PDAC; Myanmar armies fight in RE areas; Laos mandates domestic processing; Malaysia RE moves; Disconnected Canadian minister; Doom for ion adsorption clays; Malawi power supply issue, and more.

Rare Earth 13 March 2024 #142

PDAC 2024

An overwhelmingly large exhibition of everything and everyone in mining.

Rare earth participation

161 companies at PDAC registered themselves as rare earth relevant, the majority being equipment and testing companies, an ample number of junior rare earth miners and - of course - junior gold miners searching for a share-price-friendly rare earth hype.

China participation

Chinese mining companies were rather under-represented, not to say largely absent, which is understandable, as foreign direct investment in China’s mining has long been forbidden, after having ejected the few foreign companies who were present in China’s mining.

The only opening-up you get from China is, if Chinese politicians open their mouths to lecture you about it.

China’s Zijin Mining were present with a booth, but unwilling to talk.

Japan

In a defensive move the JOGMEC delegation desperately tried to hide and not make any contact, probably in order to evade junior miner’s investment pitches.

Rumours

Of course PDAC is an excellent opportunity to spread rumours.

In terms of rare earths, however, rumours have a similar feature as political rumours in China have: >90% of these rumours turn out to be true.

And we heard quite a number of rumours, pretty serious stuff of potentially severe legal consequence for the perpetrators and their companies. Essentially lying to and withholding material information from shareholders.

Nonetheless

We had very interesting and fruitful conversations with a number of rare earthlings, old faces and new ones during our 2 days at PDAC. Many open questions were answered and new information surfaced, as at events like PDAC junior rare earth miners inadvertently disclose more than they had intended to.

Rare earth investors were frequently sighted in the smoking area outside the South Entrance. Apparently not readers of this humble blog.

If you think you have the solution, then you are part of the problem.

George Carlin

China Bounty Hunting

The economy in China is really bad and people look for sources of income.

While so far there was only a reward of RMB500,000 (US$69,500) for reporting national security relevant matters and a scaled reward system for reporting potentially major economic crimes, a new and innovative method of making money is serial reporting of petty non-compliance issues of companies to the relevant government departments, who offer snitches a 30% share of the resulting fine.

The snitches are not occasional, vengeful individuals. This business is organised and backed-up by rather professional research.

Foreign-invested companies are prime targets for government-rewarded snitches, because fines for the same violation towards foreign companies tend to be higher than fines doled out to domestic companies.

Finding a foreign invested company in non-compliance, no matter how trivial and utterly irrelevant the case may be, also aids the general hostility propaganda towards foreigners and foreign investments in China.

If you have a company active in China, do not take the a.m. lightly. If a full internal compliance audit of your China entity ever was warranted, it is right now.

How did we get here?

It all started with the Chinese Communist Party Central Committee’s Document No. 9 that was circulated in 2012 and accidentally became public in April 2013. It is the starting point of China decoupling from the world, initiated in China and infecting the rest of the world just like a previously unknown virus with no known antidote would.

Rare earths: Will Germany face a shortage?

The study found that almost a third of added value in Germany's manufacturing sector depends on the production of goods containing copper. A tenth, meanwhile, comes from the production of lithium-containing goods and more than a fifth from goods containing rare earths.

The report's authors noted how car manufacturers and their suppliers are particularly dependent on these raw materials as well as producers of electrical, electronic and optical goods.

He warned that Germany's industrial economy would be "massively endangered" if it lost access to these types of raw materials, and the country's climate ambitions would also be hurt. "Without access to raw materials, there is a risk that industrial production cannot take place here," Bähr said.

The famous Fraunhofer Institute has been on rare earths for many, many years. What escapes scientists quite often is, that import dependencies have long moved on from the critical raw materials to imported components made from critical raw materials. Also Fraunhofer fall into that trap.

A shortage of rare earth, if any, will not be global but mostly affect China and Japan which both have those downstream industries, other countries simply don’t have.

21st century gun powder?

The shortage of saltpeter impeded imperial nations’ ability to wage wars, as it was essential for production of gunpowder. It took a couple of centuries to break the saltpeter import dependence by introducing replacements for gunpowder.

Perhaps in rare earths this could be a little faster.

//Politics

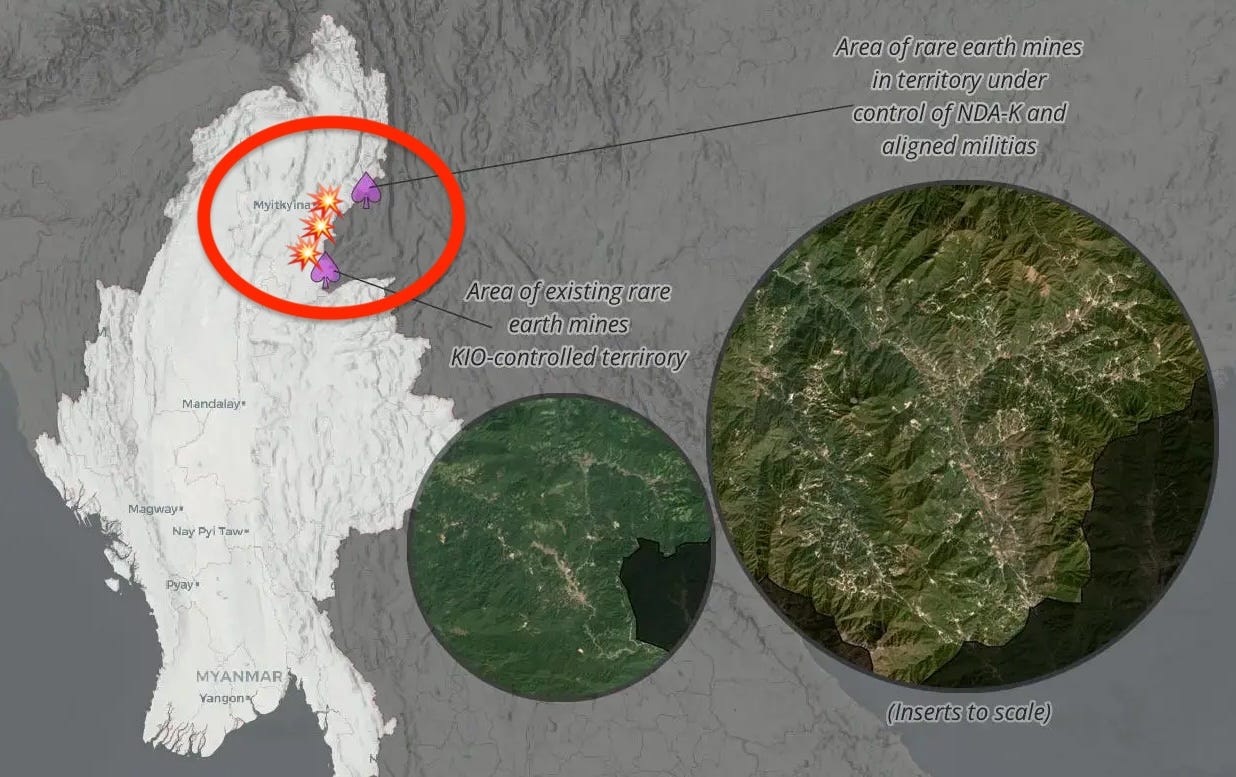

Myanmar - everyone wants the rare earth dollars

Burmese Military Junta Reels Under Fresh Rebel Offensive

Even as China managed to bring the three-group Brotherhood Alliance to the table and reports emerged of a limited understanding thos week between them and Burmese military junta, the powerful Kachin Independence Army ( KIA) and its allies launched a major offensive in Kachin State on Wednesday , attacking military camps near its Laiza headquarters in Waingmaw Township, as well as in Momauk and Myitkyina townships.

It is near infamous Special Region 1, home of the Chinese rare earth miners in Myanmar:

The junta-aligned Lisu People’s Militia leader Shwe Min was killed by the KIA in Waingmaw Township on Friday morning, Colonel Naw Bu confirmed.

Junta spokesperson Major-General Zaw Min Tun confirmed the talks had taken place to the military newspaper Myawady. He said Myanmar’s sovereignty “is still intact” and that the management of the border gates with China remains in the hands of the junta and the Chinese government, but did not comment on earlier reports that it will share their revenue with the Myanmar National Democratic Alliance Army

There is a lot of contradictory information out there. Who likely is involved:

Kachin Independence Army (of Kachin Independence Organisation KIO)

Kachin Region People’s Defence Force

Arakan Army

Myanmar National Democratic Alliance Army (whose commanders were arrested and extradited to China)

New Democratic Army-Kachin (NDA-K)

Rebellion Resistance Force

Lisu People’s Militia

Myanmar’s armed forces “Tadmadaw”

There is a lot of money on the table: Myanmar’s rare earth exports to China in 2023 were 72,000 t worth US$1.4 billion.

The NDA-K seems to be the main protection force of the Chinese rare earth miners in Kachin State.

As we explained in our post of 5 February 2024, the NDA-K is nominally subordinated to the “Tadmadaw” national defense forces as “border guards.”

Since the Kachin Independence Army (KIA) took down the Tadmadaw-aligned Lisu People’s Army’s leader, Zahkung Ting Ying of the NDA-K may be next, unless perhaps he switches sides.

As this new attack is expressly not related to last year’s “Brotherhood Alliance’s Operation 1027,” it is quite likely that in this case all the different armed groups in the wider Kachin State area are primarily vying for the big dollars from Chinese rare earth mining in Myanmar.

Malaysia

Govt urged to set up GLC to regulate, explore rare earth elements sector, says Julau MP

KUALA LUMPUR, March 4 — The government is urged to establish a government-linked company (GLC) for industrial exploration related to rare earth elements (REE) in this country.

Last year, the Minister of Natural Resources and Environmental Sustainability Nik Nazmi Nik Ahmad reportedly held discussions with state governments regarding the development of the rare earth elements framework in the country. The focus of the discussion also took into account potential areas to be explored without disturbing the permanent forest reserve ecosystem as well as aspects of processing that needed to be done in the country.

Nik Nazmi said this was due to the fact that 80 per cent of the areas that potentially contain REE and non-radioactive rare earth elements (NR-REE) are outside permanent forest reserves.

It is estimated that Malaysia has 16.1 million tonnes of NR-REE with a market value of RM809.6 billion.

It is a number of years too late for doing that. Miners in Malaysia depend heavily on Chinese - or rather Myanmar-Chinese - expertise, which in turn bases on Chinese investors interests. Why? Because the growth of rare earth consumption is not global, it happens in China.

Without the Chinese expertise and Chinese investor involvement a Malaysian “government-linked company” would need to undergo a rather steep learning curve in order function only halfway up to expectation.

Inevitably there would be rivalry with the pre-existing “government-linked company” MBI and its per-state affiliates, who are benefitting from the status-quo.

Related:

Natural Resources and three other ministries to discuss development of framework for rare earth element business model, says Nik Nazmi

The Ministry of Natural Resources and Environmental Sustainability (NRES) and three other ministries are expected to meet in two weeks to discuss the development of a framework for a rare earth element (REE) business model.

Natural Resources and Environmental Sustainability Minister Nik Nazmi Nik Ahmad said the other three ministries are the Ministry of Economy, the Ministry of Investment, Trade and Industry and the Ministry of Energy. Science, Technology and Innovation.

Related:

Penang waiting for results of tests on rare earth elements, says CM

The state is awaiting the results of the tests on the rare earth elements (REE) found in Penang which are said to be worth an estimated RM100bil, says Chow Kon Yeow.

The Chief Minister said that the state was waiting for the relevant agencies involved, which are carrying out the exploration, to present their findings.

Related

Lynas meets with Prime Minister of Malaysia at ASEAN Summit

Today, our CEO Amanda Lacaze and VP Malaysia, Dato’ Sri Mashal Ahmad, were honoured to meet The Hon Dato’ Seri Anwar Ibrahim, Prime Minister of Malaysia, at the ASEAN Summit in Melbourne, and share Lynas’ commitment to partnering with Malaysia’s rare earth industry to develop the industry of the future.

Laos

Chinese mining companies must process minerals in Laos before export

Prime Minister Sonexay Siphandone has directed the Ministry of Energy and Mines to require mining companies to process raw minerals in Laos before export – a demand aimed at the country’s numerous Chinese-funded mining projects.

Over the last 20 years, the Lao government has given the green light to 1,143 mining projects and 1,336 mineral processing projects covering more than 72,370 square km (27,942 square miles) – more than 3 percent of the country’s total surface area.

It is the trend in ASEAN and Africa to generate more added value from national resources. That requires energy. While Laos is a seasonal electric power exporter, there are also other issues that need to be tackled.

Malawi - heavy mineral sands

Power woes delay Malawi’s mines

In 2017, the Malawian government granted a mining licence to Chinese mining firm Mawei for Makanjira, a village in the country’s southern district of Mangochi. Having explored the area since 2009, Mawei had confirmed the presence of 354 million tonnes of ore containing the minerals ilmenite, magnetite, zircon, rutile and monazite.

Mawei has now had its licence for seven years but is yet to begin work, because the site is still not connected to the national grid. Amidst growing delays, locals say their hopes for higher living standards catalysed by the new mine are fading.

A 2023 World Bank report ranks Malawi as among the countries with the lowest levels of electricity access in Africa. The rate stands at 19% – an improvement on the 11% recorded during 2018’s “Population and Housing” census.

The electricity generated in Malawi is insufficient to meet the needs of a population of 20 million. There is a goal to bring capacity up to 1000 MW. Currently, the country’s electricity generator Egenco has a total installed capacity of just 441.95 MW (390.55 MW of hydropower and 51.4 MW of thermal power).

Affected rare-earthlings:

Mkango Resources (Songwe Hill and Nkalonje Hill)

Lindian Resources (Kangankunde)

DY6 Metals (Machinga)

Akatswiri Minerals (Chambe)

Lotus Resources (Milenje Hills)

“If it is not Grown, it is Mined.”

Gaius King: London South East webinar

Gaius is one of the few analysts, who actually do a proper job in the resources area and deliver true cutting-edge analysis. While not really related to rare earth and only partially related to EV, it is half an hour condensed cost of energy analysis for the rest of us.

Canada

Provincial government launches new strategy to attract investment in Sask.

New policies were announced on Monday as part of the province’s new strategy, including incentives designed to attract investment into the critical minerals sector and in multi-lateral wells, which the government described as a more sustainable drilling method.

Two existing incentives – the Oil and Gas Processing Investment Incentive and Saskatchewan Petroleum Innovation Incentive – will be extended to 2029.

Another current incentive which provides tax credits to startups in eligible technology fields will see its annual tax credit cap double from $3.5 million up to $7 million, and its eligibility will be expanded to include clean technology.

More Canada

Chinese Money Can’t Be Solution for Cash-Strapped Canadian Miners, Minister Says

Chinese investment can’t be the solution for cash-strapped Canadian miners seeking financial backing, according to Canada’s natural resources minister.

“We need to be working to solve access to capital issues, but the answer cannot be investment from Chinese state-owned industries,” Natural Resources Minister Jonathan Wilkinson said Tuesday in an interview.

We wonder on what planet of which galaxy this learned fool is living.

Measure market domination as 15% of world market share and find, oh, mon dieux, quelle surprise, China dominates global resource markets as:

The world’s largest importer, or

The world’s largest exporter, and

The world’s largest investor

If you are in resources business and you do not engage with China, which is well on its way to one third of global GDP, you are out of business, plain straight and simple. This should be the barest minimum a resources minister must understand in order to be useful.

Canada is already a rather weird place:

Alcohol is retailed in state-owned chainstores, who in Ontario close at 18:00 during weekends so that Ontarians don’t consume so much alcohol.

Happily there is a myriad of Cannabis shops everywhere, who provide drugs around the clock if you want to poison yourself. Exotic magic mushrooms? Also no problem.

Bringing a bottle of Quebec gin to Ontario is illegal. And vice-versa.

In British Colombia you can’t have Ontario wine with your dinner, but happily there are many choices of U.S., South American, European and Australian wines on the menu.

Canada likes to pose as the solution to the world’s critical minerals woes but all relevant infrastructure is compressed in the south along the U.S. border, not in Canada’s north where the resources are and where junior miners so desperately need infrastructure.

The result is that junior miners must allocate hundreds of million in infrastructure, which - of course - deters and frustrates investors.

Even building one measly dirt-road across the state borders from Quebec to Labrador is an bureaucratically unsurmountable task. Non monsieur!

Minister Wilkinson made Canada just a bit weirder.

Little wonder that many Canadians are thoroughly fed up with the Trudeau administration.

Packed UFC match in Toronto erupts into chants of 'f--k Trudeau'

Don’t try that in China.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.