Feel magnetised: The 20th Int'l RE Conference; Developments in India, Central Asia, Malaysia, Myanmar, at China Northern, Shenghe, Niron, SRC, Mkango, Godolphin, Altona and the lot.

Rare Earth 28 October 2024 #158

The 20th Rare Earth Conference

As ever solid and flawless execution of this conference by Metal Events.

The actors change, the subject remains the same. As usual there were no presentations by Chinese rare-earthlings, as they are too scared to reveal something which may get them into hot water back home. Also in Washington DC the walls have ears.

Nonetheless, long term participants titled it the best rare earth conference ever. We discuss some of the presentations below.

Kloni

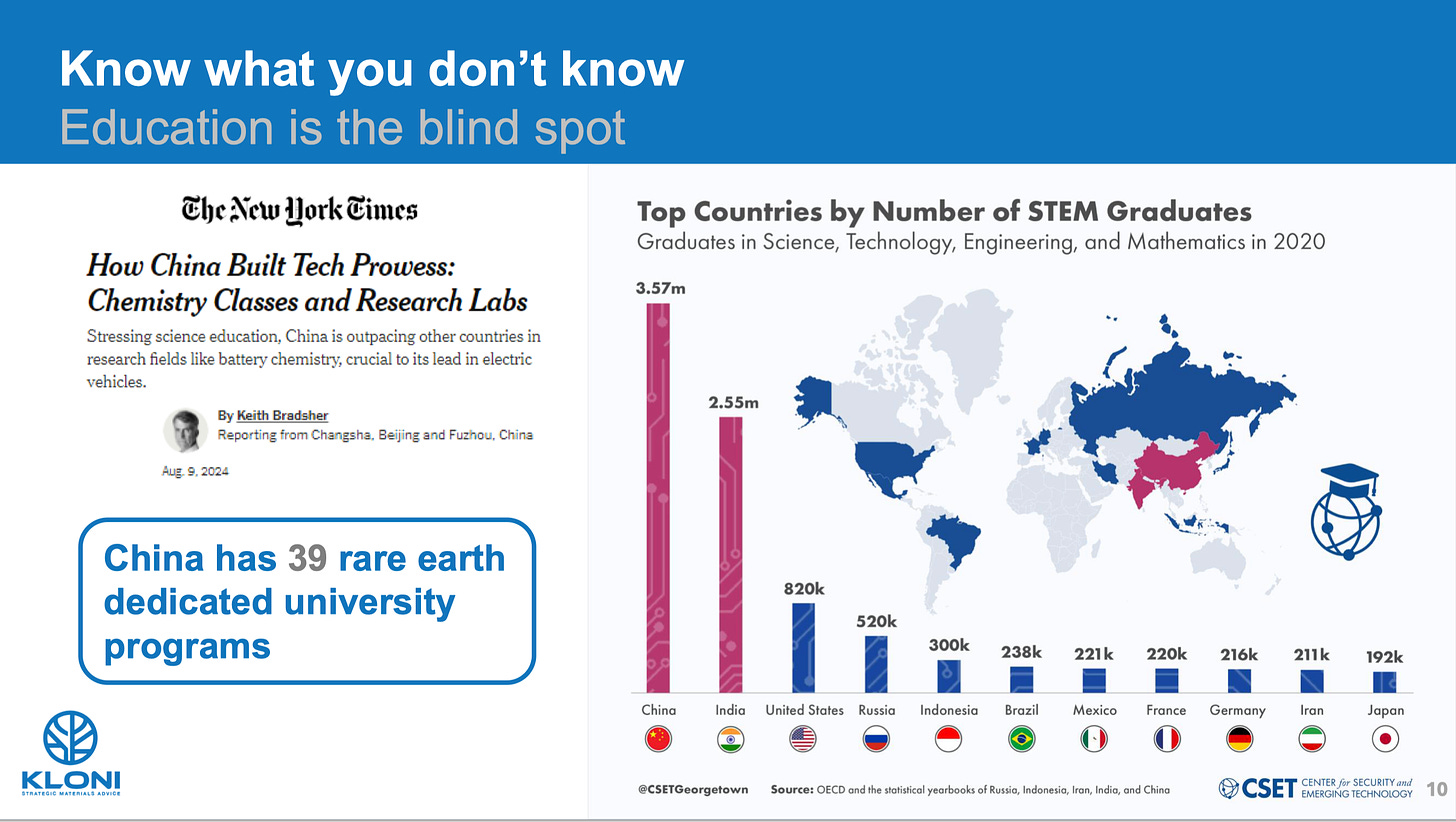

Eminent rare-earthling Constantine Karayannopoulos opened the conference making the important points that rare earth applications change significantly over time and that rare earth being indispensable is a myth. The absence of coherent and competent government policy causes much damage to the resources sector in general and rare earths in particular.

The presentation made the correct case there are no rare earth surprises from China, ever, if one only bothers watching.

Constantine Karayannopoulos is spot-on. Just recently China Rare Earth Group signed a co-construction agreement with

Shenzhen Graduate School of Peking University,

Guangdong Academy of Sciences,

Advanced Research Institute of the University of Electronic Science and Technology of China (Shenzhen),

Shenzhen Institute of Advanced Technology of the Chinese Academy of Sciences, and

This on top of its pre-existing platform with Ganjiang Innovation Institute of the Chinese Academy of Sciences and China Research Institute Group.

Lynas

The Lynas presentation handed-in shows a lot of work-in-progress and vague timelines, sometimes using definition of periods as “CY” (calendar year) and sometimes ‘FY” (financial year, Lynas’ FY is end of June). For example, heavy rare earth separation at Kuantan is forecast for “CY” 2025.

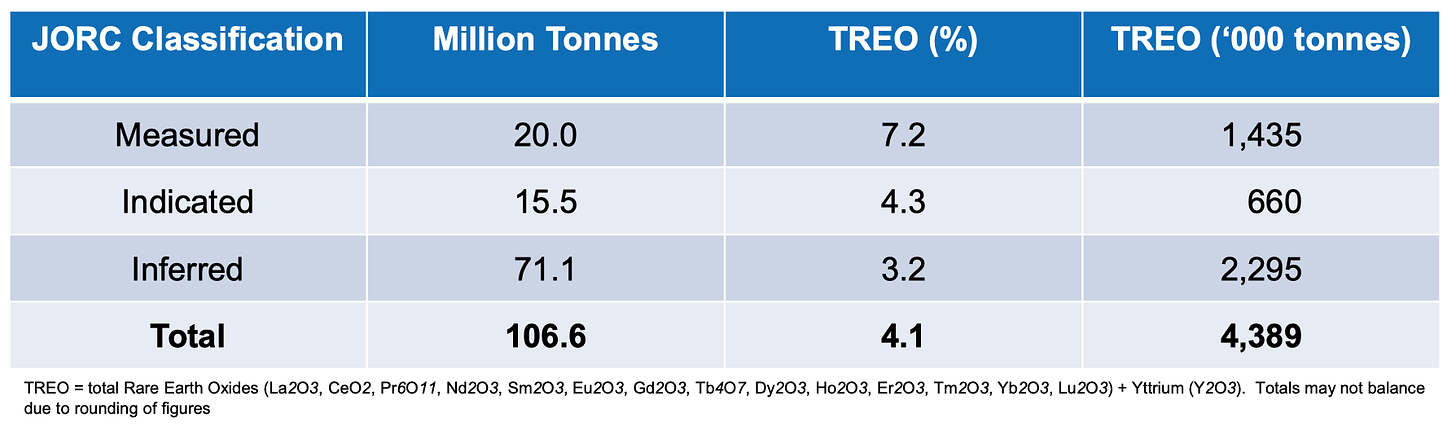

Lynas’ resource assessment looks spectacular, especially in combination with the planned capacity expansion. Measured 7.2% or 1.4 mio tons of TREO, a so-far low cost resource, any hard-rock-based junior rare earth miner with less could simply pack up and leave the industry.

There are, however, doubts regarding the extraction of rare earths from the resource, in our understanding it should now be turning to apatite, different from the largely depleted layers of monazite.

The market view Lynas favourably:

Energy Fuels

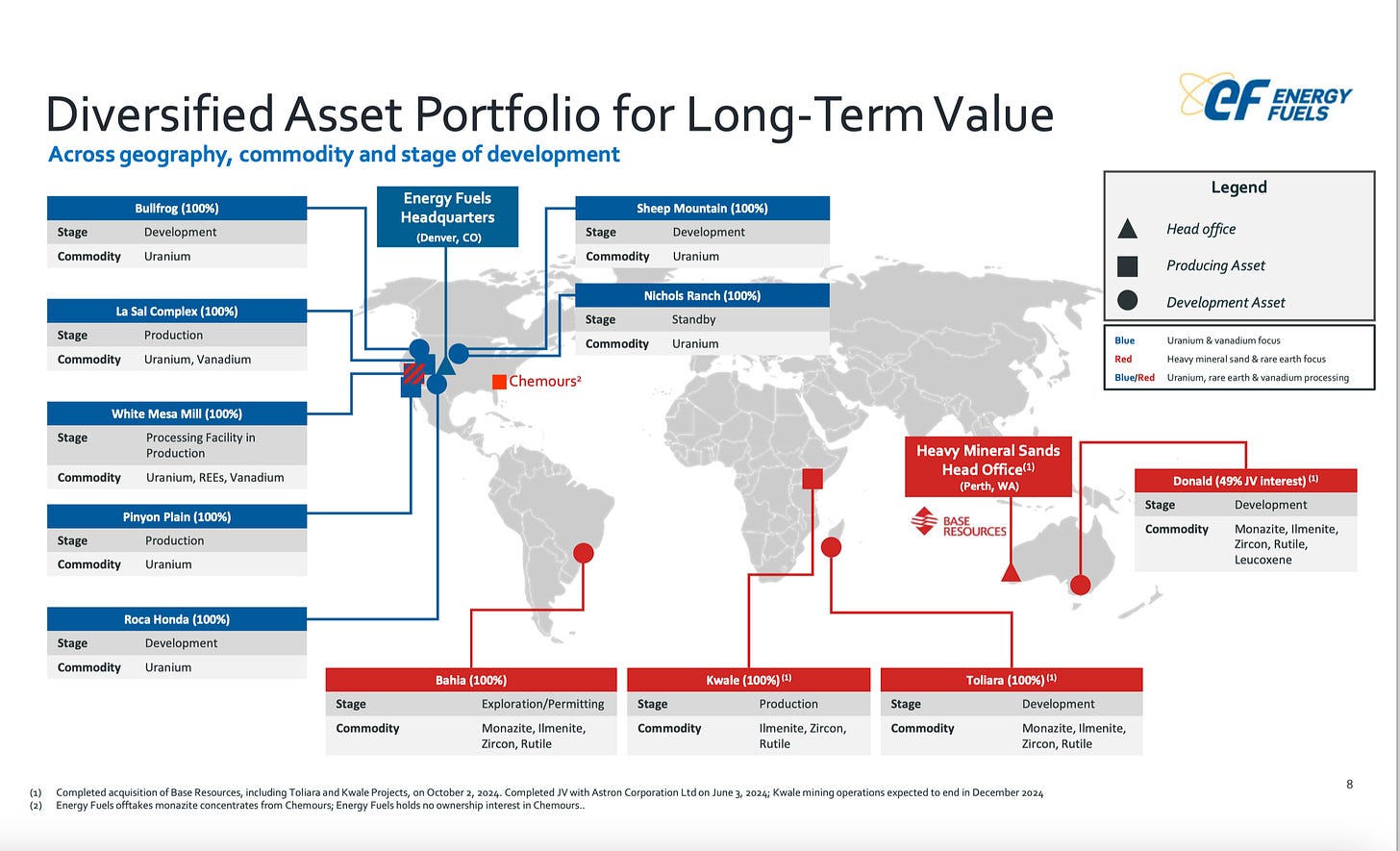

The usual steamrolling from Energy Fuels.

They produced some NdPr oxalate, which they currently sample to interested parties.

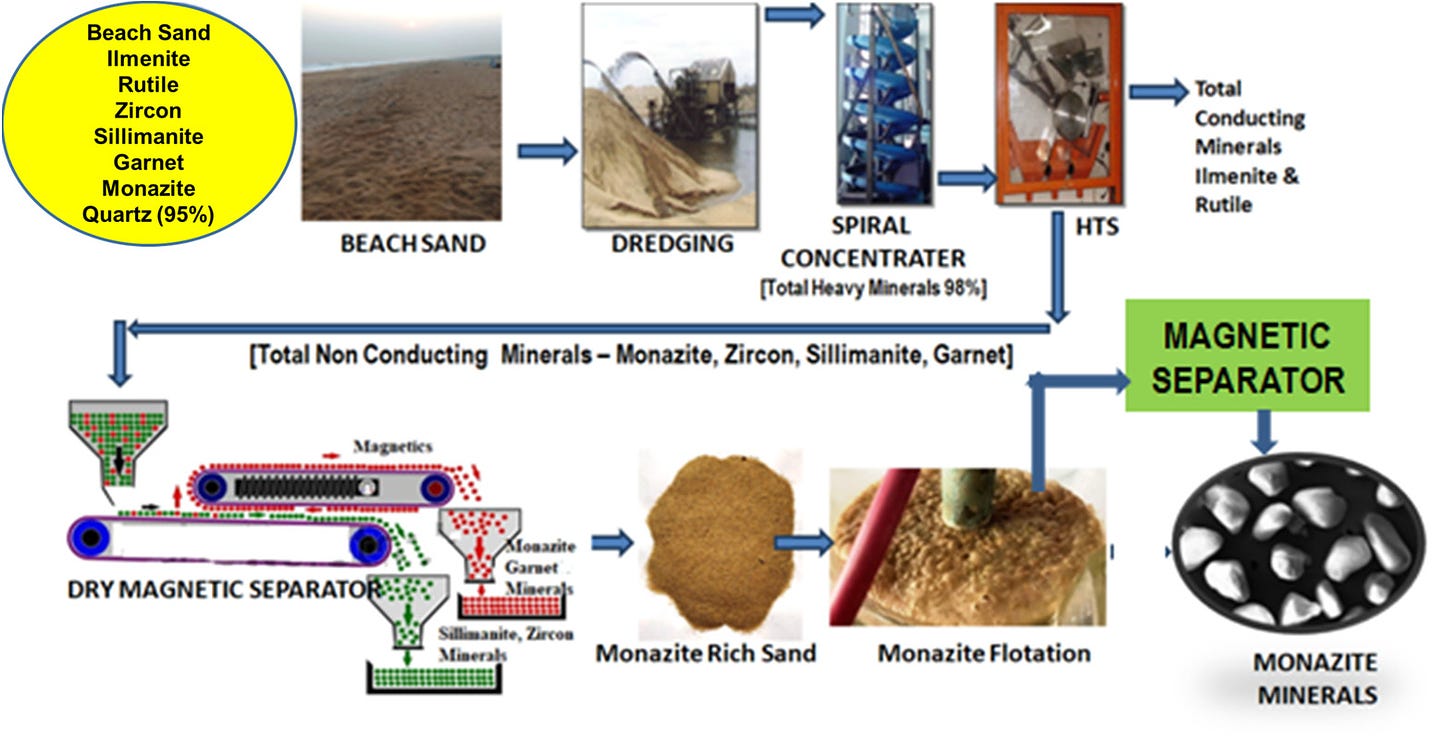

We are tempted to think that Energy Fuels may have overloaded themselves with heavy-mineral-sand-based monazite potential from Brazil, Africa and Australia. Energy Fuels expressly follow the same trend as China does in terms of surfing the HMS monazite by-product wave.

Our view is that the limit for monazite as a cheap by-product from HMS will have been reached, when the main components of heavy mineral sands, ilmenite (titanium), rutile (titanium) and zircon (zirconia) reach market saturation. At that point of time you will be back at monazite needing to be commercially self-sustained.

Currently replacing sanctioned, cheap titanium metal supplies from Russia is what potentially drives part of the HMS route. But Russian supplies simply look for other markets, potentially oversupplying titanium metal elsewhere. As ThomasNet write correctly, “unfortunately, supply chain challenges like the titanium shortage are cyclical and can quickly snowball.”

The main outlet for ilmenite remains titanium oxide as a white pigment for coatings and paint.

Also UUUU are viewed favourably by punters:

Department of Energy

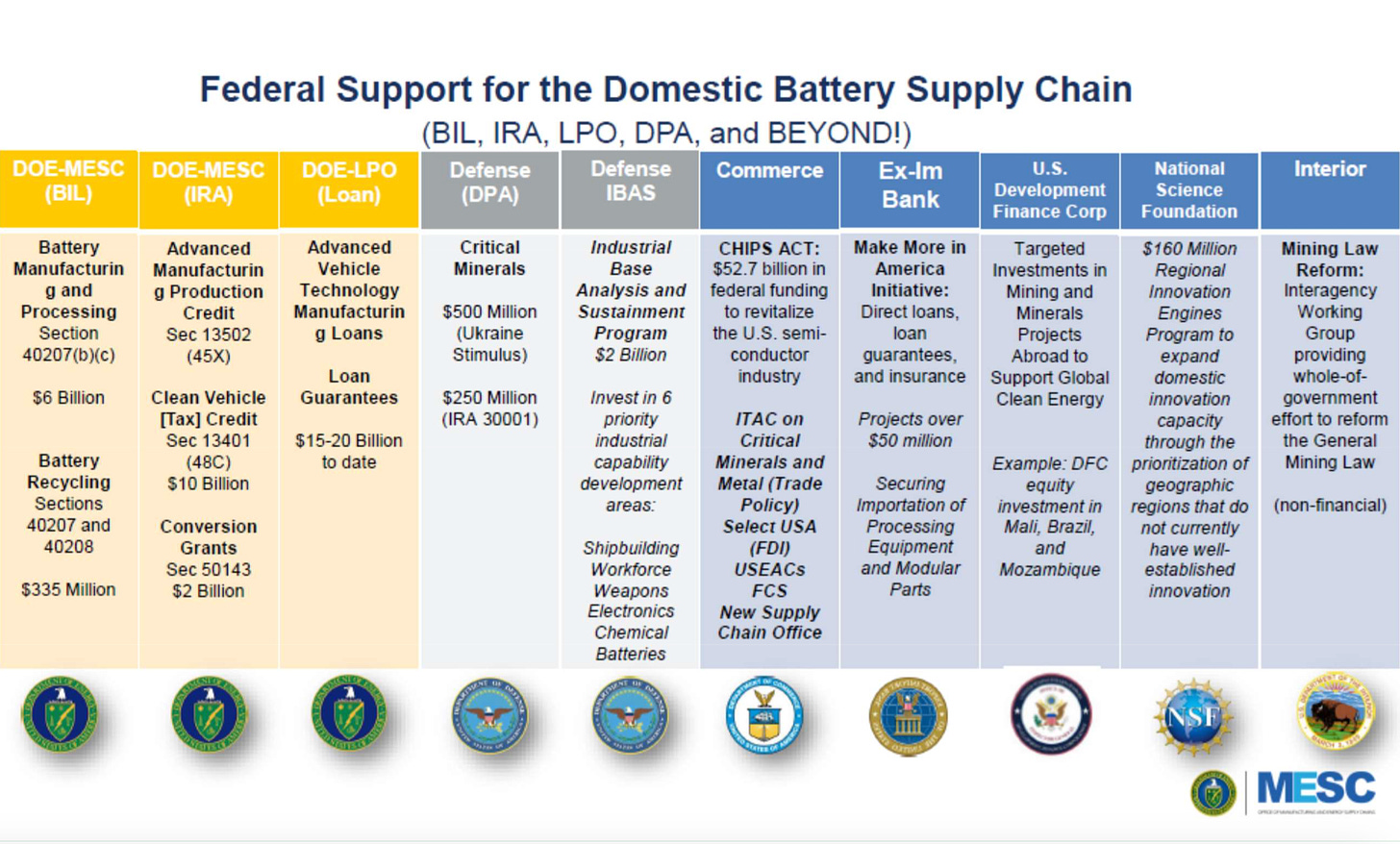

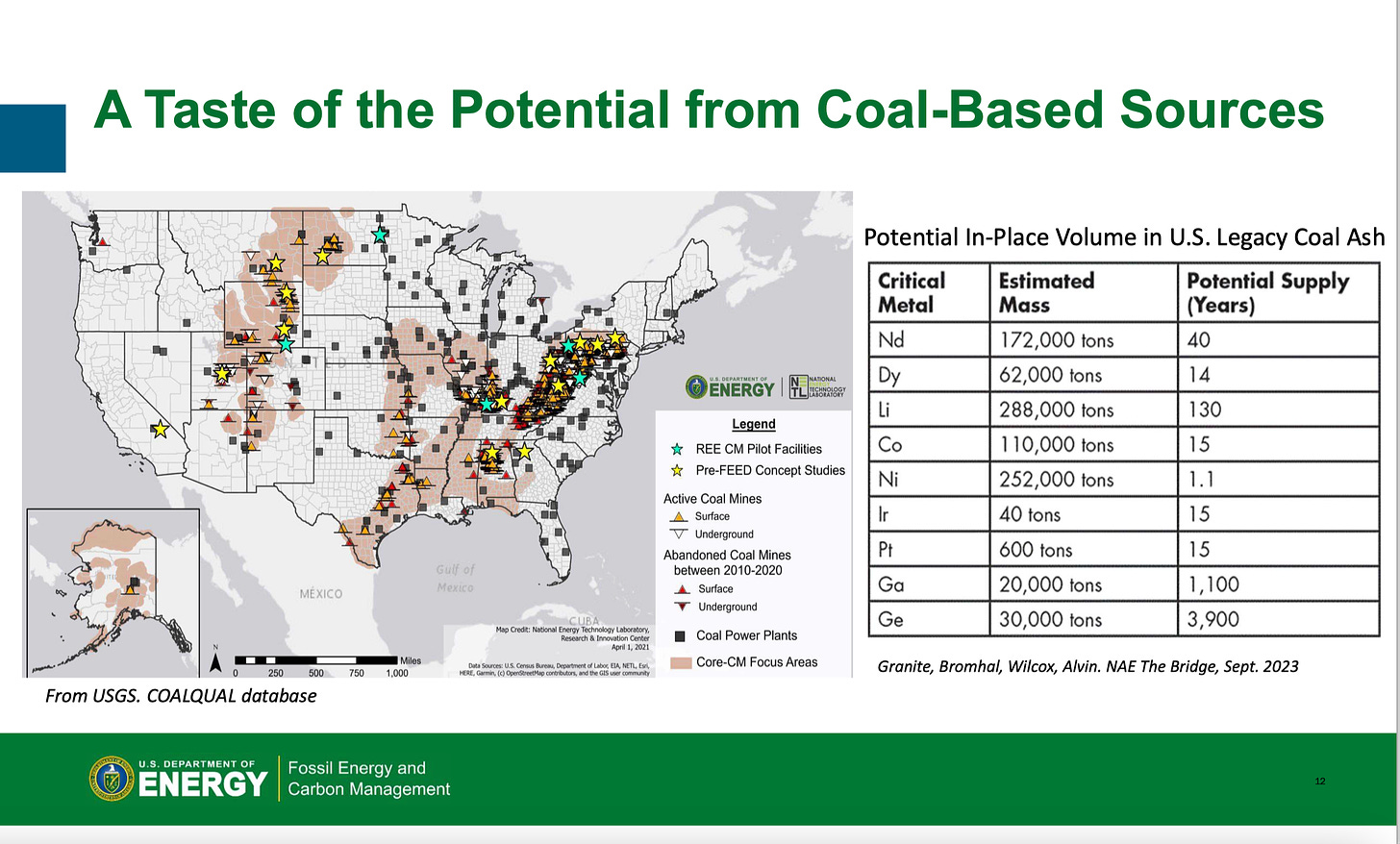

Thankfully the presentation sums up support measures offered by the U.S. government:

DoE is very focussed on what we call “embargo technologies”, the last resort for obtaining quantities of materials at whatever cost, when all other supply sources have failed:

Tradium

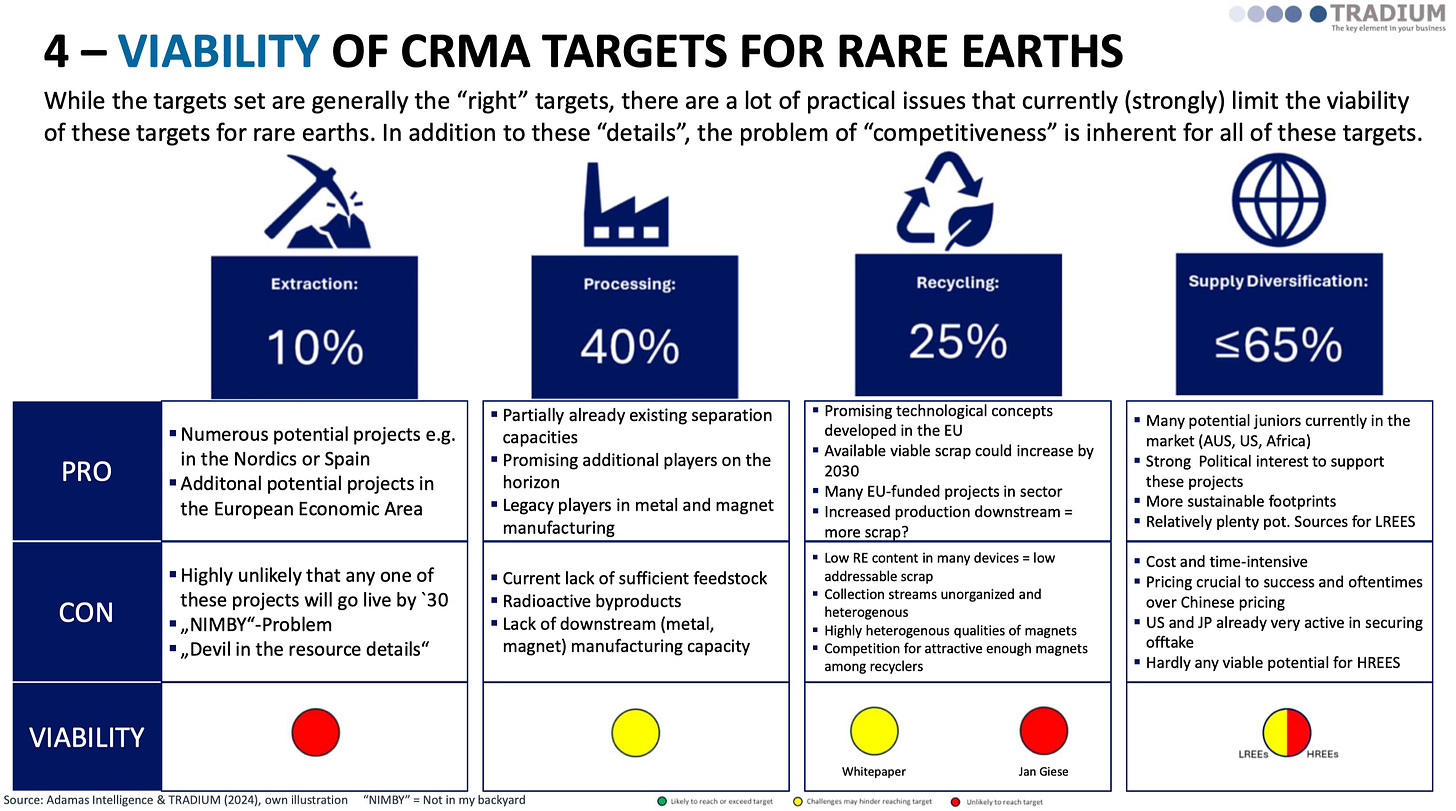

This importer of rare earths and other minor metals did a thorough analysis of the EU Critical Raw Materials Act (CRMA) and the EU’s self-mutilation of critical raw material production.

Expert Jan Giese presented the perspective of the CRMA (not) meeting its self-set objectives for rare earth:

Our view is that the EU bureaucracy is fully aware of a predictable per-item failure potential of the CRMA and will therefore measure the success of the CRMA as an average across all critical raw materials. Doing so guarantees success, because as per our assessment going by the average of all critical raw materials the objectives of the CRMA had already been met before it even became policy.

Success, Europe rejoice!

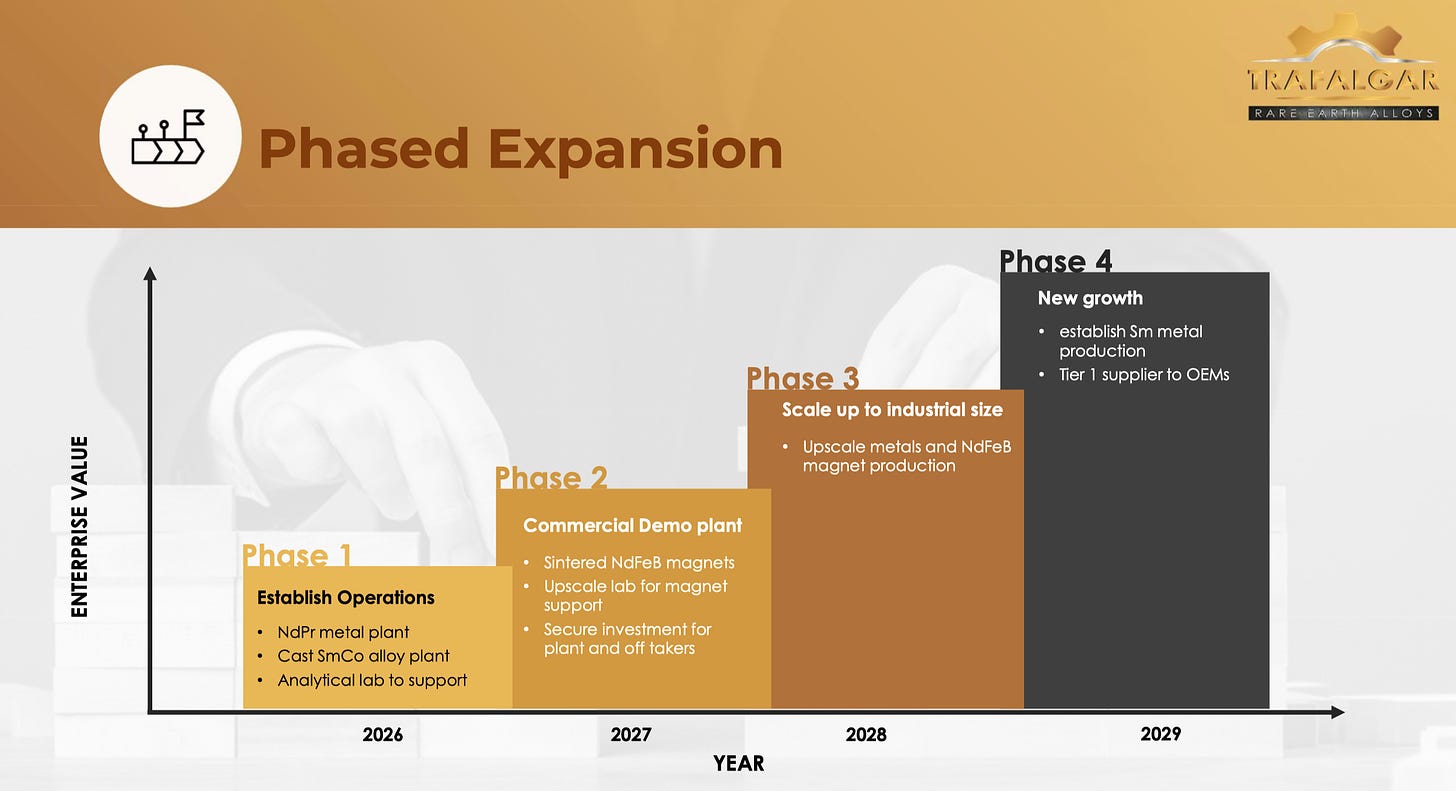

Trafalgar

This company presented its determination to build a (badly needed) complete value-chain for rare earths in India. We discuss the need of this approach in details below.

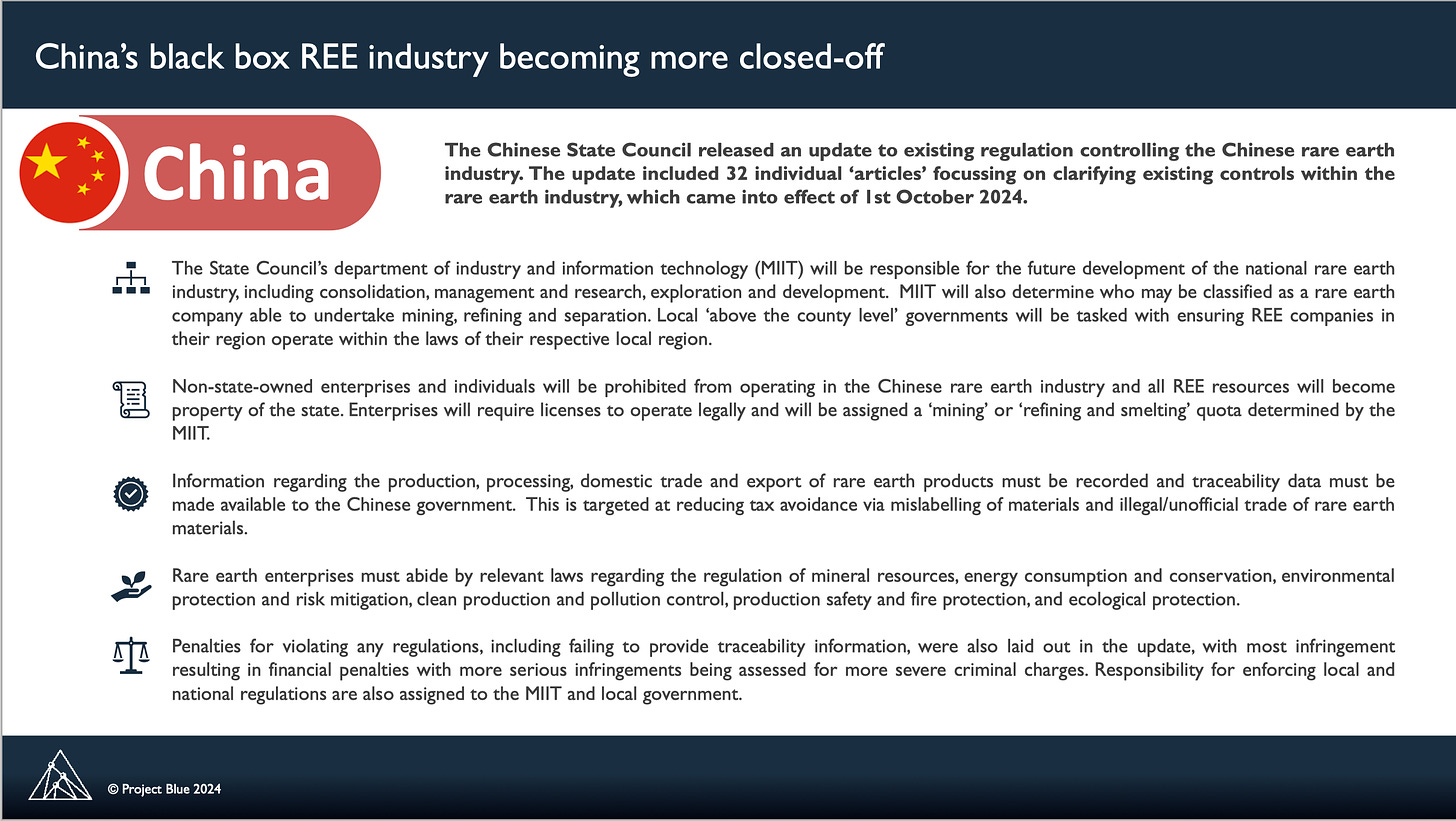

Project Blue

Our favourite rare earth consulting company presented once again its comprehensive competence in rare earths and their applications. A great job done. The only blemish in our view is here:

We had discussed the China rare earth law back in July. It folds long pre-existing regulation into a single law, not more, not less. State-ownership of resources is pretty common the world over, nothing particular to China, where it had been enshrined in the constitution since day one.

Project Blue interpret the causes and the objectives of Chinese rare earth policy incorrectly, perhaps because the company is still young. This is dangerous for junior rare earth miners, as understanding what the opposition is up to is mission-critical for survival in any market, also in rare earth.

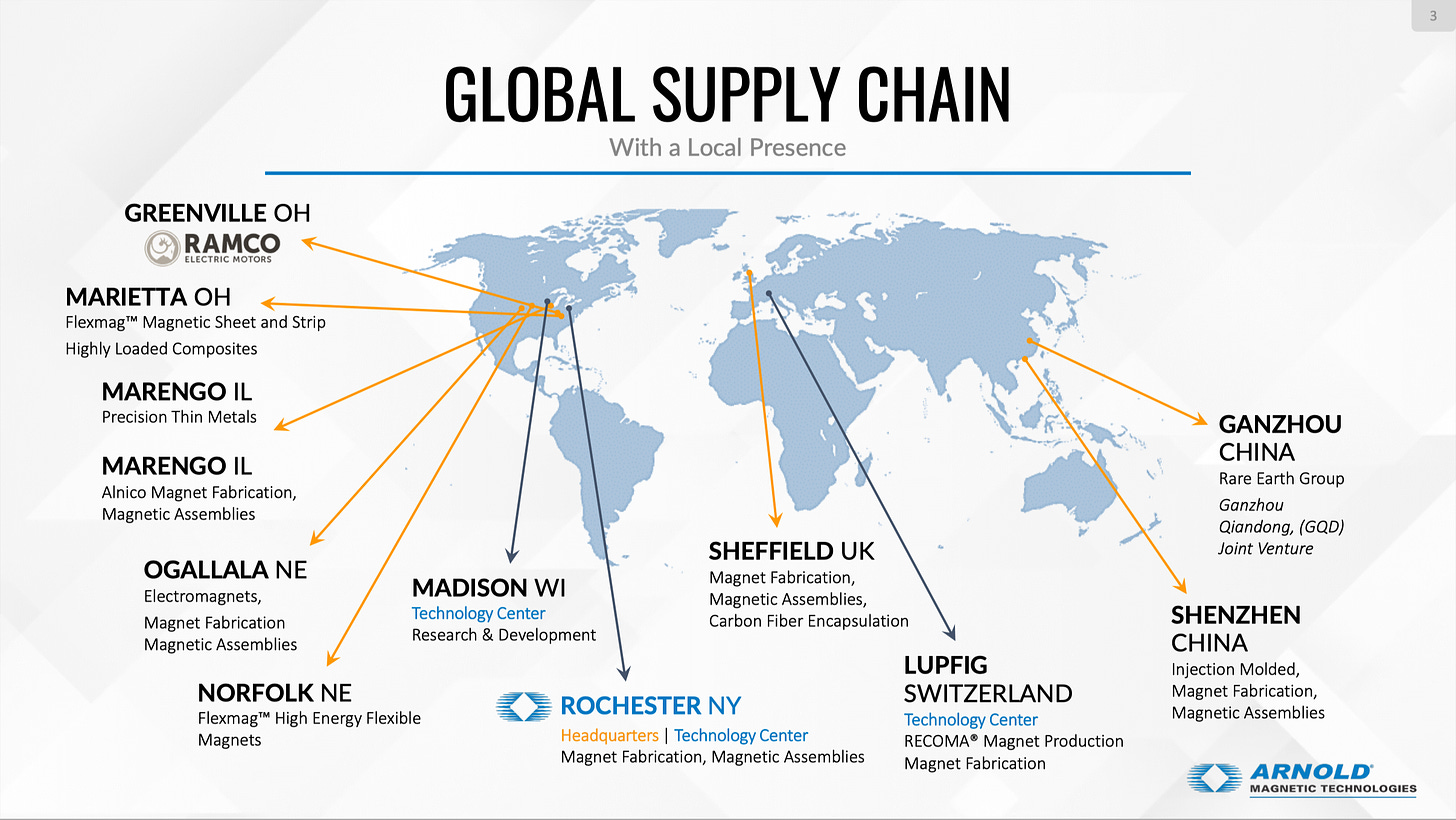

Arnold

The comprehensive and interesting presentation showed by example of magnet expert Arnold what the current and also future magnet supply chains to the U.S. market look like, perhaps in future minus magnet demand for defense applications.

Call for subsidies

Arnold featured a call for subsidies, i.e. the U.S. government throwing money at the sector, rather than actually earning money for public coffers by introducing tariffs.

Our take

The decision to introduce tariffs on NdFeb had been a good one, but public money has still been thrown at relevant magnet projects, as time seems to be pressing as far as supplies to DoD are concerned.

Once NdFeB are off the ground, it seems sensible to introduce tariffs further upstream, i.e. metals, and once metals are off the ground introduce tariffs on rare earth compounds, in order to successively encourage private investment along the value chain. This would be light on hard-earned taxpayer funds and less risky than subsidies in terms of “take-the-money-and-run”.

Subsidy zombies

Experience the world over has proven that subsidies are rarely one-off, they rather create subsidy-junkies, perpetually unable to survive without. In the day and age of de-globalisation it seems sensible to apply tariff protection and thereby forgo international market sales-potential of finished products because of higher production cost. International markets will likewise go tariff-protectionist on downstream products anyway.

Less Common Metals

Chairman Grant Smith presented LCM’s capacity to produce rare earth magnet metals and alloys. At a capacity of 2,500 t/y LCM run in the category small but beautiful, in our view the sane and correct approach in a nascent ex-China market.

In terms of downstream rare earth metals LCM may well be viewed as mirroring the capabilities of China Northern Rare Earth Group.

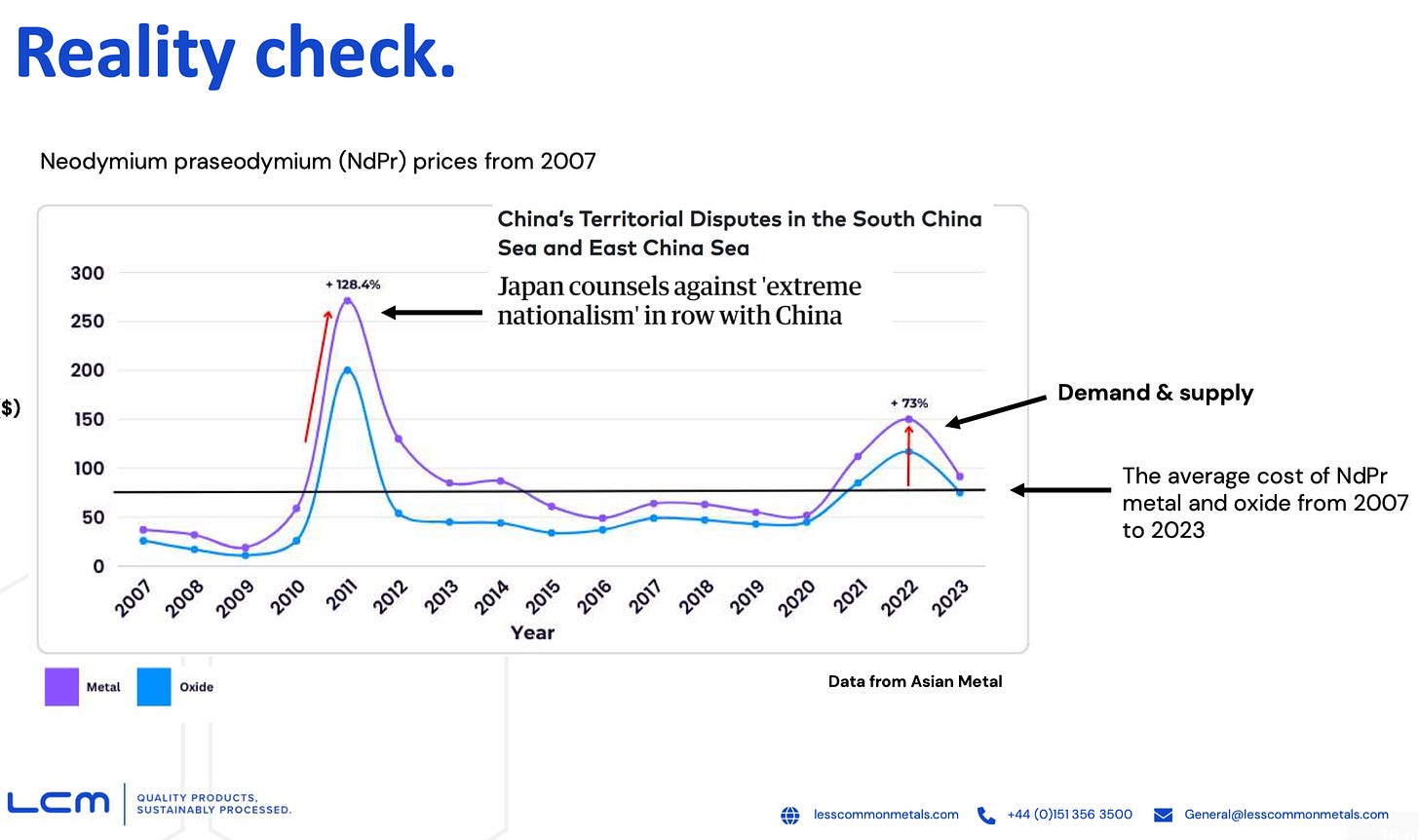

Reality check on prices

LCM make the case that rare earth prices are visibly the result of supply and demand and not related to black hands guiding the market.

Avid readers of The Rare Earth Observer will find confirmation of this in numerous of our past issues. There has been a decades-long quest in China to induce market-based pricing in rare earth, while at the same time enforcing overall compliance with sensible environmental and resource preservation regulation. Everything we have seen in rare earths during the past 25 years relates to these dual objectives.

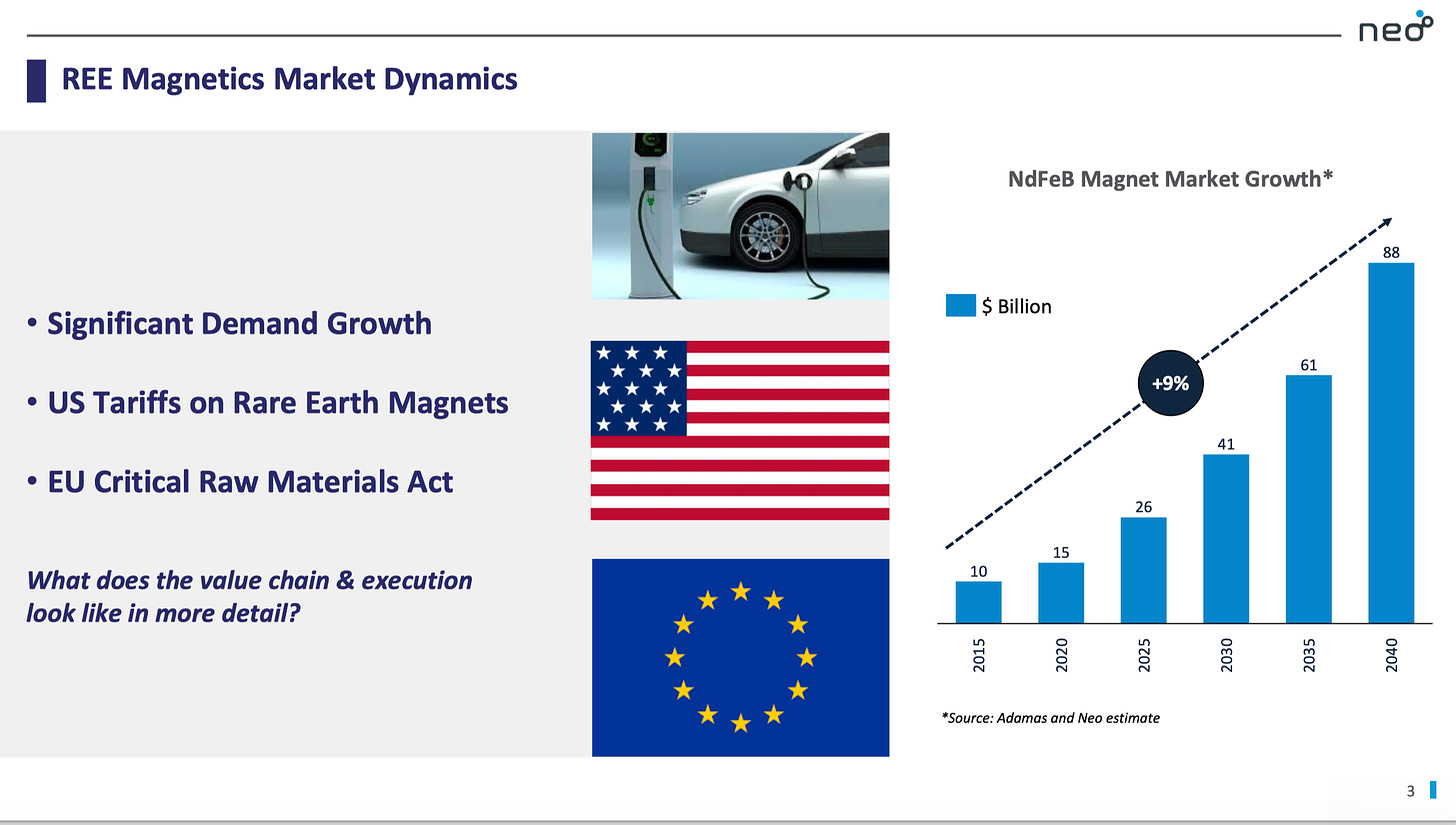

Neo Performance Materials

While rich in technical details of the rare earth value chain and Neo’s indisputable expertise in production, application know-how and R&D, the presentation conveniently lumped together what does not belong together under the heading of NdFeB magnets.

Supported by the always optimistic forecasts of Adamas Neo put the CAGR of all NdFeB magnets at 9%/year until 2040, in the unshakeable belief that ambitious government targets will be reached. Recent adjusted forecasts from China are rather around 6%/year, one third lower.

But Neo-Magnequench are not in this high growth market yet

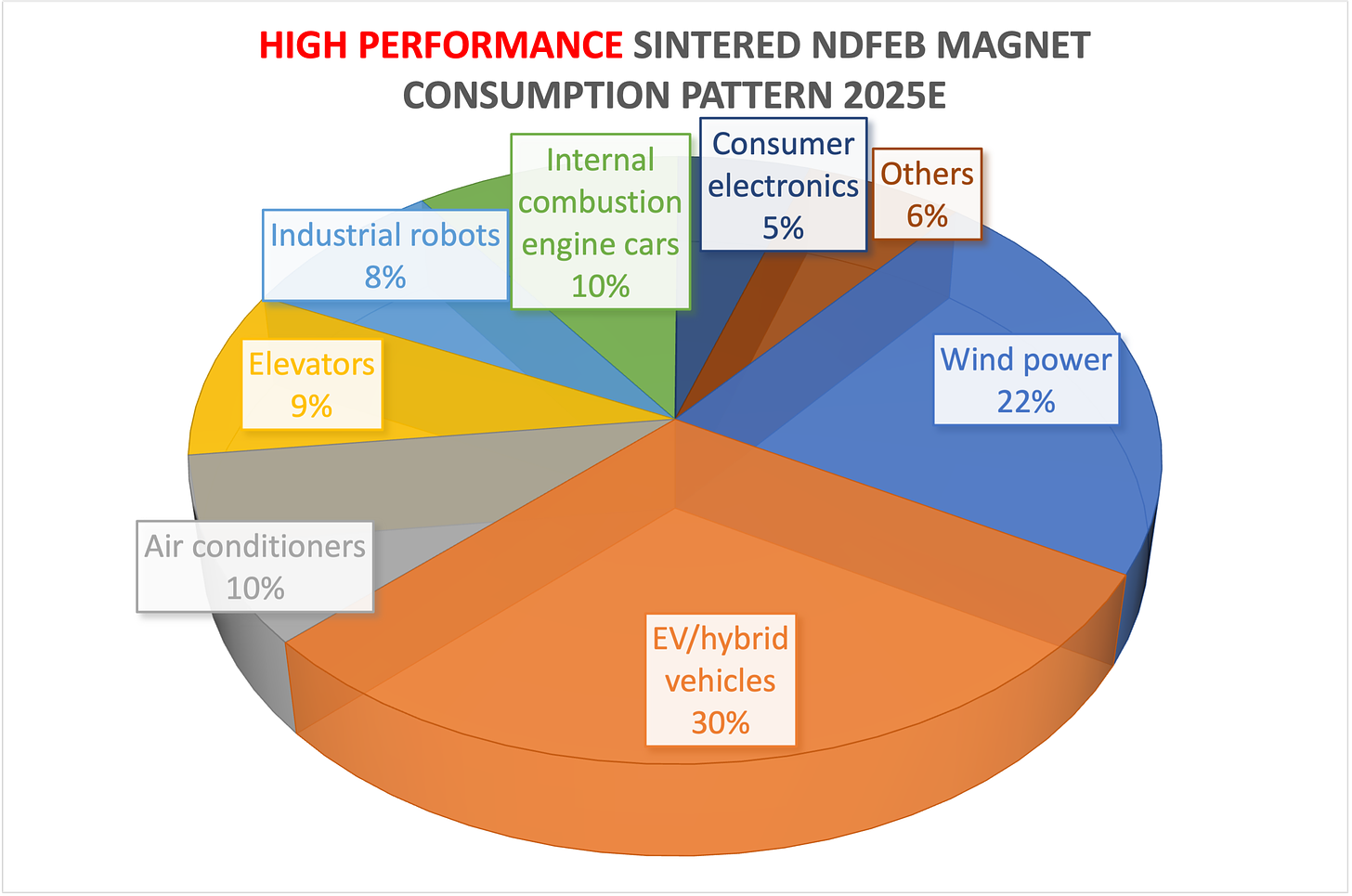

Simple fact is that Neo-Magnequench are active in BONDED NdFeB magnets and magnet powders, which is a rather small share of the overall permanent magnet market (~6% of permanent magnet market). Neo’s bonded NdFeB market is different from the SINTERED NdFeB magnet market (~57% of permanent magnet market).

WITHIN the SINTERED NdFeB magnets there is the so-far strongly growing market-segment of high performance SINTERED NdFeB magnets - and that is where the rare-earthy music is playing. Neo-Magnequench do not participate in this market yet.

Once Neo’s new factory in the Estonian-Russian border town of Narva has entered commercial production the Neo-Magnequench will become part of this growth market - not earlier.

However, the stock market is upbeat.

The full potential of Neo’s share price could only be unleashed, if the eyesore of Hastings’ ca. 20% shareholding would disappear:

Geomega

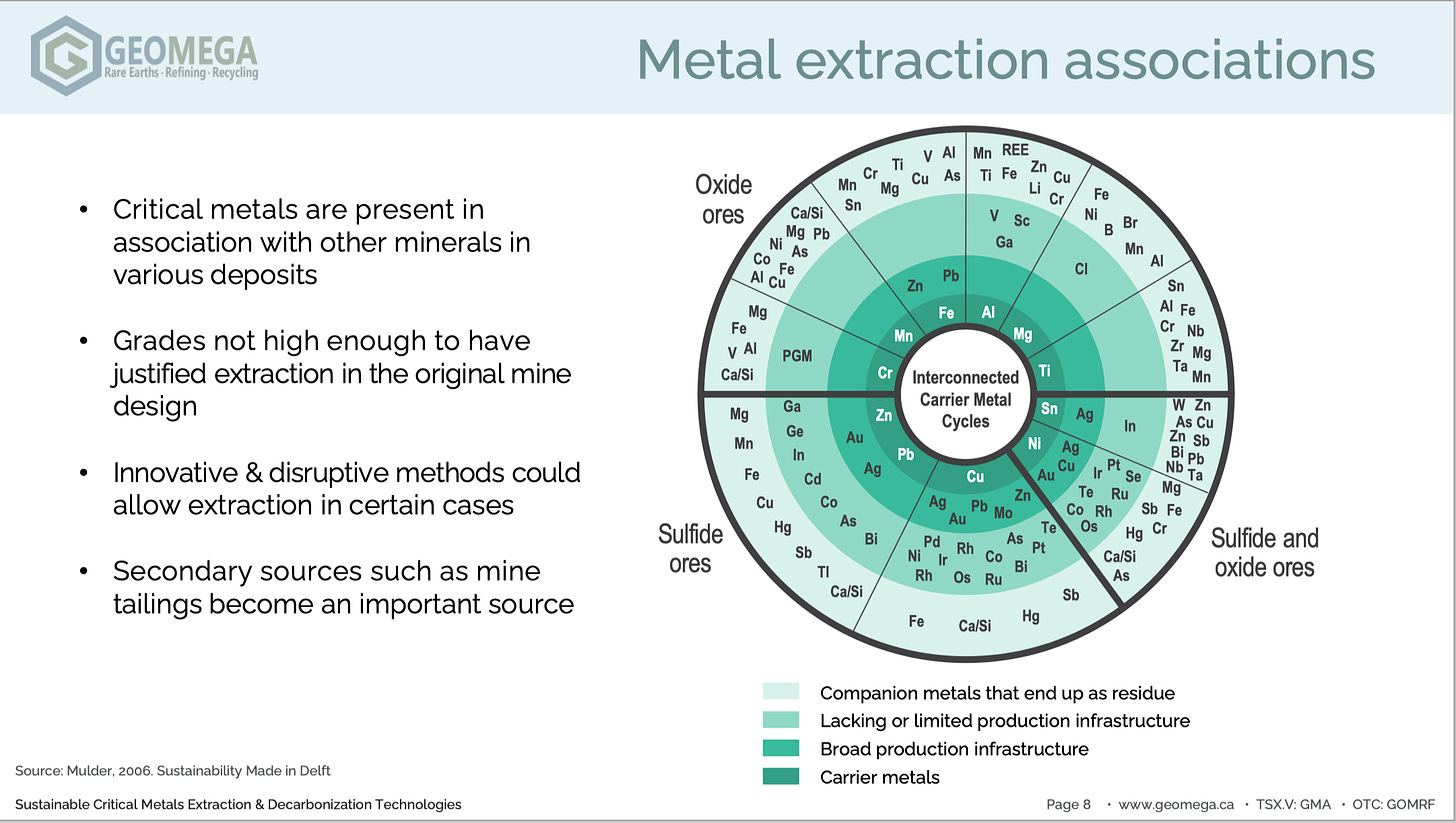

Long-term rare-earthling Kiril Mugerman presented in great detail about Geomega’s clean technologies to extract critical & strategic metals from secondary resources like red mud as well as primary resources such as bastnaesite.

There is lots of potential but the absence of hype did not inspire the audience. Also Geomega are small and potentially beautiful.

Among the speed-presentations towards the end of the conference only one was somewhat remarkable:

Brazilian Critical Minerals

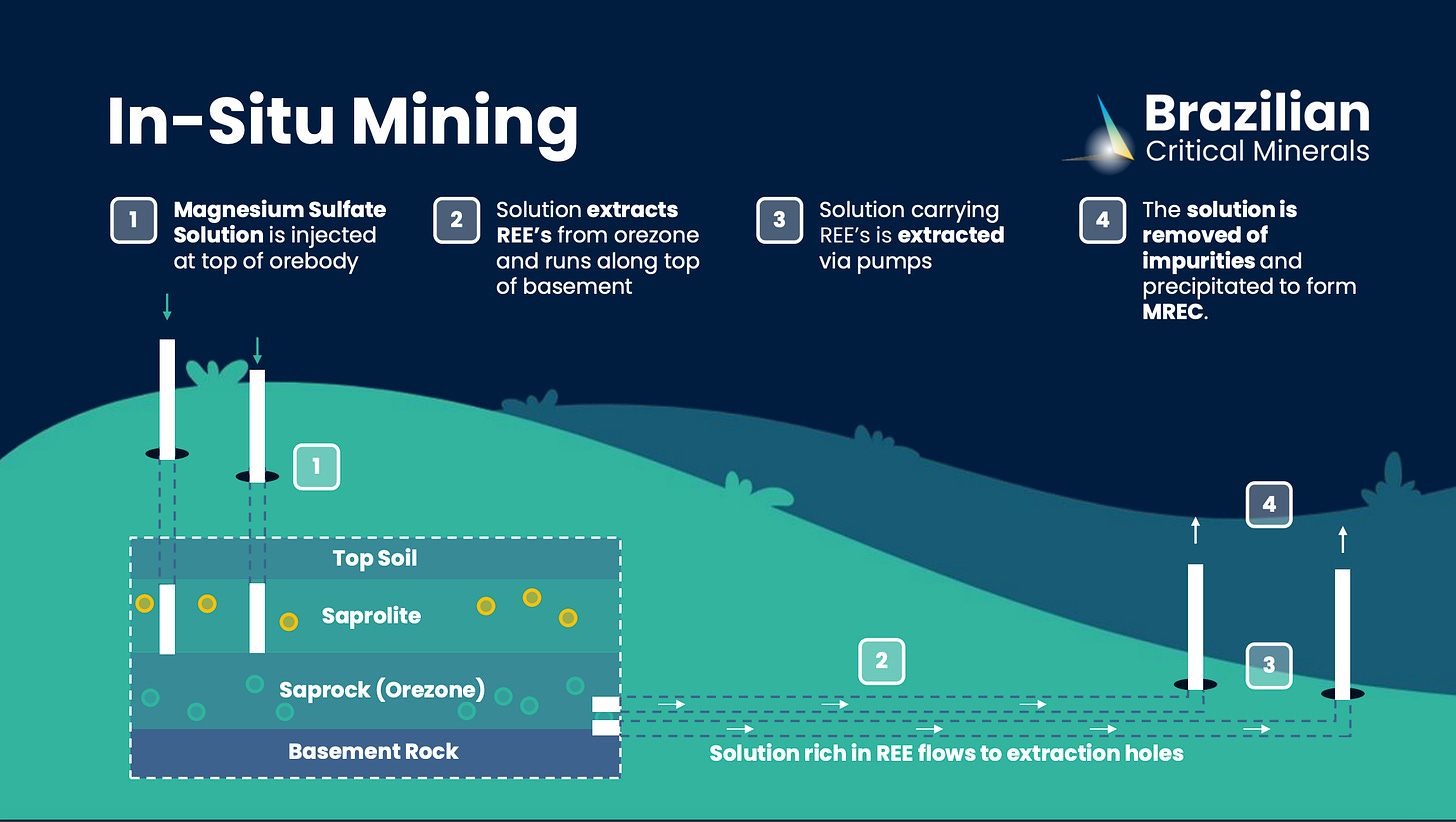

The company is one of the several IAC miner hopefuls in Brazil, but with an unusual twist. While they plan to do in-situ leaching, the leachant is anticipated to be a low magnesium sulphate solution instead of the poisonous ammonium sulphate solution others propose.

This is curious, because the only other IAC mine that uses a magnesium sulphate solution for in-situ leaching is in China, based on a process developed by the General Research Institute of Non-Ferrous Metals “GRINM” in Beijing (which, of course, is banned from being sold/used/licensed abroad). According to several sources in China the leaching yield of this process is underwhelming. BCM, pending further announcements, indicate their yield would be very high, perhaps owing to a particular chemistry of the deposit.

Since the Amazon rainforest in the deposit area has already been cut down, BCM expect no further significant environmental damage from their project.

Subsequently Meteoric boldly announced to look into magnesium sulphate leaching as well.

Hallgarten & Co.

Shifting Sands: State of Play in Heavy Mineral Sands

HMS are a key source of more than just the Titanium products widely associated with them, as key strategic minerals like Zircon/Hafmium and Rare Earth elements are also (sometimes) in the mix

The return to respectability (and doability) of monazite sands as a source of Rare Earths is a trend gaining momentum

The very stability and unsexiness of the Heavy Minerals Sands (HMS) space mitigates against the participation of those investors that want to play fast and loose in the mining markets but it makes for a duller, more placid pace

The pace of corporate actions, particularly M&A and strategic investment positioning would suggest a more dynamic space rather than a sleepy backwater

There is talk of Russia restricting exports of Titanium (presumably sponge) to the West in a tit-for-tat action in response to Western sanctions

The Heavy Mineral Sands space has a Greek chorus of doomsayers, particularly in Australian markets

The rising tide of resource nationalism does not seem to have impinged upon HMS as yet, mainly as Titanium is not perceived to have potential shortages

Ilmenite prices have weakened since mid-2022 as has Premium Zircon, to a lesser extent

As usual excellent research by Hallgarten. A pity it misses the substantial Chinese investments and activities in this space.

//Politics

Myanmar

In recent weeks the Kachina Independence Army of the Kachin Independence Organisation (KIO) overran the rare earth areas “protected” by the regime- and China-friendly New Democratic Army – Kachin (NDA-K).

When the KIO refused China’s request to stop the fighting China closed the border crossings on 21 October 2024, so no ammonium sulphate gets into Myanmar and no rare earth materials make it out to China.

China recovery?

Just before China’s national holiday a Politbureau Standing Committee meeting finally signalled long hoped-for substantial economic support measures. Markets reacted excited, expecting something like China’s post-Lehman measures.

Punters hope that China’s leadership has cut through its self-created ideological fog and realised the true extend of China’s economic problems.

Ideological compliance

They are trying to fix the repeat-problem caused by the ill-conceived, ideological Decision of the Third Plenum of the 18th Central Committee of November 2013, which essentially demands state-owned enterprise to dominate all relevant markets - which of course must go at the expense of private enterprise.

Subsequent implementation of the decision re-introduced major problems which famous Prime Minister Zhu Rongji had spent most of his time in office to fix, particularly the triangular debt problem of state-owned enterprises (simplified: you owe him, he does not pay me, so I won’t pay you - and altogether we won’t pay private enterprises anyway) and related massive bad SOE loans - at the time solved with substantial help of U.S. investment banks.

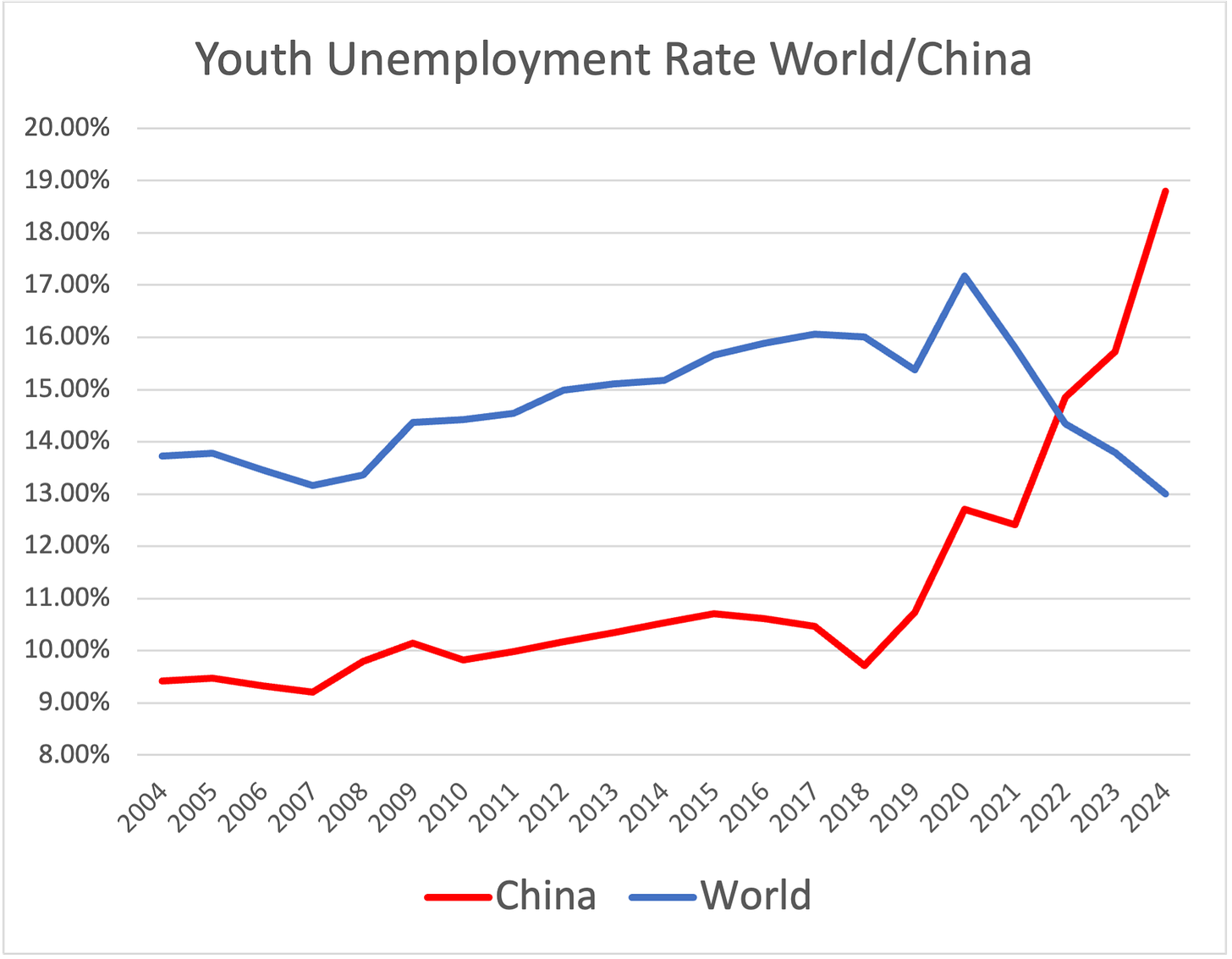

Youth unemployment

The Xi Jinping administration’s inadvertent re-introduction of the triangular debt has had a massively negative impact on the main employer in China: private business.

As a likely result of fervent-revolutionary re-introduction of old ills, recently the China youth unemployment rate has hit 18.8%. How this should even be possible is rather mysterious, considering China’s gigantic GDP should really be growing at the self-imposed rate of 5%.

Note: China’s constitution includes citizens’ duty to work. Article 42 says:

Work is the glorious duty of every able-bodied citizen.

Ever less bang for the buck

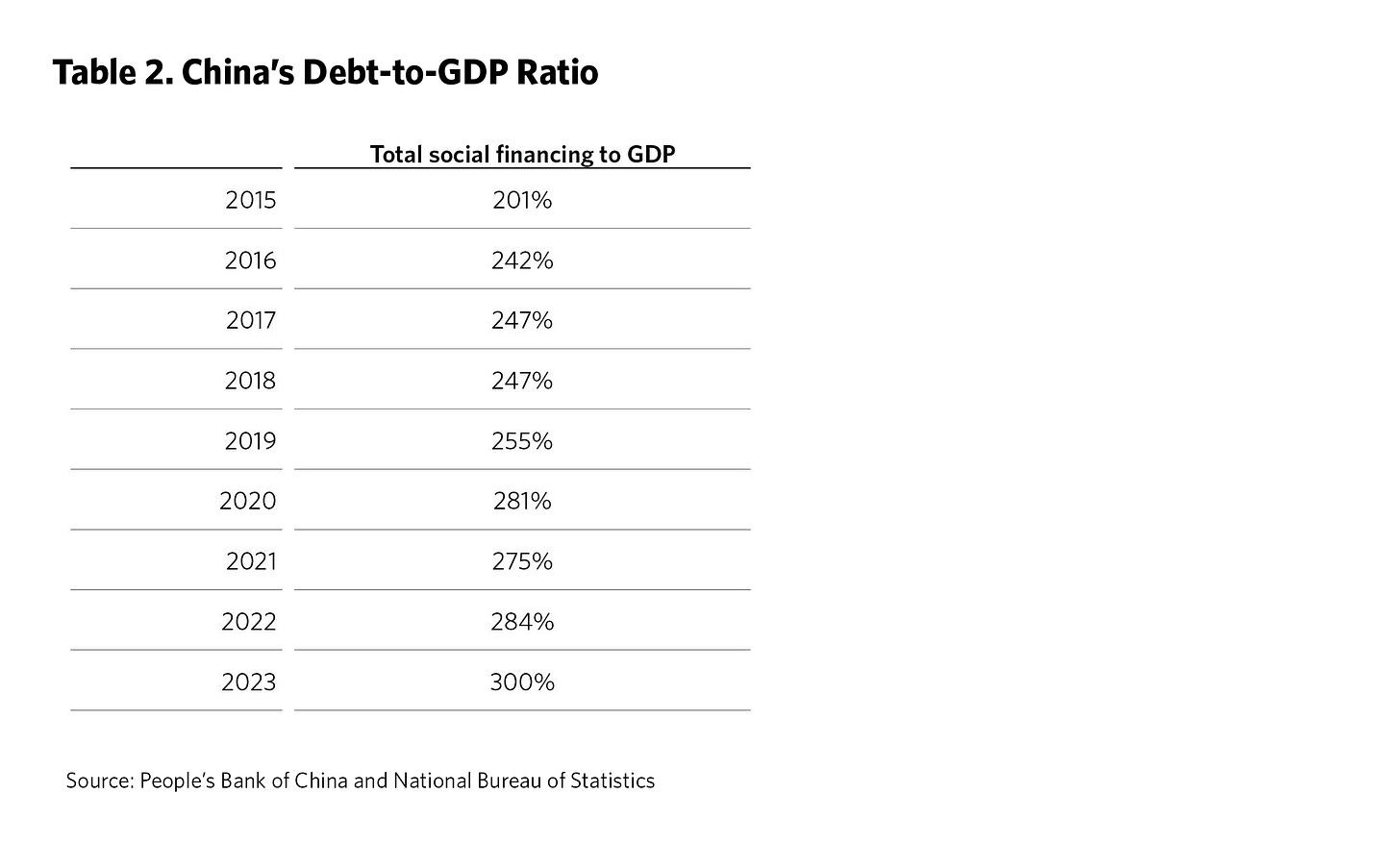

In our view the re-empowerment of state-owned enterprise had another effect, which has long been lamented about and half-heartedly been attended to by changing the way of calculation without addressing the underlying problem: China’s disproportional growth of debt to GDP growth.

The Carnegie Endowment for International Peace published at the end of July:

Total outstanding debt rose by 9.8 percent at the end of 2023 from a year earlier and by 8.7 percent and by 8.1 percent at the end of the first and second quarters, respectively. But given the slowdown in nominal GDP growth, this is still a very large increase. As shown in table 2, China’s debt to GDP has risen on average by about 12 percentage points per year. Therefore, an 8-percentage-point increase in the first six months does not suggest any slowdown in the debt burden.

Real estate

The screeching halt of China’s real estate business had been more than a decade in the making. There were enough warnings, as already 12 years ago stories of China’s “ghost cities” began appearing left-right-center.

The real estate problem Zhu Rongji did not have, as this particular market was still in its embryonic phase during his term.

However, provinces and cities are now permitted to issue bonds to finance the acquisition of excess housing stock for repurposing it to social housing, and, thanks to restrictions on buyers being lifted, there were also promising initial signs from the market over the national holiday week:

Holiday Home Sales Boom in Beijing as Latest Stimulus Entices Buyers

During the weeklong holiday from Oct.1, new home sales by area in Beijing totaled 28,100 square meters. Daily sales averaged 4,000 square meters, representing an 81% growth from last year’s National Day holiday, according to data from China Index Academy (CIA).

The number of new home subscriptions in Beijing during the holiday was 1.3 times September’s total, CIA data showed. Most projects saw a significant increase in visits and subscriptionsCIA data showed that new home subscriptions during the weeklong holiday in Guangzhou and Shenzhen were double those in September, while Shanghai surpassed last month’s totals. Pre-owned home visits and sales also rose significantly in each city, with Shenzhen’s transaction volume more than doubling year-on-year.

Rare earth

Rare earth prices rose in anticipation, but fell back right after, as the general perception of the Chinese efforts to fire-up economic growth is “not bold enough”.

While in terms of rare earth this still is sentiment and the substance of the market has not yet materially changed, there is reason to be optimistic that generally higher price level may be expected.

NPC Observer Monthly: China

Statistics Law Amendments

To start, the Law now prohibits government officials from “overly or covertly” directing their subordinates or the entities under statistical investigation to report false data (art. 7, para. 2). Those who violate this provision will be subject to internal discipline (art. 40). Officials were already barred from altering collected data or ordering their subordinates to fabricate or tamper with them (art. 7, para. 2). In addition, the amendments codified the unified authority of the National Bureau of Statistics (NBS) to organize and implement efforts to calculate regional gross domestic product (GDP) (art. 20). Previously, the provinces calculated their own regional GDP separately. Because local governments have an incentive to inflate reports of economic activity, the combined regional GDP figures “frequently exceed[ed] the national total” reported by the NBS. In early 2020, China introduced unified accounting of regional GDP to “improve the quality of data and the credibility of government statistics.”

Another effort to reduce manipulation, like including numbers of companies who had long gone out of business.

USA

CFIUS Continues to Expand Its Authority and Increase Enforcement Activity

CFIUS has increased its enforcement activity and recently disclosed that it had issued three times as many penalties in the prior 18 months as it had in the prior 30 years, including a penalty of $60 million for violations of a mitigation agreement. This follows an April 2024 proposed rule to expand CFIUS’s enforcement authority and its maximum penalty amounts.

CFIUS recently proposed to expand its authority over real estate transactions by adding 59 military installations in 30 states to the list of sites around which it has jurisdiction. This follows the first Presidential block of a real estate transaction.

CFIUS continues to actively mitigate transactions that it reviews and identify transactions that have not been voluntarily filed, as disclosed in its most recent Annual Report.

China

China tightens its hold on minerals needed to make computer chips

In a series of steps made in recent weeks, the Chinese government has made it considerably harder for foreign companies, particularly semiconductor manufacturers, to purchase the many rare earth metals and other minerals mined and refined mainly in China.

As of Oct. 1, exporters must provide authorities with detailed, step-by-step tracings of how shipments of rare earth metals are used in Western supply chains. That has given China greater authority over which overseas companies receive scarce supplies.

The dual-use regulation enforcement that we discussed before.

National security officials have tightened the flow of information about rare earths. They have labeled rare earth mining and refining as state secrets. Last month, the Ministry of State Security announced that two managers in the rare earths industry had been sentenced to 11 years in prison for leaking information to foreigners.

The cases are several years old, by no means recent. The rare earth fear-mongering of the Ministry of State Security this humble blog has featured several times.

Rare earths from China are used in U.S.-made F-35 stealth fighters as well as in wind turbines, electric car motors, camera lenses and the catalytic converters on gasoline-powered cars. Demand for them is expected to grow. The International Energy Agency predicted that clean energy industries like wind turbines and electric cars would need seven times as much rare earths in 2040 as what they needed in 2020.

The typical nonsense of piles of blueish powder being shovelled into a fighter jet. We are talking actuators and electrical motors, containing rare earth permanent magnets, all of which are “Made in China”, not some chemical compound.

In the past few years, Nvidia and other computer chip manufacturers have changed the material used in hundreds of tiny electricity management devices, called capacitors, on each chip. The capacitors are now made from ultrapure dysprosium. China’s refineries produce 99.9% of the world’s dysprosium, mostly at a single refinery in Wuxi, near Shanghai.

That refinery is one of the last two in China that are still in foreign hands, after the government’s purchase or nationalization of the rest of the industry. The longtime owner of both refineries is a Canadian company, Neo Performance Materials.

“Last two” is plainly wrong, as avid readers of this humble blog will know. Tiring.

Of course it will be difficult for the Honeywells and Lockheeds to buy rare earth magnets and components containing these in China. This is something China made adamantly clear already years ago.

The pressure is on for the snake-oil salesmen who received hand-outs from the US Government. It is time to deliver. Watch them fold up one-by-one.

For argument’s sake: If the Chinese navy was to conduct freedom of navigation operations just off the coast of Florida while propping up Cuba’s military with highly advanced weapon systems, would the U.S. continue providing magnets and components to China’s defense industries?

How to separate Xenotime from zircon ore?

Meanwhile, China’s machinery manufacturers continue advertising rare earth ore processing machinery to western buyers on Youtube:

India

Rajasthan’s rare-earth elements (REE) potential set to be unlocked by the end of this fiscal

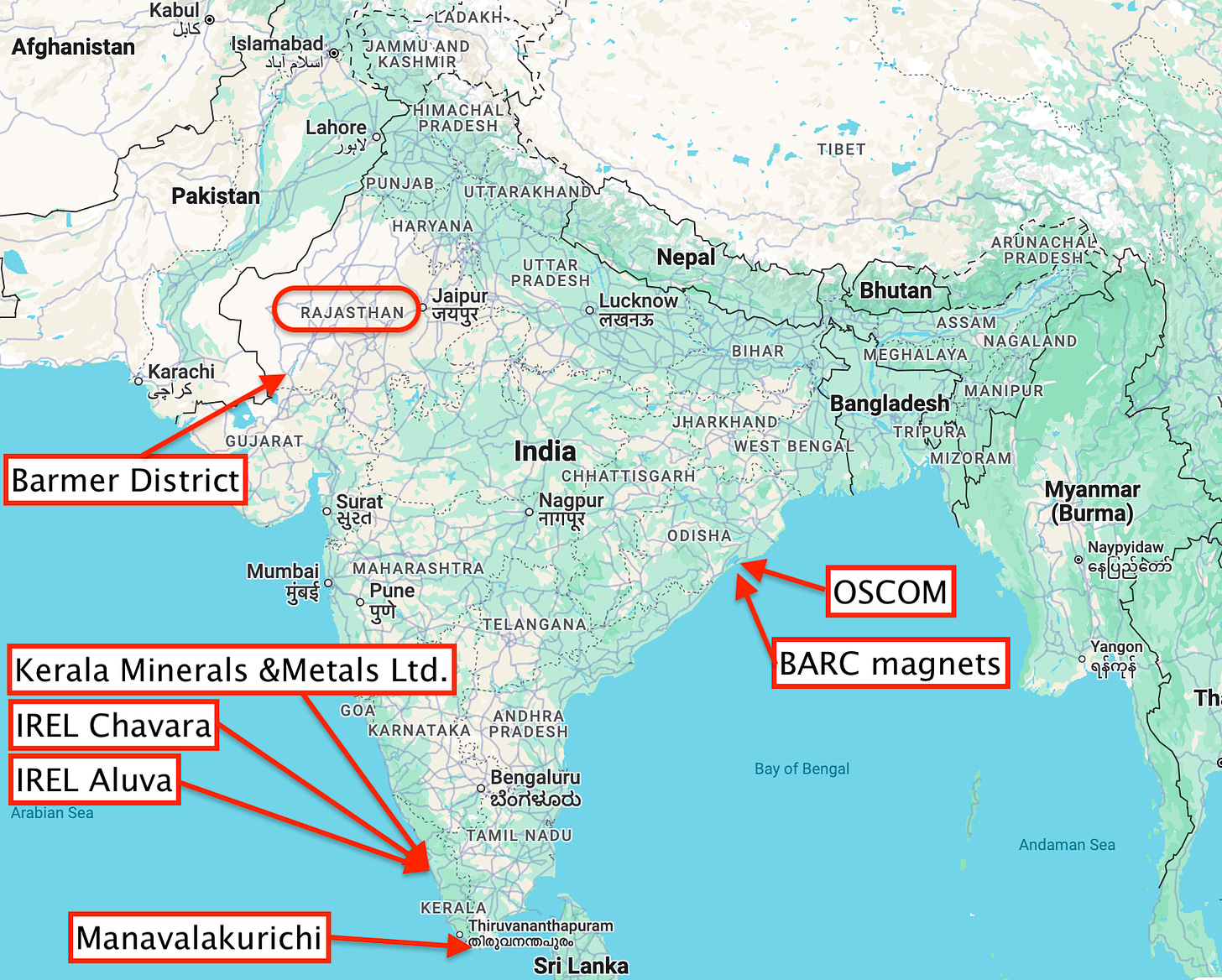

With an estimated 80-100 million tonnes of these valuable elements, Rajasthan is set to emerge as a significant player in the REE sector, said officials of the department.Several districts such as Barmer, Jalore, Sirohi, Pali, Udaipur, Bhilwara, Nagaur, Ajmer, Neem Ka Thana in Jaipur, Rajsamand, Sikar, and Banswara have REE deposits, as per preliminary surveys, they said. Confirmed deposits of REEs such as bastnäsite, britholite, synchysite and xenotime have been identified in carbonatite and microgranite rocks in these areas, they added.

"In Barmer district, particularly in Kamtai area of Sindhari tehsil, 5.41 million tonnes of REE deposits have been estimated by M/s Ramgarh [Ramgad] Minerals and Mining Limited, with light rare-earth element (LREE) content ranging from 17.31% to an average of 2.97%. However, the mining lease for this area has been cancelled under India's Rule 10A(2)(B), and the state govt is now auctioning the area," said an official.

Additionally, Department of Atomic Energy (DAE) has reserved seven blocks in Siwana Ring Complex (Siwana and Samdari tehsils) for further exploration. In Bhati Kheda, exploration has been completed, and the mining lease process is underway.

Since 2014, the state govt's department of mines and geology has been actively exploring ferricarbonatite rocks, discovering REE concentrations ranging from 0.61% to 3.21%, which is a significant finding. "Since 2016, only one REE block has been auctioned across India. Given the state's potential, REEs could prove to be a game changer," said the official.

Rule 10A(2)(B): Concessions in India used to be assigned on a first-come, first-serve base. This was changed and now Rule 10A(2)(B) requires license auctions.

Ramgad Minerals & Mining Limited (RMML), est. 1979, are part of the Baldota Group of Companies, managed by Narendrakumar Baldota and his two sons. RMML are basically an iron ore miner (500,000 t/y Iyli Gurunath Iron Ore Mine, Sandur, Karnataka), with gold and rare earth ambitions.

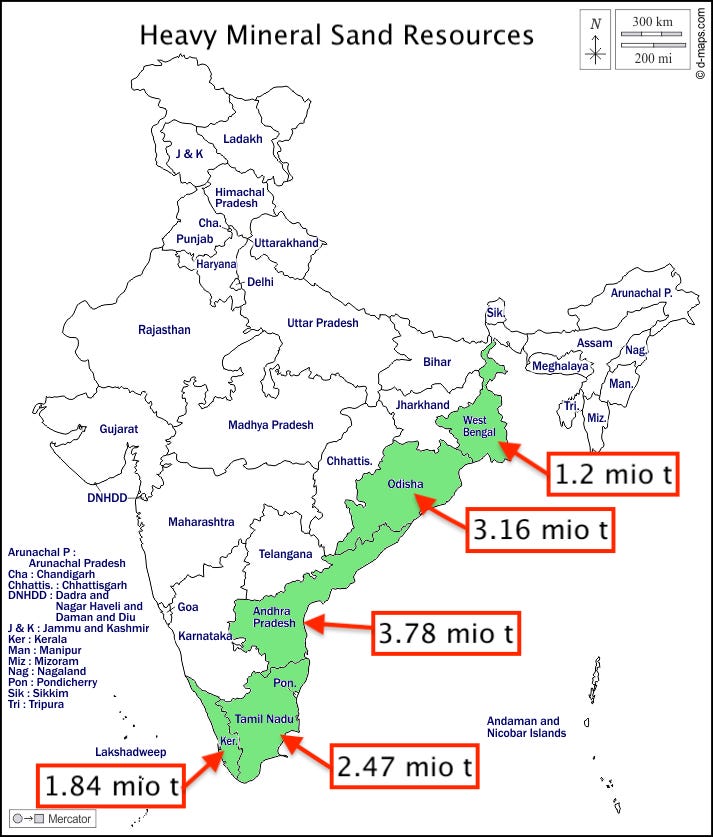

Beach Sand Monazite

Without domestic production of rare earth permanent magnets India can never ever become an alternative to China.

Owing to the controversial beach sand mining and limited resources, apparently the government may want to encourage rare earth exploration elsewhere in the country.

Where India stands in rare earth:

Heavy mineral sand/beach sand monazite

Data source: Development of Process Flow Sheet for Recovering Strategic Mineral Monazite from a Lean-Grade Bramhagiri Coastal Placer Deposit, Odisha, India - Dr Deependra Singh/IREL IREL, (formerly known as Indian Rare Earth Ltd, a SOE under the above mentioned Department of Atomic Energy), have at OSCOM 600,000 t/y of heavy mineral sand separation capacity for the large monazite resource excavated from Odisha beaches;

Manavalakurichi in Tamil Nadu State is also a heavy mineral sands mining operation of IREL;

IREL Chavara and state-owned Kerala Minerals and Metals Ltd. (KMML) mine the coast of Cochin, Kerala. KMML are historically a monazite supplier to IREL.

Rare earth raw materials

At OSCOM IREL turn out mixed rare earth chloride, capacity said to be 11,000 t/y, based on monazite;

At Chavara, Kerala, IREL process heavy mineral sands with a processing capacity of 300,000 t/y of HMS, suggesting an output of ca. 3,000 t/y of monazite;

Rare earth separation

IREL rare earth element separation facility is in Aluva, Kerala. Its capacity is said to be 2,000-4,000 t/y lanthanum and cerium oxides/carbonates as well as 600 t/y of neodymium oxide/NdPr. The starting material is aforementioned mixed rare earth chloride.

According to IREL, Aluva recently developed yttrium oxide 99.999%

The global push towards EVs and clean energy would be the driving the sales of Rare Earths, particularly the magnetic Rare Earths, but the absence of mid-stream industries in the Country is impacting IREL’s plan to increase production. [IREL Annual Report 2023]

Rare earth metals

Production of Cerium and Lanthanum Metals in Industrial scale have commenced and those for Neodymium Metal, Titanium Sponge along with recovery of Rare Earths from end-of-life magnets are going to follow shortly. [Rare Earth & Titanium Park, Acharpura Campus, Bhopal - IREL Annual Report 2023]

Rare earth permanent magnets

At Bhabha Atomic Research Center (BARC) near Port Vizag is the experimental 3 t/y rare earth permanent magnet facility operational since mid 2023.

IREL also produce a mixed rare earth carbonate for export to China. Export is a good way to make sure that IREL’s products can be competitive with China’s.

The concerns

India actually has everything in place for rare earth and rare earth permanent magnets. But IREL are state-owned and India’s bureaucratic inertia is notorious.

India’s rare earth Kerala State, the “coconut state”, has been ruled continuously - with one brief interruption - by the Marxist wing of the Communist Party of India (CPI-M) since 1987 - as a result of elections, not forced-upon by decree, albeit with an unacceptable degree of political violence.

Kerala’s Net State Domestic Product (GDP minus depreciation of capital goods) is ca. US$3,300/head, ranked 11th of the 33 Indian states. For comparison, the rare-earthy provinces of China, Jiangxi and Inner Mongolia, have a GDP/head of US$10,000-15,000.

Beach sand excavation can never be pretty and it inevitably degrades the coastline and the environment, which affects not only fishermen. In addition to that there are radioactivity issues from HMS-monazite processing, which sound pretty similar to those encountered by HMS-monazite miners elsewhere, most recently Rio Tinto.

Again, India can’t ever be a serious alternative to China, if India does not offer a complete and functioning supply chain for rare earths and rare earth permanent magnets.

Trafalgar Rare Earth Alloys Private Limited

During the 20th International Rare Earth Conference in Washington DC, Ian Higgins, formerly MD of LCM, introduced Trafalgar Rare Earth Alloys Private Limited, who initially plan to set up a rare earth metal production in Gujarat State, India.

Seasoned rare earth hands John Elder and Ian Higgins are directors of Trafalgar Rare Earth Alloys Private Limited (est. 28 November 2023). Through the Hariharan family the Trafalgar Rare Earth is related to Trafalgar EPC Private Limited (est. 2003) and Trafalgar Industries Private Limited (est. 2020).

Related

Panthera Resources PLC retains Fasken in its dispute under the Australia-India Bilateral Investment Treaty, against the Republic of India

Fasken is representing Panthera Resources PLC (“Panthera”), a gold exploration and development company, in its dispute under the Australia-India Bilateral Investment Treaty of 26 February 1999 against the Republic of India. The dispute concerns the Bhukia Gold Project, a gold mine project in the state of Rajasthan.

The claims stem from the 1999 Agreement between the Government of Australia and the Government of the Republic of India on the promotion and protection of investments. Indo Gold, Panthera’s Australian subsidiary, has accused the Indian government of alleged breaches of its obligations under the Australia-India Bilateral Investment Treaty after local authorities in the state of Rajasthan refused to issue a prospecting license for the Bhukia gold project.

Junior rare earth miners may easily get caught up in India’s bureaucracy.

Related

India Is Now Russia’s No. 2 Supplier of Restricted Technology

Indian exports of restricted items such as microchips, circuits and machine tools surpassed $60 million in both April and May, about double from earlier months this year, and leaped to $95 million in July, according to the officials, who asked not to be identified discussing private assessments. India is exceeded only by China.

India’s role in the the shipment of such goods has presented a further challenge because US and EU policymakers want to nurture partnerships with Prime Minister Narendra Modi’s government even as he cultivates ties with Putin. India has also emerged as a top buyer of Russian oil despite allied efforts to restrict sales.

In terms of rare earths, China’s exports to Russia up to August have dropped a lot year on year, be it rare earth compounds, rare earth metals or rare earth permanent magnets.

Recent enquiries from Russia point at sanctions actually working in rare earth. Not directly, rare earths are not sanctioned, but indirectly. With updates to entity lists every other week, sanction-compliance related workload at banks is disproportional to potential gains from engaging in trade with Russia.

Related

Russia's Su-57 Felon Might Have Reached the 'End of the Line'

Western sanctions following Russia’s invasion of Ukraine have severely impacted Moscow’s ability to produce the Su-57, Russia’s fifth-generation stealth fighter.

While Russia has attempted to source components through intermediaries, this has slowed the program, highlighting the importance of international partnerships for advanced military systems.

Dagens.com also reported last week, "leaked documents from Russian military electronics manufacturer Mikropribor, which supplies key components for the aircraft, indicate that the lack of several essential Western parts is becoming a major obstacle."

Q.E.D.

Meanwhile, in the West…

Military Intelligence Defines the Risks of Weapons Industry Capabilities in Europe

According to the MI annual report, one of the core problems facing the defense industry in both the EU and the Czech Republic is the unavailability of raw materials and the vulnerability of the logistics chain.

The European defense industry has become dangerously dependent on supplies from third countries. Due to limited resources and the difficulty [impossibility] of processing raw materials, most materials for arms production must be imported.

The arms industry relies heavily on precious metals, but their production is largely controlled by China and Russia. China, for example, accounts for over 90% of Europe’s supply of rare earth elements, which are essential in the production of heavy [?] metals [which the EU also can’t produce].

The fragmentation of production chains and reliance on non-European subcontractors also pose a problem.

To reduce costs, the production of less sophisticated components has been outsourced to non-European plants, which reduces production capacity in Europe and increases transport times due to logistics. As a result, European arms producers can only deliver their products in limited quantities and on long lead times.

Globalisation impact. But Europe is in a regulatory straightjacket. Unable to address the challenge, Europe may become more dependent on U.S. defense industries.

Talking about governments

Teck Resources CEO in Critical Minerals Support Plea

The Canadian mining industry faces a significant challenge in developing its critical minerals sector, according to Teck Resources CEO Jonathan Price.

Speaking at an event in Ottawa, he highlighted the disparity between government support for downstream industries and the mining sector itself.

He noted that that, while both the US and Canada are focused on developing electric vehicle (EV) and battery manufacturing sectors, support for mines and mineral processing continues to lag. This imbalance could potentially hinder the growth of the entire supply chain.

This is 100% correct. Canada’s officialdom likes to advertise Canada internationally as the solution to all mining resource problems.

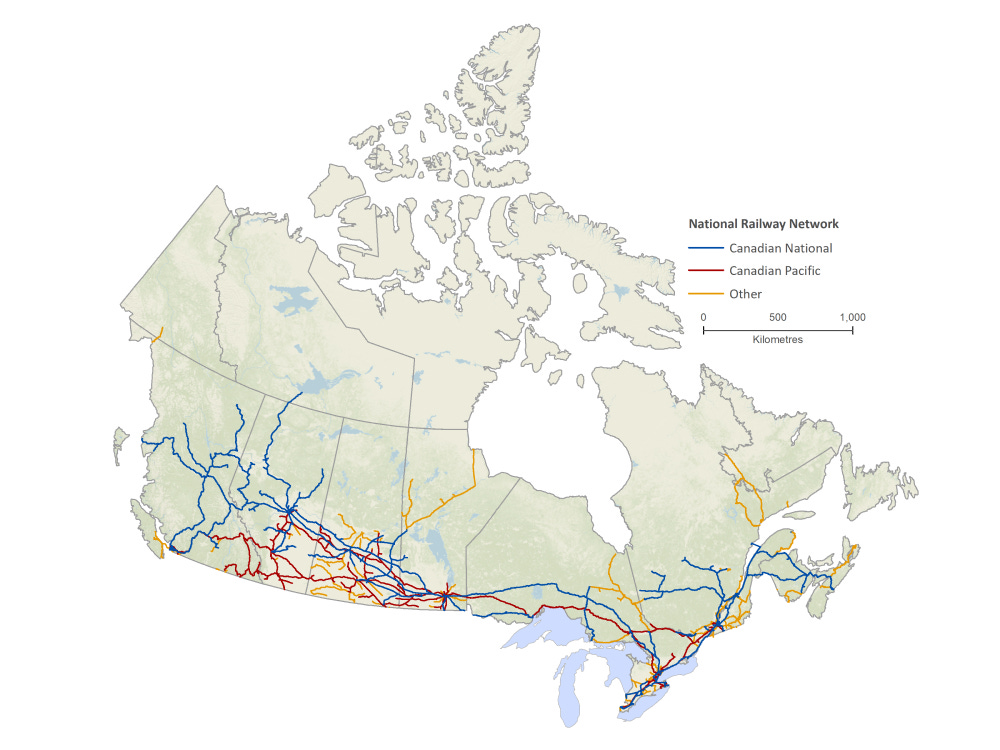

Uncomfortable truth is, however, that many of Canada’s key resources are in logistically inaccessible areas up north. Canada is not doing enough to make the resources logistically accessible.

Canada’s railway network, for example, is largely hugging the border to the U.S. There are few rail extensions north where many of the resources Canada praises itself for are located.

Kenya to restrict raw exports of gold, other minerals

Kenya plans to restrict the export of some minerals in raw form after the ongoing construction of processing plants is completed, a move that portends a major policy shift aimed at maximising earnings for the government and communities.

The Ministry of Mining says gold, gemstones and granite will be the first batch of minerals to be exported after value addition.

Demanding local value addition is an ongoing trend, for which Indonesia’s bold moves were a trailblazer.

Uneducated

Central Asia Emerges as Epicenter of Rare Earth Mineral Rush

Central Asian countries like Kazakhstan, Uzbekistan, and Tajikistan are emerging as key players in the rare earth mineral market.

China’s outsized role has led to a dangerous level of international reliance on Chinese exports to meet global and national energy and climate goals. Becoming competitive with China and easing this imbalance will therefore require other global powers to ramp up their own efforts to secure supply contracts for these elements in the places where they are naturally occurring and where their extraction is relatively affordable.

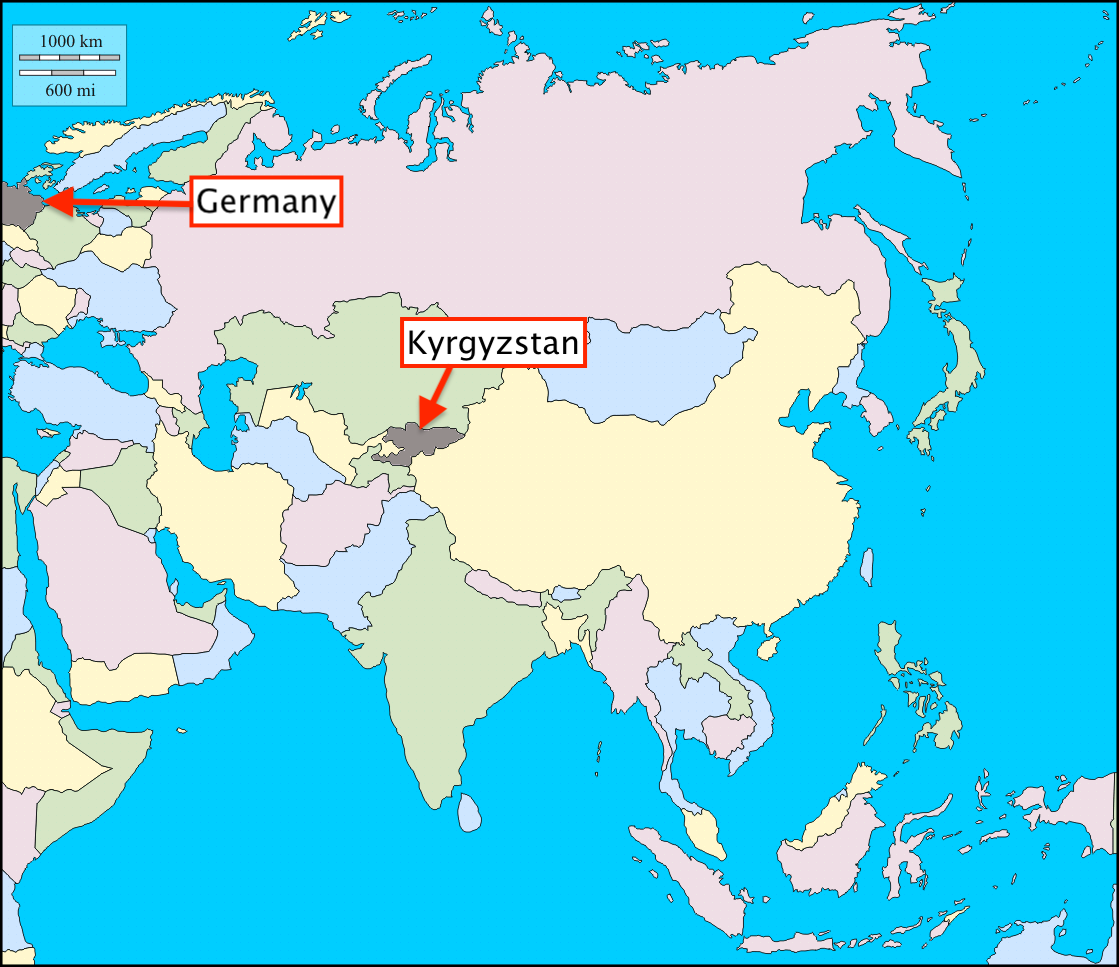

One look on a world map raises the question, just how to get raw materials in Central Asia to where they are (supposedly) needed in the West. Baring “beam me up, Scotty” there is no cost-competitive logistics concept apart from rail-transport to Bandar Abbas (Iran) and on-carriage from there, if one wants to avoid rail transport through China or Russia.

The natural markets for Central Asian raw materials are Russia and China. See Germany-Kyrgyzstan below.

Kyrgyzstan

Modern technologies needed to unlock agricultural sector’s potential — Cabinet

According to Akylbek Japarov, Kyrgyzstan is rich in natural resources, including minerals, metals and precious stones, as well as rare earth metals.

«We recently launched the development of a large titanomagnetite deposit Kyzyl-Ompol, which will become an important stage in the country’s mining industry,» he noted.

The official expressed readiness to cooperate with German partners in the development and processing of raw materials, which will significantly increase the added value of the Kyrgyz Republic’s resources and ensure sustainable economic development.

Kyrgyzstan has an absolutely lousy record when it comes to the mining and resources sector.

How do you want to transport industrial materials from Kyrgyzstan to Germany anyway:

By Russian railways?

Through Iran’s Bandar Abbas Port?

Through China and Pakistan?

Across the drying-out Caspian Sea, much of it controlled by Russia and Iran, via Azerbaijan and Georgia and then through the Russian-controlled Black Sea?

Mongolia

HESS: Mongolia’s unique success story between rock and a hard place at risk

Externally, Mongolia faces severe pressure from both its neighbours. Vladimir Putin has sought to re-assert Russia’s dominance, epitomised by his September visit to the Mongolian capital of Ulaanbaatar, a visit engineered to demonstrate Putin’s ability to escape an International Criminal Court (ICC) arrest warrant for crimes against Ukraine.

Beijing, for its part, has repeatedly threatened Mongolia’s commodity markets over the last decade.

More than 80% of Mongolia’s exports go through China, a figure only set to increase given the sanctions on Russia. The last time Beijing shuttered the borders, in 2016, the Mongolian government was plunged into a debt crisis, forced to run a deficit of nearly 18% of GDP to mitigate the impact.

But Western investors have been even more important in supporting Mongolia’s development than Western politicians. Although it was by no means an easy ride to get there, Anglo-Australian miner Rio Tinto led the development of the country’s flagship Oyu Tolgoi copper-gold deposit. Underground operations finally opened last March.

However, getting the mine to full production and harnessing Mongolia’s rare earth potential face domestic political risks. This April the Mongolian legislature passed an amended Minerals Law. It was supposed to support a new sovereign wealth fund, aimed at diversifying Mongolia’s economy. The amendment authorises the government to seize up to 50% of their shares in mining projects without compensation and authorises forced sales of minority stakes.

It is not the first time the government has threatened foreign investors, including Rio Tinto, over the terms of investment agreements.

There are several bastnaesite rare earth projects in Mongolia.

Rio Tinto’s largest shareholder is Aluminium Corporation of China, go figure:

Malaysia

Sanusi: Expedite REE mining SOP to curb illegal exports

The federal government has been called to act swiftly in issuing a standard operating procedure (SOP) for the exploration of rare earth elements (REE) to stem illegal export of the prized minerals abroad.

Sanusi said this situation led to a significant loss of national revenue as the minerals could have been processed domestically.

"It's not just happening in Kedah, but in other states as well. I've mentioned before that there are 25 illegal mines across the country, only one of which was in Kedah.

"There are plenty in other states, but why is it that only the one in Kedah is causing such a fuss? The MACC (Malaysian Anti-Corruption Commission) should go and arrest them, regardless of who they are," he told a press conference after launching the Greater Kedah blueprint at Seri Mentaloon here today.

Sanusi added that the state government already has its own SOP for REE minerals mining, but it cannot be enforced as the matter falls under the federal government's jurisdiction.

He said the SOP covers exploration processes, mining methods, including prohibiting the felling of trees.

The main problem for rare earth in Malaysia is the shameless rent-seeking of politicians paired with compliance issues in the administration.

A repeat of Bukit Merah is looming, but this time - if they don’t watch it - it will be ammonia poisoning of the water resources and it will be nation-wide, not just local. And, as usual, the politicians afterwards will have been as innocent as new-born babies are.

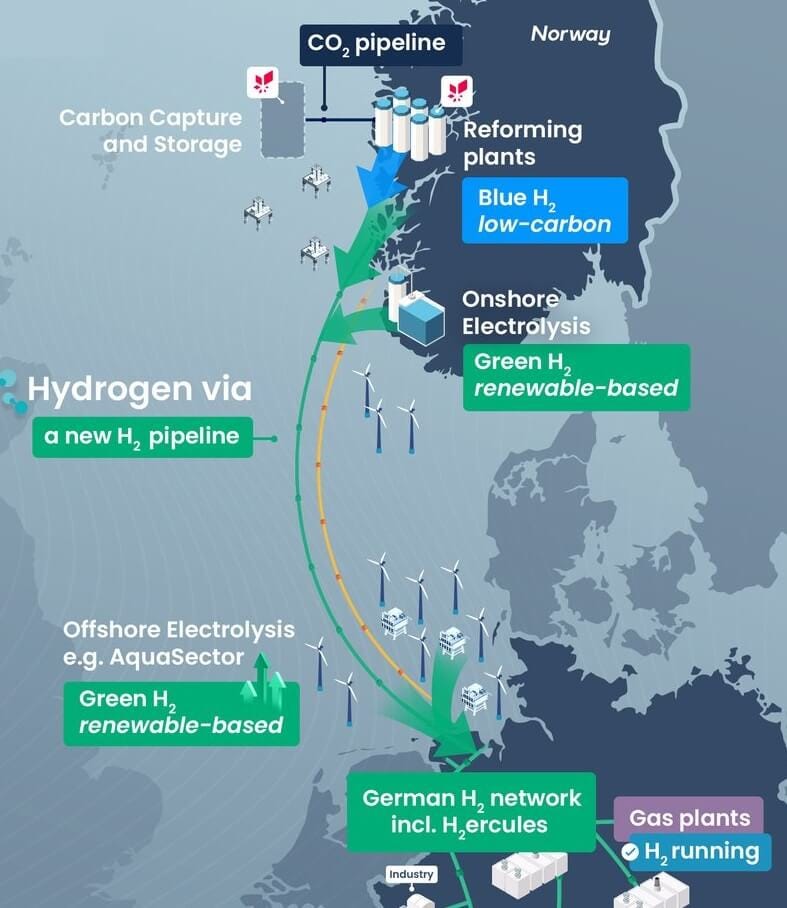

The Hydrogen Bust Is Here

I’m recalling Reed and Eddy’s article because at least nine hydrogen projects have been canceled or delayed over the past two months. Last week, Reuters reported that ThyssenKrupp, the same company that Reed and Eddy gushed about six months ago, is now “reviewing its plans for the production of green steel, casting doubt over its ambitions to use hydrogen in its push to decarbonize what is one of the most polluting industrial processes.” The article continued, noting that the company may halt its $3.3 billion hydrogen plans and that the review highlights “the challenges German industry faces in meeting emissions targets while staying competitive in a sector that suffers from high energy costs and cheaper products from Asian rivals.”

Also pumping hydrogen from Norway to Germany may perhaps not have been the brightest of all ideas.

//Electric Vehicles

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.