U.S. Tariffs: China shows the Rare Earth Nuke, the Detailed Rules; EU keeps Worst Projects out; Carester's numbers don't tally; Victory's Self-Defeat; and more.

Rare Earth 5 April 2025 #172

About the case

This is a bit longish, but we have no better way of diving into the issue than starting at the surface.

President Trump walked the big talk and imposed further punitive duties on everyone for everything.

Tariffs of 65% now rest on “Made in China”, however, exemptions may or may not apply to rare metals and rare earths.

The details of how the U.S. administration arrived at what tariff rate, like Lesotho, of all countries, 50%, or tariffs on an island where only penguins and seals live, are not really relevant because the tariffs are not intended for the long term anyway - though they go a long way at displaying aptitude and competence.

Essentially the whole thing shall serve to accumulate negotiation leverage and exert economic pressure.

Why and for what you can read in this brief paper:

A User’s Guide to Restructuring the Global Trading System

It was published last year in November by Stephen Miran, the newly appointed Chair of the Council of Economic Advisers of the U.S.

Mar-a-Largo Accord

Basically, the current U.S. administration views the post-WWII path of the U.S. as being unsustainable in all and any aspects. What they want to bring about is a global reset, redefine the world economic order and keeping the USD as world reserve currency.

In a way it is like trying to eat the same cake several times over.

President Trump can not communicate the underlying cause very well because of his apparent limitations. But the aim of the U.S. administration is true, it does want to eat the same cake several times over, with all its might.

The process involves causing so much economic pain to the rest of the world, that every country will agree almost anything to make the pain go away and sign on to what is likely going to be called the Mar-a-Largo Accord.

Doubts

The manufacturing model that President Trump has in mind has begun expiring already 40 years ago. Historically masses of farm workers had been replaced by mechanisation of farming. Employment moved on to manufacturing. Now the continuous trend in manufacturing is factory automation - with the predictable impact on employment.

Any job-policy must be forward-looking. Bathing in memories of the good, old times will not be productive. But doing so gets you votes from the regular American folks out there, whose hospitality also China’s Xi Jin Ping came to appreciate in Muscatine, Iowa:

But jobs are not the prime objective here anyway.

While we understand the self-created, unsustainable situation this U.S. administration wishes to tackle, the means and methods chosen do not appear to be suitable.

Miran himself points out the risks involved, because as an intelligent and educated person he must have severe doubts that this strategy could work.

Looming failure?

The U.S. administration may have failed in rallying the American people behind the idea and the task.

It would have been high time for a Winston Churchill-style Blood, Toil, Tears and Sweat speech instead of the usual incoherent rants.

The potential is one of spectacular failure, if the rest of the world does not react as hoped for - and stalls, calling the bluff.

Also, all and any multilateral agreements such as a Mar-a-Largo Accord would require a level of trust and confidence that the current U.S. administration no longer enjoys.

Much more likely is the rest of the world shaping a new order around the isolated U.S.

China exports to the U.S.

According to China Customs, China exported goods valued at US$524.6 bio in 2024. The Top 20 items represent 30% of the total:

Impact of tariffs on U.S. prices

No, China does not pay for the tariffs, as the inexperienced desk-jobbers at the current U.S. administration like to state. And they even get officially offended, if confronted with simple truths like 1+1=2.

The impact of tariffs on rare earths would be instant

Generally, just like many other products, rare earths are stock-distribution products. As a stockist you always base your sales price on inventory replacement cost at any given time. And tariffs are part of the cost.

China stalls, calls the bluff?

Instead of succumbing to the U.S. shock and awe strategy, China doubles down and promptly introduced reciprocal tariffs as well as making several rare earths subject to dual-use product control measures.

China is not likely to make the U.S. the “phenomenal offer” that the Trump administration seems to hope for. China is most likely to call the bluff.

Tariffs aside, what does dual-use classification mean for rare earths?

Read-on, we’ll guide you there.

Dual purpose

As always, China regulation does not only serve a singular purpose. It will almost always serve a second or third purpose.

In spite of the facts that

China has built up large export-oriented capacities for both, rare earths and rare earth permanent magnets and

China will hurt itself….

….and China makes a couple of rare earth elements and their related products under dual-use export licensing under the international Nuclear Non-Proliferation Treaty (NPT).

China’s Ministry of Commerce (MOFCOM) says:

The Chinese government has implemented export controls on relevant items in accordance with the law in order to better safeguard national security and interests and fulfill international obligations such as non-proliferation. The relevant items have dual-use attributes, and it is an internationally accepted practice to impose export controls on them. As a responsible major country, China has included the relevant items in the list, which reflects its consistent position of firmly maintaining world peace and regional stability.

And this occurs to China’s officialdom half a century after signing the NPT and after more than 40 years of actively exporting rare earths? This explanation is nothing short of being ridiculous.

The regulation is meant as a form of punishment, as it makes buying the relevant products very onerous. In itself does not necessarily reduce availability.

But there is a second purpose.

Reduction of exports

The dual-use licensing does not stop exports, but it slows exports down significantly, simply because of the sheer number of export orders that will need to be vetted and approved by China’s Ministry of Commerce.

This slow-down will reduce exports of the relevant items.

Besides punishment, this reduction actually is another objective here.

Why?

Look no further than China’s reduced rare earth availability caused by Myanmar dropping out as a supplier.

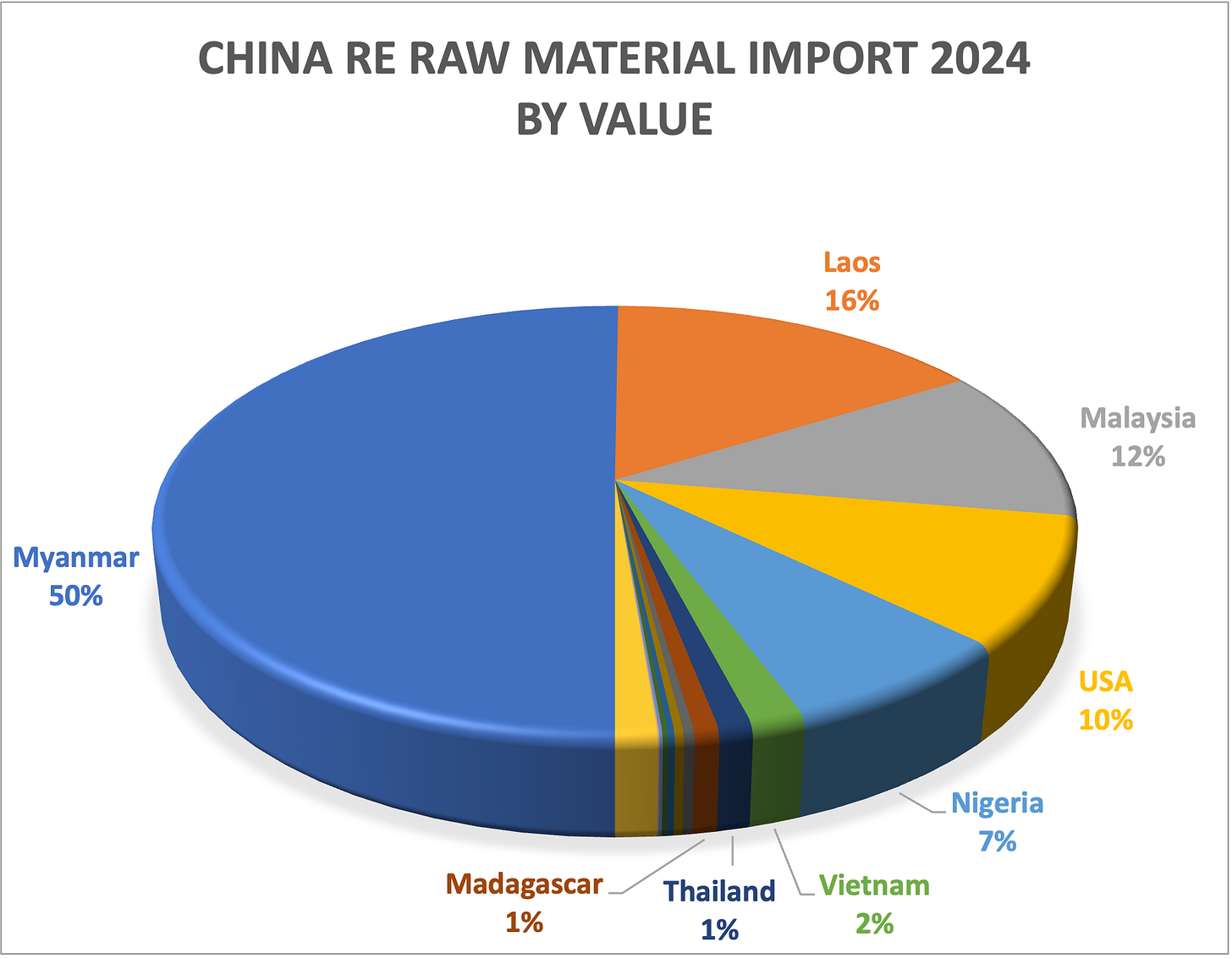

Myanmar used to be 25% of China’s rare earth imports by volume and 50% of China’s rare earth imports by value:

This large reduction of raw material import with subsequent tightening availability would have driven up rare earth prices, rather sooner than later.

This decrease of Myanmar export of heavy rare earth enriched raw material is particularly relevant to terbium, dysprosium, gadolinium, lutetium and yttrium.

Keep that in mind as you read on.

USA share of China’s overall rare earth exports

In 2024 the U.S. were 29% of China’s rare earth compounds export volume and 29% of China’s rare earth compounds export value:

In rare earth metals the destination USA plays no role.

What rare earths are exported from China to the U.S.?

In order to understand the significance of China’s export control measures, you must understand this:

Here are the charts for visualisation:

As far as rare earth metals are concerned, the U.S. share is only 2-3%. The main rare earth metal market is Japan.

With the above in mind we can now attend to China’s rare earth measure.

The Ministry of Commerce and the General Administration of Customs announced in Announcement No. 18 of 2025 the decision to implement export controls on some medium and heavy rare earth related items

In accordance with the relevant provisions of the Export Control Law of the People's Republic of China, the Foreign Trade Law of the People's Republic of China, the Customs Law of the People's Republic of China, and the Regulations of the People's Republic of China on Export Control of Dual-Use Items , and in order to safeguard national security and interests and fulfill international obligations such as non-proliferation, with the approval of the State Council, it is decided to implement export controls on the following items:

I. Samarium-related items

(I) 1C902.a Samarium metal, alloys containing samarium and related products :

1. Samarium metal (reference customs commodity number: 2805301910).

2. Alloys containing samarium:

a. Samarium-cobalt alloy;

b. Samarium iron alloy;

c. Samarium nickel alloy;

d. Samarium aluminum alloy;

e. Samarium-magnesium alloy.

3. Sputtering target materials containing samarium (reference customs commodity numbers: 3824999922, 8486909110):

a. Samarium sputtering target;

b. Samarium-cobalt alloy sputtering target;

c. Samarium-iron alloy sputtering target.

4. Samarium cobalt permanent magnet material.

(II) 1C902.b Samarium oxide and its mixtures (reference customs commodity numbers: 2846901940, 2846901993, 3824999922).

(III) 1C902.c Samarium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902810, 2846902910, 2846903910, 2846904820, 2846904910, 2846909920, 3824999922).

The samarium-cobalt magnet (SmCo) is the default magnet for defense use, because it is so much more heat resistent than the much-hyped neodymium-iron-boron magnet (NdFeB).

Samarium is also important as a neutron-absorber in nuclear reactors.

II. Gadolinium-related items

(I) 1C903.a Gadolinium metal, gadolinium-containing alloys and related products :

1. Gadolinium metal (reference customs commodity number: 2805301910).

2. Gadolinium-containing alloys:

a. Gadolinium magnesium alloy;

b. Gadolinium aluminum alloy.

3. Sputtering target materials containing gadolinium (reference customs commodity numbers: 3824999922, 8486909110):

a. Gadolinium sputtering target;

b. Gadolinium-iron alloy sputtering target;

c. Gadolinium-cobalt alloy sputtering target.

(ii) 1C903.b Gadolinium oxide and its mixtures (reference customs commodity numbers: 2846901930, 2846901993, 3824999922).

(III) 1C903.c Gadolinium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902810, 2846902910, 2846903910, 2846904820, 2846904910, 2846909920, 3824999922).

Three major applications

Contrast media for MRI scans

Several applications in nuclear reactors for its high neutron absorption

Doping of metals

3. Terbium-related items

(I) 1C904.a Terbium metal, terbium-containing alloys and related products :

1. Terbium metal (reference customs commodity number: 2805301300).

2. Alloys containing terbium:

a. Terbium cobalt alloy;

b. Terbium-cobalt-iron alloy.

Sputtering target materials containing terbium (reference customs commodity numbers: 3824999922, 8486909110):

a. Terbium sputtering target;

b. Terbium-cobalt alloy sputtering target.

4. NdFeB permanent magnet material containing terbium.

(II) 1C904.b Terbium oxide and its mixtures (reference customs commodity numbers: 2846901600, 2846901993, 3824999922).

(III) 1C904.c Terbium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902100, 2846902810, 2846903100, 2846903910, 2846904200, 2846904820, 2846909300, 2846909920, 3824999922).

Relevant to the rest of the West should be these application as a dopant for silicon-based semiconductors and as an ingredient of lamp phosphors for LED, fluorescent lamps, et al.

IV. Dysprosium-related items

(I) 1C905.a Dysprosium metal, dysprosium-containing alloys and related products :

1. Dysprosium metal (reference customs commodity number: 2805301200).

2. Alloys containing dysprosium:

a. Dysprosium-iron alloy;

b. Terbium-dysprosium-iron alloy.

3. Target materials containing dysprosium (reference customs commodity numbers: 3824999922, 8486909110):

a. Dysprosium target;

b. Terbium-dysprosium-iron alloy target.

4. NdFeB permanent magnet material containing dysprosium.

(II) 1C905.b Dysprosium oxide and its mixtures (reference customs commodity numbers: 2846901500, 2846901993, 3824999922).

(III) 1C905.c Compounds containing dysprosium and their mixtures (reference customs commodity numbers: 2846902200, 2846902810, 2846903200, 2846903910, 2846904300, 2846904820, 2846909400, 2846909920, 3824999922).

Most of dysprosium is used as an ingredient of high-performance NdFeB magnets. Again, this hits primarily Japan.

Then it is used in lamp phosphors, LED, fluorescent lamps, et al.

Also dysprosium can be used as a neutron absorber in nuclear reactors.

V. Lutetium-related items

(I) 1C906.a Lutetium metal, lutetium-containing alloys and related products :

1. Lutetium metal (reference customs commodity number: 2805301910).

2. Ytterbium and lutetium alloy.

3. Lutetium sputtering target (reference customs commodity numbers: 3824999922, 8486909110).

(II) 1C906.b Lutetium oxide and its mixtures (reference customs commodity numbers: 2846901800, 2846901993, 3824999922).

(III) 1C906.c Lutetium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902810, 2846902910, 2846903910, 2846904820, 2846904910, 2846909920, 3824999922).

By far the largest market for lutetium is a single user in the U.S., Siemens Medical Systems. It is used in positron emission tomography (PET) as lutetium orthosilicate.

Also lutetium goes into lamp phosphors (LED, fluorescent lighting).

VI. Scandium-related items

(I) 1C907.a Scandium metal, scandium-containing alloys and related products:

1. Scandium metal (reference customs commodity number: 2805301800).

2. Alloys containing scandium:

a. Scandium aluminum alloy;

b. Scandium-magnesium alloy;

c. Scandium copper alloy.

3. Scandium sputtering target (reference customs commodity numbers: 3824999922, 8486909110).

(II) 1C907.b Scandium oxide and its mixtures (reference customs commodity numbers: 2846901980, 2846901993, 3824999922).

(III) 1C907.c Scandium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902810, 2846902910, 2846903910, 2846904820, 2846904910, 2846909920, 3824999922).

Scandium is famously used as an aluminium alloy. China exported 202 kgs of scandium metal in 2024, of which 134 kgs went to Japan.

Other applications include excimer and solid-state lasers, high temperature superconductors and solid oxide fuel cells.

VII. Yttrium-related items

(I) 1C908.a Yttrium metal, yttrium-containing alloys and related products:

1. Yttrium metal (reference customs commodity number: 2805301700).

2. Alloys containing yttrium:

a. Yttrium aluminum alloy;

b. Yttrium magnesium alloy;

c. Yttrium nickel alloy;

d. Yttrium copper alloy;

e. Yttrium iron alloy.

3. Sputtering target materials containing yttrium (reference customs commodity numbers: 3824999922, 8486909110):

a. Yttrium sputtering target;

b. Yttrium aluminum alloy sputtering target;

c. Yttrium-zirconium alloy sputtering target.

(II) 1C908.b Yttrium oxide and its mixtures (reference customs commodity numbers: 2846901100, 2846901993, 3824999922).

(III) 1C908.c Yttrium-containing compounds and mixtures thereof (reference customs commodity numbers: 2846902600, 2846902810, 2846903600, 2846903910, 2846904600, 2846904820, 2846909690, 2846909920, 3824999922).

China’s exports of yttrium oxide in 2024 were 2,747 t, to destinations:

Japan: 1,572 t

EU: 494 t (plus 51 t of yttrium carbonate)

USA: 329 t (plus 493 t of yttrium carbonate)

Korea: 255 t

Add to that minor quantities of other yttrium compounds.

Yttrium is also party of lamp phosphors, again for LED, fluorescent lighting and such.

Then it is used in YAG lasers and is used in superconducting yttrium barium copper oxide.

Application in multi-layer ceramic capacitors would hit the electronics industry.

And it is a component of magnesium-yttrium alloy, hot-rolled plates of which are produced for the U.S. military.

For clarity:

1. The alloys controlled by 1C902.a.2, 1C903.a.2, 1C904.a.2, 1C905.a.2, 1C906.a.2, 1C907.a.2, and 1C908.a.2 include ingots, blocks, bars, wires, sheets, rods, plates, tubes, granules, powders, etc.

2. The sputtering targets regulated by Items 1C902.a.3, 1C903.a.3, 1C904.a.3, 1C905.a.3, 1C906.a.3, 1C907.a.3 and 1C908.a.3 include those in the form of sheets, tubes, etc.

3. Permanent magnetic materials controlled by 1C902.a.4, 1C904.a.4, and 1C905.a.4 include magnets or magnetic powders.

4. The oxides, compounds and mixtures thereof regulated by Items 1C902.b, 1C902.c, 1C903.b, 1C903.c, 1C904.b, 1C904.c, 1C905.b, 1C905.c, 1C906.b, 1C906.c, 1C907.b, 1C907.c, 1C908.b and 1C908.c include but are not limited to powders and the like.

Export operators who wish to export the above-mentioned items shall apply for a license from the State Council’s commerce department in accordance with the relevant provisions of the Export Control Law of the People’s Republic of China and the Regulations of the People’s Republic of China on Export Control of Dual-Use Items.

Exporters should strengthen item identification and indicate whether they are controlled items in the remarks column when declaring. If they are controlled items, the export control code of dual-use items should be listed. If there are doubts about the above-mentioned information, the customs will question it according to law, and the export goods will not be released during the questioning period.

This announcement will be officially implemented from the date of publication. The Export Control List of Dual-Use Items of the People’s Republic of China will be updated simultaneously.

Ministry of Commerce General Administration of Customs

April 4, 2025

The clarification simply drives home that these elements in all forms, sizes, shapes, alloyed or not, fall under this regulation.

Why were these elements chosen, and not others?

Gd, Lu, Y and Sc were chosen for maximum potential impact.

Sm is the core component of very defense-relevant SmCo magnets

Tb and Dy were chosen for maximum impact on nascent rare earth permanent magnet production in the West and mature rare earth permanent magnet production in Japan, apart from potentially denying the West phosphors for lighting products. Imagine you flip the switch and no light goes on.

La and Ce were not chosen because China absolutely needs to export these two freely in order to mitigate its rare-earth inherent imbalance (producing a market-adequate quantity of one lanthanide will inevitably tip the supply-demand balance of all other lanthanides).

The export volumes of Nd and Pr, also known as the much-hyped NdPr of junior miners for a largely virtual market, are not useful as a stick as the export volumes are really small. At this time there is no substantial market for NdPr in the West, apart from Japan. And Japan covers the overwhelmingly largest share of its NdPr demand from Lynas, who are in the process of increasing output.

Any changes in China’s rare earth primarily affect Japan, who is the largest buyer of high-value rare earths from Sino-Japanese joint ventures.

The potential magnet impact

China exports of rare earth permanent magnets (REPM) in 2024:

Quantity: 58,148 t (+10% year on year)

Value: US$2.867 billion (-13% year on year)

In 2024 China exported these magnets to 130 countries worldwide.

The EU is China’s largest customer by far for REPM, three times larger than the U.S..

The top 10 buy 89% of China’s REPM export quantity:

PLEASE understand there are MANY different grades of magnets. Remember that NdFeB magnets have two mortal enemies: rust and heat.

The by far largest share of rare earth permanent magnets are commodity type NdFeB magnets which contain neodymium, praseodymium, cerium and iron. They start demagnetising at around 80℃. You will note, that none of the ingredients is under this new dual-use export licensing.

The whole magnet whoo-ha in the West is about high-performance rare earth permanent magnets for EV motors, wind turbines and high-powered miniature electric motors for military drones, for example.

These high performance permanent magnets operate in high working temperature environments, well above the max 80℃ of commodity magnets. In order to mitigate the impact of high working temperatures, Dy and Tb are added to high-performance NdFeB rare earth permanent magnets.

By the wording of this dual-use license regulation, high-performance rare earth permanent magnets fall under the regulation because of Dy and Tb content.

There is no alternative supply of Tb and Dy except China. By potentially withholding Tb and Dy China can hobble currently embryonic NdFeB high-performance rare earth permanent magnet production in the West - and cause problems for Japan’s mature NdFeB supply chains.

And yet another purpose: Chinese NdFeB manufacturers claim to have advanced to high-performance NdFeB magnets that do not contain any Dy and Tb, while offering sufficient heat stability and performance. Less onerous export procedures incentivise the manufacture of such magnets.

Our take

We hope to have explained the details of why China is adding these rare earths to the dual-use license list.

It is not a real export reduction as yet, but it will slow exports down and the slowing will affect overall export volumes of the relevant products.

The U.S. is the largest buyer of lutetium, the second largest buyer of yttrium and the second largest buyer of rare earth permanent magnets, i.e. samarium, dysprosium and terbium.

While Japan is somewhat collateral damage (which certainly had been discussed during Wang Yi’s recent visit to Japan), the dual-use regulation was in direct response to U.S. tariffs and was crafted to potentially harm the U.S. by withholding selected export licenses for destination U.S.

In its announcement MOFCOM indicated a way out:

China is willing to strengthen foreign exchanges and cooperation and promote compliant trade through the bilateral export control dialogue and exchange mechanism.

To say, if we can have bilateral agreements on certain things, we may blanket trust you and will not mess with rare earth exports to your country.

EU: Selected Projects under European Strategic Projects under the Critical Raw Materials Act

This selection was not about getting the best projects in, it was rather about keeping the worst projects out.

Our findings:

Regarding Caremag find our comments in the Companies section below.

As to recycling we would suggest to read and try to understand the report of the KU Leuven university. Don’t pint too many hopes on recycling making a dent in the EU for the coming 10 years.

For Mkango’s Pulawy plans we should like to see a PEA first. If Pulawy should have anything to do with the Songwe Hill deposit, then it will be yet another still-born project.

LKAB we discussed several times. We understand the LKAB project at this time as an embargo mitigation effort, similar to the U.S. plans for rare earth from coal ash.

Tibetan prayer mill

Also we have often enough pointed at the EU shortcomings at the regulatory level which must be addressed. We communicated it to EU officers directly, to the media, to audiences of conferences and associations, and of course to our esteemed readers here.

There is not much more one can do, while hard-earned taxpayer money goes up in flames.

Important

Carester and Pulawy certainly understand that only a separation of all lanthanides from La to Lu will be effective in addressing the rare earth dependencies.

//Events

CMI Summit IV: The War for Critical Minerals and Capital Resources

The stakes have never been higher in the global race for critical minerals—vital to our technology-driven economy and national security. Join industry leaders, policymakers, and strategic investors at the CMI Summit IV: The War for Critical Minerals and Capital Resources, taking place May 13–14, 2025, at the prestigious National Club in Toronto. Hosted by the Critical Minerals Institute (CMI), this event is your gateway to unparalleled insights, strategic partnerships, and actionable solutions addressing the complex challenges of building critical mineral supply chains, navigating geopolitical pressures, and investing in sustainable mining and advanced technology.

Featured speakers, moderators and panelists include the Who is Who of rare earths in the West. Above description is an understatement.

2025 REIA AGM and Annual Conference

We are thrilled to announce the 2025 REIA Annual Conference, taking place on 17-19 June 2025 at the Delta Hotels by Marriott in Montreal. This event is a cornerstone in our efforts to promote and enhance the rare-earth-industry supply chain.

Last year’s REIA conference was a roaring success in terms of exposing corporate fog, unrealistic aspirations and dreams.

Note:

Expect no contributions and presentations from Chinese attendants, as rare earths are officially a matter of “national security” in China.

China’s Ministry of State Security is relentlessly enforcing rare earth secrecy. Walls have ears and no Chinese rare earthling has any desire to receive an “invitation for tea” upon return to China.

Top China rare earth bureaucrats, i.e. the c-suite of Chinese state-owned enterprise, require a permit to travel.

4th International Scandium & International Critical Metals & Minerals Conference

Fairmont Hotel, Toronto, Canada

19-20 June 2025

We would not expect anything than more of the same-old, same-old scandium talk: Those scandium-hopefuls who are not feasible at current prices lecturing the audience that scandium demand would increase if scandium prices were lower….

Last year we featured a piece on scandium.

Mining Asia

18 - 19 June 2025

Marina Bay Sands Expo & Convention Centre

Singapore

Not a particularly rare-earthy event. Participation is costly. Singapore investors are generally indifferent towards junior mining in general and rare earths in particular because they don’t see the value and also don’t understand the risk-reward balance.

//Politics

Myanmar rebel group allows export of rare earth inventories to China: sources

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.