De-Facto Boycott: China's Ga & Ge exports to Germany Zero; General Atomics blacklisted; USTR Federal Register Notice HS-Codes; Again: Eudialyte does not yield RE;

Rare Earth 26 May 2024 #149

The more people know, the less they need to believe.

Bodo Wartke

China risk

China’s New World Order - How dependent is the West?

While we do not think that dramatic background music is in any way appropriate for a documentary, thoroughly recommended watching.

A spokesperson?

We take a closer look.

From 27:41 a supposedly “unoffical mouthpiece of the Communist Party” appears.

His name is Victor Gao (高志凯 Gāo Zhì Kǎi), Vice President at the Center for China and Globalization (CCG), chairman of China Energy Security Institute, Chair Professor at the University of Suzhou, among other positions.

He appears frequently on Chinese and foreign TV as a commentator, he also posts regularly on Weibo where he a 720,000 followers.

Center for China and Globalization

The think-tank CCG insists on being independent from government and party and it receives much praise from foreigners. However, it is simple fact that, like any organisation in China, the CCG non-government organisation (NGO) must have a Communist Party cell and accept the guidance of the Chinese Communist Party. If they refused, CCG would cease existing.

The CCG also has a YouTube channel, posting to which from China’s intranet is only possible by jumping over the Great Firewall of China. A privilege shared with organisations like Xinhua, the New China News Agency and CGTN, China Global TV Network.

Who is Victor Gao?

As a pupil in Suzhou Gao gained attention for his exceptional English skills, apart from his other intellectual gifts and high intelligence. In his childhood and youth he is said to have consumed all English language books in the Suzhou City library.

Gao’s education:

1978-1980 Suzhou University

1981-1983 Beijing Foreign Studies University (English literature)

Thereafter he became the youngest China Foreign Ministry translator of the Chinese leadership ever for his exceptional English skills.

Deng Xiao Ping left a deep and lasting impression on Gao, by Gao’s own public admission. It may be the reason why Gao parrots comparatively little of “Xi Jin Ping Thought on Everything & Sundry.”

Yale University

1989-1993 Gao attended Yale University where he graduated in law and later in political sciences.

Career

Gao changed jobs frequently and also dipped in and out of several think tanks.

Gao’s career included Vice President of Morgan Stanley Asia, Daiwa Securities, General Manager of the Investment Banking Department of China International Capital Corporation, Senior Vice President of China National Offshore Oil Corporation, and Hong Kong Securities and Futures Supervisory Commission’s Second Advisor on China affairs.

A New York lawyer

He has been licensed attorney-at-law in the State of New York since 1994 (registration number 2590818), where also his wife supposedly lives. One of Gao’s children, Victor Gustaf Gao, currently is a managing director at Carlyle in Washington DC.

Not a CPC member

He is believed to be a member of the Revolutionary Committee of the Chinese Kuomintang, one of the six “other parties” in China’s parliament (China’s constitution permits other parties, as long as these are socialist parties - and submit to the leadership of the Chinese Communist Party).

No spokesman authority at all

What he says may not necessarily need to be a position of the CCP or of the Chinese government, because officially and unofficially he represents neither.

Describing Victor Gao as an “unofficial mouthpiece of the CCP” is quite a bit of a stretch, even though it may partly flatter Gao’s inflated ego.

Privileged class

Gao undoubtedly is an exceptionally gifted and rather vain person, a survivor in China’s privileged class, and quite possibly a genuine nationalist.

Meanwhile those who are less privileged in China than Victor Gao are leaving in ever increasing numbers, to seek fortune where they see hope: In USA.

The interview

The interview seems to have been filmed at one of the exclusive business clubs in Beijing.

Victor Gao issues a false statement when he says:

If Germany joins the U.S.-imposed, unjustified sanctions against China, then exports to Germany will be under the same review as the Chinese government has announced, as far as Ga and Ge [are concerned].

Why false?

Because it has already happened.

Gallium

China exported:

2023: 30.8 t, 55% less than 2022. Exports to Germany shrank from 26.4 t (2022) to 10.6 t (2023). Down 60%.

1-4 2024: 3.27 t, 72% less than during the same period 2023. Exports to Germany fell from 5.2 t to zero.

By the way, China imported in 2023 unwrought gallium: 4,176 kgs, half from Russia, half of it from Germany.

Rare earth relevance: Gallium is a dopant for rare earth permanent magnets.

Germanium

China exported:

2023: 42.2 t, 3.4% less than in 2022. Exports to Germany dropped from 9.8 t in 2022 to 7.13 t in 2023. Down 27%.

1-4 2024: 9.24 t, 54% less than during the same period 2023. Exports to Germany fell from 4 t to zero.

Russia was China’s most important germanium export market in 2023, 9.1 t, up 55% year on year.

All is a misunderstanding (as usual in China)?

Industry insiders try to explain the drop in exports by the lengthy dual-use export license application process with a backlog of several months up to half a year.

We don’t buy it

There are certainly not thousands of license applications and we would sincerely doubt that any information provided in the license applications should come as a complete surprise to China’s total surveillance state.

Therefore, we just don’t buy the explanation. Even if there was a backlog, it would have been created on purpose.

What use?

Gallium arsenide (GaAs) and gallium nitride are common bandgap semiconductor materials.

Germanium was one of the earliest materials used in semiconductor technology and played a crucial role in the early transistors and diodes. But its role in semiconductors is kind of diminished because of silicon. Germanium’s current major end uses are fibre- and infrared optics, solar cell wafers, and LEDs. A technology metal.

Conclusion

Notwithstanding China’s obligations under the Treaty on the Non-Proliferation of Nuclear Weapons, where China indeed has done too little for too long in terms of export licensing of dual use products, we would like to remind our avid readers that any significant China rule will always serve ‘dual purposes.’ If you see a central government rule in China that ostensively serves only a single purpose, you may just not be looking hard enough.

One thing for sure, China has terminally lost its customers’ confidence in its reliability. It is no longer just imagination, under China’s current administration the China-risk is an advanced, persistent threat, real, acute and present.

The Chinese government makes China’s de-risking imperative. Something many China businesses may not necessarily view kindly.

China is a nation built on exports, its government should be the nation’s sales force. Currently the Chinese government does a pretty crappy sales job.

No, China is not the victim!

We will continue repeating this like a Tibetan Prayer Mill would (pun intended).

Seek truth from fact:

In terms of general hostility China kicked off the political confrontation with Document No. 9 of the Central Committee of the CPC in 2012 by declaring the West and everything it stands for as a threat.

China then began economic follow-up up with reversal of earlier reforms in the Decision of the Third Plenum of the Central Committee of the CPC in 2013.

The baffled West needed full 5 years to understand what was going on.

CCG and Gao

Globalisation with Chinese characteristics has always been one-way China exports with as little as possible of reciprocity, plus patchy implementation of China’s WTO Accession Protocol of 2001.

Victor Gao and the CCG think-tank continue fighting a lost battle for globalisation.

Ministry of Commerce, China

Announcement of the Unreliable Entity List Working Mechanism on Taking Unreliable Entity List Measures against Three U.S. Companies including General Atomics Aeronautical Systems

1. In order to safeguard national sovereignty, security and development interests, in accordance with the "Foreign Trade Law of the People's Republic of China", the "National Security Law of the People's Republic of China" and other relevant laws, the working mechanism of the Unreliable Entity List is based on Article 2 of the "Regulations on the Unreliable Entity List" , Articles 8 and 10 and other relevant provisions, it was decided to include General Atomics Aeronautical Systems [GA-ASI] and General Dynamics Land Systems of the United States that participate in arms sales to Taiwan as unreliable Entity List and take the following actions:

(1) The above-mentioned enterprises are prohibited from engaging in import and export activities related to China;

(2) Prohibit the above-mentioned enterprises from making new investments in China;

(3) Senior managers of the above-mentioned enterprises are prohibited from entering the country;

(4) Disapprove and cancel the work permit, stay or residence qualification of the senior managers of the above-mentioned enterprises in China.

General Atomics (GA) is a major defense contractor. It was founded in 1955 as a division of General Dynamics and was taken over by the “Blue Brothers”, Neal and Linden Blue, in 1986.

According to GA’s website the banned GA-ASI “produces a series of unmanned aircraft and provides electro-optical, radar, signals intelligence, and automated airborne surveillance systems.”

Rare earth relevance

Through its wholly owned subsidiary Synchron, GA owns the majority of shares of Rare Element Resources, owner of the Bear Lodge rare earth deposit, whose pilot processing plant is under construction and is expected to go online in Q3 2024.

Bear Lodge is the one and only junior rare earth mining project in the entire U.S. that we have any confidence in. >4% TREO (245,500 t) and process Made in Germany at Umwelt- und Ingenieurtechnik GmbH in Leipzig.

In view of the above ban on GA, perhaps the U.S. government might want to bring its ridiculously long and cumbersome mining permission process up to speed.

Concentration of Critical Minerals Production Is a Risk: International Energy Agency

Between now and 2030, as much as 75 percent of growth in the supply of lithium, nickel, cobalt, and rare earth elements will come from just a handful of countries, according to the latest Global Critical Minerals Outlook report by the International Energy Agency. For the types of graphite used in batteries, nearly 95 percent of supply growth will likely come from China.

NTD talks to Diana Furchtgott‑Roth, the director of the Center for Energy, Climate, and Environment at the Heritage Foundation, to find out the potential risks.

Mrs. Furchtgott‑Roth says that a 100% tariff on Chinese-made EV is insufficient, that there should be an outright ban on them.

USTR Issues Federal Register Notice on Section 301 Proposed Tariff Modifications and Machinery Exclusion Process

In accordance with President Biden’s direction, Ambassador Tai is issuing a formal proposal in the Federal Register to increase tariffs on specific products in strategic sectors. The notice also establishes the framework for an exclusion process for machinery, and proposes temporary exclusions for 19 tariff lines for solar manufacturing equipment. The notice establishes a 30-day period for public comment on these modifications.

Lots of critical minerals on the list, but rare earths are not on it. Only rare earth and non-rare earth permanent magnets.

Tariff exclusions on about half of 400 products will expire, 164 exclusions will continue until May 2025.

Premature gloat

This is a proposal and request for comments. It is not yet a final decision and implementation, like one jubilant junior rare earth miner praised in its e-mail newsletter. Evidently a tariff- and trade virgin.

Invitation for comments

DATES:

May 29, 2024, at 12:01 a.m. EDT: The public docket on the web portal at https://comments.ustr.gov will open for interested persons to submit comments.

June 28, 2024, at 11:59 p.m. EST: To be assured of consideration, submit written comments on the public docket by this date.

Akin Gump write:

Stakeholders affected by the tariffs should strongly consider submitting comments, particularly those in the electric vehicle, battery, solar and semiconductor supply chains.

We are certain Big Auto will comment extensively.

Here is the expanded link to the notice: https://ustr.gov/sites/default/files/USTR%20FRN%20Four%20Year%20Review%20Proposed%20Modifications%20fin.pdf

U.S. Office of Foreign Assets Control

OFAC Revamps Reporting Requirements

On May 10, 2024, OFAC issued an IFR that would amend its Reporting, Procedures and Penalties Regulations (RPPR) at 31 C.F.R. Part 501 to, among other things, modify certain reporting requirements pertaining to blocked property and rejected transactions. Subject to any changes OFAC may make following a 30-day comment period, the proposed changes will become effective on August 8, 2024.

Notably, the IFR would:

Narrow the definition of “transactions” for purposes of the rejected transactions reporting requirement under § 501.604(a) such that rejected “sales or purchases of goods or services” must be reported to OFAC, as opposed to all transactions “related to…goods or services.”

Limit the information that must be reported for such rejected transactions under § 501.604(b) to solely information available to the filer at the time the transaction was rejected.

Add a requirement to report to OFAC within 10 business days of when any blocked property is unblocked or transferred, including pursuant to a valid order issued by a U.S. government agency or U.S. court.

Modify and expand the procedure for requests to OFAC to release property blocked due to mistaken identity, typographical or other similar error.

OFAC’s latest changes concerning reports of rejected transactions are in part a response to public comments it received to its June 21, 2019 IFR amending the RPPR, many of which sought greater clarity regarding the rule’s scope.

OFAC is accepting public comments until June 10, 2024.

The Office of Foreign Assets Control (OFAC) is an agency of the U.S. Department of the Treasury.

OFAC administers and enforces economic and trade sanctions on U.S. foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, and other threats to the United States.

Media incompetence

China Hits Out in All Directions After US and Allies Ramp Up Trade War

China is retaliating over anti-dumping measures taken by the U.S. and European Union amid concern that heavily subsidized Chinese products are threatening national industries.

The country's Ministry of Commerce on Sunday announced an anti-dumping investigation into POM (polyoxyethylene) copolymers produced in the U.S., the EU, Japan and Taiwan after receiving an application "on behalf of" Chinese producers of the plastics.

As usual with our esteemed and principled media this is superficial research, with some commonplaces added and then a screaming headline put on top for clickbait.

A fail. Read on.

Misspelling

It is not “polyoxyethylene.” The product is called polyoxymetylene, that is where the “M” in POM comes from. The product is commonly referred to as polyacetal. It is made from methanol.

The U.S. actually is the target

If Newsweek had looked just a tiny bit closer (we did!), it would have become glaringly obvious that more than one third of China’s POM import originates from one single US-owned company, Celanese Corp. Celanese produce polyacetal in Germany, Korea (JV), USA and Saudi Arabia (JV).

It is a forgone conclusion that China antidumping duties may well include these origins. This is a swipe at the U.S., China is very likely to have intended.

Beijing’s officialdom must be exasperated at the quality-reporting of western media.

China

European Chamber calls for Action to restore Business Confidence

Instead of benefitting from the strong economic rebound that many had expected, European firms operating in China found themselves facing more uncertainty. China’s structural issues—including sluggish demand, growing overcapacity and the continued challenges in the real estate sector—along with market access and regulatory barriers, continued to negatively impact European companies.

A positive finding in the survey is the notable increase in the proportion of respondents reporting market opening in their industry (45%, +9pp y-o-y). However, 68% reported that business became more difficult, the highest percentage on record. In addition:

55% of respondents ranked China’s economic slowdown as a top-3 business challenge, a 19-percentage point increase year-on-year (y-o-y);

58% missed business opportunities as a result of market access or regulatory barriers;

44% are pessimistic about profitability over the next two years, the highest level on record; and the proportion of respondents positive about their growth prospects dropped a staggering 23 percentage points y-o-y.

The strategies companies are employing to adapt to the business environment have the potential to set China into a negative cycle that would add to the country’s economic woes:

52% of respondents plan to cut costs, with 26% of them doing so by reducing headcount.

13% have already shifted, or taken the decision to shift, existing investments out of China (although 21% have indicated they will be onshoring more of their supply chain).

42% are considering expanding their operations in China in 2024 – the lowest level on record.

The EU Chamber in China surveys are consistently the most accurate indicators where China’s economy is headed.

Back in 1992 John Cleese offered the most adequate description of what has been happening in China since late 2012:

American envoy advocates for value addition of Tanzania's strategic minerals

The US Ambassador to Tanzania, Mr Michael Battle, has said Tanzania has the right, the responsibility and the obligation to demand that any country extracting its minerals provide value-added productivity to create wealth in Tanzania for its citizens.

“The government has the opportunity not to ask or request but to demand companies in the mining sector add value to the minerals extracted before exporting them so that the worth of the precious stones can be felt right here,” he stressed.

The minister of Minerals, Antony Mavunde, echoed the US envoy, stressing that the government's stance is that all strategic minerals must have added value in Tanzania so that the citizens can benefit in terms of revenue and employment.

Exporting raw materials, Mr Mavunde added, means taking away jobs from Tanzanians.

A U.S. jab at Chinese resource investors in Africa.

In terms of rare earth this concerns China state-controlled Shenghe Resources shareholdings:

Peak Rare Earths (Ngualla), Shenghe shareholding 19.7%

Vital Metals (Montero’s Wigu Hills), Shenghe shareholding 9.99%

Exclusive: Vietnam forfeits billions of dollars in foreign aid amid anti-graft freeze, document says

Vietnam lost $2.5 bln in aid, another $1 bln stuck, letter says

It failed to spend nearly $19 bln of its own money since 2021

Anti-bribery drive freezes administration, blocks climate funds

The previously unreported figures from the unpublished document, dated March 6, highlight frustration among foreign investors over regulatory hurdles and lengthy approval procedures that have caused prolonged deadlock as the Communist-ruled country is gripped by an escalating anti-corruption campaign and political turbulence.

The power grid, crucial infrastructure for the country, has been deemed in need of upgrades, and large amounts of foreign funds are available for the work. However, existing rules prevent the state-owned network operator from accessing that money at least until 2027 because of financial issues, the official said as an example of the deadlock.

We said before, it is not wise to exchange reliance on China for reliance on Vietnam. It is not friend-shoring. Vietnam is as socialist as China is. As Marxism-Leninism cultists both see eye-to-eye. As nationalists they don’t.

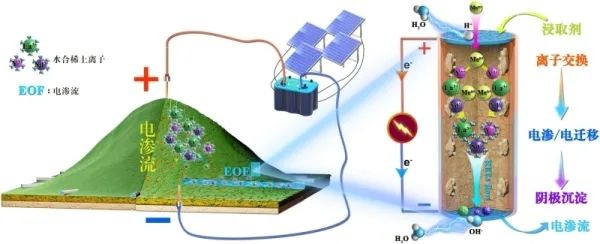

Ion Adsorption Clay Rare Earths

Rare Earths: Shades Of Grey

We should like to remind ion-adsorption-clay-hopefuls and their enthusiastic supporters of this report.

The issues surrounding IAC mining have not evaporated into thin air, just because it is pursued by Westerners outside China.

Radioactive waste in the picture above does not refer to pure thorium or uranium compounds, but to waste substantially polluted with Th and U.

And before any IAC-hopeful starts howling “our deposit’s radioactive content is minimal”: your rare earth content is minimal, too. Radioactive content in proportion to rare earth content may actually be quite high.

Via REIA

Fuelling the future, poisoning the present: Myanmar’s rare earth boom

Two years after our last report, we have revisited this region’s toxic mining landscape. New trade data, satellite imagery and community testimony reveal that the world’s dependence on a remote corner of Myanmar has only deepened, and so too have the consequences for the people who live there.

Interviews with local mine workers and community members suggest that the impact on workers’ health, on the environment and on local communities continue to be devastating. One community member in the town of Chipwe said: “There are no longer fish in the waters. Stepping into the water can cause itching and infections. When the animals drink the water, they die.”

We also found that imports of heavy rare earth oxides from Myanmar to China skyrocketed from their previous highs of 19,500 tons in 2021 to reach 41,700 tonnes in 2023 – more than double China’s own quota for domestic HREE mining. Given that limited alternative sources have emerged in the meantime, this further cements Myanmar’s role as the single largest source of vital HREE.

The numbers are wrong. It was 35,000 t in 2021 and 72,000 t in 2023.

Myanmar’s lucrative trade in HREE – worth $1.4 billion in 2023 – risks financing conflict and destruction in a highly volatile region. In 2018 Myanmar’s civilian-led government banned exports and ordered Chinese miners to wind down operations. Since 2021, extraction has continued in the context of a ruthless dictatorship and widening civil conflict.

This is also incorrect.

The mining has been going on since 2014, with exports to China starting in 2015, There was a somewhat smallish reduction of 15% in 2018/19, which may or may not have been Myanmar government action. We attribute this drop to the continuous decline of relevant rare earth prices in China between March and November 2018, not to any Myanmar government action.

Then there was the interruption by zero-COVID measures on both sides of the border from end of 2021 lasting through 2022.

Apart from the a.m., China’s rare earth imports from Myanmar have kept increasing from 2015, regardless of flavour of government in Myanmar.

Wishful thinking at Global Witness

That democracy in Myanmar should have come along with environmental compliance is wishful thinking.

No Myanmar party would voluntarily want to forgo a billion dollar business opportunity.

Equally wishful thinking is that mining of ion-adsorption clay elsewhere should look substantially different, e.g. Brazil. The current mining method is an economic imperative, if one wanted to touch this type of resource at all.

There is an alternative mining method from China with a much improved environmental footprint, however, the yield is quite low and the know-how is embargoed by the Chinese government for foreign licensing/export anyway.

Uneconomic tank or heap leaching would require strip-mining of these shallow and wide deposits, resulting in large scale desertification.

Banking on prices multiplying is also futile, as buyers would resist cost increases, particularly Big Auto everywhere. And high prices for rare earths would result in even more ion-adsorption clay mining.

Lowering or even completely doing away with these heavy rare earth elements in NdFeB magnets is no solution, as there are many other applications absolutely requiring these metals. Just think modern medicine.

All the buyers in China know perfectly well about the environmental impact of mining this type of resource. It is well-known already from the environmental catastrophe caused from mining this resource all over southern China, reports about which are omnipresent on the Chinese intranet.

The truth here is that China’s government and its largely state-owned rare earth industry knowingly accept the environmental destruction in its neighbouring country. China’s zero-COVID policy has proven to the world that China can stop Myanmar rare earth - if it really wants to. China Inc. just doesn’t want to.

Our view

Perhaps this type of rare earth resource, ion adsorption clay (IAC), should not be mined at all for the time being; a conclusion that the Chinese government reached already more than 10 years ago when it closed all domestic ion-adsorption clay mines. This, by the way, was the start of migration of experts and workers from Chinas’ Ganzhou to Kachin State in Myanmar, as in China they had nothing to do anymore.

To the best of our knowledge there are currently only 4 IAC deposits being mined in China, since 2022/23. On probation.

Arguably we should limit ourselves to heavy rare earth content in hard rock rare earth deposits and from monazite/xenotime in heavy mineral sands.

China has perfected the extraction of all rare earths from also hard rock resources, even heavy rare earths in low concentrations. But also this know-how is embargoed for export/foreign licensing.

Laos

Rare earth miner to compensate Lao villagers for polluting river water

On Feb. 22, a mining operation in Houaphanh’s Xam Neua district run by Laos-China Rare Mineral Development Company North 2 Ltd. discharged polluted water into two area rivers, causing a large fish kill and damaging the ecosystem in 36 villages.

Tests in early March showed that the water from the Van and Xam Rivers contained cyanide, zinc, copper and iron, and was high in acidity. On March 4, villagers wrote a letter calling on the People’s Council of Houaphanh Province to deal with the pollution as soon as possible.

Khamso Kouphokham, Deputy Director General of Department of Energy Policy and Planning at the Ministry of Energy and Mines, said that authorities had ordered the company in question to suspend its operations until inspections and testing were complete.

Laos-China Rare Mineral Development Company North 2 Ltd. operates facilities in Houamuang district’s Outhai village and in Xam Neua district’s Sobxay and Thabpheung villages. The company has invested US$41 million to develop a 500-hectare (1,235-acre) mining concession.

Other Chinese-backed rare earth mining operations in Laos have been less well-received by residents following recent incidents of environmental damage and land disputes.

Ammonia is strangely not mentioned, though it can lower the pH of water, resulting in higher acidity. Cyanide points at gold mining.

China’s Xiamen Tungsten have a Laotian rare earth joint venture with a gold miner, Chifeng Jilong Co., Ltd.

Via REIA

Critical Raw Materials Act: Opportunities, Challenges, Viability, Next Steps

An interesting subject, a good effort, but it falls far short of expectation.

The devil lives in the detail. In our view authors fail in recognising literally all of the red flags.

Had the authors considered well-published information and additionally vetted their findings with pre-existing reports, some of which took a very long time to compile, then this assessment would certainly have come to a completely different conclusion.

//Rare Earth Magnets

Listen to the master

Permanent Magnets: Myths, Misconceptions and Marketing - The Magnetics Show North America, May 2024

Here is the PDF copy of the presentation:

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.