Magnet Maker invests in OZ Monazite Dud; Rainbow clarify; Greenland Eudialyte Hype; Stereotypes & FUD in Media; Russia in new Rare Earth Push; Italy eases Mining Regulations; Hope for better prices?

Rare Earths 17 July 2024 #152

There can be no excess capacity in low-carbon alternative energy products in a world afflicted with the existential climate change that we are experiencing.

Stephen Roach (former chairman of Morgan Stanley Asia)

Rainbow clarify

Regarding our post Pilot Plant Update of Rainbow, which in our view was hardly comprehensible, Rainbow sent us the following clarification:

We noted your commentary about Rainbow Rare Earths’ recoveries at Phalaborwa in the most recent edition and wanted to provide you with the following clarification:

As announced on 19 June 2024, the overall recovery of rare earths achieved at the primary pilot plant at Mintek in Johannesburg was 66%, versus the 65% used in the PEA.

The 66% was made up as follows:Therefore, the total rare earths recovery is 66% via the two leaches and the two CIX circuits feeding to the combined CIC circuit.

A significant 15% of the rare earths from the phosphogypsum feed is leached in the impurity leach circuit, which can otherwise be thought of as a pre-leach with upfront rare earth recovery and impurity control functionality. This represents 23% of the recoverable rare earths (i.e. from the total of 66% recoverable). This is extracted from the impurity leach bleed via a newly introduced continuous ion exchange (“CIX”) circuit, the eluate from which can progress to the downstream continuous ion chromatography (“CIC”).

The remaining 51% of the recoverable rare earths from the phosphogypsum feed is leached in the rare earth leach circuit. The pregnant leach solution from the rare earth leach is processed via precipitation, strong acid bake and water leach. The water leach solution feeds the original CIX ahead of the CIC.

I hope this clarifies matters, but please let me know if you have any follow-up questions.

Even this we needed to read twice for comprehension.

As a matter of principle we publish official responses to our contents, in case Rainbow had any doubts.

//Stereotypical clickbait

Wall Street Journal: A very disappointing piece

Rare-Earth Prices Are in the Doldrums. China Wants to Keep Them That Way.

China’s overproduction, with its increasingly negative impact on industry profits, only makes sense as part of a broader economic strategy. The country produces roughly 60% of the world’s mined rare-earth minerals. In recent years, it has also tightened its grip on the entire magnet supply chain: It controls 91% of refining activity, 87% of oxide separation and 94% of magnet production, according to the Centre for European Policy Studies. That gives it considerable sway over what happens to rare-earth prices.

One theory is that China has deliberately pushed prices lower to help buttress its green-energy industries. The country is willing to be a loss leader in parts of the value chain to help downstream ambitions such as exporting EVs into international markets, says Ryan Castilloux, managing director of Adamas Intelligence.

A more cynical argument is that Chinese overproduction is designed to stymie efforts to develop alternative sources of supply. Low prices of rare earths have squeezed margins for Western producers.

Beijing seems eager to maintain its grip on rare earths. In late June, the Chinese government unveiled a new set of regulations that tightened its control of domestic production. That followed an export ban on rare-earth processing technologies last year.

This article is probably the worst accumulation of falsehoods and stereotypes in recent rare earth history.

It reveals the shallow knowledge of contributors, probably rooted in the near complete absence of on-the-ground experience.

If this shallowness should be what we should expect of forthcoming rare earth conferences, then it is better to save the money and go for a beer with a rare-earthling instead. This would be more enriching.

Overall it is articles like this in generally considered reputable publications do a disservice to government, the public and to entire the rare earth space, whether producing or not.

Castles in the sky

Rise of African rare earths bolsters supply pipeline for China and the West

Tanzania will become one of China’s fastest-growing sources of imported rare earth ores this decade, despite producing none today.

Under the presumption that Peak Rare Earth and Shenghe will work out, else not. And Wigu Hills is and remains under international arbitration. No chance of turning out anything by 2029, or ever.

Tanzania is only one of five African countries that have rare earths projects due to come online by 2029. The others are Angola, South Africa, Malawi, and Uganda.

The devil lives in the detail.

First of all, where should the billions of dollars for enabling mining of these deposits come from? Any clever suggestions?

Then:

Angola’s Longonjo is a rare-earth-enriched thorium resource with a difficult mineralisation. There is no trace of the promised “bunkers” for the radioactive waste in the planning, only an open tailings storage. With governments of Angola, the UK and EU as well the IAEA turning a blind eye, Longonjo in Angola could become a potential repeat of the Bukit Merah catastrophe in Malaysia. But we expect an exit of the operator anyway.

South Africa’s Glenover has been around for ages and nothing ever happened, the Steenkampskraal mine is so hot (for Benchmark: this is lingo for high levels of radiation) that crews - if there were any - could only spend very limited time working there, Zandkopsdrift is and remains dormant, the only one with a reasonable prospect of going live is small-but-beautiful Phalaborwa;

Malawi (Mulanje, Machinga, Kangankunde, Milenje Hills, Nkalonje Hill, Songwe Hill, Nanthache Hill) on paper there is only Lindian’s Kangankunde whose feasibility assumptions look reasonable (chapeau to Project Blue). Infrastructure is a substantial challenge. Songwe Hill’s PEA is a disaster and a prime example why rare earth projects fail;

Uganda’s Nankoma is dormant and Makuutu is ion adsorption clay (IAC) on Uganda’s comparatively rather shallow groundwater table. In-situ leaching of the deposit with ammonium sulphate solution will not only poison the groundwater. Similar to China’s Bayan Obo problem with polluted radioactive groundwater assumed to be seeping slowly towards the Yellow River, northern China’s prime water resource, Lake Victoria, one of Africa’s main water resources, could be at risk from in-situ leaching of IAC in Makuutu. Alternative tank-leaching will kill the project commercially.

Wigu Hill in Tanzania has been under international arbitration for quite a while. Vital Metals will only be able to own it should Montero win in arbitration against Tanzania and if Montero stick to the original deal. And if Vital Metals should be successful in taking the shortcut in Tanzania, it will be its Chinese shareholder who will finance and control everything going forward. Overall zero potential of supplies to EU.

African rare earths should become critical to Western rare earths supply chains facing cost challenges in building ex-China mined capacity.

The overall cost challenges are no different from elsewhere, but with a different distribution/weight.

The issue in the “West” is regulatory, there is no permanent disposal home for inevitably occurring radioactive waste from processing. This refers to thorium and uranium, as residual actinium, if any, so far has been impossible to separate from lanthanum. The memory of Neo’s radioactive waste disposal problem in Estonia still lingers.

The “Solvay doctrine” of leaving the radioactive waste to the miners is resource colonialism, unfit for the 21st century, in no way compatible with the spirit of universal sustainability of growth enshrined in the Paris Agreement.

Even if there was the one or the other '“radionuclide-free” rare earth resource, the market sizes of the valuable rare earth elements in both, the U.S. and the EU, are actually too small to justify additional rare earth processing - on top of missing rare earth metal making.

If Benchmark would listen closely, they could gather the acknowledgement of this open secret from rare-earth hopefuls’ presentations.

Overall Benchmark’s assessment can only be viewed as a shallow and uninformed.

//Politics

Italy moves to boost procurement, reuse of critical raw materials

Italy is set to adopt a package of measures aimed at boosting procurement and reuse of critical raw materials, a draft decree seen by Reuters shows, including simpler permitting procedures for the release of mining concessions.

Prime Minister Giorgia Meloni's government has made it a priority to extract more such materials at home to make local industries less reliant on imports from countries like China.

Italy estimates it can domestically source 16 of the 34 raw materials considered critical by the European Union, including lithium and bauxite.

The draft, promoted by Industry Minister Adolfo Urso, states that projects for the extraction, processing or recycling of these materials are "non-deferrable and urgent."

Licences for these activities have to be issued within a maximum of 18 months under the scheme, which government officials said could be discussed by the cabinet as early as Thursday.

A provision in the Italian decree is likely to upset Green lobbies, as it paves the way for exploration permits for strategic raw materials to be issued without any environmental impact assessment.

It became law on 26 June 2024. Here is the link to the original document.

Analysis: China’s clean energy pushes coal to record-low 53% share of power in May 2024 - Carbon Brief

Clean energy generated a record-high 44% of China’s electricity in May 2024, pushing coal’s share down to a record low of 53%, despite continued growth in demand.

The new analysis for Carbon Brief, based on official figures and other data that only became available last week, reveals the true scale of the drop in coal’s share of the mix.

Coal lost seven percentage points compared with May 2023, when it accounted for 60% of generation in China...

The new findings show a continuation of recent trends, which helped send China’s carbon dioxide (CO2) emissions from fossil fuels and cement into reverse in March 2024.

If current rapid wind and solar deployment continues, then China’s CO2 output is likely to continue falling, making 2023 the peak year for the country’s emissions.

Are EU trade barriers on China fair? Beijing’s new probe demands answers after bloc action

China’s trade-and-investment-barrier investigation, which began on Wednesday, is looking at how the EU’s Foreign Subsidy Regulation has affected Chinese companies.

Authorities will use questionnaires, public hearings and field inspections, and aim to be finished by January 10, the Ministry of Commerce said on Wednesday, adding that the half-year probe could be extended to April 10 under special circumstances.

Mofcom said EU practices that fall under the scope of China’s investigation include the bloc’s probes into Chinese locomotives, solar panels, wind-power products and security-check equipment.

“Trade-protectionist measures are not conducive to the development of the global green industry or cooperation in the automotive sector,” the ministry’s spokesperson said, adding that China would take all necessary measures to safeguard its own rights and interests in the face of abusive rules.

This is a valid point. All this “green development” is happening in order to reduce the significant man-made contribution to global warming, so to gain time for adapting.

Arguably, one could view it as China having been fastest to the market and it is now punished for being so fast.

All this would likely be no issue, had China not alienated its partners by implementing the contents of Document No. 9 of the CPC Central Committee of 2012 and started decoupling after the 3rd Plenum of the 18th Central Committee in 2013.

This was amplified by an aggressive “Wolf-Warrior” foreign policy and uncalled-for militarisation of the South China Sea.

If any of the above may have been cause or rather effect is something that can feed a lengthy debate. But whatever the debate outcome, justified or not, China is has damaged its image as a benign partner acting in good faith.

Russia to boost rare, rare-earth metals production by 2030 — minister

"Technologies for processing of complex ores and extracting such metals were developed in prior years. Currently, government-supported investment projects are being prepared for the start by Rosatom - these are Lovozersky concentration plant and Solikamsk Magnesium Plant; projects of Rostec and Highland Gold - Tyrnyauzskoe tungsten and molybdenum [deposit], Tastygskoe lithium [deposit] and Ermakovskoe beryllium deposit. Furthermore, there are initiatives of private companies - Skygrad will process phosphogypsum tails in Voskresensk and Norilsk Nickel is working on the Polar Lithium [project] in cooperation with Rosatom. Owing to such projects, we expect to boost rare and rare-earth metals production by eight times by 2030 and reduce the share of imports in consumption to 15%," the minister said.

In 2023 Russia imported 1,477 t of rare earth compounds from China. So if this was all, Russia would be aiming for 1,250 t of own rare earth compound production. A very humble objective.

Rare earth metals and alloys were 211 t all-in and on the magnet front Russia received 5.3 t of NdFeB powder, 1,935 t of non-rare-earth permanent magnets and 927 t of rare earth permanent magnets from China in 2023.

Related

BRICS accounts for 72% of global rare-earth metals reserves — official

BRICS countries after the accession of new members to the association provide for 72% of global reserves of rare-earth metals, head of the Russian Federal Subsoil Resources Management Agency (Rosnedra) Evgeny Petrov said in an op-ed posted on the TASS website.

Key risks to sustainable development of the global economy are in exhaustibility of fossil fuel and the imbalance of reserves of critical mineral feedstock and technologies required for the successful energy transition, Petrov said. Mineral and raw material complexes of BRICS countries complement each other as regards mining and production of critical minerals.

Moscow’s renewed attention to rare earth should make Neo Performance Materials really nervous because their Estonian operation depends on the loparite concentrate from Rosatom.

Apparently Neo are already busy with South East Asia, looking for alternatives.

Also North Korea strives for rare earth independence

Sci-tech Presentation in Field of Rare Earth Application Technology

A national sci-tech presentation in the field of rare earth application technology took place at Kim Chaek University of Technology on March 20, under the sponsorship of the Korean Rare Earth Application Technology Association under the Central Committee of the General Federation of Science and Technology of Korea.

Present there were officials, scientists, teachers and postgraduates of Kim Il Sung University, Kim Chaek University of Technology and the Ore-dressing Engineering Institute of the State Academy of Sciences.

The participants heard speeches on the practical and reasonable ways to establish domestic rare earth oxide and alloy production processes.

The proposals substantially conducive to the expansion of the rare earth application sector and the development of the national economy were highly appreciated.

Meanwhile, there took place a demonstration of the rare earth oxide extraction process that day.

We reported 4 years ago on a North Korea rare earth scam and about the epic 38North Special Report.

North Korea has been exploring rare earths for a long time and has a history of exporting rare earth ores to China. We checked and could not find any recent rare earth or rare earth permanent magnet trade between DPRK and China.

Which then begs the question how North Korea can build advanced weapon systems? After all the hermit state has nuclear missile and satellite capabilities.

The 2023 report “Critical metal resources in Democratic People’s Republic of Korea” says:

According to the (Republic of) Korea Institute of Geoscience and Mineral Resources (KIGAM), the deposit has 7.5 billion MT of resource, out of which 16.9 million MT have an average of 0.5–0.6% REO (Korea Institute of Geoscience and Mineral Resources (KIGAM) 2019)

At least there are lab-quantities of neodymium oxide from North Korea:

Meanwhile in Vietnam

Vietnam faces challenges in rare earth processing for tech industries

Vietnam currently lacks a factory capable of processing rare earth ore into products that meet export standards, where the total rare earth oxide content must be at least 95%. This information was recently shared by Ass. Prof., Dr. Hoang Anh Son, Director of the Institute of Materials Science, during the quarterly press conference of the Vietnam Academy of Science and Technology.

Recently, many enterprises and foreign partners from the US, Japan, South Korea, and other countries have shown interest in cooperating with Vietnam in the field of rare earth mineral extraction and processing. However, only a few producers in these countries possess advanced rare earth processing technology. They retain the intellectual property and keep the technology confidential without transferring it.

Overall, the extraction and processing of rare earth mines in Vietnam are still very limited. The main reason for this delay is that enterprises have not mastered the technology to process products to the required standards (rare earth oxide content ≥ 95%) and do not possess the technology to separate individual rare earth products.

It is quite obvious that Vietnam’s rare earth plan is to exclusively apply to state-owned industry, as private and foreign invested enterprises are not mentioned. Within the state-owned sector, the rare earth situation may well be as described.

The underlying tendency may be a back-to-the-roots thinking similar to its northern neighbour, run by fellow comrades.

China Filling Huge Arms Order Placed by Myanmar Junta

China is supplying military hardware and ammunition to the Myanmar military junta as it struggles with fierce and growing armed resistance across the country.

Sources familiar with the matter based in Naypyitaw and on the Thai-Myanmar border said Beijing is in the process of shipping arms purchased by the regime.

The Irrawaddy has learned the list includes military hardware for both ground forces and the regime’s air force.

Currently, the regime’s deputy leader Soe Win is in China to attend the Green Development Forum organized by the Shanghai Cooperation Organization (SCO), according to junta media.

However, it’s believed the main reason for his visit is to take care of more urgent matters like arranging arms purchases and shipments. In the Myanmar military, major arms purchases overseas are normally handled by the army chief—a position Soe Win currently holds.

Also the Myanmar opposition forces and protectors of foreign rare earth mining in northern Myanmar sport Chinese guns, as we previously documented.

Laos, Singapore strengthen edu and clean energy ties

According to the Lao Ministry of Foreign Affairs, two-way trade between Laos and Singapore has reached US$182.5 million this year, with Lao exports exceeding USD 96.3 million and imports over USD 86.1 million. Additionally, Singaporean businesses have invested in 83 projects across Laos, totaling USD 362 million.

Meanwhile, the two sides also pledged collaboration in renewable energy, rare-earth minerals, agriculture, health, and tourism. In regional affairs, the two prime ministers affirmed their commitment to strengthen Asean community building and support Laos as this year’s Asean chair.

Governor of North Dakota, USA

Burgum: Supreme Court’s Chevron opinion a game changer for states fighting federal overreach

By overturning the 40-year-old Chevron deference doctrine, justices sent a clear message that Congress, not federal agencies, is responsible for making laws. And the high court confirmed that it’s the role of the courts, not agency “experts,” to interpret those laws. This opinion is a massive win for states’ rights, the rule of law, and our founding principle of three branches of government.

North Dakota knows about Biden’s regulatory overreach all too well. We are currently engaged in battling the federal government on over 30 rules and regulations covering everything from unattainable emission caps designed to kill electricity generation plants to a draft plan that would cut off nearly half of federal oil and gas acreage from leasing. Some of these “rules” are 800 to 1,400 pages long.

The competition of ideas is why the world’s largest and strongest economy exists in these free United States and not in monolithically controlled countries. It’s why China steals and copies technology from U.S. entrepreneurs. It’s why U.S. influence spread across the globe as the Soviet Union imploded.

Costly EV mandates and subsidies are driving inflation, empowering our adversaries and hurting, not helping, the environment.

You may read-up about the Chevron deference doctrine at Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc.

The governor is clearly going overboard with stereotypes. He makes a rather important point, though. So far the U.S. has always been a “high performance permanent magnet” for the world’s top talent in major disciplines, offering unmatched academic and individual freedom in world-leading universities, paired with high rewards, albeit in a merciless meritocracy. There is little doubt that this attractiveness continues playing a defining role in U.S. dominance.

We really can’t estimate, if and how far this judegement may affect the permitting process for rare earth related investments.

//Science

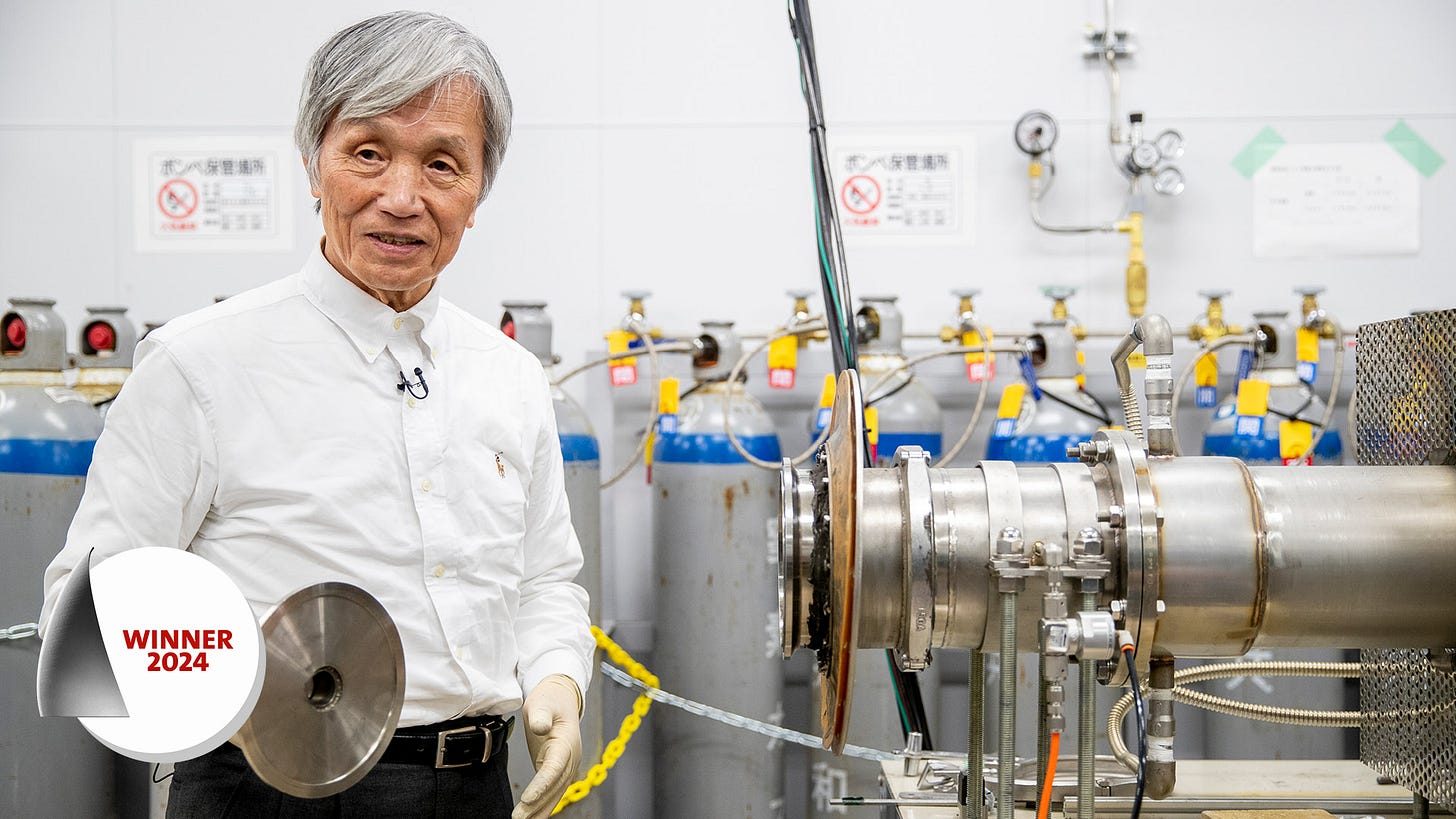

European Patent Office: Japanese scientist wins the European Inventor Award 2024 for the world's most powerful permanent magnets

The European Patent Office (EPO) has announced Masato Sagawa as the winner of the 'Non-EPO countries' category of the European Inventor Award 2024. Dr Sagawa developed the world's strongest permanent magnet in 1982, changing the future of computing, medical technology, green energy and multiple other fields.

Inspired by iron's greater availability and lower cost compared to the cobalt prevalent in magnets of that time, Sagawa began blending iron with various common rare earth minerals. His breakthrough came when he included Boron into the mixture to increase the distance between the iron atoms, significantly boosting their ability to resist demagnetisation - a property essential in permanent magnets. Ultimately, he settled on the alloy of neodymium, iron, and boron (Nd-Fe-B) that we know today, but what truly sets his magnets apart is the multi-patented sintering technique used in their creation. More than four decades later, this process still produces the strongest magnets relative to their size.

Here the link to the original European Inventor Award 2024.

//Renewable Energy

Robert Bryce

The Offshore Wind Energy Scandal Is Even Worse Than You Think

Two of Europe’s biggest energy companies are abandoning the SS Offshore Wind.

In May, Shell, the UK-based oil and gas giant (2023 revenue: $317 billion), announced that it was cutting staff from its offshore wind business because, according to Bloomberg, the company has decided to focus on markets that “deliver the most value for our investors and customers.” Bloomberg also reported that the staff cuts were made after the departures of top executives in the company’s offshore wind and renewable power businesses.

Last month, Murray Auchincloss, the CEO of oil and gas giant BP, imposed a “hiring freeze and paused new offshore wind projects.” According to Reuters, the new CEO is putting more “emphasis on oil and gas amid investor discontent over its energy transition strategy” and that BP (2023 revenue: $208 billion) was cutting investments in “big budget, low-carbon projects, particularly in offshore wind, that are not expected to generate cash for years.”

The moves by BP and Shell are only the latest examples of the troubles facing the offshore wind sector, which has been foundering on the shoals of higher interest rates, citizen opposition, and ballooning costs. Over the past year, numerous projects on the Eastern Seaboard, including Skipjack Wind in Maryland, Park City Wind in Connecticut, and South Coast Wind in Massachusetts, have been canceled due to bad economics. In all, according to data compiled by Ed O’Donnell, a nuclear engineer and a principal at New Jersey-based Whitestrand Consulting, about 14,700 megawatts of offshore wind capacity has been canceled. For comparison, about 15,500 megawatts of capacity is now in development, under construction, or operational.

Bryce is producer of the legendary energy documentary “Juice”, worth watching all chapters on Youtube:

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.