On Rare Earth prices; Flawed Price Forecasts; Yet Another IAC Miner in Brazil; Bold Ideas from EIT; Vietnam, Kazakhstan, and the lot

Rare Earth 1 August 2024 #153

This issue deals with rare earth prices as well as a logic flaw in relevant price forecasts. As usual it is long, as many things need explanation.

China’s rare earth pricing

In our observation the published prices in China are synthetic, a kind of consensus values like analysts put on share prices.

There are few and far-between 3-line reports of prices of actual transactions in China’s market for finished rare earth products. These occasional (or even accidental?) reports show substantial differences to published prices.

The published consensus prices show the price trend on the base of a consensus price, not more than that.

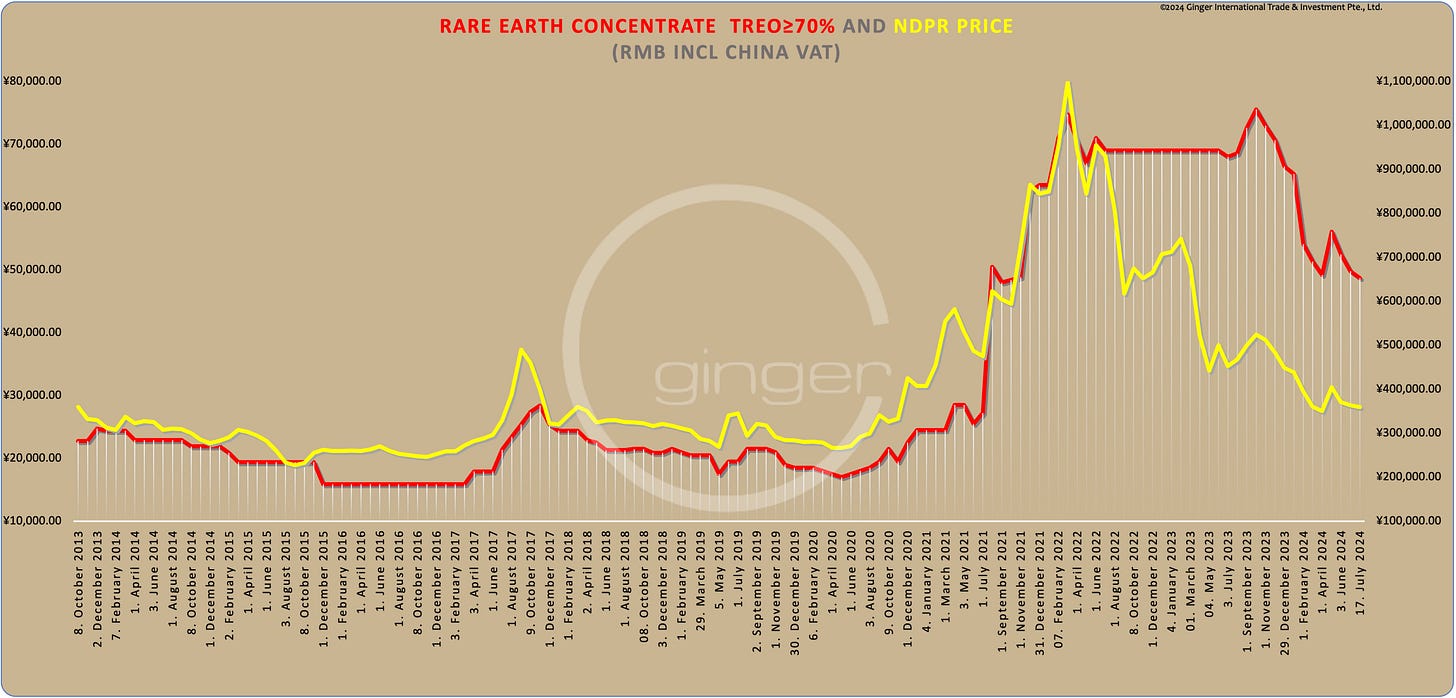

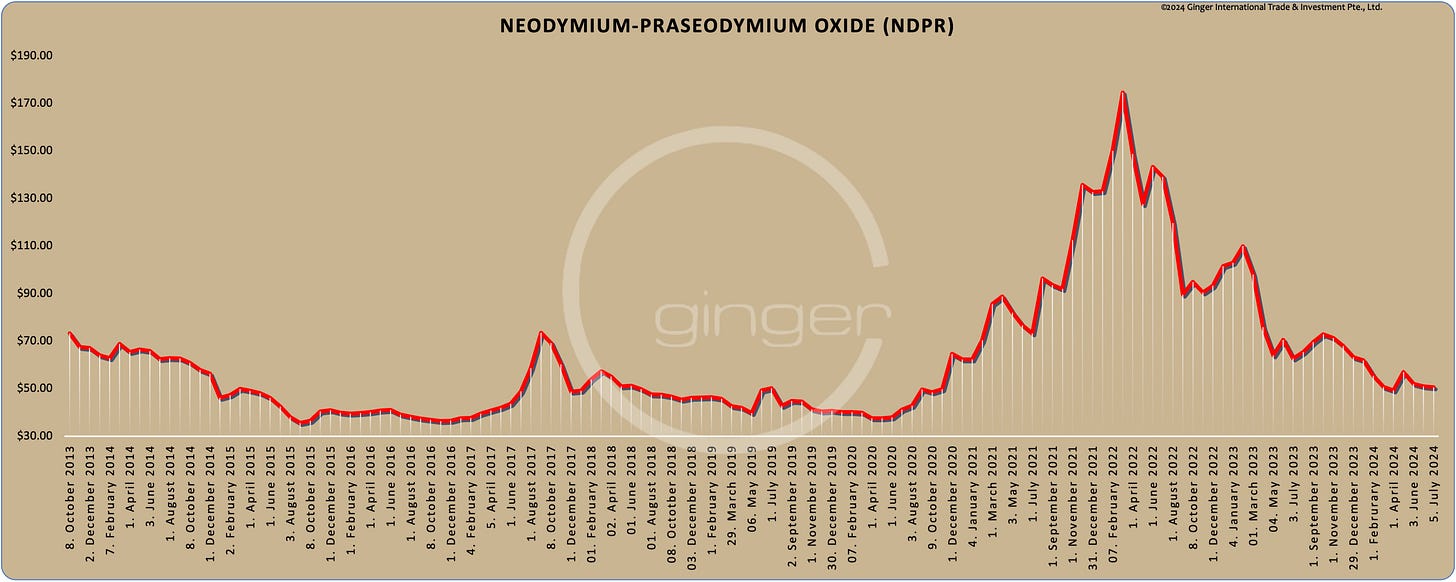

We would like to point you to this graph based on published China rare earth prices for rare earth concentrate and for much hyped NdPr.

While NdPr and rare earth concentrate prices are generally trailing each other, the rare earth concentrate price since late 2021 is on a much higher base than before.

Struggle for value

The price development of rare earth concentrate is the result of a decades-long effort by China’s bureaucracy to create a level playing field for all rare earth companies in China and thereby establish a “healthy” market. There are fundamental problems in assessing what the real cost and the real price of rare earth should be.

State-owned Baotou Steel and state-owned China Northern Rare Earth Group are at the core of these problems. They control a lion’s share of China’s domestic rare earth market.

Why there is no easy fix: Imagine you are a CCP official, a bureaucrat or both and you are put in charge of a state-owned enterprise. The job was not your choice, but your career depends on making it work if it doesn’t, and making it work better if it does. And all that while you find sawdust under your seat every single day. If not successful, you can kiss your career goodbye. Rest assured, you will pull all levers.

Price fixing

Baotou Steel supplies its Bayan Obo rare earth concentrate to China Northern Rare Earth Group.

Prior to 2021 Baotou Steel and China Northern could fix the price for the rare earth concentrate from the iron ore mining tailings (cost allocation of which can be arbitrary) of Bayan Obo somewhat freely. Officers of both companies serve both companies concurrently, which certainly helps smoothing “negotiations.” Confidence in this arrangement was the reason why China Northern could say on several occasions that they will match and if necessary undercut any price of any competitor. That is anti-market, also in a socialist market economy.

Cutting corners

As a result all other Chinese rare earth companies had to cut corners in order to be able compete with China Northern.

Reform

Since the rare earth concentrate price fixing has become subject to shareholder approval and both, Baotou Steel and China Northern, shareholders of one another, may not vote, things seem to have changed.

Imports, the intended side-effect

And there was another impact, in our opinion intended. Subsequent to the 2012 domestic mining ban on single element monazite (Bayan Obo/Baotou is MIXED monazite and bastnaesite) followed by the closure of all (known) ion-adsorption clay mines in China in 2014, the need (and want) to import rare earth raw materials became evident. But that required a domestic raw material price level that enables imports.

Making imports feasible

Enter the resource tax applicable only to domestic rare earth resources (also applicable to Baotou Steel since 1 September 2021 - impact see chart above), zero tariffs on rare earth raw material imports, increased domestic cost of compliance (no more cutting corners in Xi Jin Ping’s age of compliance) and there you have it.

Going out

A slight problem with that was the availability of rare earth raw materials abroad. While there were large numbers of junior rare earth mining projects, no-one - except perpetual rare earth foe Japan Inc. - invested in order to bring these projects to production.

So, relatively early two major investors from China became active, state-owned East China Exploration & Development Bureau (a.k.a. Jiangsu Eastern China Non-Ferrous Metals Investment Holding Co., Ltd, Hong Kong East China Non-Ferrous Minerals Resources Co Ltd, or simply “ECE”) and state-controlled Shenghe Resources. Chinese private investors hopped on to the train.

And in Myanmar the former “bosses” of closed ion-adsorption clay deposits in China plus their otherwise unemployed expert staff became active under the protection of local warlord Zahkung Ting Ying (formerly Communist Party of Burma aligned) and started exports to China in 2014/15. The IAC resources in Myanmar and South East Asia had been known to China’s relevant geological institutes much earlier.

The impact

Imports or rare earth raw materials increased massively from 15,699 t in 2015 to 219,904 t in 2023. In terms of rare earth oxides contained (TREO) in these imports we estimate as much as 150,000 t in 2023.

This does not include rare earths extracted from imports of heavy mineral sands, another area of China investing in resources abroad.

Need for price formula

These imports can only work if priced along price formulas which base on the synthetic published domestic consensus pricing of rare earth finished products. What if the foreigners don’t accept the formula anymore?

What, if?

Should the pricing mechanism break and foreign miners suddenly ask for self-determined prices rather than the synthetic China consensus price formula, there are China’s domestic resources to fall back on.

In rare earth China is import reliant, not import dependent.

Don’t want

But falling back on domestic resources is absolutely not wanted. Rare earth are only part of China’s domestic resource preservation policy, which determined long ago that - in practically all non-ferrous metals - feeding China’s consumption primarily from domestic resources would be entirely unsustainable.

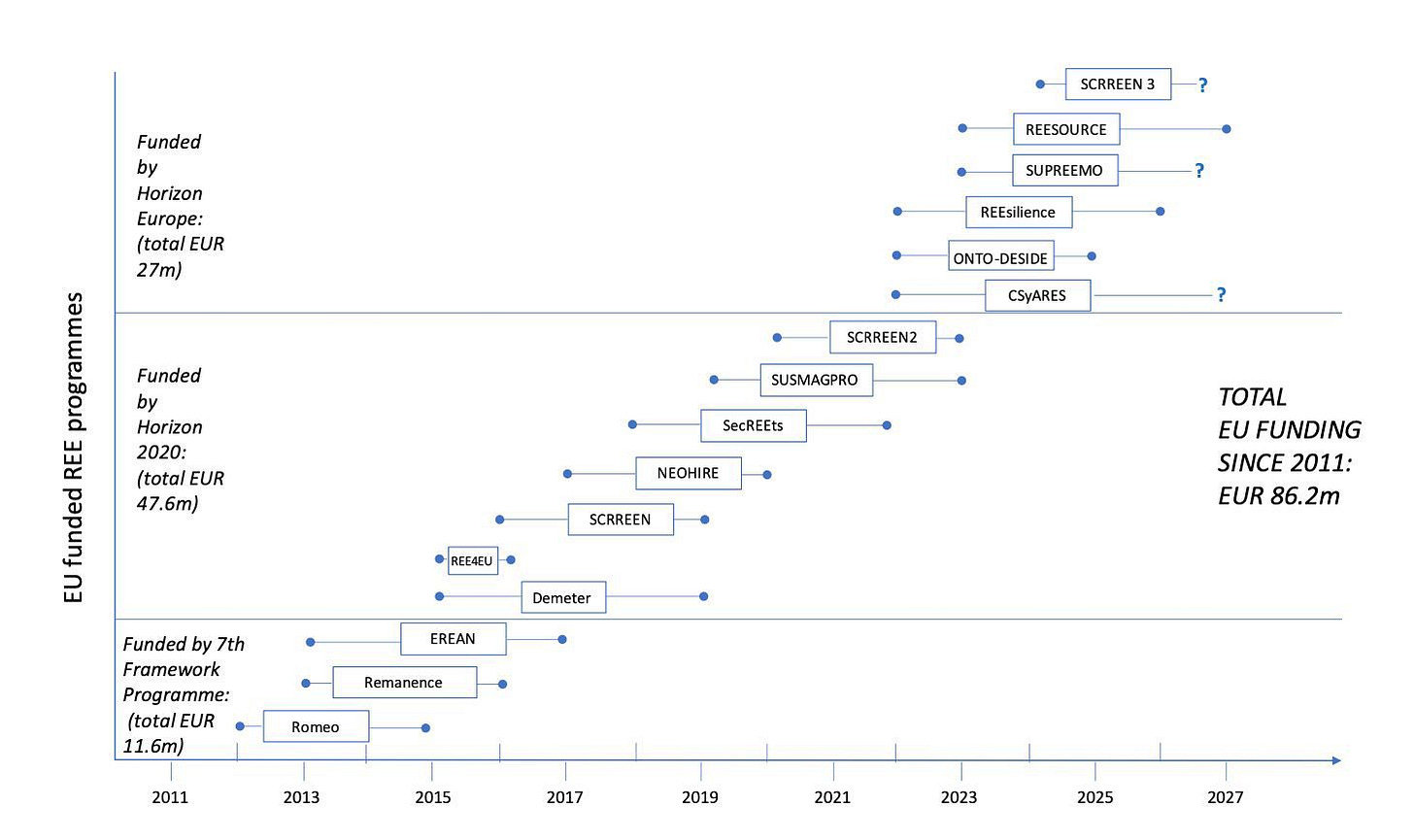

EIT Raw Materials (European Institute of Innovation and Technology)

Europe needs way to price critical minerals independently of China, group says

Europe needs a system to set prices for critical minerals needed for the energy transition that is not dependent on China, which dominates much of the global sector, the head of an EU-funded group said.

“Europe should have a critical materials platform that has a price-building mechanism that reflects the supply and demand situation in Europe,” Bernd Schaefer, CEO of EIT RawMaterials, told Reuters.

Schaefer also called for an exploration fund to boost mining of critical minerals in Europe.

“This should not be just a couple of million (euros), it should be a billion, it must be a big number.”

Mining in the EU

By now Schaefer should have understood full-well, that not missing funds but “Not In My Backyard” attitudes paired with a an regulatory regime generally headed for the opposite direction are the main obstacles to mining in Europe.

Even if Schaefer manages to establish CRM mining in Europe here or there, it would be entirely beyond the point.

De-industrialisation

As a result of policy the EU has long moved-on from banal raw materials. The EU’s import dependencies trend ever more to imports of value-added components and devices aiding ever more advanced downstream technology. Therefore upstream linkage of the value chain has become increasingly patchy and in some products it has gone completely missing.

This being so, even if CRM were mined in the EU, there would still be missing links.

Re-industrialisation

If one wanted to re-industrialise, after years and years of looking at it, it should have occured to policy makers long ago that what they would really need to do as a first step is encourage domestic production of the more and more import-dependent components and devices, before doing anything else.

This would most certainly involve import tariffs on the respective components and devices.

Lobbies weigh in

Even the idea of imposing import tariffs would immediately activate mighty industrial lobbies, whose masters are often at the core of import dependence. We have just seen it happen in EV.

If you ever walk through the center of Brussels, look at who occupies the office buildings. Consultants and lobbies everywhere you look. These lobbies can press quite hard at every level of the bureaucracy, both in their home EU-member countries and at the EU Commission, and they can cloud politicians’ outlooks for re-election.

Long story short, you would rather avoid anything that the mighty lobbies would be opposed to.

The easy way out

So you turn on to an area like raw materials, unavailability of which in the EU is at times complained about by the mighty lobbies - while they somehow always forget to mention “at Chinese prices.”

The opposition to raw material projects would not be as concentrated as in industrial lobbies, but rather scattered, local or regional, smaller and weaker and thereby exerting much less pressure on the political establishment.

The bucket with the missing links you simply kick down the lane to the next EU Commission.

Taking a step back

Core EU countries used to live of exporting hi-tech products, always one step ahead of the competition. And they found a ready market in China.

Trouble is that China has caught up and even overtaken the EU in hi-tech. China makes absolutely splendid products nowadays. Not only is the Chinese market for EU products melting away, China has also become a formidable competitor in all relevant export markets.

While it is in general not wrong to look at what can be done about raw materials (at Chinese prices), the real issue should be regaining the technology lead. There is a somewhat solid base for that and supporting it may show results, rather than burning tax-payer funds in still-born raw material initiatives.

Again, it is our view that the EU in rare earth saddles the horse from the wrong end. They should work from downstream to upstream to systematically fill the holes along the value chain, not from upstream to downstream - with a gaping disconnect in-between [read about Solvay’s hapless stunt below].

Only supporting the Neo Performance Materials/Magnequench factory in Estonia was a step in the right direction.

At this time we would not worry about raw material supplies from China too much, as China habitually encourages overproduction of raw materials in order to guarantee abundant supply and low prices for its domestic industries, with oversupply seeping into exports. This being so, export availability from China should be here to stay, unless China would want to depart from provenly successful policies.

On its part, the EU may want to depart from provenly unsuccessful policies.

Related

Just Transition Fund Runs Out of Money for Big Plans

The Enterprise and Innovation Foundation (EIS) has closed the application process for support for major investments in Ida-Virumaa due to the fact that it has run out of money. EUR 144 million has been earmarked for this measure. EUR 80.5 million of this has already been distributed among 14 projects, of which the largest support – EUR 18.7 million – has gone to NEO Performance Materials, which is building a magnet factory in Narva.

According to the EIS, in addition to the allocated funds, the total amount of applications for large investment grants currently under review and assessment is €104 million. It is common practice for support programmes to accept applications slightly over budget in order to ensure that there are sufficient applications that meet the conditions of the measure, the EIS said. Interest in the grants increased at the beginning of the year, when the state relaxed the conditions for submitting applications, as there were few applications last year, and at the same time the deadline for the implementation of these projects, August 2026, is approaching.

Neo will report 2nd quarter results on 9 August 2024. We are likely to see an impact of discontinued niobium and tantalum in Estonia, certainly also because of the radioactive waste having nowhere to go to, and discontinuation of the rare earth processing at Weihai, China.

No longer rare: China's overproduction sends rare-earth prices tanking

Seeking to tighten its grip on the industry, China in June put out a list of regulations to protect supplies of these economically important metals. The regulations, issued by the State Council and taking effect on Oct. 1, say rare-earth resources belong to the state.

No fact checking

Mineral resources belonging to the state is according to Article 9 of the Constitution of the People’s Republic of China of 1982.

No big deal

Had the Nikkei done some even superficial research then it would have occured to them that it’s globally not uncommon for subsurface mineral rights and surface rights being separated, with mineral rights owned/controlled by the state.

The Nikkei may have started at home with Japan’s Mining Act.

Japan Inc’s state of mind

But despite Beijing's attempt at tighter controls on the industry, the market has remained in the doldrums.

Nikkei complains when rare earth prices go down, Nikkei complains when rare earth prices go up. For the Nikkei any change seems to be always bad and by default must always be subject to the black hand of China’s government.

Japan Inc. longs for predictability and stability from a country where there can be no equilibrium, ever.

The quota

Production quotas have increased over the past few years. In 2023, a third set of quotas was added on top of the first- and second-half quotas. Quotas that year totaled 255,000 tonnes, up 21% from 2022. Many believe that this year's quotas will exceed those of 2023.

We argue that the rare earth quota in China should primarily be viewed as related to resource preservation, resource taxation and environmental protection.

China’s zero-tariff imports of rare earth raw materials have been soaring because of China’s resource policies and related fiscal measures.

Price myths

The Nikkei could have gathered from Japan Inc that there had been a substantial shortage of NdPr vis-a-vis actual and forecast demand, sending rare earth prices up. The supply-gap was resolved through the combination of capacity increase and demand not growing as forecast, sending prices down.

Actually, owing to the rare earth inherent imbalance, there can be no supply-demand equilibrium. No matter how, you can’t regulate nature.

Currently you must overproduce neodymium in order to have enough dysprosium and terbium:

That is why dysprosium and terbium are engineered out of NdFeB magnets and why a much of the research in China’s dedicated national rare earth research institutes goes into potential new applications for perpetually oversupplied one-dollar-products, “cheap as cabbage” lanthanum and cerium.

Japan’s cabbage imports

Same as in USA and EU, lanthanum and cerium are ca. 70% of the volume of Japan’s rare earth imports for applications in:

Fossil fuel production (mostly lanthanum)

Fossil fuel consumption (mostly cerium)

Polishing powder (lanthanum, cerium, and certain other rare earths)

Nearly 80% of polishing powder consumption in China is for polishing smart phone screens. Consumption of rare earth polishing powder is rising, but prices for run-of-the-mill La and Ce grades remain below US$1/kg.

Deleting rare earth

The Chinese government currently is currently trying to scrub rare earth information off its massively censored intranet.

What they may be afraid of: China’s officialdom probably has low confidence in global intellectual property protection, which is actually one of the elements of global rules that are actually still working.

General Hostility

Rare earths become "Western earths"? Wishful thinking!

Here a translation of one of the recent Ministry of State Security (MSS) rare earth publications on China’s Orwellian mass control platform WeChat:

What they are talking about is Japan, known for probing pesky details, Chinese rare earth experts migrating to South East Asia on foreign passports and what can generally be described as normal, boring and utterly benign market research, common practise in all industries. It can be borderline, but in general it isn’t.

It is China’s “national security” paranoia with a legal base that criminalises anything and everything, depending on the direction the wind is blowing.

People in glass houses shouldn't throw stones

Needless to say that China denies everything and blames a smear campaign of hostile foreign forces. The usual. What else can they say anyway?

No slander

MSS certainly know full-well it is no slander to accuse “Chinese rare earth enterprises that have gone overseas of causing serious environmental pollution.” It is rather indisputable fact.

Flimsy cover-up

Why would a Chinese key state rare earth enterprise try to hide behind a cloud of seemingly unrelated companies other than to deny its involvement in systematic environmental destruction in Myanmar?

On even only superficial research one can connect the dots and look right through it.

Uncontroversial 7 years ago

Kazakhstan

24 geological exploration licenses issued by Kazakh authorities in H1

The Geology Committee issued 24 geological exploration licenses in Kazakhstan in the first half of 2024, reports the Ministry of Industry and Construction.

“The Committee is actively issuing licenses for geological exploration of subsoil. In the first half of 2024, 24 licenses were issued,” reads the message.

Rare earth metals are being searched for at 12 sites near the single-industry towns of Arkalyk, Ridder, Khromtau, Zhezkazgan and Balkhash.

Shows clearly what the priorities are.

US must do more to counter China's actions, No. 2 diplomat says

U.S. Deputy Secretary of State Kurt Campbell said on Tuesday that Washington must do more to counter Chinese actions, including its strategy for creating military bases and its pursuit of rare-earth minerals in Africa.

Campbell told a hearing of the Senate Foreign Relations Committee that competition with China was the "defining geopolitical challenge confronting modern American diplomacy" and said the U.S. Navy and Air Force needed to step up their games in the Indo-Pacific.

"We need to do more, and we have to contest Chinese actions, not only in terms of their forward basing strategy, but their desire to go after Africa's rare earths that will be critical for our industrial and technological capabilities," Campbell said.

Rare earths are vital for high-tech applications, including defense equipment, and for U.S. President Joe Biden's efforts to electrify the auto market to fight climate change.

The U.S. is eager to secure sources beyond China, which in 2022 accounted for more than 70% of world rare-earth production.

The U.S. lost its raw material opportunities in Africa long ago. Doing what the U.S. can do best, drive technology forward and engineer-out the bulk of rare earths, cobalt and such will be more promising than pant after China in order to catch up with China’s resource-grab and what basically is tired 40 years old technology.

The very minute an equivalent or better magnet than NdFeB goes into mass production, the whole rare earth story will crumble.

Vietnam

Trident Global Holdings and Zoetic Global Announce Major Deal to Transform U.S. Industries with Rare Earth Elements

Trident Global Holdings, a leading Korea-based company, announced today a groundbreaking major strategic joint venture with Zoetic Global. The collaboration aims to co-develop premium rare earth mines, ensuring that global and U.S. companies have access to these critical elements. The joint venture has the potential to generate billions in economic value and to implement sustainable practices into the rare earth mining industry.

In this venture, Trident Global Holdings, which already has a strategic cooperation development agreement with Vietnam’s Hung Hai Group—owner of three mines in Lai Chau Province, northern Vietnam—will partner with Zoetic Global to deliver the latest, environmentally friendly technologies to maximize the efficiency of rare earth production. These mines, including Bac (North) Nam Xe, Nam (South) Nam Xe, and Dong Pao, collectively possess confirmed reserves totaling 7 million metric tons of valuable rare earth elements.

This sounds a bit strange.

Two companies no rare-earthling has ever heard of partner with Hung Hai, privately owned by Tran Dinh Hai. The company is in renewable energy, but also in batteries, hydrogen, anything high-profile that generates snappy headlines.

Until a few years ago the company results were described as “modest” by the official Vietnamese media.

We could not verify if Hung Hai has any rights over the state’s rare earth mines.

But since Vietnam Communist Party chief Nguyen Phu Trong has died recently, perhaps anything is possible again in Vietnam

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.