MP Materials: Ruined by Tariffs; White House RE Second Guessing; Saudi Arabia's Green Horses; RE Magnets: Where is the Data?; Unusual NdFeB Project in Baotou; Denial of Gravity: Solvay & Carester;

Rare Earth 18 April 2025 #173

Another chapter in the tariff drama

The U.S. administration, true to Wild-West shoot first, ask questions later, applied a maximum possible punishment for failed trade negotiations before any negotiations have even taken place.

In terms of trade this is a nuclear first strike. For the current 90 days it is largely limited to China, while U.S. import cost rise 10% flat for all other countries - except for the U.S. long-term arch enemy: Russia.

As in a nuclear war, also in terms of trade Rand Corporation’s “MAD” applies here: Mutually Assured Destruction.

It seems to be slowly dawning on politicians in the U.S. what destructive forces the current U.S. administration has unleashed on both sides of the Pacific Ocean.

Capitol Hill BBQ

Trade Representative Greer tried hard to defend the indefensible on Capitol Hill, and we sat through the entire length of the relentless bipartisan grilling of Greer by both houses. It appears that Greer is of good character and one could reasonably expect him to resign. But that would probably end his career, as neither of the two flavours of the U.S. political system would ever forgive him.

The exception list

Looking at the items on the “reciprocal” tariff exception list it would appear that the U.S. want what China no longer wants to give to U.S. defense industries.

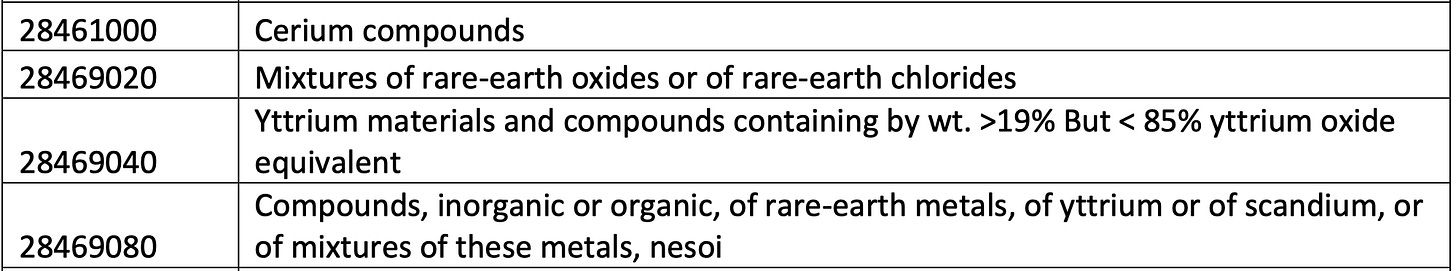

In terms of rare earth the “reciprocal” tariff list contains this:

It is not only rare earth, rare metals are also on the list. For example:

RE magnets not on the exclusion list

Notably absent from the reciprocal tariff list are rare earth permanent magnets and thereby these are subject to trade war tariffs.

While in general a step in the right direction, it is excessive and destructive to U.S. domestic industry, as there is absolutely no chance at all to replace 7,445 t (2024) of rare earth permanent magnets from China by domestic production in the near or medium term.

More impact questions

A global news network asked us, what impact we would expect on U.S. industry from China potentially withholding all rare earth dual-use products. We simply could not visualise a wholesale embargo for its sheer magnitude of impact.

U.S. defense contractors dead in the water

However, China has warned before that it does not wish to aid the production of weapons that can threaten China. It has put a number of U.S. defense contractors on its do-no-business entity list. Export licenses for product destined to other U.S. defense contractors are also not going to happen.

Different from the current U.S. administration changing course according to the direction the wind is blowing, China's dual-use measures are edged in stone and no trade negotiation is going to make them go away. The U.S. defense industry now must develop its own rare earth resources.

Capability for production of the default defense magnet exists, samarium-cobalt. But the samarium for U.S. defense contractors has just gone missing.

In terms of NdFeB magnets, defense consumption of which still is rather low but foreseeably substantially increasing, all hopes must be pinned on the eVAC project, the only one with the sophistication and know-how required for this mission-critical task.

One must keep in mind, that VAC are substantially China-dependent not only on heavy rare earth metals (even if it is Chinese rare earths processed in the UK), but also for the rest of its operations, incl. the JV with China’s so-far biggest NdFeB manufacturer.

Hectic activity in the White House

It probably just dawned on the current U.S. administration what a fabulous complete pig’s breakfast it has just served-up.

The White House issued yet anotherone of its numerous, often impulse-driven executive orders (like Maintaining Acceptable Water Pressure in Showerheads):

Owing to the lack of depth, absence of relevant knowledge and a general adversity to knowledge acquisition at the very top of the current U.S. administration, it may have escaped the administration’s attention that relevant legislation already exists.

Or is the current U.S. administration duplicating in order to pretend it was its own idea?

Rare earth panhandlers’ field day

The panhandlers and snake-oil salesmen of dysfunctional processes and fictitious rare earth projects as well as their lobbyists will be out in force in order to gain from the impulsive and generally uniformed current U.S. administration.

If there should be any residual common sense left in the current U.S. administration, it should trust no-one, hand out nothing and adhere to a Chinese proverb just this one time:

Ace up China’s sleeve

Driving U.S. gasoline prices up

Of the 13,600 t of rare earth compounds the U.S. imported from China in 2024, 8,665 t or 63% of the total were lanthanum compounds.

Lanthanum is an essential component of fluid cracking catalyst (FCC). It increases the selectivity of crude oil refining products at lower temperatures.

Domestic substitution

We do not know the margins of FCC catalyst manufacturers in the U.S., which include WR Grace, Albemarle and BASF.

What we do know is, however, that even if the trade war tariff was to apply to lanthanum, U.S. domestic lanthanum prices will not be high enough to make U.S. domestic lanthanum oxide/carbonate production feasible.

Case at point MP Materials, who in spite of massive support from their major shareholder in China ran an unsustainable operating loss of 73 cents per US$1 of revenue in 2024.

The ace

If China was to stop exports of lanthanum to the U.S. and penalise circumvention and re-routing of lanthanum through third countries, the complete absence of lanthanum could lead to U.S. gasoline prices at the pump increasing by up to 30%.

This would effectively destroy all hopes for the Republican Party in elections for years to come and therefore the current U.S. administration would likely want to subsidise gasoline price in such case.

A good, old, time-honoured, socialist and unsustainable practise.

White Paper on China's Position on Sino-US Economic and Trade Relations | China's Position on Certain Issues in Sino-US Economic and Trade Relations

The growth rate of US exports to China is significantly faster than its exports to the world. Since China joined the World Trade Organization, US exports to China have grown rapidly, and China has become an important export market for the United States. According to UN statistics, the US exports to China in 2024 were US$143.55 billion, an increase of 648.4% from US$19.18 billion in 2001, far higher than the 183.1% increase in US exports to the world during the same period.

China is an important export market for US agricultural products, integrated circuits, coal, LPG, medicines, and automobiles. China is the largest export market for US soybeans and cotton, the second largest export market for integrated circuits and coal, and the third largest export market for medical devices, LPG, and automobiles. According to UN data, in 2024, 51.7% of US soybeans, 29.7% of cotton, 17.2% of integrated circuits, 10.7% of coal, 10.0% of LPG, 9.4% of medical devices, and 8.3% of passenger vehicles were exported to China.

The US service industry has a complete range of industries and strong international competitiveness. Overall, with the continuous development of the economy and the improvement of people's living standards, China's demand for services has increased significantly, and the service trade between China and the United States has grown rapidly. According to statistics from the US Department of Commerce, from 2001 to 2023, the service trade volume between China and the United States expanded from US$8.95 billion to US$66.86 billion, a six-fold increase. According to Chinese statistics, in 2023, the United States will be China's second largest service trade partner; according to US statistics, China is the fifth largest service export destination for the United States.

While we are not here to defend China’s mercantilism and find the content disputable, this white paper is food for thought.

While ignoring U.S. strength completely, trade in services, the current U.S. administration is generally looking backward, denying that the USA have long moved on. As we wrote in our previous post:

The manufacturing model that President Trump has in mind has begun expiring already 40 years ago. Historically masses of farm workers had been replaced by mechanisation of farming. Employment moved on to manufacturing. Now the continuous trend in manufacturing is factory automation - with the predictable impact on employment.

A user on TikTok, perhaps a Chinese propaganda unit, sums-up the current U.S. administration’s vision:

China’s dual use licensing of rare earth products

Impact on defense-relevant goods

Thanks to contributions from among our readers we can now specify closer, what defense-relevant applications (there are many others!) China may have wanted to target by putting 7 rare earth elements under dual-use export licensing:

Scandium: Solid oxide fuel cells for unmanned systems (one single U.S. company accounts for the lion’s share of world scandium demand)

Yttrium: Thermal barrier coating for jet engines (yttria stabilised zirconia) and YAG laser

Dysprosium and Terbium: Magnetostrictive actuators (fighter jets) and Terfenol-D (sonar) - but also to prevent your bank cards from demagnetising….

Samarium: Samarium-cobalt (concretely Sm2Co17) is the most relevant defense magnet for its high heat resistance, multiple times higher than the best NdFeB magnets.

Gadolinium: Electromagnetic interference shielding

Lutetium: Solid-state lasers (LuAG), even though the massive U.S. import of lutetium is for Siemens Medical Systems.

U.S. tariffs for Chinese products excluding above rare earths are at >100% at the time of this writing.

And the U.S. import dependency on these materials is 100%, too.

There is domestic replacement potential:

The U.S. could have replaced most of the above.

USGS first warned of U.S. rare earth dependency 23 years ago on 20 November 2002. But in October 2002 Congress had authorised the use of military force against Iraq on the lofty assumption that it possessed weapons of mass destruction. So the Bush administration was too busy with getting America ready to obliterate another former U.S. ally.

After a brief flare up of U.S. rare earth activity upon the rare earth crisis in 2011, all efforts were put to rest after China had lost its appeal against the WTO panel ruling over Chinese export quotas and trade restrictions of rare earths in 2014.

Apart from the DOE developing some embargo technology, rare earth from coal ash, pitifully little was done or achieved.

When President Trump still thought China’s Presiden Xi was his friend, the largest U.S. rare earth resource was handed over to Chinese control by Trump 1.0 in 2017, a single bidder auction, against the advise and pleas of all experts. China drove Mountain Pass to success. And China can also ruin MP Materials in an instant (China’s current trade war tariffs against U.S. goods also apply to MP Materials’ bastnaesite, and it is farewell to MP Materials. See Companies section below).

Also the Trump 2.0 administration is tossing taxpayer money at entirely hopeless projects, promoted by lobbyists and other spin-doctors, while dreaming of the annexation of Greenland, which thoroughly underwhelms in rare earth, incl. hosting the single worst non-resource of rare earths, eudialyte.

Lobbyists & Wall Street mess things up

Unfortunately, as described above, the usual suspect spin-doctors, hand-in-hand with Wall Street, are going into a feeding-frenzy, a battle for government handouts, and they may again prevent the U.S. from doing the right thing.

The right thing

If the U.S. government follows meticulously S.714 - Critical Mineral Consistency Act of 2025 which amends this act, if it staunchly evaluates along well-known metrics, focusses on proof of concept, remembers that “grade is king”, it will find the right solution; if it listens to those who scream loudest for money while pretending gravity would not exist, then it will be Ground Hog Day all over again.

By the way

China's homegrown jetliner completes first commercial flight in Laos

A C909 aircraft completed its first commercial flight in Laos on Saturday, marking another step in China's efforts to introduce more domestically developed planes into the markets of Belt and Road partner countries.

The aircraft, which was delivered to the Lao Airlines on March 30, took off from Vientiane's Wattay International Airport and landed at the Pakse International Airport at 11:17 local time.

Not only has the current U.S. administration ruined Boeing’s sales chances in China, it also emboldened China’s airplane manufacturer COMAC to grab sales opportunities against Boeing’s 717 and 737-600.

But in terms of C909 aircraft, China has some uncomfortable dependencies on U.S. companies:

Of course these companies in turn have China dependencies of their own.

Happy embargo-boomeranging and trade-warring!

Exposed

Where Is The Data

This site was initiated by consultants to the permanent magnet industry to bring clarity to the subject of published data on permanent magnet properties.

There seems to be a reluctance – particularly with new entrants to the field – to publish data on the properties they have achieved to date. Even preliminary data (if marked as such) is useful to designers and assembly manufacturers so we would encourage people to publish what they have. We are asking companies with a “No property data found” entry to send us a link so that we can add it to this page.

Some excerpts:

Noveon – No property data found.

Niron – No property data found.

MP Materials – No property data found.

USA Rare Earth – No property data found.

Reemag – No property data found.

People are clearly fed up with deceptive announcements and corporate fog.

Governments and investors should be, too.

China halts critical rare earth exports as trade war intensifies

Shipments of the magnets, essential for assembling everything from cars and drones to robots and missiles, have been halted at many Chinese ports while the Chinese government drafts a new regulatory system. Once in place, the new system could permanently prevent supplies from reaching certain companies, including American military contractors.

Reuters clickbait.

The system should have already been in place for all the other dual-use products.

We understand the issue is that the current rare earth permanent magnet HS-code used in China does not discriminate among NdFeB containing dysprosium and terbium and those who don’t. Creating the additional HS-codes and implementing them in all systems should be the hang-up here.

Strengthening export controls on rare earth-related items reflects the determination to safeguard national security

Chinese rare earth companies will, in accordance with the requirements of the announcement, strengthen compliant trade, adhere to a high level of opening up to the outside world, and ensure that relevant items are not used for military purposes or sensitive areas. At the same time, they will continue to strengthen international mutually beneficial cooperation with friendly countries, deepen the synergy and integration between upstream and downstream companies in the industrial chain, and achieve a virtuous interaction between high-quality industrial development and high-level security.

Clear mission statement. No more rare earth products for the U.S. defense industry.

JETRO - Japan External Trade Organisation

China to impose export controls on seven types of medium and heavy rare earth-related items from April 4

In response to the announcement, the China Non-Ferrous Metals Industry Association, a Chinese industry group, issued a statement, stating that, based on companies' past practices, the export controls will not affect companies' normal economic and trade activities or the stability and security of the industrial chain or supply chain, as long as they do not undermine China's national sovereignty, security, or development interests.The statement went on to state that Chinese rare earth companies will act in accordance with the requirements of the announcement to ensure that relevant items are not used for military purposes or in sensitive areas, and will strengthen international cooperation with friendly countries and coordinate with companies upstream and downstream in the industrial chain.

JETRO are always fabulous. They also list the relevant Chinese government websites and - of course - JETRO have their own brief on the governing rules:

For details on license applications, the Ministry of Commerce has set up a "Dual-Use Item Export License" page, which lists the application flow, application documents, and the format, and on March 28th also published "Guidelines for Completing Dual-Use Item Export License Applications," which includes a checklist to be checked at the time of application, and answers to frequently asked questions. See also the JETRO research report "Dual-Use Item Export Control Regulations (401KB) ."

According to the Dual Use Item Export License page, the license completion period time limit is 45 days - unless MOFCOM requires additional inspection, in which case there is no time limit.

Australia

Critical Minerals Strategic Reserve could make sense to counter global measures

A Critical Minerals Strategic Reserve potentially could do two things:

1. Further incentivise critical minerals exploration and production in Australia

2. Create a strategic stockpile that provides Australia greater resilience against global trade measures, and greater influence over these critical mineral supply chains.

Japan Organization for Metals and Energy Security (JOGMEC) add:

In addition, local media reports dated April 4, 2025 stated that the Australian government is considering measures under the policy to purchase products from Australian critical mineral producers and find the best market for them or store them for use in Australia's allies or domestically. The media said it was unclear whether the strategic stockpile under the policy would apply only to the United States or to Australia's strategic partner countries and regions as well.

Australia does not really have the downstream industries for many of the so-called critical raw materials.

Why should the Australian taxpayer pay for a stockpile of products that Australia does not use?

Unless, of course, it should be for-profit.

Saudi mining giant Ma’aden eyes rare earths partnership

Saudi Arabian mining company Ma’aden is in the process of selecting an international company to establish a rare earths processing partnership, aiming to position the kingdom as a critical minerals hub, reported Reuters, citing three sources familiar with the matter.

The company is evaluating potential collaborations with MP Materials from the US, China’s Shenghe Resources, Australia’s Lynas Rare Earths or Canada’s Neo Performance Materials.

Ma’aden plans to finalise its decision by the end of June. The companies will develop plans for both a rare earths processing facility and a subsequent magnet production facility within Saudi Arabia.

Are there rare earths in Saudi Arabia?

We had a look.

According to the Minerals Inventory an Potential Assessments Report of Saudi Arabia’s Ministry of Industry & Mineral Resources it looked like this back in 2016:

More updated data are available from Saudi Arabia’s National Geological Database Portal.

This does not look prospective at all. Unless there is something we missed, we can barely contain our excitement.

So what is it that they want to process in Saudi Arabia? Monazite from Africa?

As to the potential partners:

Lynas are dependent on JOGMEC pulling along. JOGMEC’s interest is that Lynas get the heavy rare earth processing going, be it in USA or in Malaysia. Having said that, Saudi Arabia is an important energy partner of Japan Inc.

MP Materials are fully dependent on their major shareholder Shenghe Resources. If Shenghe Resources pull the plug the plug on MP Materials, the lights go out in Mountain Pass.

Shenghe Resources are a China government controlled entity. The Chinese government has impressively display its determination to keep all rare earth processing know-how at home. Allowing precedence like a project in Saudi Arabia would create me-toos. Nonetheless, in rare earths we have seen plenty of green horses vomiting in front of a pharmacy.

Neo Performance Materials have just shown by selling-off to Shenghe Resources that they want to get out of low margin rare earth processing. But also here, green horses…

Have we suddenly and unexpectedly run out of land-based resources?

Kiribati, China talk deep-sea mining

Pacific nation Kiribati says it is exploring a deep-sea mining partnership with China, dangling access to a vast patch of Pacific Ocean harboring coveted metals and minerals.

Beijing has been ramping up efforts to court Pacific nations sitting on lucrative seafloor deposits of cobalt, nickel and copper — recently inking a cooperation deal with Cook Islands.

Kiribati opened discussions with Chinese Ambassador Zhou Limin (周立民) after a longstanding agreement with leading deep-sea mining outfit The Metals Co fell through.

Kiribati holds rights for deep-sea mining exploration across a 75,000km2 swathe of the Pacific, in a region known as the Clarion Clipperton Zone. Through state-backed subsidiary Marawa Research, Kiribati had been working with Canada-based The Metals Co to explore the mineral deposits. However, that agreement was terminated “mutually” at the end of last year, the company told AFP.

So far there is no indication of the world running out of land-based metal resources which would necessitate messing around with the deep-sea environment, risking destruction of world food chains.

There is also no indication whatsoever that ocean-floor mining should be profitable:

The Metals Co expects a Japanese entity “PAMCO” to come up with a PFS shortly,

GSR says it wants to get the science and environmental side right, before looking at the commercials.

Both argue that the metal demand for energy transition may exceed land-based resources’ ability to deliver.

We don’t buy it, as we have seen enough glowing demand forecasts going up in smoke over the years.

//Electric Vehicles

Naming and shaming first ranked EV manufacturers for buying batteries made with a commodity of changeable origins is questionable.

Likewise we do not condone the wholesale stereotypical “the Chinese” here, “the Chinese” there. 7 News should be talking about a private company here, who is not named in the report.

When Union Carbide poisoned an entire city in India, people were also not talking about “the Americans,” nor was there any inclination that the U.S. government or the U.S. as a nation were to blame.

The operations in Indonesia are subject to the Law of the Land. China’s President Xi Jin Ping, himself an ardent environmentalist at home, has made adamantly clear on several occasions that no Chinese company abroad can count on any support from the Chinese government, if it does not observe the law of the county it is operating in.

Lets put some meat on the bone.

The original investor from China is Tsingshan Holdings.

Tsingshan Holdings are a stainless steel company, China’s first private stainless steel maker.

Tsingshan’s original investment in Indonesia was 2009.

The target was to produce ferro-nickel for stainless steel, not battery materials.

In China Tsingshan were notorious for particularly bad quality steel products

Therefore Tsingshan in the past could only sell its stainless steel products at hefty discounts, while some companies banned the purchase of any Tsingshan products altogether for lousy quality, deficient quality control and poor attitude towards quality claims.

You can read-up the complete history of the company here: King of Nickel, Tsingshan Holdings' Journey to the World

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.