China's Regulations on Export Control of Dual-Use Items adopted; PRC's EV Makers' Know-How to stay at Home; Cyclic = WeWork?; SRC make RE metal; Pensana Directors resign after U.S. Handout;

Rare Earth 28 September 2024 #157

National Holiday

For the coming 9 days China’s businesses will be on holidays, as the nation celebrates the 75th anniversary of the People’s Republic.

Pre-holiday prices of rare earth suggest an optimistic mood before the holiday. But this is the case for all markets in China. The government wants everyone in high spirits during the self-praise exercise ahead.

The Chinese public keeps being fed with far-fetched stories of evil foreign spies, hostile foreign force saboteurs and secret-thieves. In doing so, China’s Ministry of State Security (MSS) continues to systematically stir-up xenophobia. The knife-attacks on foreigners by deranged members of the public in China are undoubtedly a result of that.

Just this week yet another rare earth spy story hit the Chinese intranet. But we deem it futile and utterly boring to keep quoting the MSS publications here.

Just be aware that this is going on.

//Politics

砸锅卖铁 - Smash the pots, sell the iron

This is a term from Mao Zedong’s disastrous Great Leap Forward, causing what is referred to as the greatest famine in world history:

In 1958, Mao launched the Great Leap Forward, a campaign that aimed to further transform China from its agrarian roots to a socialist economy through rapid industrialization and collectivization. By monopolizing agriculture, the government was able to buy grain cheaply and sell it for a much higher price in order to finance industrialization.

Many communities were assigned to the production of a single commodity: steel. 'Backyard furnaces' were constructed at every commune and urban neighbourhood to help increase steel production. People used every type of fuel they could to power these furnaces, from coal to the wood of coffins. Where iron ore was unavailable, they melted household objects, including pots and pans, and even bicycles. The result was not steel, but pig iron, which was largely unusable. Workers at factories, schools, hospitals and farms were pulled from their jobs to assist in the production of steel.

Ultimately, the Great Leap Forward ended in economic devastation, famine, and death. The result of so much labor being diverted to steel production in combination with poor weather conditions resulted in a shortage of food that caused tens of millions of deaths. Estimates of the deal toll range from 18 million to 45 million.

Back in fashion

The term 砸锅卖铁 is back in fashion, in the meaning of selling it all.

China’s provincial and municipal governments are selling off whatever assets they can liquidate, just in order to keep government running.

Crisis mode

The reason is shortage of funds owing to the ongoing real estate crisis and the economic downturn in China.

Lease of land for real estate was a big chunk of government income, adding to corporate tax and the local share of VAT income. Real estate currently is rather unreal, corporate profits are low or negative and private consumption is only just about holding up.

Consequently government coffers are facing depletion.

Since selling it all is not enough, there are reports of fines and outright shake-downs of businesses for gaining additional government income, so-called non-tax revenue.

The root

Basically, China’s household wealth is buried under the smoking rubble of China’s real estate market and the central government has just announced considerable efforts in dealing with the impact.

Even though we see ever larger export volumes at ever lower prices, exporting itself out of crisis does not work so well for China, as the external political environment is not receptive to more Chinese exports, largely because of China’s aggressive foreign policy paired with mercantilism, both currently countered by China containment policy and tariff measures, aimed at putting the genie back into the bottle.

Diversionary Theory of War

Spoiler: It won’t happen, rather escalation may ensue. The diversionary theory of war, often falsely attributed attributed to Prussia’s legendary Otto von Bismarck, says basically: if you have a domestic problem, carry it to the outside and start a war. In order to prevent just that from happening while simultaneously containing China, the U.S. is working hard to re-establish relevant communication channels with China.

Rare earth relevance

As long as China’s economy is in the doldrums, do not expect a sustained rise of rare earth prices.

Just think about the large volumes of rare earth permanent magnets used in high rise office/apartment buildings or shopping centers: elevators, escalators, aircons, washing machines, dish-washers, microwaves, water heaters, fans, home-entertainment, automatic doors, and so on. Or rare earth lamp phosphors for LED lighting.

China is where >90% of the rare earth market happens and there is nothing that will change that in the medium term, unless China chooses to change it.

Mysterious Europium Oxide Exports

China’s total europium oxide production per year is ca. 500,000 kgs.

China’s europium oxide exports sank from 13,800 kgs in 2021 to 4,900 kgs in 2023.

Europium-relevant exports of LED phosphors were 43,600 kgs in 2021, 76,900 kgs in 2022 and 5,400 kgs in 2023 (yes, the lights in your homes and offices run on Chinese rare earths. All of them). Dominant in 2023 USA with 1,700 kgs and Vietnam with 1,080 kgs.

The case

An attentive rare-earthling pointed us to exorbitant Chinese europium oxide exports to Singapore in April 2024: one shipment of 60,000 kgs, twelve times China’s total europium oxide export quantity of the entire year 2023.

We first assumed a false data entry, entering kilograms instead of grams.

But then two more XXXL-size europium oxide exports from China popped up: two shipments of 75,000 kgs each during August. This time to Turkey.

Neither Singapore nor Turkey are typical export destinations for europium or any rare earth quantities of this size. China’s largest europium customers are Russia and Japan.

The shipments originate from several sites in southern China’s Jiangxi and Hunan provinces, the realm of China Rare Earth Group.

Traditional applications from lighting phosphors via x-ray, quantum memory and addition to nuclear control rods would not justify shipments of this size.

From generally well-informed sources we hear that europium export demand is up for unknown reason and that there actually has been disposal of accumulated stocks. But why to Singapore and Turkey, of all places?

China

Regulations on Export Control of Dual-Use Items of the People's Republic of China

On September 18, 2024, Premier Li Qiang chaired an executive meeting of the State Council to review and approve the Regulations of the People’s Republic of China on Export Control of Dual-Use Items (Draft).

These implementation regulations under China’s Export Control Law had been pending for several years, probably in order to keep some powder dry.

Baker-McKenzie had a good analysis of the original draft.

Chinese commentators suggest that

the passage of the regulation to some extent implies the deterioration of the international cooperation environment

and

if the regulations are implemented, it may lead to greater restrictions and blockades on technology and products for the United States. For many American technology companies that rely on the Chinese market, this will undoubtedly increase their operating risks.

Now the regulations are being implemented.

As per the rules, trade restrictions can be put on products that are not on any list (hint: rare earth and rare earth permanent magnets - we warned before of potential dual-use classification of rare earths).

The late adoption of these rules quite apparently is related to the U.S. Department of Commerce currently proposed “Toothbrush Regulations.”

We are amazed that the western media ignore it.

DoD and DoE will demand Results

If and when rare earth and rare earth permanent magnets become targets under dual-use classification, the U.S. government agencies, having thrown so much money at rare earth and rare earth permanent magnet hopefuls, will demand to see results.

And that will the time be when you will see almost every single one of the hopefuls falter, one after another.

If there wasn’t bi-partisanship on everything China, presidential candidate Trump could butcher the Biden administration on rare earth alone.

China similar to U.S.

On the other hand, U.S. rare earth troubles are not dissimilar to the semiconductor subsidy frauds in China. The Chinese state threw a lot of money at wannabe semiconductor startups, who pretended to have cracked the (western) nut. Related hurray-announcements turned out to have been fake and everything turned to mush.

Anyway, it seems China and the West make headway in their race to the bottom.

The saviour for the U.S. may be from the up north - read further under Companies below.

Related

China Warns Japan of Retaliation Over New Chip Export Curbs

The escalating tensions between China and Japan over potential chip curbs highlight the intricate web of global technological dependencies and geopolitical strategies. As China issues warnings of retaliation and Japan faces pressure to align with U.S. policies, the semiconductor industry's future hangs in the balance.

How might Japan's decision impact the delicate balance of power in the Asia-Pacific region, what measures could China take to safeguard its semiconductor industry in the face of increasing restrictions, and how will global supply chains adapt to potential disruptions in semiconductor manufacturing?

What measures China could take to safeguard its semiconductor industry? None, see above.

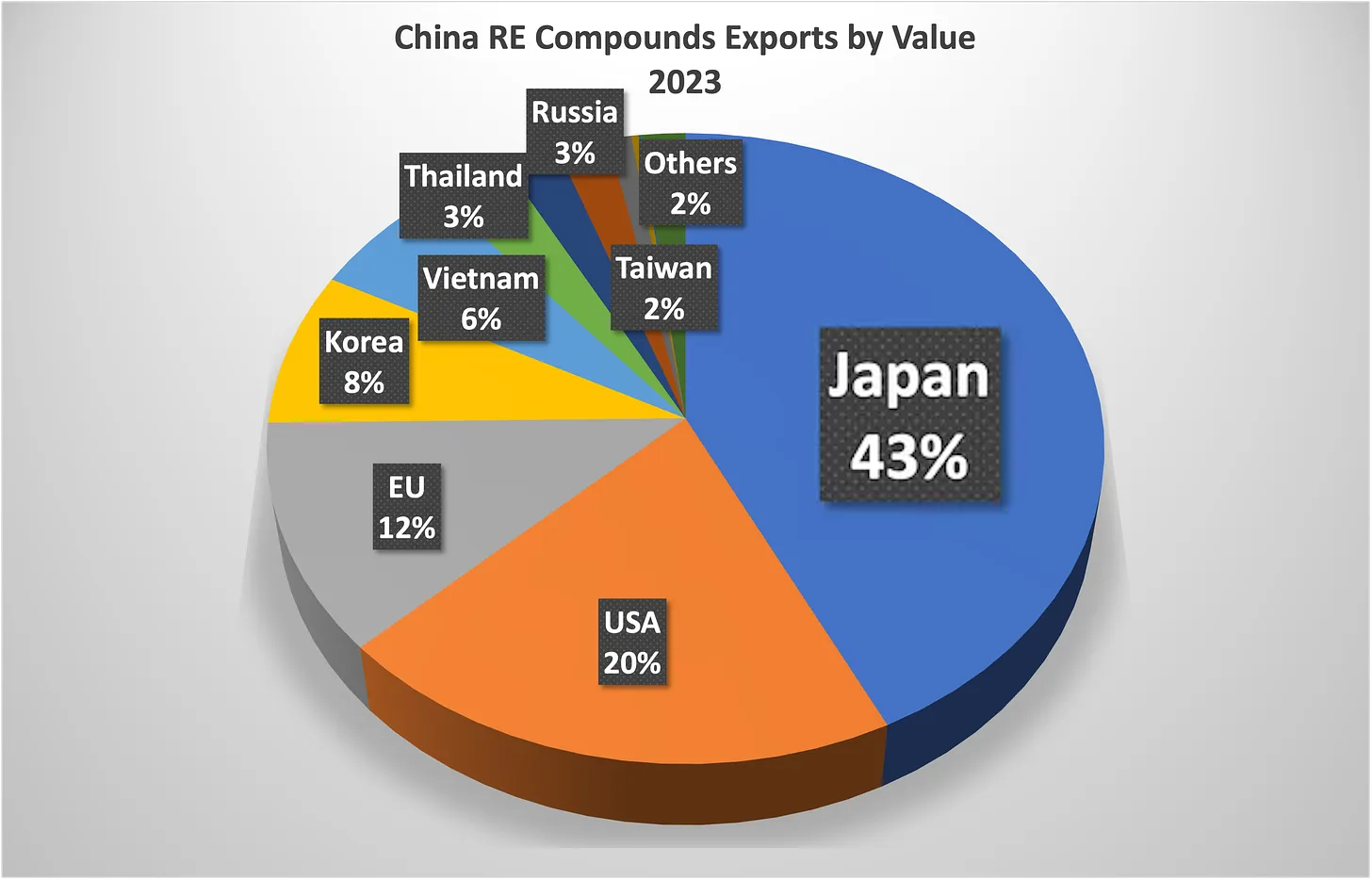

Disruption of global supply chains and taking on Japan? This requires zero imagination: rare earth of course.

Mainland China puts exit ban on exec from Taiwan’s Formosa Plastics Group

A senior executive from one of Taiwan’s biggest industrial conglomerates has been banned from leaving mainland China since arriving in Shanghai for a visit more than two weeks ago.

The unnamed executive from Formosa Plastics Group landed at Shanghai Hongqiao International Airport on a flight from Taipei on September 1, and was immediately detained by border control authorities, Taiwan’s Central News Agency reported on Wednesday.

The executive was questioned and released, only to be stopped from leaving the mainland when he later tried to depart, the report said.

The person has not been able to return to Taiwan since, and the reason for the action was not known, according to the report.

Exit bans are a way for mainland authorities to stop individuals, sometimes businesspeople or prominent political dissidents, from leaving its soil. Often the target of the exit ban is not notified that they are under the restriction until they try to cross the border.

There can be umpteen reasons for that, good and not so good ones. In general it can justifiably be said that Taiwanese businessmen are certainly no angels.

But it could also happen that a disgruntled person posts allegations on the Ministry of State Security reporting website. A competitor, a let-down business partner, a terminated employee, a disappointed lover, anyone can make allegations - which will certainly be followed-up by the ministry, especially in if it relates to “Splittists of the Motherland” or “Hostile Foreign Forces.”

Information Blackout

The Chinese authorities are concealing the state of the economy

The official numbers show that the GDP growth rate has reverted to pre-pandemic level, despite the moribund housing industry and low investment in infrastructure. This is a risible claim, says Logan Wright of Rhodium Group, a consulting firm. “The broader problem is simply that the GDP data have stopped bearing any resemblance to economic reality,” he explains.

When a special economic zone in Shanghai set out rules earlier this year governing the use of data, it explicitly banned the transfer abroad of any information on stock prices or market trends, a surprising regulation for what is, after all, China’s financial hub. Stockbrokers are ever more reluctant to hand over analysts’ reports; negative takes on the economy or state policy are becoming rare. Some official data series on industrial output have started to vanish, Mr Wright says. A legal database that appeared online a decade ago is becoming less comprehensive and harder to access, says Rory Truex of Princeton University. When it comes to obtaining data, he says, “Nothing good in China can last.”

The gradual strangulation of information about the economy is not just vexing for foreign investors and economists. It also raises the same question that Mr Zhao did in his censored article: on what basis do Mr Xi and other senior officials make decisions about how to manage the economy?

No one outside the highest reaches of power understands exactly what Mr Xi reads and how he acts on the information. China’s economic policymaking has always been somewhat opaque, but this mattered less when growth was strong and policymakers appeared pragmatic. With growth deteriorating and the bureaucracy becoming more ideological, the dearth of good information about the economy is much more worrying. It may eventually become as big a problem for China’s leaders as it is for puzzled outsiders.

Information on rare earths began disappearing from the Chinese intranet two years ago.

Wealth of Information

While we sympathise with the frustration, it is highly unlikely that China’s universal surveillance state with Communist Party cells in every company of more than 25 employees should be in any way under-informed about the state of the economy, or under-informed of anything else for that matter.

The question is rather if problems aren’t approached ideologically.

The Ideology Pope

Why would China’s supreme ideologist Wang Huning (王沪宁), the man behind former leaders Jiang Zemin’s “3 Represents” and Hu Jintao’s “Scientific Development” , the source of the “Chinese Dream”, “Great Rejuvenation of the Chinese people” , both parts of “Xi Jinping Thought”, sit on the uppermost decision-making body of China, the 7-member Standing Committee of the Political Bureau of the CPC?

To put an ideological angle on policies and decision-making, of course, vetting for ideological compatibility. Do not underestimate him. He is a highly educated, well-traveled, sophisticated, skilful and highly intelligent party-intellectual. The sudden end of Xi’s trademark zero-COVID policy? Look no further.

But as John Cleese once put it:

Question: How many Socialists does it take to change a light bulb?

Answer: We are not going to change it, we think it works.

Related

China Electricity Consumption

The late prime minister of China, Li Ke Qiang, while still governor of Liaoning, was quoted as saying to the U.S. ambassador in 2007 that statistics in China were man-made and that he preferred to refer to electricity consumption and railway freight volumes as growth indicators.

According to China’s National Energy Administration these are the numbers up to end of August:

Not bad at all, on the surface. 66% of electricity consumption by primary and secondary industry, part of which is the rare earth business.

NDRC, formerly known as State Planning Commission

National Development and Reform Commission: China has the ability and confidence to achieve its annual development goals

The annual scale of foreign investment has remained the largest among developing countries for more than 30 years, and the areas open to foreign investment are also expanding. In the next step, the National Development and Reform Commission will work with relevant departments and localities to implement the 2024 version of the national negative list for foreign investment access to ensure that new opening measures are implemented in a timely manner; for areas outside the negative list, foreign-invested enterprises will be given national treatment in accordance with the principle of consistency between domestic and foreign investment in accordance with the law.

China is not necessarily worse than elsewhere on the planet, but we have now heard this particular Beijing-sermon for 2 decades and no-one with even rudimentary China experience takes it seriously anymore.

The State-owned Assets Supervision and Administration Commission of the State Council held a meeting to promote the professional integration of central enterprises and a signing ceremony for key projects

The meeting required that central enterprises should focus on key areas to help strategic emerging industries develop better; promote the consolidation, complementation and strengthening of industrial chains, and lay a solid foundation for the integrated development of industrial chains and supply chains; forge core competitive advantages and firmly grasp the initiative for future development; promote integration and fusion, optimise resource allocation, and effectively improve the operating efficiency of state-owned capital.

12 groups of 26 units signed key projects in four batches. Six central enterprises, including China Southern Power Grid, China Telecom, FAW, China Chengtong, China Rare Earth Group, and China Green Development, made speeches.

To provide more clarity for this horribly formalistic, stilted gibberish, the Nikkei reported:

On the 26th, the Chinese announced that it would reorganise 12 overlapping businesses of 26 companies, including major state-owned companies. The main targets are key areas positioned as "strategic emerging industries" such as automotive batteries and rare earths.

US, Allies Counter China’s Rare Earth Metals Dominance

NATO Secretary General Jens Stoltenberg gave his farewell remarks on Thursday at the German Marshall Fund Event.

“Freedom is more important than free trade … Russia used gas as a weapon to try to coerce us. And to prevent us from supporting Ukraine. We must not make the same mistake with China. Depending on Chinese rare earth minerals, exporting advanced technologies, and allowing foreign control of critical infrastructure weakens our resilience and creates risks,” he said.

For years, the United States and its allies have been trying to break China’s control of rare earth minerals. These minerals are key for high-tech industries, including weapons.

Yes, well, in reality all efforts were stopped in 2014 after the WTO had judged China’s rare earth trade measures being incompatible with WTO rules. At the end of 2014 China stopped all these (anyway unsustainable) practises and instantly all efforts rare earth efforts of the U.S. stopped, too. Only Japan continued. But Japan has its own agenda.

Junior mining

Gaius King on LinkedIn:

Annual global (nonferrous) exploration expenditure from 1996 to 2024f has increased in nominal terms on average by 3.9% pa over the past 29 years. But if we adjust using US CPI, expenditure in real terms is a far more modest 1.4% CAGR.

Despite the fact that the annual production of various commodities, including zinc (+75%), lead (+67%), gold (+34%), silver (+76%), copper (+105%), nickel (+233%) and lithium (+3,188%) have increased materially in the interim, many of the larger deposits currently in production were discovered three to four decades ago. As we highlighted recently, there has been a particular dearth of significant discoveries to replace existing Pb-Zn-Ag VMS deposits. The same argument could be made for gold….

At some point, there will be a rush of investment by Developed Nations into a host of commodities, when it suddenly dawns on them how fraught their supply chains really are.

If ex-China demand develops and holds up, that is. Investment from China is the sole and single hope of many rare earth projects.

All of us have witnessed already that ambitious mining led to imbalanced output growth, leading to price collapses and idling of mines.

Related

Mining Industry Needs $5.4 Trillion In Investments To Meet 2035 Demand, McKinsey Says

Eighty percent of the metal and mining industry's revenues are derived from just five materials: steel, thermal coal, copper, gold, and aluminum, according to a recent McKinsey report.

Steel and thermal coal alone account for 60%–70% of revenues, driven by their massive production volumes of 7 billion tons of coal and 2 billion tons of steel. Copper, gold, and aluminum contribute another 15%–20% of total revenues, with copper playing a particularly crucial role in the energy transition.

Rare earth elements, essential for technologies like wind turbines and electric vehicles, are also projected to see strong growth in demand. Still, McKinsey estimates their market size to be relatively small – under $20 billion, but vital for magnets and other high-tech components.

Strong growth in rare earth demand? Where? In China!

Like almost all experts, also McKinsey grossly underestimate the enormous economic leverage of rare earths.

Biden-Harris Administration Invests $5.5 Million to Develop New and Alternative Products Using our Nation’s Supplies of Critical Minerals and Materials

The “Critical Material Innovation, Efficiency, and Alternatives” funding opportunity announcement (FOA) will provide up to $150 million over several rounds of project selections to help to build a secure, sustainable domestic supply of critical minerals from sources across the United States, including recycled materials, mine waste, industrial waste, and ore deposits.

Here is the list of projects: Project Selections for FOA 3105: Critical Material Innovation, Efficiency, and Alternatives (Set 2)

//Science

Russia

Rare Earth Metals for Drones. Vyatsu has substituted Electric Motors and Servo Drives of Imports

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.