Lynas analyst estimates fall; Mixed news for EV; Giant Denso plan RE-free motor; RE-prices fall double digit during 1st two weeks of the year; Norway's REE Minerals; Vietnam-Korea RE hype; and more

Rare Earth 22. January 2024 #137

SimplyWallSt warn about Lynas

SimplyWallSt e-mailed investors:

Lynas financial year ends in June and rare earth prices keep falling, because of China’s limping economy. Current trends affect Lynas sales prospects in China, essentially the butter on Lynas’ bread.

See more in the price section at the end of this post.

China discovers new rare earth minerals

The mineral was found by experts in the city of Taiping, in the central province of Henan, and was named Ni Pei Stone, in honor to a prominent Chinese geologist, the Ministry of Natural Resources informed.

It ranges in color from light red to reddish brown and holds the record for having the highest cerium content among silicate minerals discovered in nature, the source stressed.

The last thing the world needs is more overproduced cerium.

China unearths million-tonne lithium deposit, heating up global resource race as Thailand also boasts big find

The Ministry of Natural Resources said the huge reserve – about 1 million tonnes of the silvery-white alkali metal that is often called “the new oil” or “white gold” – was found in Yajiang county, Sichuan province, the Xinhua Insight news outlet reported on Thursday.

China already had about 7 per cent of the world’s identified lithium resources, ranking sixth in the world after Bolivia, Argentina, the US, Chile and Australia, according to the US Geological Survey.

But it refines around half of the world’s lithium and relies heavily on the overseas market for the material.

If mining this resource begins affecting China’s lithium-related imports, some miners will be in deep trouble.

//Politics

Laos Partners with Chinese Firm for Tech Advancement in Mineral Exploration, Environmental Management

On 10 January, the Ministry of Technology and Communications forged a strategic partnership with China Rocket Co., Ltd., a leading Chinese company, to leverage remote sensing satellite technology for several developmental purposes.

Under this agreement, the joint utilization of satellite tracking technology is set to enhance mineral exploration services for both public and private entities, and the two sides are committed to providing detailed reports to relevant authorities, seeking support and approval for future collaborative efforts.

The Laotian government is trying hard to get a handle on the mining sector.

Brazil negotiates mining investments with Saudi Arabia – minister

Brazil and Saudi Arabia are discussing investments in sustainable mining and the energy transition, according to Brazilian Minister of Mines and Energy, Alexandre Silveira.

Attending the World Economic Forum in Davos, Switzerland, Silveira met with the Saudi ministers of investments, Khalid Al-Falih, and industry and mining, Bandar Alkhorayef.

In 2023, Manara Minerals, a joint venture between the Saudi state mining company Ma’aden and the Public Investment Fund, acquired a 10% stake in Vale Base Metals, the basic metals subsidiary of the Brazilian company, for approximately $3 billion.

Saudi Arabia recently signed memorandums of understanding for mining collaborations with Egypt, Russia, Morocco and the Democratic Republic of Congo.

Norway lured by deep-sea mining for rare metals

Norway has just authorised commercial deep-sea mining on its seabed, which is rich in rare and precious metals. This announcement has whetted the appetite of mining companies, which are developing robots and drones to collect the potato-sized rocks, located at a depth of 3,000 metres. Billions of euros are at stake in the exploitation of these so-called critical minerals, which are essential for building electric vehicle batteries and solar panels. But deep-sea mining could prove devastating for ecosystems.

In 2021, crude oil and natural gas exports accounted for 50% of Norway's export revenues and more than 20% of the country’s gross domestic product (GDP).

Apparently, Norway wants to diversify.

Coal India Ltd eyes lithium, rare earth mines from govt

As part of its diversification plans, state-run Coal India Ltd (CIL) plans to acquire rare earth and critical mineral mines including lithium directly from the government, in addition to bidding for Jammu & Kashmir’s lithium reserves in upcoming auctions.

On prospects of acquisition of foreign critical mineral assets, another person said on the condition of anonymity that CIL is having deliberations with prospective overseas partners and agreements are expected soon.

In June, the ministry of mines came up with a list of 30 minerals critical to India’s economy—antimony, beryllium, bismuth, cobalt, copper, gallium, germanium, graphite, hafnium, indium, lithium, molybdenum, niobium, nickel, PGE (platinum-group elements), phosphorous, potash, REE (rare earth elements), rhenium, silicon, strontium, tantalum, tellurium, tin, titanium, tungsten, vanadium, zirconium, selenium, and cadmium.

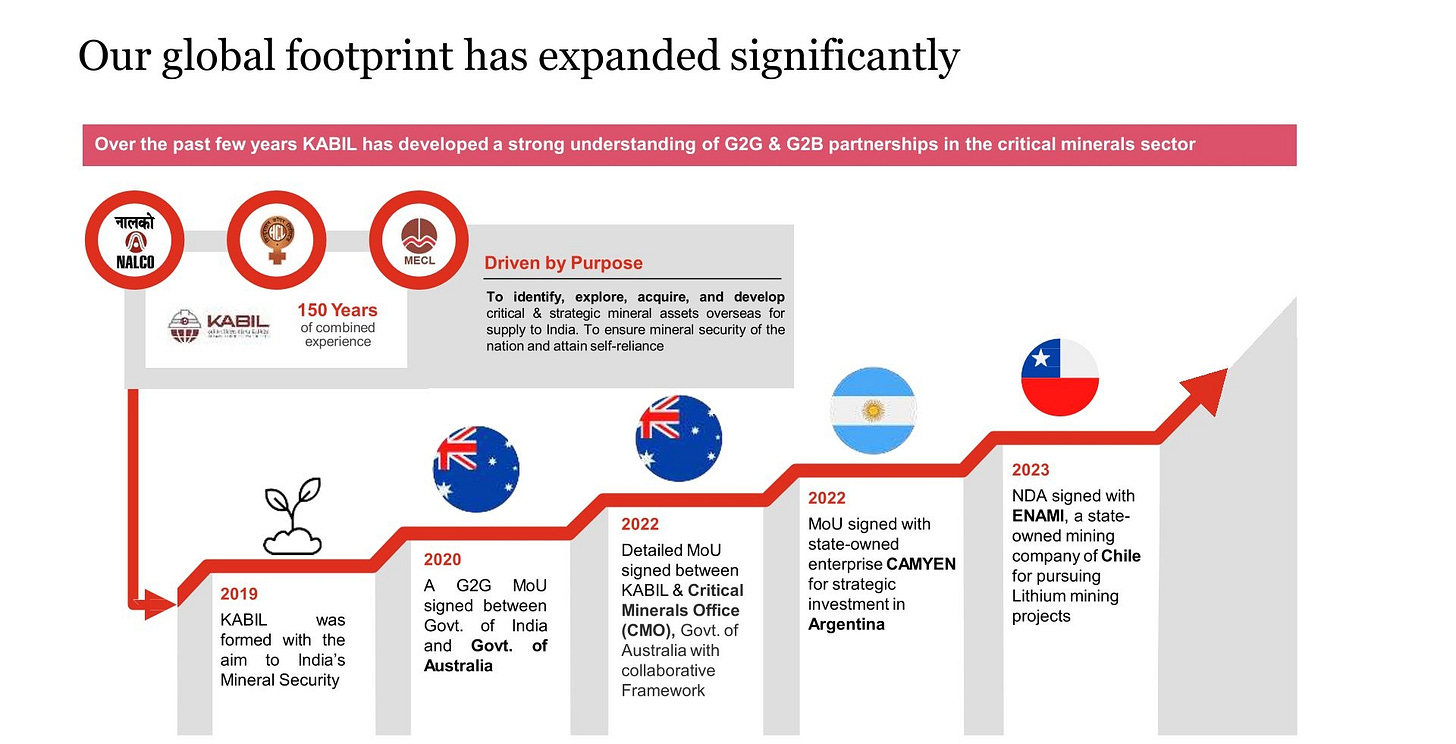

State-owned mineral and metal joint venture Khanij Bidesh India Ltd (Kabil) have been searching for overseas investment opportunities for years. We have not heard of any tangible results, other than discussions and non-binding MOUs with foreign government entities.

Dialogue with governments may be more within Kabil civil servants’ comfort zone, rather than engaging foreign privately-owned investment targets.

//Electric Vehicles

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.