Anti-corruption bloodhounds target New Energy; Chicken without heads; JOGMEC dump NMI?; Ahead of IPO Fujian Changting raise capital from BYD and China Northern; Prices continue fall; ARR, Vital, etc.

Rare Earth 12. April 2023 #117

Experts know more and more about ever less, until they know everything about nothing.

Generalists knows less and less about ever more, until they know nothing about everything.

Chicken without a head

2 months ago we carried the subject of China’s proposed regulation on prohibited and restricted exports of rare earth related technology and magnet know-how:

Nothing happened, no-one picked it up, and now suddenly all are running around like chicken without a head, 2 months later.

Everybody talks about it, but no-one has read the details.

We had included the important, pesky details, something our trust-principled media apparently can do without.

We deflate the speculation and put things into perspective.

//Politics

China ‘weaponising’ grip on vital rare earth metals

Paul Atherley, chairman of UK rare earths refinery developer Pensana, said: “This represents a seismic shift from China’s previous position and brings an outright export ban one step closer.

“China said they would never introduce export restrictions on rare earths after 2011. The announcement appears to be a clear warning of its willingness to weaponize its dominant position in rare earths.”

Indiscriminate hurling of stereotypes from one of the usual suspects. There are no restrictions on rare earth exports, neither planned, nor formalised.

Gareth Hatch, a rare earth elements expert and boss of Strategic Materials Advisory, said the restrictions threatened to hit American and European companies with specialist equipment on order from China, such as furnaces and presses used to make magnets.

Good point and we fact-checked this.

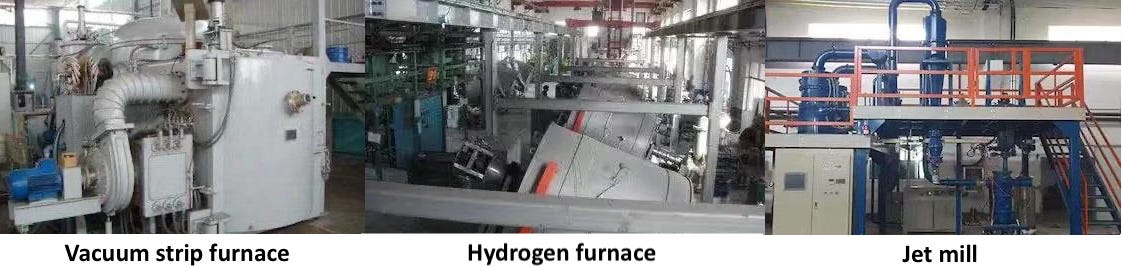

For the process starting from the rare earth oxides this should be the main equipment:

All of this is available outside China. So, no general worries about hardware.

But the devil lives in the detail, and that is the know-how. The leading permanent magnet expert, John Ormerod, points out:

The other point to mention is that the few "experts" outside of China/Japan know-how is typically 1990's vintage. So a steep learning curve is required to get to 2023 technology.

Preventing China’s NdFeB makers from globalisation

In our view China introduces this rule to prevent Chinese rare earth permanent magnet makers from investing abroad.

This in turn prevents a market for rare earth magnet materials outside China to develop, a market which actually barely exists outside China, with the glorious exception of Japan.

Junior rare earth miners like to play down the fact that there is actually no market outside China for the thousands of tons of NdPr they wish to produce (no, Japan is not the answer - Japan government-invested Lynas turn out more NdPr than Japan needs).

Unraveling and opportunity

China has already seen the trend unfolding in batteries (see CATL), which ultimately unravels China’s stranglehold on battery materials.

China does not want this unraveling to extend to rare earths.

Because of this proposed rule Chinese magnet companies can’t follow China’s flagship EV makers, if and when these should invest abroad, and they also can’t move closer to their foreign customers.

This opens a window of opportunity for western NdFeB magnet makers.

India is the prime target of the ban

In our view the main target for this prohibition actually is China’s long term foe India, where the base for a rare earth to magnet value chain is being laid. India has been looking for Chinese cooperation and magnet know-how for years and through many channels, with a shoe-string budget, of course.

Now cooperation with China becomes a dead-end street for India’s NdFeB development.

Related:

Is China’s ‘reported’ potential ban of rare earth magnet technology a paper tiger?

Assuming the report is correct and the changes go through, what would be the implications on western markets [she apparently does not read TREO]

Well actually the other is ‘nothing’ to ‘no impact’ was the feedback experts shared with me from the Critical Minerals Institute (CMI) Board that I am a new member of, the debate seemed to offer a consensus that this was nothing more than a paper tiger.

Superficially correct, this piece misses the point, in our opinion.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.