RE Prices go Apesh*t after Quota; The cold hard Numbers: China RE Exports up, but *what* is up?; US Gov't and RE: Absurdity rulez.

Rare Earth 1 August 20225 #180

Note

We would have loved to dive into recent publications of gravity denialists among junior rare earth miners, but macro developments taking precedence spared the juniors from this humble blog’s analysis - for now.

Contents of The Rare Earth Observer including its archives are worth many millions of dollars. We keep it comparatively cheap for the public good, also tolerate shameless sharing by a number of accounts.

We note that certain large media subscribe short term, lift contents of The Rare Earth Observer and then pass it off as their own. If you have any residual decency left, attribute contents properly.

US-EU trade deal

Yet another greatest deal ever. There is no lack of tiring superlatives in the current US administration’s announcements. As usual, details are scarce. Supposed exclusion of minerals and critical materials sounds very rare-earthy. The details are yet to be drawn up, to be discussed with the EU Council, and finally, different from the US, to be ratified by the EU Parliament.

Before that there will be no greatest deal ever.

US export restrictions

The current US administration has frozen new export controls on China in order not to endanger trade talks. This implies US export controls should be a bargaining chip for trade negotiations.

China argues its export restrictions on critical materials base on domestic law and international agreements. Thereby it can’t use its restrictions as trade bargaining chips, unless it wants to imply China’s commitments under whatever international agreements were for sale.

Or China admits that its restrictions had no foundation in those international agreements China which is bound to (China is no member of the Wassenaar Arrangement and even rejects it as “anti-China”).

Either one would be a complete loss of credibility.

While the current US Administration continues dreaming China’s integrity was for sale, China investigates Nvidia for a potential backdoor in the H20 chip

Presidential brown-nosing leads to US-sanction relief?

MSN reports:

The U.S. Treasury Department announcement on Thursday came two weeks after the head of Myanmar's ruling junta praised President Donald Trump in a letter and called for an easing of sanctions in a letter responding to a tariff warning. Administration officials said there was no link between the letter and the sanctions decision.

A notice from the U.S. Treasury Department said KT Services & Logistics and its founder, Jonathan Myo Kyaw Thaung; the MCM Group and its owner Aung Hlaing Oo; and Suntac Technologies and its owner Sit Taing Aung; and another individual, Tin Latt Min, were being removed from the U.S. sanctions list.

The Treasury Department declined to say why the individuals had been removed from the list.

The Bangladeshi Daily Star comments:

The sanctions weren't lifted in a vacuum. Two weeks earlier, Myanmar's top general, Min Aung Hlaing, sent a letter to US President Donald Trump. In it, he praised Trump's leadership, floated tariff reductions, and, importantly, asked for sanctions relief. The wording was deliberately flattering, almost performative. But also pragmatic. Myanmar wants access to US markets. It needs economic oxygen. And it knows how to talk to a White House that thinks in deals. Shortly after, the US Treasury removed several junta-linked names: businesspeople operating in defence logistics, tech, and supply chains. Some had only been sanctioned recently. Again, no formal reason was offered. But nothing in geopolitics happens in a vacuum.

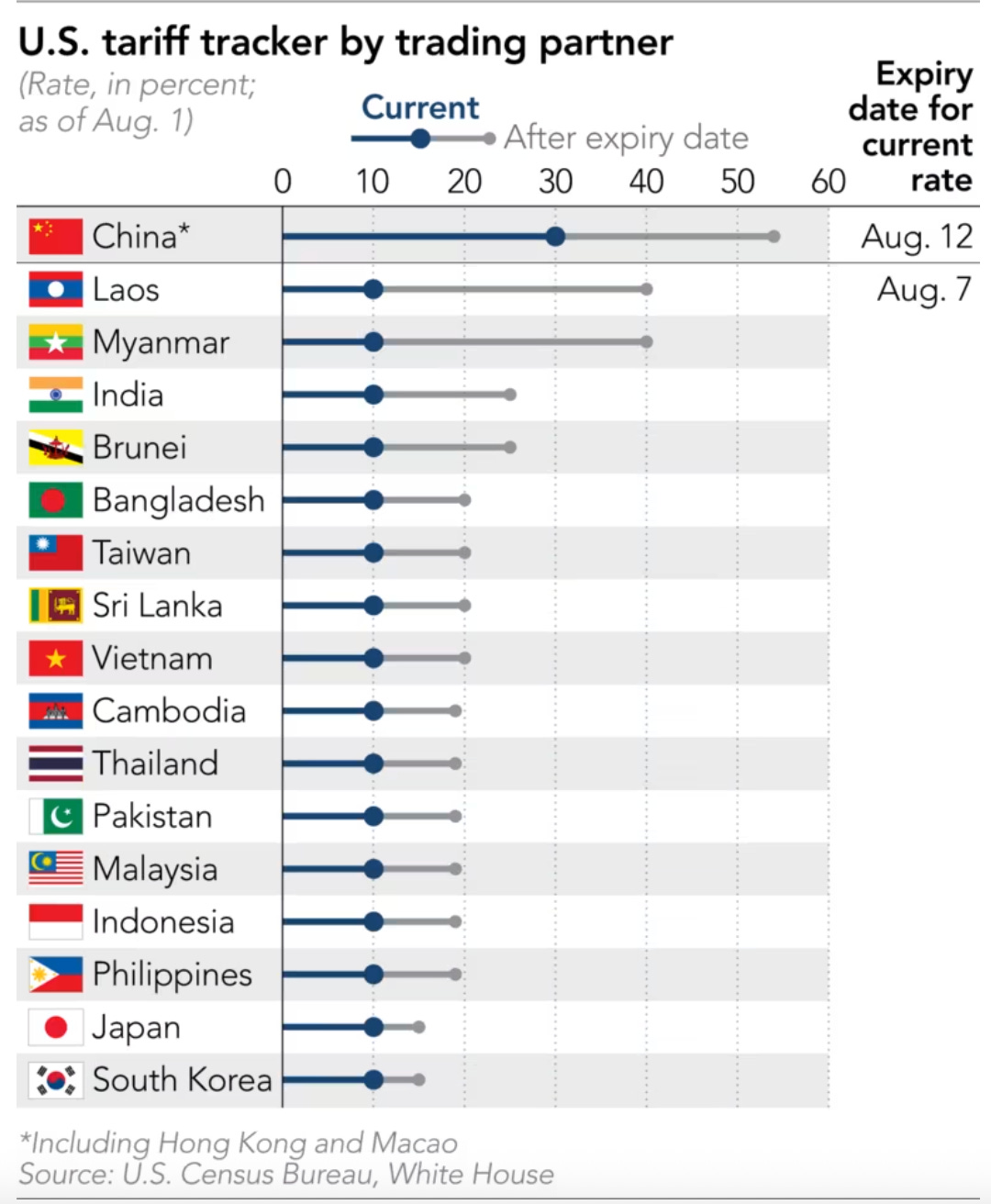

In Asia - excluding China - it is war-torn Myanmar that faces the highest US tariffs, along with impoverished Communist Laos:

Lets not pass judgement and instead wait and see what happens to Myanmar tariffs.

China rare earth quota

The First Batch of Rare Earth Mining, Smelting and Separation Total Volume Control Indicators in 2025 was assigned to China Northern Rare Earth Group (CNRE), China Rare Earth Group (CRE) and likely to Shenghe Resources on 9 July 2025.

They are to subdivide the quota among those enterprises they are in charge of, no matter where these are located in China.

The quota is late. It is a post-mortem. The reason is that for the first time ever the quota must include rare earths produced from imported rare earth raw materials.

Whatever the import quota amount may be, it puts Shenghe in a tight spot. Shenghe is by far the smallest of the Big Three and is the most import-dependent one. If the quota should be too small, it would limit Shenghe’s ability to grow. If the quota is too big, Shenghe may be blamed for all and any shortages that may occur as a result of not being able to import enough raw material. So there was certainly some discussion about the quota, delaying the initially targeted release date.

Shenghe Resources lost its main supplier for good, as MP Materials are no longer allowed to export anything to China. That is a condition of the US Department of Defense taxpayer supported rescue package for MP Materials. All other Shenghe rare earth projects abroad do not produce anything yet, except perhaps the one or the other heavy mineral sands project.

The quota is secret. Reason must be the import quota. Foreign suppliers could use it beautifully to estimate how much China has left to buy and tune the pricing accordingly. In view of China’s substantial rare earth raw material import dependence China would be put in a tight spot by clever foreign suppliers.

The quota must have leaked, as every Tom, Dick and Harry in China scrambles to lay his hands on some import monazite.

Related to the quota story there are interesting developments which we discuss in our Prices segment below.

NdFeB Magnet Exports from China

Looking at the first half exports of NdFeB magnets from China, the total volume has dropped 5,210 t or 19% year-on-year because of the borked implementation of China’s dual-use licensing rule for 7 rare earth elements.

While some media living in a parallel universe say “rare earth magnets are flowing again”, we disagree. We believe a much larger quantity earmarked for export is stuck in China.

Please find our analysis below.

Who needs clean tab water if we can have magnets?

If you had to choose, what would it be:

Electric vehicles and wind turbines?

Or rather clean tab water?

China has increased rare earth exports, but it is not what you might think.

No, it is NOT the sacred “magnet rare earths” junior rare earth miners are worshipping. As you will see in our analysis, lanthanum exports to the U.S. doubled. The increase is also for application in water treatment. Probably U.S. importers guessed correctly that lanthanum prices can’t go any lower.

Washington meetings

Many executives of junior rare earth companies may be great geologists, exquisite gold miners and Wall Street whizz-kids, but they have too little knowledge about the applications of their prospective products. Thereby they can’t grasp the criticality of rare earths except perhaps 4 elements, and even these 4 only partly. Then they talk about oxides when it is metals that are needed - many people can’t make the difference.

With an insufficient level of rare earth application competence, oblivious to real market needs, they then attend government meetings and help to turn everything into the Muppet Show we are currently witnessing.

China has forcefully proven that it is no longer willing (or able?) to guarantee world rare earth supplies. It is no longer a matter of cost, for the rest of the world it is a matter of having the essential products - or not having them. All of them, even for a currently US$120 mio per year rare earth market like the U.S.

The legacy of monazite processing in Brazil

Long forgotten is the legacy of two rare earth companies, USAM and USIN, who produced rare earths from monazite in Brazil from the 1940s to 1992.

This excellent, brief paper describes in brutal clarity what junior rare earth miners desperately avoid discussing with investors and stakeholders, the radioactive element contents of their deposits and the consequences it may have, if not handled professionally while applying responsible care.

Brazil now has what a number of African countries don’t have, a regulatory framework for radioactive waste.

In our view it is essential part of junior rare earth miner compliance to be transparent and open about their potential output of radioactive waste and details of how it will be dealt with. Every single drill-core analysis can show the values of radioactive elements contained and there is no excuse not to be open about it, unless one wants to deceive investors about the feasibility of a project.

This short paper is excellent reading for investors, stakeholders and governments. It not only applies to monazite, it can happen with other rare earth resources, too.

Why Everything in China is about Export

Our fellow substackers NPC Observer carried an enlightening piece about China’s pricing law.

If you read it you will get a hunch that for a Chinese industrial company there are only two ways of becoming successful: breaking the rules (“if you can cheat, then do cheat” 能骗, 就骗) or export.

Export is the best way of achieving prices free from the shackles of China’s Socialism with Chinese Characteristics and Xi Jin Ping Thought in the New Era. While at face value the share of export revenue may be minor, for many Chinese industrial companies export is not the icing on the cake. It is the cake.

Trump administration to expand price support for US rare earths projects

Top White House officials told a group of rare earths firms last week that they are pursuing a pandemic-era approach to boost U.S. critical minerals production and curb China's market dominance by guaranteeing a minimum price for their products, five sources familiar with the plan told Reuters.

The previously unreported July 24 meeting was led by Peter Navarro, President Donald Trump's trade advisor, and David Copley, a National Security Council official tasked with supply chain strategy. It included ten rare earths companies plus tech giants Apple, Microsoft and Corning (GLW.N), which all rely on consistent supply of critical minerals to make electronics, the sources said.

The price is a secondary issue in view of the currently small US market. US$120 mio per year in terms of rare earth compounds. The market for the much adored magnet material compounds essentially does not exist, because there are almost no rare earth metal makers who use them. And there are not enough metal makers, because of the lack of rare earth permanent magnet makers.

A market-adequately size separation facility is warranted. As Ucore still try to make work what evidently doesn’t instead of going for the old-reliable first, someone else has got to do it.

How China Won the Thorium Nuclear Energy Race

This explainer finally points out that thorium is a radioactive by-product of rare earth production. Finally someone begins to understand.

However, we contest some contents:

Hastelloy-N is not a Chinese invention. It was invented at Oak Ridge National Laboratories.

Contrary to the video’s claims, we could not find any commercial TMSR “up to the 1980s”, which “went away one after another”. Therefore the subsequent suggestion TSMR should be uncompetitive is invalid.

//Politics

Japan and EU to explore joint rare-earths procurement

apan and the European Union will launch a new "economic two-plus-two" dialogue to bring together their foreign and economy ministers, Nikkei has learned.

The parties will consider joint public-private partnerships aimed at reducing reliance on China, such as in the procurement of rare-earth elements.

The framework will seek to further deepen Japan-EU relations.

The two sides have agreed to the new dialogue at the working level. The framework will be announced in a document to be released in conjunction with the Japan-EU leaders summit slated for July 23. The two sides will use the initiative to jointly develop supply chains for such critical minerals as rare earths.

As one case see from the statistics, there is principally no supply problem of primary rare earths raw materials from a number of sources.

The issue for Japan and EU is that they want/need radionuclide free product, i.e. leave the radioactive waste in the countries of origin. That intention should make South America and Africa really, really happy. It is something that China does not do.

Brazil triples rare earth exports to China as Washington-Beijing rift ripples through trade

Brazil’s rare earth exports to China tripled in the first half of 2025 just as Chinese imports surged to a record high, fuelling concerns that Beijing-Washington trade tensions may be quietlyreroutingg the world’s supply chains through emerging economies.

Rare earth compound exports reached US$6.7 million, a threefold increase over the first half of 2024. While small in absolute terms, analysts see the growth as a sign of China’s bid to diversify its access to strategic minerals.

1st half 2024 China imported from Serra Verde 27 t of MREC for US$133,000 (US$4.93/kg). In the first half of 2025 China imported from Serra Verde 427 t of MREC for US$1.5 mio (at a discounted US$3.50/kg).

The ocean voyage time is 45 days, add a delay here and there and you are at 2 months. May be Serra Verde shipped 1,500 t MREC in May and June which have not arrived in China yet. Otherwise we would have no explanation for the US$6.7 mio of rare earth mentioned in the article.

China risks global heavy rare-earth supply to stop Myanmar rebel victory

and

Myanmar: KIA Clash Risks China’s Rare Earth Imports

As you will see from statistics below, this problem no longer exists - for the time being.

In Myanmar, a rush for rare earth metals is causing a regional environmental disaster

"In the past, the river was central to village life. When it cleared, people would come down to bathe in it and use it for cleaning and other things. But after people started getting skin rashes, we realized it was unsafe, and people started avoiding it," Prasert says.

That's when the Department of Pollution Control started testing the water, and found arsenic levels nearly four times the World Health Organization (WHO) limits, and unsafe levels of other hazardous metals, in a river that flows some 150 miles through Thailand's Chiang Rai province before emptying into Southeast Asia's biggest and longest river, the Mekong — where unsafe levels of arsenic were also detected earlier this month. Pianporn Deetes is the regional campaign director for the NGO International Rivers.

Pianporn and other activists blame unregulated gold and rare earth mining in Myanmar's neighboring Shan state for the transborder pollution.

Miners working for China’s economic benefit even risk to pollute the Mekong, potentially affecting the livelihood of 70 million people.

In all fairness, the civil war mess in Myanmar is an enormous challenge. China’s “fixer” in Myanmar, Deng Xijun 邓锡军, Special Representative for Asian Affairs of the Chinese Foreign Ministry, should be exhausted. We don’t want to imagine the situation in Myanmar without China weighing in time and time again.

Suppose China would let go and let many years of work and billions of Chinese investments go to waste. Drugs, contraband and also illegally mined minerals would still make their way to China, one way or another. And scam centers would mushroom even more. Some degree of control is better than no control at all.

But perhaps it would be advantageous if Beijing would acknowledge the pollution problem for a start.

Chinese Investment Reshapes Myanmar’s N. Shan as MNDAA Consolidates Power

In both Hsenwi and Laukkai, the capital of the MNDAA-controlled Kokang region near the Chinese border, the MNDAA has actively courted Chinese capital, offering long-term land leases and market redevelopment contracts. It is even offering foreign investors permanent residency in its “Special Region 1”, as the MNDAA cumulatively refers to the territories it controls. The result has been a rapid transformation of the region’s economic and demographic landscape.

Composed primarily of Han Chinese from the Kokang region of northern Shan State, the MNDAA, or Kokang Army, is a key member of the Brotherhood Alliance of three ethnic armed groups, which launched a major anti-regime offensive in 2023 and 2024 that succeeded in seizing a large swathe of northern Shan State.

Historically backed by China, the group has been focusing on its own strategic and economic interests since early this year after striking a ceasefire with the Myanmar regime.

Following the 2021 coup, China launched the Yunnan-Myanmar (Yangon)-Indian Ocean Transport Corridor, a multimodal route integrating sea, rail and road to connect landlocked Yunnan Province with Southeast Asian markets. Once fully operational, this route would enable goods from Singapore to reach central China in just 72 hours via Yangon, Mandalay, Lashio, Hsenwi and Chinshwehaw in the Kokang Self-Administered Zone. Chinese investment along this corridor has significantly elevated Hsenwi’s geopolitical and commercial relevance.

Sugarcane—particularly from Kokang—is one of northern Shan State’s major exports to China’s Yunnan Province. Driven by domestic supply shortages and expanding ethanol production, Yunnan’s growing demand for sugarcane has made Myanmar an increasingly attractive supplier.

Add rare earths to that.

Related

Exclusive: Trump team hears pitches on access to Myanmar's rare earths

The Trump administration has heard competing proposals that would significantly alter longstanding U.S. policy toward Myanmar, with the aim of diverting its vast supplies of rare earth minerals away from strategic rival China, four people with direct knowledge of the discussions said.

Nothing has been decided and experts say there are huge logistical obstacles, but if the ideas are ever acted upon, Washington may need to strike a deal with the ethnic rebels controlling most of Myanmar's rich deposits of heavy rare earths.

Contributors to The Rare Earth Observer were stunned.

We are used to follies of governments, but this one really beats them all:

There is no such thing as a “heavy rare earth deposit”, a term appearing frequently in junior rare earth miner horse manure. It is always all lanthanides, differing in their assembly deposit by deposit. And, yes, there are very, very “light-earthy” ion adsorption clay deposits out there.

Reuters - always so eager to throw the “exclusive” click-bait headline - should actually know by now.

“Logistical obstacles?” What a laugh! To begin with, where should the million metric tons or so of ammonium sulfate, ammonium bicarbonate and/or magnesium sulphate - essential for the in-situ leaching - come from, if not from China? Collected at Honeywell in Hopewell, Virginia, and then airlifted to Myanmar’s interior by the US Air Force, or what?

This is not New York City Chinatown. The entire commerce in whatever products in the areas in question is firmly in the hands of ethnic Chinese, trading exclusively with China. On top of that, the ruling warlords are partially fellow Communists of the Maoist flavour. The China-dependence could not possibly be deeper.

This absurd proposal goes hand-in-hand with other greatest deals of all times: Ukrainian rare earths, anyone? Or how about the great deal with DR Congo?

Who Really Profits from Myanmar’s Rare Earths?

Myanmar’s rare earth production now ranks among the top globally, but the social and ecological impacts in Kachin State remain deeply troubling. The rapid expansion of mining – often driven by demand from neighbouring countries – has led to the destruction of forests, contamination of rivers and soil, and displacement of local communities. Toxic chemicals used in the extraction process have damaged ecosystems and endangered biodiversity, while the lack of regulation and accountability has made it difficult to monitor or mitigate these effects. Moreover, many mining operations are associated with armed groups or operate without formal oversight, fueling conflict and undermining peace efforts in the region.

The numbers for 2024 indicate that China import dependence in heavy rare earths overall should be 70%. If Myanmar only it would be 50%.

As Myanmar’s role in the global rare earth supply chain grows, calls for more transparent, ethical, and environmentally responsible practices continue to intensify.

To China’s credit, even after decades of trying it has still not solved the environmental problems of rare earths within its own jurisdiction.

That state-owned enterprise Baotou Steel classifies its environmental failure, potentially soon affecting the Yellow River—north China’s most important water resource—as a company secret, is fabulously arrogant and it is an attempted insult to human intelligence.

Developing Rare Earth Processing Hubs: An Analytical Approach

This “analytical approach” starts off with a barrage of long debunked falsehoods and misinformation that we will not discuss here again. We are used to CSIS bending fact for supporting outlandish conclusions. We called out CSIS for obvious falsehood before.

A mineral processing hub is a centralized location or facility where raw mineral ores are transformed into refined materials suitable for industrial use. These hubs typically manage several key stages of the value chain, transforming raw ore into high-purity metals suitable for manufacturing. Mineral processing hubs leverage economies of scale by streamlining regulatory requirements, including reducing the number of permits and environmental impact assessments necessary for operations. Additionally, they capitalize on the concentration of key resources, including energy, transportation, and water infrastructure; specialized human capital with advanced technical expertise; and greater access to financial capital. This integrated approach enhances operational efficiency and cost-effectiveness across the value chain.

How does a commercial enterprise streamline regulatory requirements? It is governments who need to do that.

In efforts to swiftly scale up processing capacity, the DOD deployed significant funds to rare earths projects via the Defense Production Act. Since 2020, the DOD has awarded over $439 million to companies like MP Materials, Lynas USA, and Noveon Magnetics for building LREE and HREE separating and processing and permanent magnet manufacturing capabilities.

Noveon building a rare earth separation facility? This is exactly the nonsense that we are used to from CSIS.

And why Lynas is not very likely to build LREE and HREE separating facilities in the US you can gather further below.

Labor, water, energy, processing materials, and technology costs make rare earth processing a high-cost endeavor with slim profit margins. This price environment creates additional challenges for REE processors struggling amid such tight margins, and low operation costs are a significant determinant of whether a hub can be competitive.

Let us sink on our knees to thank CSIS for this trail-blazing deluge of commonplaces.

The United States emerges as the front runner as a global rare earth processing hub, scoring 2.7 out of 3.0. Several factors position the U.S. as an ideal location for rare earth processing: In addition to adequate infrastructure, ample feedstock, and significant R&D investment, recent policy developments position the U.S. to become a leader in REE processing.

Australia (2.6/3.0), Saudi Arabia (2.6/3.0), and Canada (2.5/3.0) are also top performers in the index.

Saudi Arabia? Have CSIS had an even so brief look at the unworkable rare earth resources there?

Commonplaces and falsehoods. Terrible.

Analysis of China’s rare earth related trade - 1st half 2025

The analysis is not as detailed as we usually analyse the yearly numbers. It involves accessing hundreds of statistics and related resources.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.