabed Authority (ISA) in Jamaica regulates ocean floor mining globally. So far it has granted exploration licenses but no mining licenses.

Reciprocity

Among the holders of exploration licenses are China and Japan. It is quite predictable that, should Japan ever receive a mining license for Minami Torishima, China will press for a deep-sea mining license for whatever, simply based on reciprocity and ‘fairness’. And that will bring about a proliferation of mining licenses to whomever, wherever, things spinning out of control.

On being challenged at the conference Kato evaded answering the relevant question.

Kato even questions the authority of the UN by stating multiple times that Minami Torishima is in the UNCLOS Exclusive Economic Zone (EEZ) of Japan. This he said in order to insinuate that Japan would actually not need the ISA’s approval for deep-sea mining. So, first JOGMEC recognise the authority of the ISA by applying and being granted an exploration license, and afterwards Japan should withdraw recognition?

Our take

The Fukushima Nuclear Power Plant was also within Japan’s Exclusive Economic Zone.

Concretely, there are things within EEZs that affect all of the world. That includes messing with the oceans. And therefore Japan will kindly wait until there is sufficient, dependable research on the environmental impact and the possible chain-reactions caused by deep sea mining globally.

Rare earth ocean miner

A potential deep-sea miner for rare earths is Chatham Rock Phosphate, New Zealand. The company was denied environmental license approval already once.

Last Week Tonight

Deep Sea Mining

John Oliver is most certainly not the ideal source for all things mining or anything else for that matter. He makes valid points, though.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.