CREC acquire option on Lao RE refinery; BYD's Slave-Gate; China RE Bluff?; China to mine Kutessay II; Peak, MP, NMI and the lot

Rare Earth 26 January 2025 #165

A brief note

It is the time of the year when the usual suspect attention-seekers post their forecasts, which, within a few months of time, tend to become an utter embarrassment.

There is considerable uncertainty in the community just how rare earth concentrate prices work. In our Price section below we give you the price formula for the bastnaesite-monazite between the market-dominating China Northern Rare Earth Hi-Tech Group and the Baotou Steel, the miner of the world’s largest rare earth mine, Bayan Obo.

You will also find in the Price section that pre-Spring Festival price year-to-date are rising, heavy rare earths at twice the rate of light rare earths’ price increases. China’s Spring Festival lasts from 28 January to 4 February, however, the migration wave already started two weeks ahead of that.

Among the rare-earthy activities in South East Asia there is yet another attempt of CREC to acquire a Laos-based rare earth separation factory. Find the background and the details in the Companies section underneath.

Last but not least we pull the carpet under yet another junior rare earth miner. His ion-adsorption clay project does not hold water - quite literally.

Correction

In our previous post we described the large-scale Fen rare earth deposit in Norway as a monazite deposit.

A renowned international expert and long-time supporter of this humble publication points out, that this would an incorrect description for the Fen deposit. We accept and agree.

While Fen does contain monazite and bastnaesite, it is more adequately described as a “Fe-dolomite carbonatite" deposit.

The companies working on Fen are REE Minerals AS and Rare Earths Norway AS.

Comment from Mkango/Hypromag

Regarding our post on Hypromag’s feasibility, there has been a friendly and candid exchange. Mkango/Hypromag’s final comment is as follows:

Whilst the reference to centerless grinding in the flow chart implies that we will only be producing disk type magnets, this is definitely not the case. The inclusion of both axial and transverse (and isostatic) presses in the flow sheet enables production of both cylindrical and cuboid blocks for subsequent finishing, which includes wire sawing as well as grinding to maximise product flexibility. We will clarify in the flow sheet diagram going forward i.e. this step would be better referred to as more generic “grinding” for both axial and transverse products, rather than centerless grinding, which, as you are aware, is for cylindrical magnets – thank you for flagging this.

The main initial products derived from the axial press / centerless grinding are likely audio applications and we have a number of discussions ongoing with customers in this sector, and there are certainly other applications beyond this. So we are not just limited to office furniture.

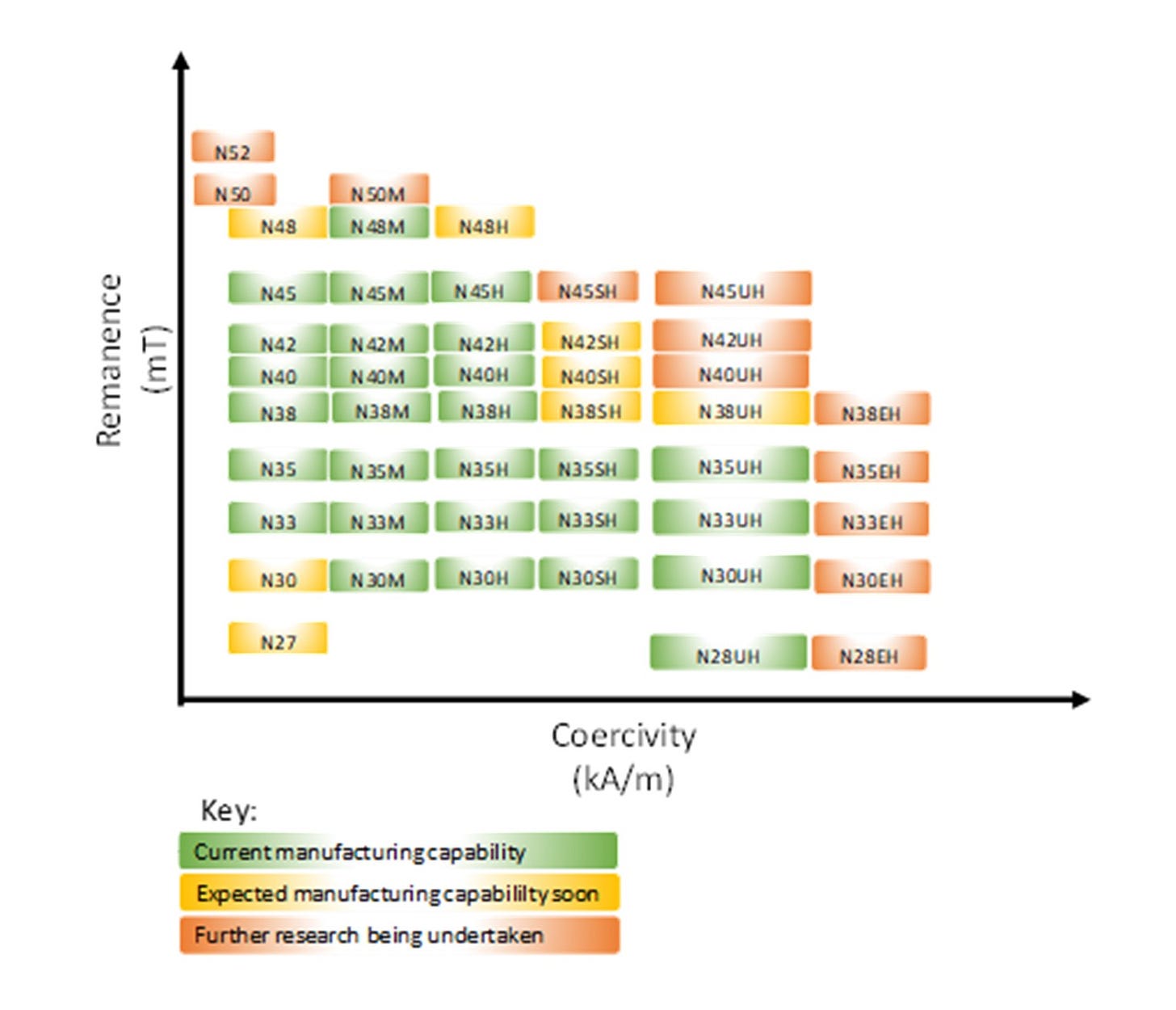

Blocks produced from the transverse press and finished magnets derived therefrom would have a broad range of applications. This includes buyers of blocks for further finishing and finished magnets for a range of applications including those in the press release. For example, below is an example of magnets produced for an automotive application, but there is a broad spectrum of applications beyond this based on the grades achievable in the chart sent previously [see the chart hereunder]

In terms of capital costs in USA versus China, as you are aware, it would be expected for USA capital costs to be higher for an equivalent scale and scope operation.

It would be easy to shoot holes on also in this, but a concept can never be perfect to the last detail. Uncertainties always remain. It is entrepreneurial risk.

We hope, that the capital cost can be reduced to a more adequate level and that they’ll adjust the pay-back period to exclude the 5-year ramp-up period.

Critical Minerals Essentials

Amvest Terraden publish the read-worthy Critical Minerals Essentials newsletter. You can subscribe by clicking on this link.

Note: Amvest and The Rare Earth Observer are not related and have no business dealings with one another. There is no coordination and our views are not aligned.

Big bluff

China has discovered a super-large-scale rare earth mine!

Recently, the reporter learned from the China Geological Survey of the Ministry of Natural Resources that China has discovered a super-large-scale ion-adsorption rare earth mine in the Honghe area of Yunnan Province .

The ultra-large-scale ion-adsorption rare earth mine discovered this time has potential resources of 1.15 million tons [TREO], of which key rare earth elements such as praseodymium, neodymium, dysprosium, and terbium exceed 470,000 tons. This is another major breakthrough after the first discovery of ion-adsorption rare earth mines in Jiangxi in 1969. It is expected to become China's largest medium and heavy rare earth deposit .

Next, the China Geological Survey under the Ministry of Natural Resources will continue to increase its investigation and evaluation efforts to further expand my country's exploration results for medium and heavy rare earths in the Honghe area of Yunnan.

Old news

The original report had been in late July, 2022, soon three years ago. It then re-appeared beginning of June 2024 (The Rare Earth Observer reported). And now they come up with it for a third time.

Here the news report from CCTV13, China’s news channel of 17 January 2025:

Background

Location is near Ma’andi Xiang (Honghe Prefecture, Yunnan Province), 610 km from Pangwa, Myanmar, where a number of the Myanmar rare earth deposits are.

How we got here

Since the Kachin Independence Organisation took control of the rare earth mining operations last year, taking them away from China’s friends who were associated with Myanmar’s military junta (The Rare Earth Observer reported), negotiations to get this business going again, this time under “rebel management”, don’t seem to have borne fruit.

Importance & relevance

The prospect of a billion dollar rare earth business is very attractive and important for financing the Kachin Independence Organisation’s ongoing war against the Myanmar military junta.

Myanmar is one third of China’s rare earth import volume and two thirds of China’s import value. China’s rare earth won’t go without.

Politics

China of course does not want to abandon its friendly relations with the Myanmar military junta by aiding the opposition and it prefers the previous arrangements.

China therefore suspended the trade across the Kachin Independence Organisation controlled border points and with it the rare earth and ammonium sulphate trade of China Rare Earth Group.

Unlikelihood

In-situ leaching and pool leaching are in the elimination category of China’s National Reform & Development Commission’s plans (NDRC - formerly known as State Planning Commission), so it is not likely that this deposit will be exploited.

Our take

This is possibly a negotiation bluff.

China tries to make the Myanmar side believe, that China would not need rare earth supplies from Myanmar anymore.

So they dug out this news from 3 years ago, repackaged it, spiced it up with 4 people plus a geologist roaming the landscape and digging aimlessly in mud, and then put it on all China news outlets.

This with the expectation that the news would be watched in bordering Myanmar, making the Kachin Independence Organisation anxious to close the rare earth deal at China’s terms.

Meanwhile, China’s rare earth raw material imports from other South East Asian nations are strongly increasing.

China/India

Foxconn stops sending Chinese workers to India iPhone factories

Foxconn is halting new work rotations for its Chinese employees at its Apple iPhone factories in India, and sending Taiwanese workers instead, according to five people familiar with Foxconn’s operations in India. Shipments of specialized manufacturing equipment meant for India have also been held up in China, the sources told Rest of World.

The development is likely to disrupt iPhone assembly lines in the Foxconn factories in the southern states of Tamil Nadu and Karnataka, which produce iPhones as part of Apple’s efforts to diversify production away from China. Some of the sources said the Chinese government is responsible for the suspensions of worker deployments and equipment exports.

“Currently, the equipment and manpower are not allowed to go over [to India],” one of the sources told Rest of World. “And India doesn’t have the technology to produce the equipment.”

What is this concept? Chinese machines and Chinese workers to India? And the companies seriously expected China to sit by and watch?

Trump will not rule out force to take Panama Canal, Greenland

Asked at a press conference at his Florida resort whether he could assure the world he would not use military or economic coercion as he tries to gain control of the Panama Canal and Greenland, Trump said, "No, I can't assure you on either of those two. But I can say this, we need them for economic security."

If the father of the idea is to isolate the US and drive the rest of the world into China's open arms, then Trump has chosen the right path.

Not to add another one to Trump’s unspectacular failures, we would like to reiterate once more our educated view, that the Rimbal Pty Ltd/Critical Metals Corp proposed, under-explored Tanbreez (Kingslerne) eudialyte project in Greenland may well be used as a resource of funky bathroom tiles for U.S. military bases, but not as a rare earth resource.

And the Kvanefjeld uranium-enriched rare earth concentrate (or rare-earth-enriched uranium concentrate) will absolutely require a dedicated supply-chain, like Shenghe Resources had built in China, in anticipation of its investment in Transition Energy Minerals (former Greenland Minerals) bearing fruit.

Last but not least Trump may want to consider the comments of Constantine Karayannopoulos regarding exploration and mining in Greenland in our Companies section.

Lost in translation

Coercion and Countermoves: The US-China Economic Rivalry

The bureaucrat perspective. Possibility of a trade deal between the U.S. and China is deemed to be zero for the coming 10 years.

Hart’s literature recommendation

At minute 31:32 Melanie Hart is asked for literature recommendations. She recommends reading a Xi Jin Ping article in Qiushi (“Seek Fact”), a bimonthly official publication of the Central Committee of the Communist Party of China.

According to Hart, Xi supposedly wrote that “our aim is to make international supply chains dependent on China”.

It is not an article written by Xi Jin Ping of November 2020. It is the text of a speech given by Xi Jin Ping at the 7th meeting of the Central Financial and Economic Affairs Commission on April 10, 2020.

According to the Center for Strategic International Studies’ translation, which Mrs Hart must be referring to, Xi supposedly said:

We must sustain and enhance our superiority across the entire production chain in sectors such as high-speed rail, electric power equipment, new energy, and communications equipment, and improve industrial quality; and we must tighten international production chains’ dependence on China, forming powerful countermeasures and deterrent capabilities based on cutting off supply to foreigners.

We found the latter part of the sentence quite remarkable, so we cross-checked.

To our dismay we had to find that this is an abjectly false translation. What Xi actually said is, according to the Chinese language text:

First, we must extend our strengths, consolidate and enhance the international leading position of advantageous industries, forge some "killer" technologies, continue to enhance the advantages of the entire industrial chain in the fields of high-speed rail, power equipment, new energy, communication equipment, etc., improve industrial quality, tighten the dependence of the international industrial chain on China, and form a strong countermeasure and deterrence capability *against* supply cuts by foreign parties. [形成对外方人为断供的强有力反制和威慑能力]

We conferred with Chinese native linguists and language teachers inside and outside China one-by-one for verification. It appears, that this creative “translation error” of CSIS cannot possibly have been an accident.

Apparently one must be very careful with contents that U.S. “think tanks” like CSIS publish.

On the other hand, it is still quite amazing to see how China’s current government has ruined a generation of Chinese people’s hard work within a relatively short period by turning “Made in China” into something like a hazard warning label.

Chinese companies approved to mine rare earth metals in Kyrgyzstan; technology and cooperation help resource development

Kyrgyzstan's Minister of Natural Resources, Ecology and Technical Supervision, Meger Mashiev, recently announced that a Chinese company will be responsible for developing the country's rare earth metal resources at the Kutessay deposit.

This cooperation not only fills Kyrgyzstan's technological shortcomings, but also marks the further deepening of international cooperation in the field of resource development in Central Asia.

Located halfway between Bishkek, Kyrgyzstan, and Almaty, Kazakhstan, Kutessay II is a historic deposit with resource of 18 mio t with a TREO of 47,000 t.

It had been the principal USSR rare earth processing site and it was closed in 1991. Afterwards the factory was looted.

Sillamae, Estonia, was not a Soviet rare earth factory, as Hallgarten mistakenly report. The Sillamae factory, today Neo Performance Materials, had been a uranium processing plant during Soviet times, as per our findings.

Kutessay II has been subject to 10-year legal battles between Stans Energy, who had acquired the rights to the deposit in a single-bidder-auction for US$863,550 in 2009, and Kyrgyzstan. We wrote about the details of the case here and here.

There is a legally enforceable title under international law against Kyrgyzstan, a lot of money.

In 2013/2014 JOGMEC took a quick look, but apparently held-off owing to the evolving dispute.

2020 to 2022 Neon Mining, a Russian company owned by Russian-controlled Ricky Holdings, Singapore, briefly held the Kyrgyz licence and tried to raise money for developing Kutessay II, as well as to settle with Stans Energy.

The lawyers, who owing to legal fees financing arrangements literally own Stans Energy’s title, rejected.

So Kyrgyzstan had to find another partner, someone who does not mind international legal awards: Someone in China. For the legal title problem, the Chinese side is careful not to disclose which specific company is active regarding Kutessay II.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.