Japan largest buyer of China RE; China RE raw material imports rise 68% yoy; Malaysia rare earth corruption arrests; Florida's phosphates; Ferrite magnets for EV; India says no to China EV;

Rare Earths July 28, 2023 #126

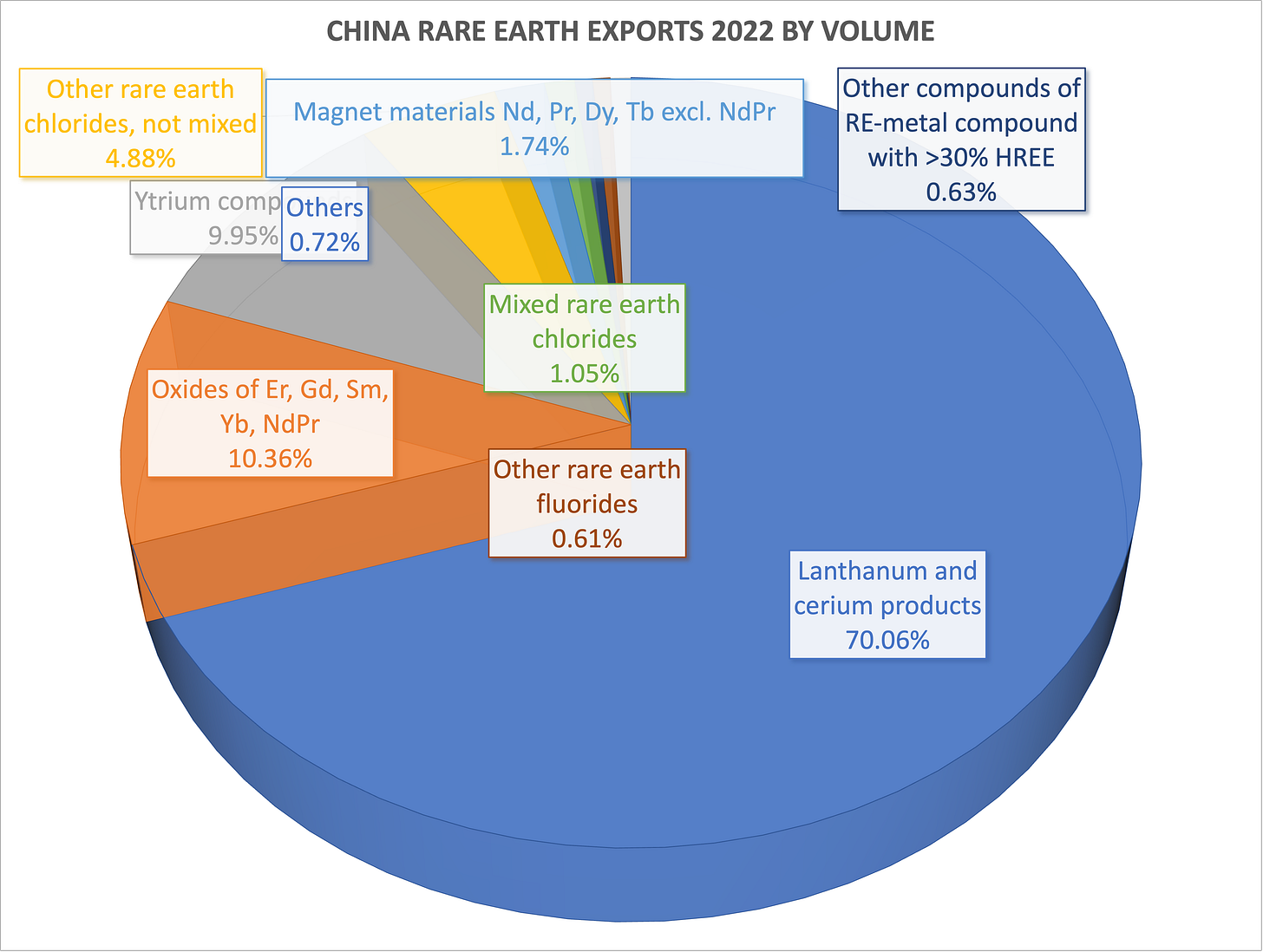

General structure of China’s rare earth exports

There were questions regarding our previous post about the history of the 2010 Senkaku Incident and the 2011 rare earth price spike, specifically why Japan was disproportionally affected.

China’s largest export market for rare earth compounds by far is Japan. The country imports also the widest range of rare earth products:

By quantity, however, Japan is not the largest market:

The reason is that China exports relatively large quantities of very cheap materials. 70% of China's rare earth export volume consists of uneconomical lanthanum and cerium compounds. These compounds contribute only around 7% of the total export value.

The four largest buyers for these materials - last year still priced at US$2-4/kg FOB China - are the US, EU, Japan and Taiwan, mainly for application in

petroleum refining catalysts,

catalytic converters in internal combustion engine vehicles and hybrids,

polishing powders,

Glass industry applications.

China’s high value rare earth compound exports in 2022:

Neodymium oxide:

Thailand 48%,

Japan 22%,

EU 10%,

Russia 7%, and

USA 4%.

Praseodymium oxide:

Vietnam 30%,

Thailand 26%,

EU 23%, and

USA 16%.

Dysprosium oxide:

Japan 65%,

Philippines 12%,

Korea 11%, and

EU 6.5%.

Terbium oxide:

Japan 88%,

USA 8%, and

Korea 3%.

Oxides of Er, Gd, Sm, Yb, NdPr and other oxides:

Japan 49%,

Vietnam 15%,

EU 14%, and

USA 7%.

Yttrium compounds:

Japan 57%,

USA and EU each 14%,

Korea 12%.

In rare earth metals it is much more pronounced.

Japan’s share in China’s rare earth metal exports 2022:

Neodymium metal: 97%

Dysprosium metal: 98%

Terbium metal: 96%

Lanthanum metal: 92%

Other rare earth metal alloys: 42%

Other rare earth metals: 66%

We can understand if EU Commissioner Breton says, the EU would be 98% dependent on China’s rare earth metals.

Last year China shipped rare earth metals valued at US$7.4 mio to the EU. Among others for use as flint in one-way lighters, which are manufactured in Mr Breton’s homeland and in Spain - by the same French company.

A scandalous strategic dependency.

For good measure, here the structure of rare earth permanent magnet exports from China:

The a.m. is, what the EU Commissioners, their much acclaimed but mostly clueless academics and their highly paid consultants needed too much time to understand.

Keep reading with a 7-day free trial

Subscribe to The Rare Earth Observer to keep reading this post and get 7 days of free access to the full post archives.