Old stereotypes; EU's planned economy; Malaysia begins RE royalty; China RE sourcing in SEA shaky; A XXL IAC deposit; Rainbow de-risk; REEMF progress; GMA add funding; Quadrant's troubles; Lynas' AGM

Rare earth 29 November 2023 #133

Miscalculating the competition

Old stereotypes

In terms of China and rare earth, for reason unknown, 10-20 years old stereotypes of environmentally and technologically substandard practises in China persist.

This in turn leads to the perception, that western miners simply have to dig out some rare earth bearing mud, have it processed based on decades-old or self-made processes, no matter how deficient and uncompetitive, never mind recovery rates and other pesky details.

A recipe for spectacular failure.

China’s standards applied to rare earth mining

Let us bring you a little bit up to speed, what the standards are that are applied in China for domestic resources:

A: Mining recovery rates

Hard rock open pit rare earth deposits:

Thin ore bodies (⩽5 m thickness): mining recovery rate min. 94%

Medium ore bodies (5-15 m thickness): mining recovery rate 95%

Thick ore bodies (⩾15 m thickness): mining recovery rate 96%

Hard rock underground deposits: mining recovery rate ⩾90%;

IAC miners who use heap leaching technology to mine ionic rare earths: mining recovery rate ⩾87% (leaching phase) and ⩾70% (full phase);

IAC miners who use in-situ leaching: mining recovery rate 84% (leaching phase) and 67% (full phase);

B: Ore dressing recovery rates as REO

Hard rock rare earth ores recovery rate, classified as per China standard DZ/T0130.13-2006:

Easy selectivity ore: ⩾85%

General ore: ⩾75%

Hard selectivity ore: ⩾65%

IAC mineral processing recovery rate: ⩾90%

C. Comprehensive resource utilisation rate (CRU) - “squeezing the lemon dry”

Basically, all value carrying contents of ores must be recovered, not only the targetted resource.

CRU rate for minerals that are symbiotic with hard rock hosted rare earth minerals: ⩾60%.

CRU rate for other minerals in hard rock hosted rare earth deposits: 30%

For IAC rare earths, the rare earth concentration of the leaching mother liquor is used for the evaluation of its CRU. After the injection of liquid into the pile or ore block is stopped, the concentration of rare earth ions in the leaching mother liquor should not exceed 0.1g/L.

The regulatory frame work

All this is determined by these standards (non-exhaustive list):

GB/T 13908 General principles for geological exploration of solid minerals

GB/T 17766 Classification of reserves of solid mineral resources

GB 18599 Standards for pollution control of general industrial solid waste storage and disposal sites

GB 20664 Natural radioactivity limits for non-ferrous metal mineral products

GB/T 25283 Comprehensive mineral resources Exploration and evaluation specifications

GB/T 42249 Technical indicators for comprehensive utilisation of mineral resources and their calculation methods

GB 50863 Tailings facility design specifications

GB 51016 Non-coal open-pit mine slope engineering technical specifications

DZ/T 0203 Mineral geological exploration specifications for rare metals

DB36/T1158-2019 Geological Exploration Specifications for Weathering Crust Ion Adsorption Rare Earth Minerals

DZ/T 0204 Specifications for Geological Exploration of Rare Earth Minerals

DZ/T 0205 Specifications for Geological Exploration of Minerals Rock Gold

DZ/T 0214 Specifications for Geological Exploration of Minerals Copper, Lead, Zinc, Silver, Nickel, and Molybdenum

DZ/T 0336 Specifications for Rough Research on Solid Mineral Exploration

DZ/T 0340 Mineral Exploration Requirements for the performance test and research of ore processing and smelting technology

DZ/T 0399 Mining resource reserve management specifications

HJ 651 Technical specifications for mine ecological environment protection and restoration

TD/T 1036 Land reclamation quality control standards

TD/T 1070 Mine ecological restoration technical specifications ( all parts)

The terms and definitions are contained in GB/T 17766, GB/T 42249 and DZ/T 0340.

Straight jacket

Achieving these standards is essential for permitting and financing in China. Existing projects had been given an ample period for adjusting and meeting these standards.

And what about China’s rare earth investments abroad?

There is a traffic light system for Belt & Road-participating China policy banks and funds, indicating the potential of ESG challenges for projects. Mining projects are classified as “red”, setting off a mandatory review of ESG for each respective project.

But here is the catch: There are no sanctions for non-compliance.

But what, if?

Even if the above should not be universally implemented in China, even if the one or the other would manage to get away with less, the West should not assume the lowest acceptable standard, but the highest achievable one.

If the West wants to compete with China sustainably in rare earth, we’d better understand well the powerful competition’s up-to-date mode of operation and sharpen-up.

If the West bases assumptions on overcome stereotypes, then a rare earth Little Big Horn is in the making.

Custer’s 7th Cavalry was not only vastly outnumbered. The soldiers had been issued the standard US-Army single-shot Springfield Carbine, capable of firing about 8 rounds per minute. The Native Americans used the Henry Rifle, which could fire 13 rounds - in 30 seconds.

Agreement reached on critical raw materials in Europe

The European Union has been developing legislation to ensure the EU can access a “secure, diversified, affordable and sustainable supply of critical raw materials”. In March 2023, the EU Commission presented its draft Critical Raw Materials Act (CRMA), which the EU Parliament and Council must now adopt.

The Act will now be formally put to the vote in the Committee on Industry, Research and Energy on December 7.

Among other things, the CRMA involves the EU requirement for local quotas for the extraction, processing and recycling of critical raw materials. The benchmark here is the total demand in the European Union. For 2030, the Commission proposed 10 per cent from local extraction, 40 per cent from processing and 15 per cent from recycling. In addition, the EU should not source more than 65% of its annual demand for a strategic raw material from a single third country in 2030. In this way, the committees intend to reduce the very high level of one-sided dependency on China.

This is the latest version of the EU Critical Raw Materials List:

Lets pick on it:

Barite, main application oil & gas drilling.USGS says:

In the oil- and gas-drilling industry, alternatives to barite include celestite, ilmenite, iron ore, and synthetic hematite that is manufactured in Germany. However, the use of substitutes has been in relatively small

amounts, and barite remains the preferred choice for drilling applications.We thought, the EU wants to rid the world of fossil fuels? Then why view oil-drilling chemicals being critical materials?

Magnesium, USGS says:

Resources from which magnesium may be recovered range from large to virtually unlimited and are globally widespread. Resources of dolomite, serpentine, and magnesium-bearing evaporite minerals are enormous. Magnesium-bearing brines are estimated to constitute a resource in the billions of tons, and magnesium could be recovered from seawater along world coastlines.

How can magnesium be considered “critical”, if it is this abundant? Probably, because the EU meant to list “cheap” magnesium.

Silicon “metal”: Silicon is not a metal, it is a semiconducting metalloid, same category as germanium, arsenic, antimony, tellurium, and polonium.

Carbon hogs

Interesting that on the quest for ‘net zero carbon’ the EU considers coking coal (metallurgical coal) as critical raw material.

Carbon-emission-wise we can hardly imagine a product worse than coking coal.

Except for graphite electrodes, perhaps, an enormous carbon hog in both, its production and its use.

The EU uses graphite electrodes in “sustainable” EU-scrap metal melting and for “green” steel when melting pig iron. The emitted carbon monoxide reacts with oxygen in the air to form carbon dioxide, a prime greenhouse gas.

The EU wants a steel industry based on hydrogen fuel, so how does metallurgical coal make it on the Critical Materials List?

We could go on, but you get the sequence. The list looks like a helicopter-approach, lacking fundamental understanding, compiled possibly simply on the base of ‘we don’t have it’, without proper reflection.

The big plan

10% from local extraction

In view of blanket EU environmental protection policies paired with a fervent not-in-my-backyard (NIMBY) opposition to local mining projects, we doubt that even this humble target can be reached.

40% from processing

We would like to see, for example, how the permitting of processing flake graphite to battery grade spherical graphite in the EU goes, in terms of opposing policies and NIMBY. Or tantalum, rare earths and others.

<65% from a single country of origin

This target would require managed trade, measures of which may perhaps be incompatible with WTO terms.

Planned economy

While acting with the best of all intentions, the approach of the EU is reminiscent of elements and solid foundations of provenly successful socialist planning in the Soviet Union: It seems detached from reality

Malaysia

Kedah MB: State sets rare earth elements royalty rate at 15pc starting 2024

The Kedah state government has set a 15 per cent royalty rate from the mining of rare earth elements (REE) in the state starting next year.

Menteri Besar Datuk Seri Muhammad Sanusi Md Nor said this is a new rate which will be collected if REE becomes the main key deliverables of Kedah’s mining sector.

“Following the approval of the REE exploration, the state government expressed its gratitude to the federal government for providing Kedah the opportunity to be selected as the second pilot project after Perak,” he said when tabling the Kedah Budget 2024 during the Kedah State Assembly (DUN) session at Wisma Darul Aman here, today.

Muhammad Sanusi said the pilot project selection had placed Kedah as a state with the potential to carry out REE mining with an estimate 250,000 tonnes by the Department of Minerals and Geoscience compared with the state’s total REE reserves amounting to 1.2 million tonnes.

By request of one of our avid readers

Trade in rare earth elements increases in 2022

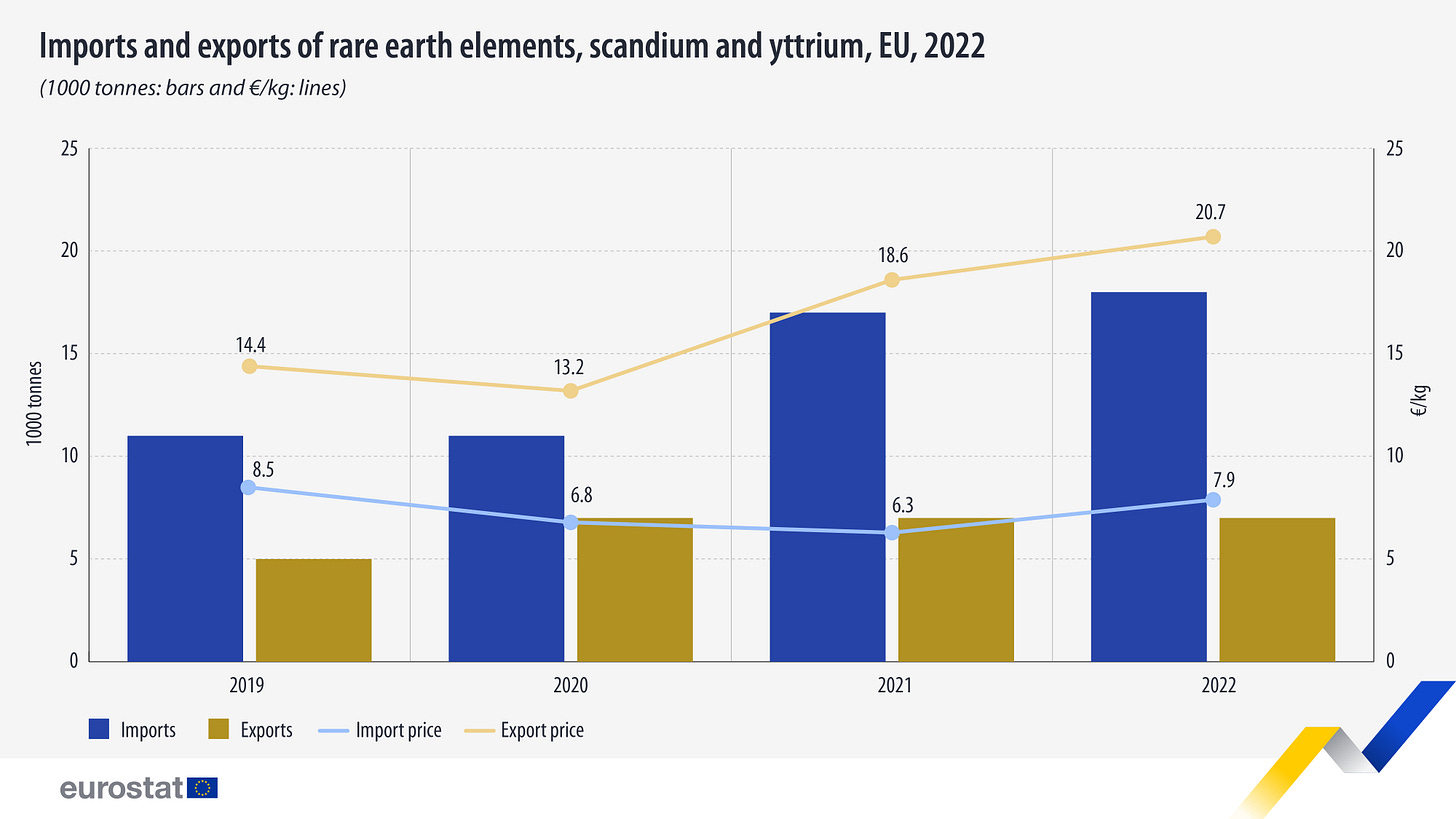

In 2022, the EU witnessed a significant increase in the import of rare earth elements (REE+). A total of 18 thousand tonnes were imported, a 9% increase from 2021, and 7 thousand tonnes exported, a decrease of 8% compared with the previous year. The value of imports surged to €146 million, marking a 37% rise compared with 2021, while exports reached €142 million, representing a 2% increase over the previous year.

The average price for imports was €7.9 per kilogram, marking a 26% increase compared with 2021, while the price of the exports was €20.7 for each kilogram of rare earth elements, an increase of 11%.

Lets start with the above part first.

EU statistics in rare earth suffer from such a lack of depth and detail, that in our view renders them completely useless, as far as rare earths are concerned. They used to be better, by the way. Now they are like trying to read from the intestines of a dead raven.

And on top of that the Eurostat database is as slow as Japanese miso soup.

While the EU statistics do make a difference between RE compounds and RE metals, the statistics do not properly distinguish between primary raw materials, intermediate products and finished rare earth compounds. All is lumped together, leading to this misinformation and quite possibly also to miscarriage of policies, unless EU politicians should be getting better statistics than us mere mortals - we sincerely doubt it.

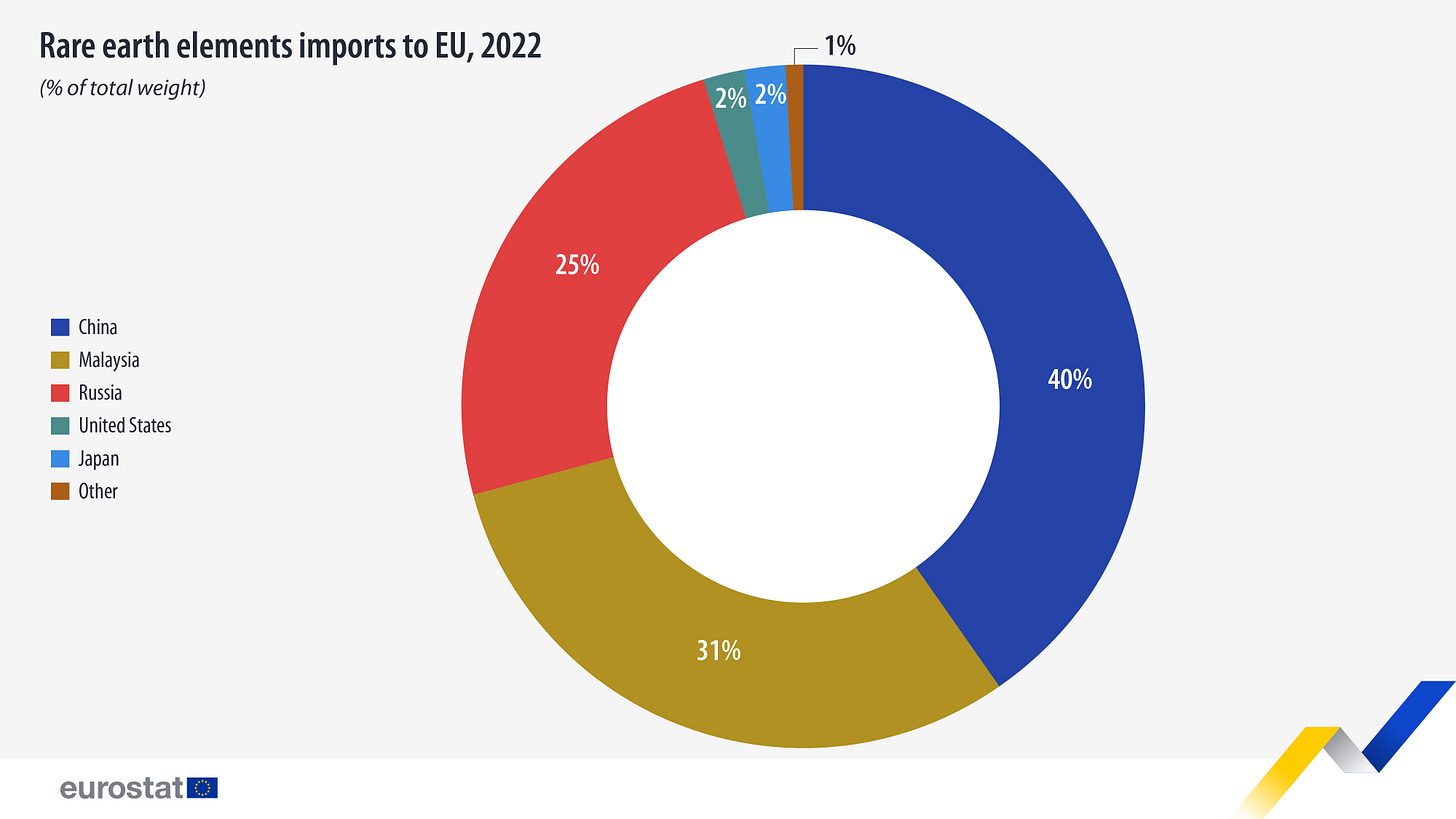

China was the largest partner for imports of rare earth elements, accounting for 40% of the total weight of imports, or 7.4 thousand tonnes.

As far as these 7,400 t from China are concerned, these consist of - with a small margin of error:

Lanthanum compounds: 5,710 t

Cerium compounds: 532 t

Other rare earth oxides: 646 t (Er, Gd, Sm, Yb, Sc and NdPr)

Yttrium oxide: 443 t

Praseodymium oxide: 13 t

Neodymium oxide: 42 t

Dysprosium oxide: 10 t

Lutetium oxide: 3 t

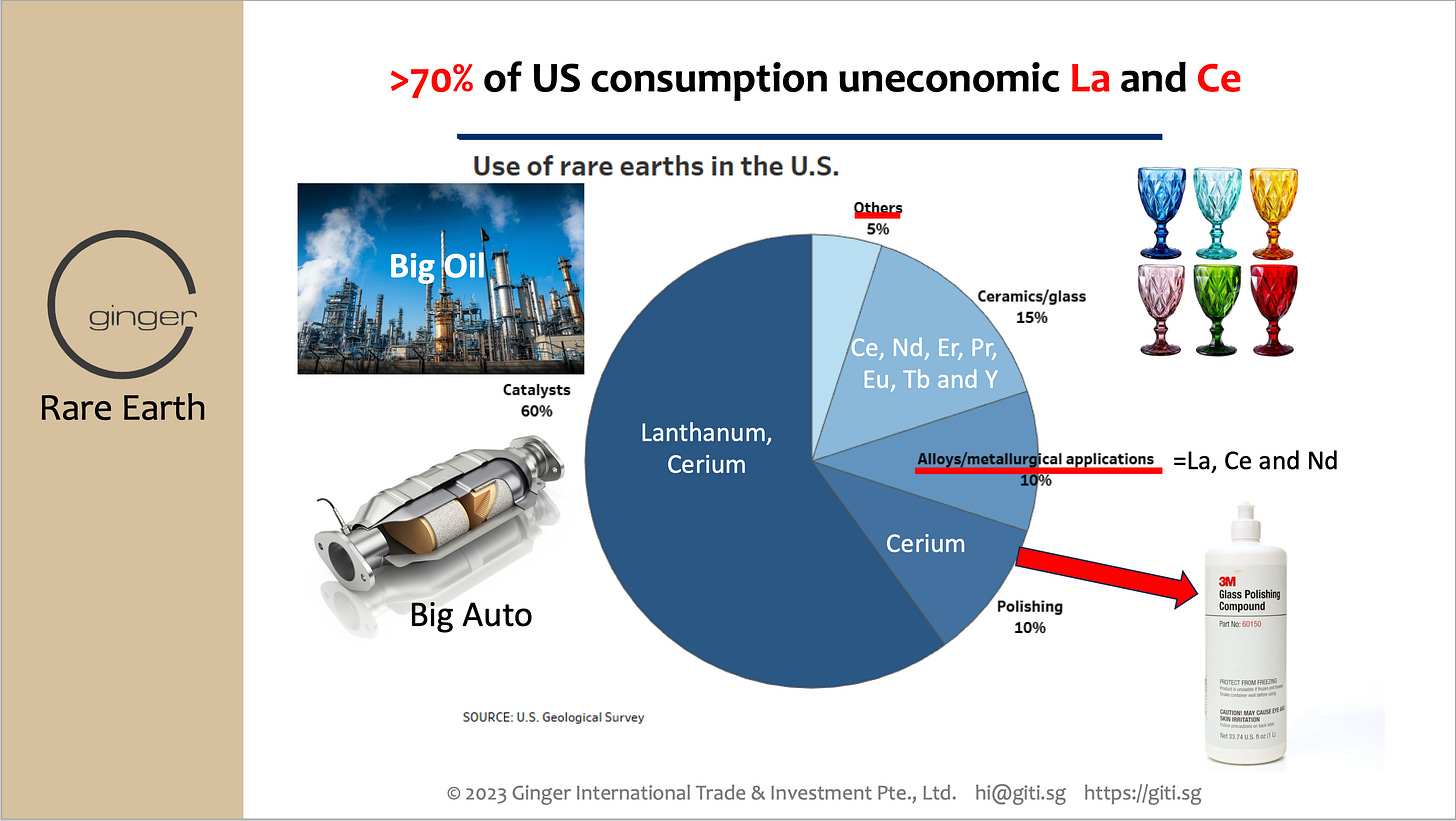

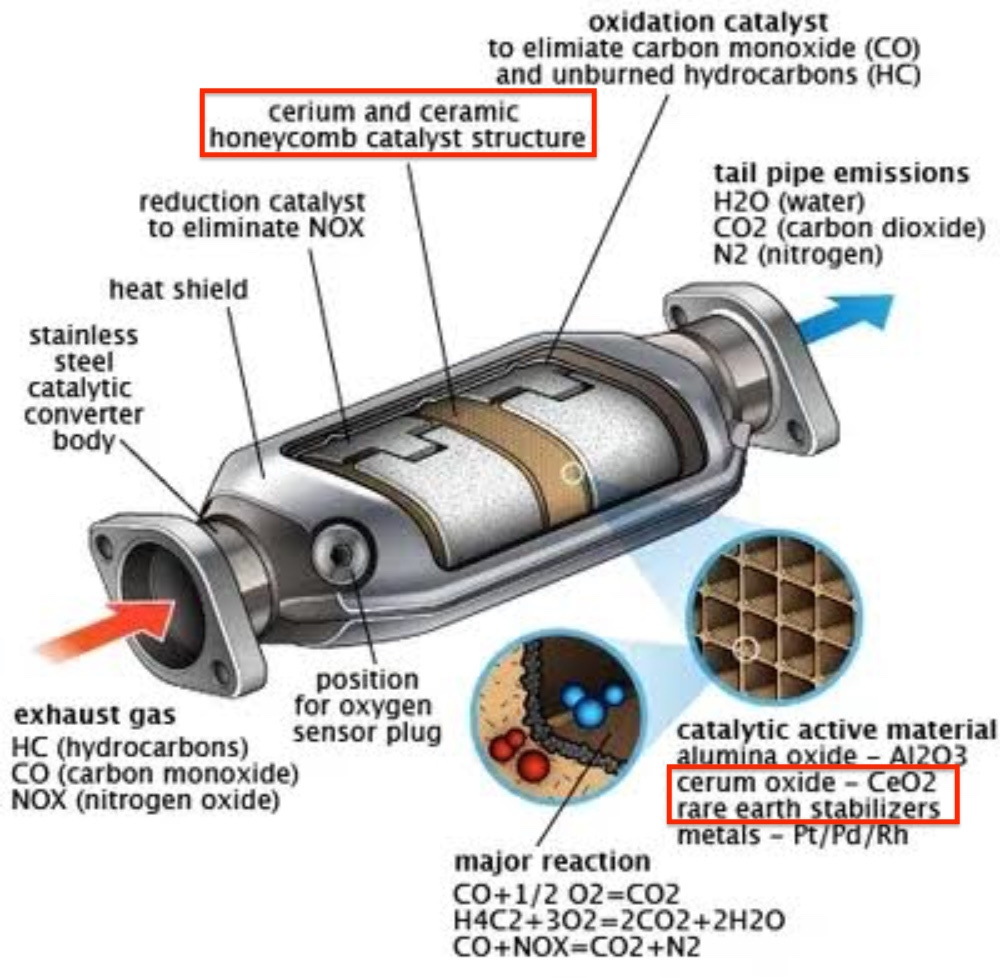

>80% of imports from China are uneconomic lanthanum and cerium compounds for applications in

fluid cracking catalysts (oil refineries),

catalytic converters (internal combustion engine cars), and

polishing powders (glass).

By the way, the US do not look much different:

In case you wonder what the exports of RE from the EU are:

NdFeB magnet rare earth oxides and sometimes mixed rare earth carbonate are exported from Neo in Estonia to Neo’s magnet factories in Thailand and in China;

Solvay produce ca. 20 proprietary blends of cerium, lanthanum, zirconium, and aluminum oxides as a substrate to be used in catalytic converters. These end up as rare earth export from the EU in the statistics.

Imported cerium is converted in Italy to proprietary polishing power, and quite a bit of this is exported to the US, actually. Also this ends in the statistics as rare earth export form the EU to the US.

Back to the publication of Eurostat:

China’s 40% share we already discussed above.

Russia’s 25% share is the loparite-based rare earth concentrate from Rosatom’s Solikamsk plant for Neo in Estonia;

The 2% from the US are mixed rare earth carbonate from Energy Fuels, also for Neo in Estonia;

Malaysia’s 31% share of imports are mostly Lynas’ La and Ce compounds for you can guess whom.

The 2% from Japan are likely related to catalysts or catalytic converters.

As you can see, the inadequacy of EU trade statistics is really a problem. Literally everything, finished product, intermediate or just raw material is lumped together.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.